‘Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!’ – Lewis Carol, Alice In Wonderland

‘The real voyage of discovery consists not in seeking new landscapes but in having new eyes’ – Marcel Proust, In Search Of Lost Time

To join the ~10,000 FMCG executives that receive already all our FMCG CEOs Insights, sign-up at the following link: FMCG CEOs: Managing For Growth

Last week, we completed the 27th meeting of the year with a top 50 FMCG C-level executive. The same concerns keep coming back:

- How to manage this unprecedented inflation (2021-23) through desinflation (2024/25) to likely deflation (2026 & beyond) sequence?

- How do we keep fueling the EPS algorithm at a time pricing gains are expected to dry-up soon & price-elasticity/ volume declines are just kicking-in?

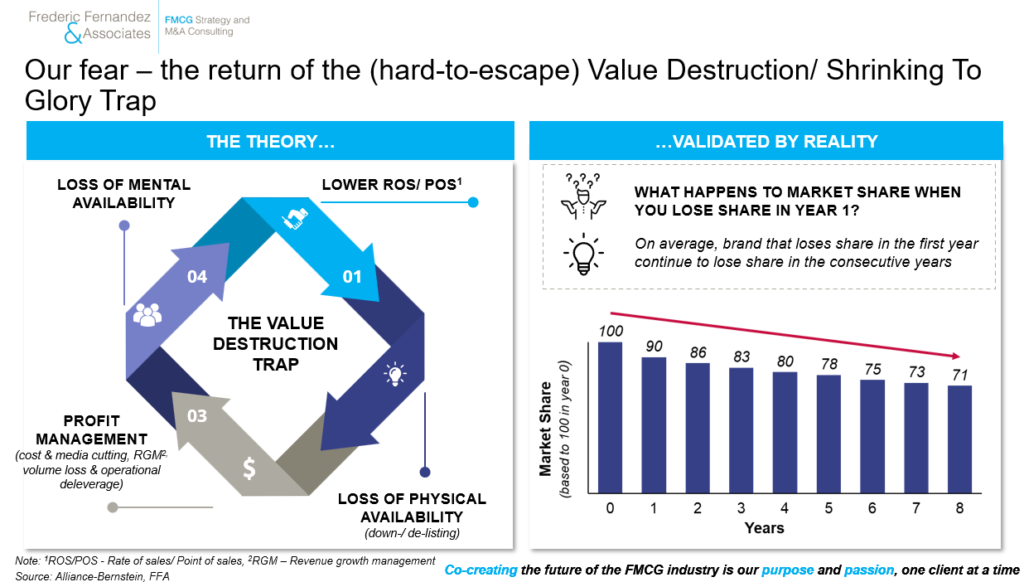

- How do we ensure we stay away, across most of our business from, the ‘so hard-to-escape’ ‘Value Destruction/ Shrinking-To-Glory Trap’?

- If it is clear we need to avoid to repeat the same mistakes of the last decade (mostly: over-focus on bottom-line improvement, strategic revenue management as the main revenue lever and acquisition of large & mature assets), how do we concretely achieve & sustain organic growth outperformance?

- The last three years’ market conditions dramatically weakened competition from insurgent brands, could this be that the next three years will dramatically weaken the largest FMCG companies with the weakest footprint/ portfolio (countries, categories, channels, distant challenger positions, higher price elasticity, under-invested/ neglected brand growth models)?

The last two weeks’ Q3 releases results finally convinced us to share now this publication. A publication that was in our drawer for many years. Q3 2023 earnings will likely be remembered as a turning point in the last 20 years history of the FMCG industry:

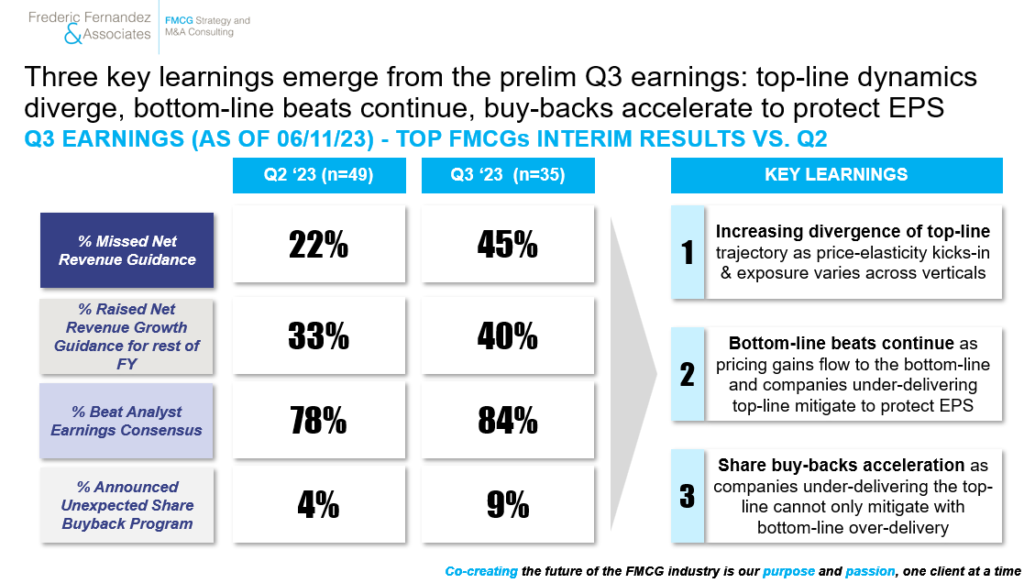

- A point of increasing top-line divergence between the FMCG companies with a strong footprint/ portfolio (countries, categories, segments, channels, strong market positions, low price-elasticity, robust brand growth models) that keep beating top-line consensus and all the others that increasingly miss top-line consensus

- A point of increasing bottom-line convergence where unprecedented pricing gains start flowing strongly for all to the bottom-line driving broad-based EPS beats while the top-line underperformers double-down on cost take-out to make their EPS

- A point of share buy-backs acceleration where an increasing number of players anticipate mounting pressures on their EPS algorithm

Saying it differently, we are at the beginning of a ‘shrinking-to-glory’ cycle. We have seen this ‘movie’ before over the last decade, although the violence of the upcoming sequence is likely to be unprecedented.

Our strategic thesis is simple:

- An unprecedentedly challenging sequence is ahead of us

- Success will be, more than ever, about organic growth outperformance while avoiding the mistakes of the past

- If there is objectively no scarcity of profitable growth, we need to deeply & holistically adapt our approach to organic growth to achieve & sustain outperformance

- It will require not only a change in strategy (where-to-play/ how-to-win/ key enablers choices) but also sometimes a deep change in execution capabilities, brand management operating model & culture

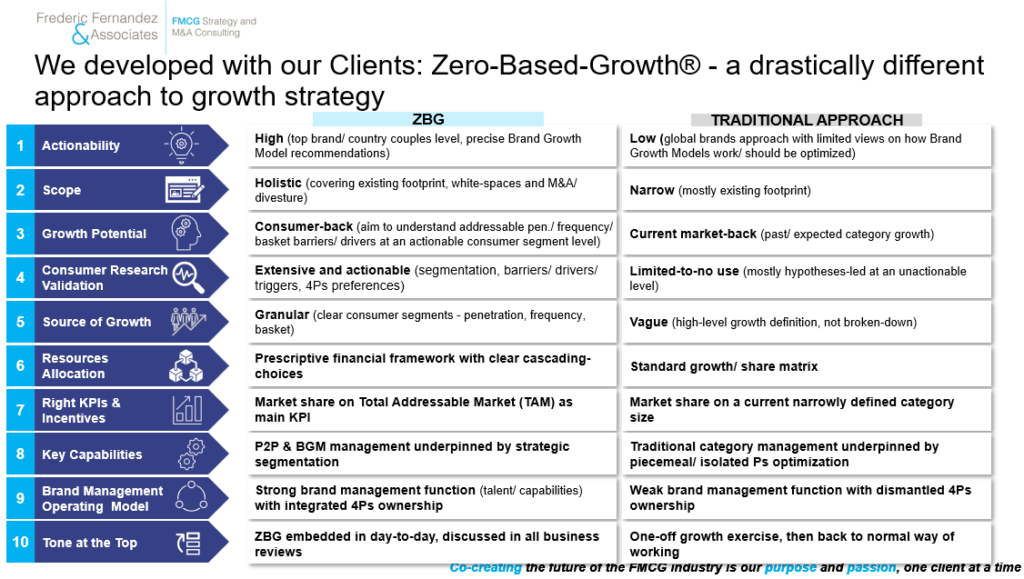

This is what we call Zero-Based-Growth® (ZBG®)

The excess of ZBB (Zero-Based-Budget) doomed the 2014-2020 period. Our hope is that ZBG® will be one of the key enabler of growth & EPS outperformance over this coming decade.

This is the challenge ahead of us. Exciting & decisive times

Below are our detailed perspective in ten key messages supported by few charts.

Enjoy the read

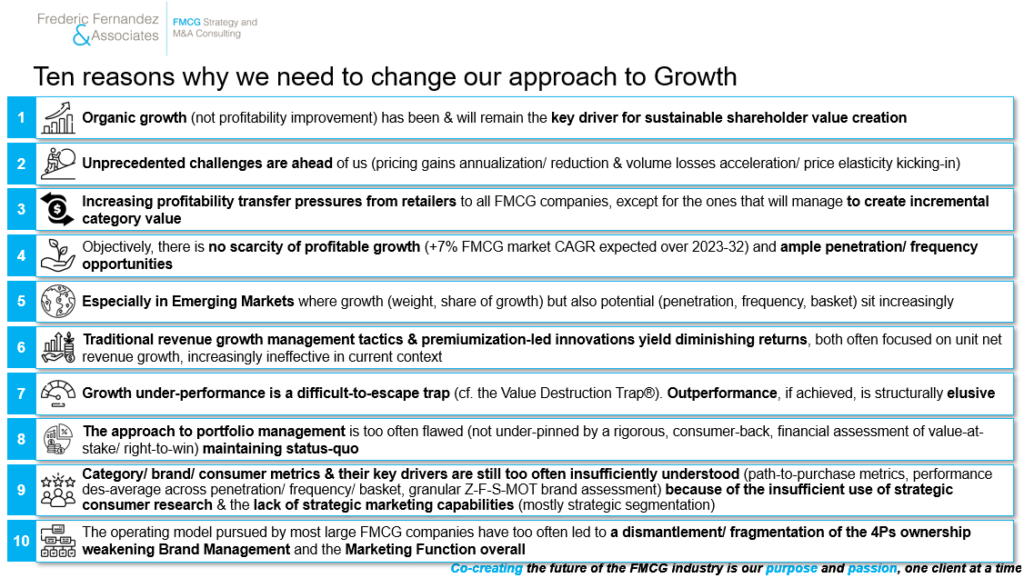

1) We see at least ten reasons why we need to update our approach to Growth in the FMCG industry

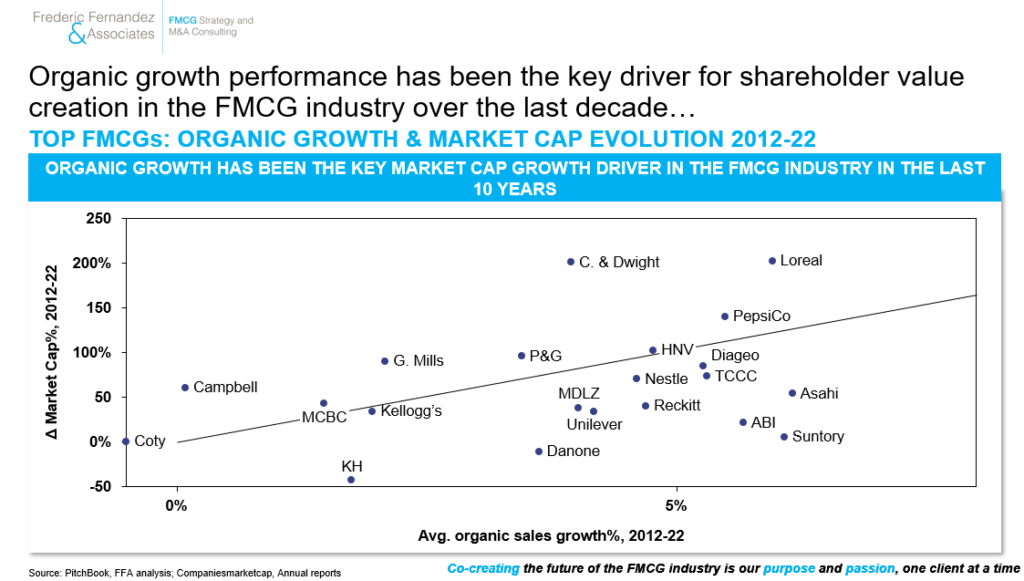

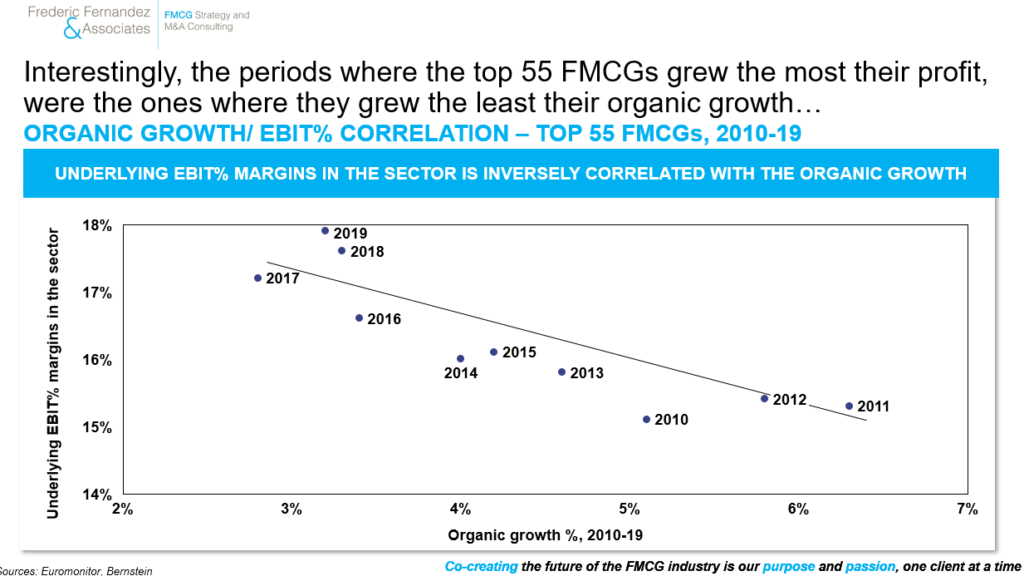

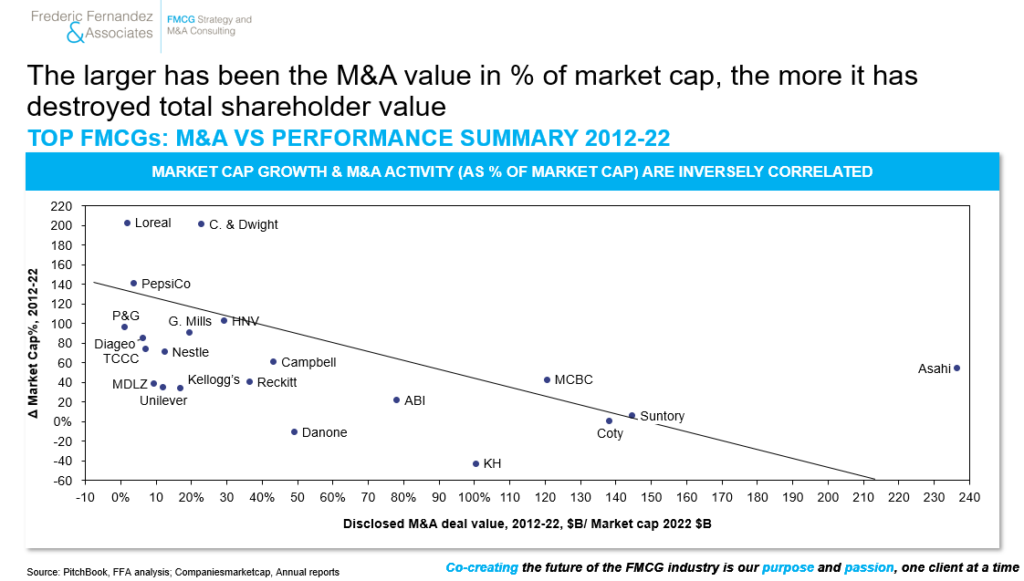

2) Organic growth (neither profit improvement, nor large scale M&A) drove shareholder value over the last decade

To hear more about M&A key learnings & best practices over 2012-22 in the FMCG industry, please refer to our last publication: FMCG CEOs: 2012-22 M&A Winners & Losers Or Breaking The Code Of Successful M&A In The FMCG Industry

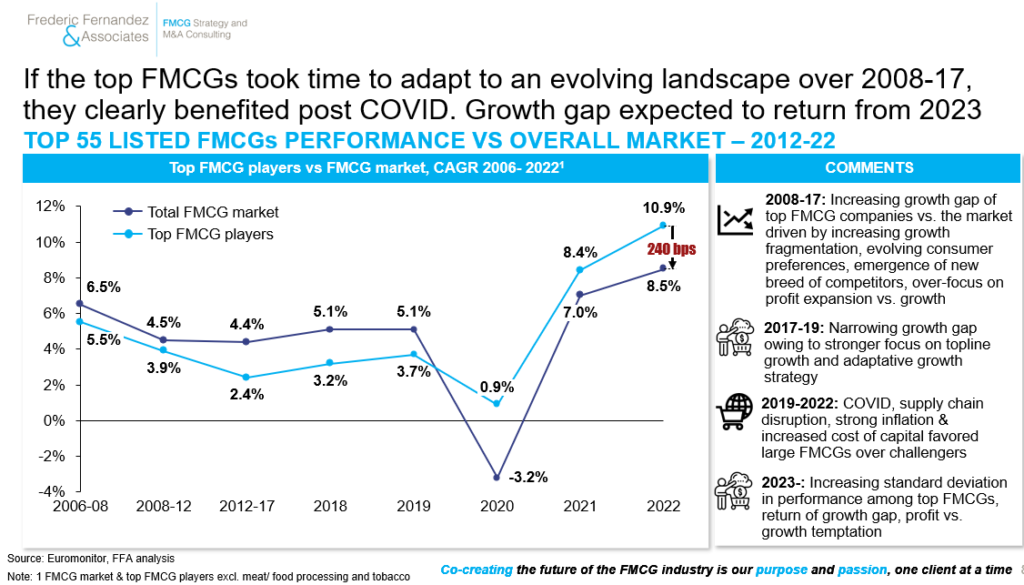

3) After more than a decade of underperformance over 2008-2019 & a relief driven mostly by external shocks over 2020-23, we are expected the growth gap to return on average for the world largest FMCG companies from 2023

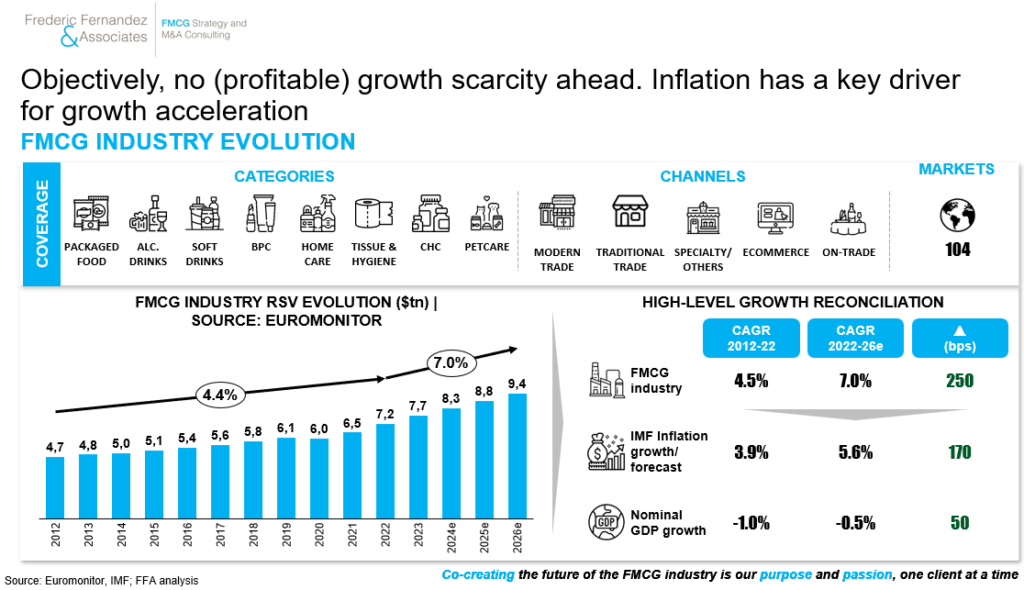

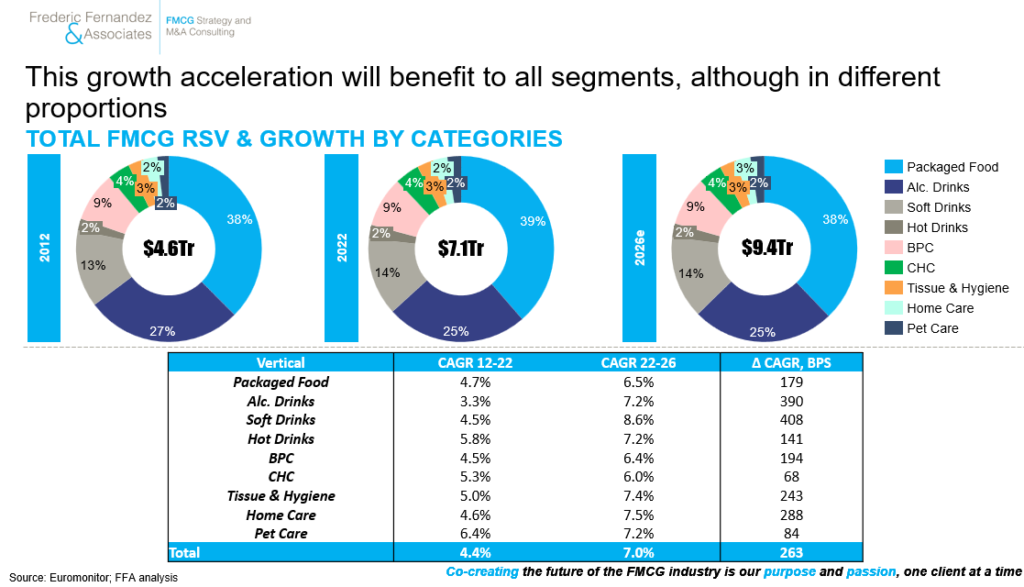

4) Although objectively, there is no (profitable) growth scarcity in the FMCG industry in the years to come. This is true for all categories

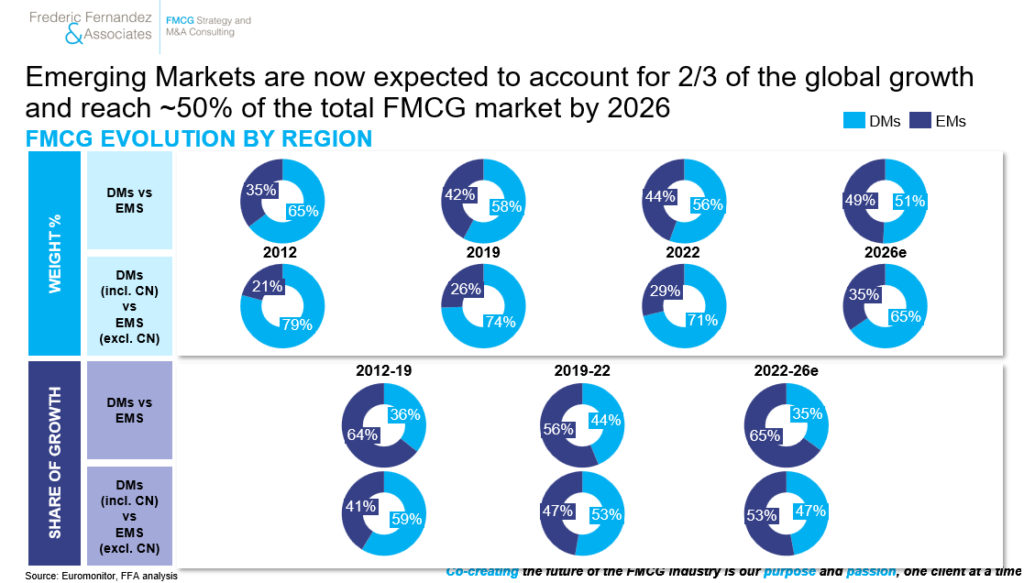

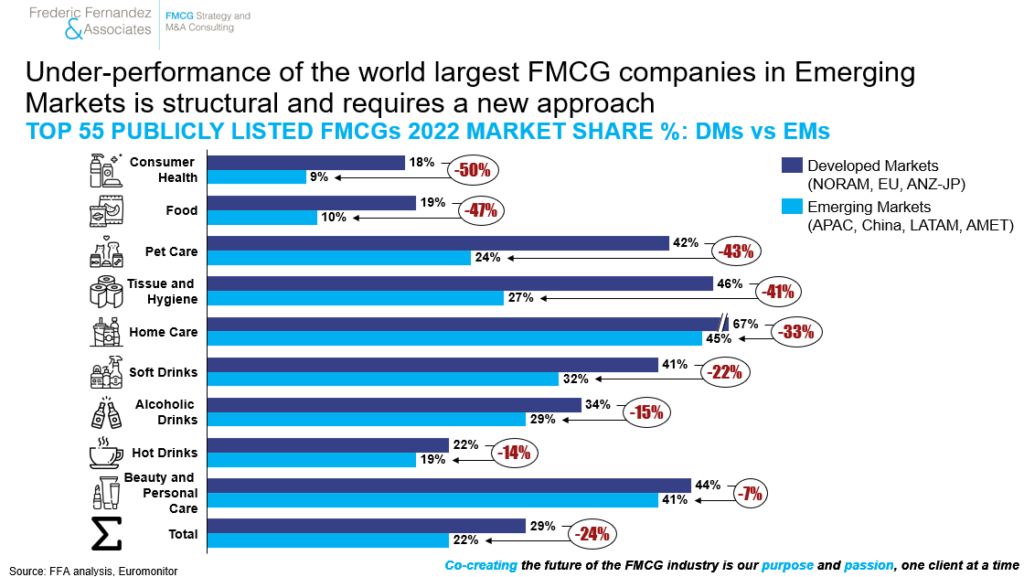

4) Emerging Markets (and not just China) will increasingly become ‘must-win-battles’ but they will need to be strategized differently to address their structural differences (fragmentation of retail/ media landscape, affordability barriers, different local preferences, often lack of brand heritage…) & finally achieve outperformance

More on this topic in our previous publication: FMCG CEOs: The $1 Trillion Race – Why Winning In Emerging Markets Outside China Has Become A Must-Win Battle & Ten Rules To Outperform

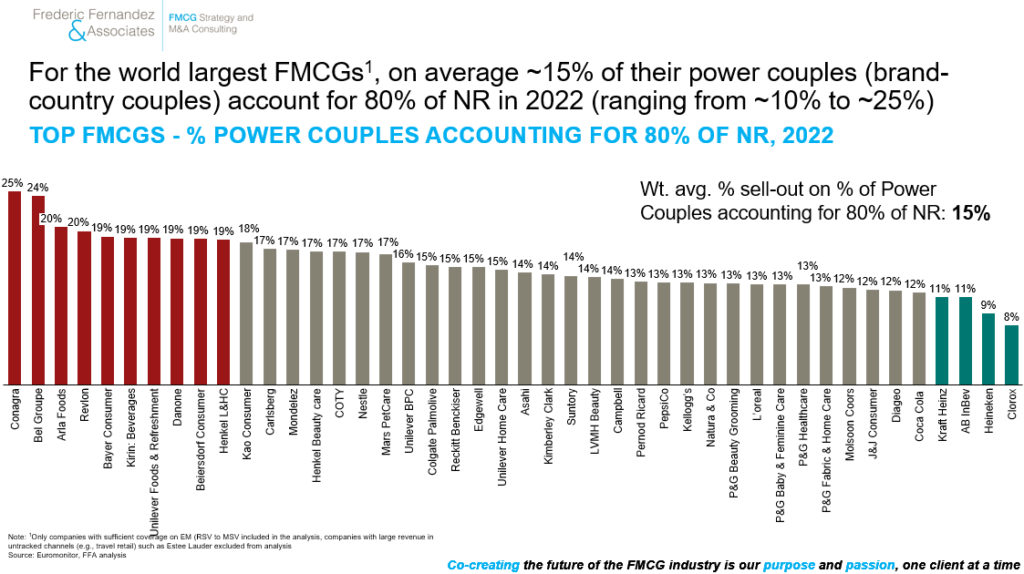

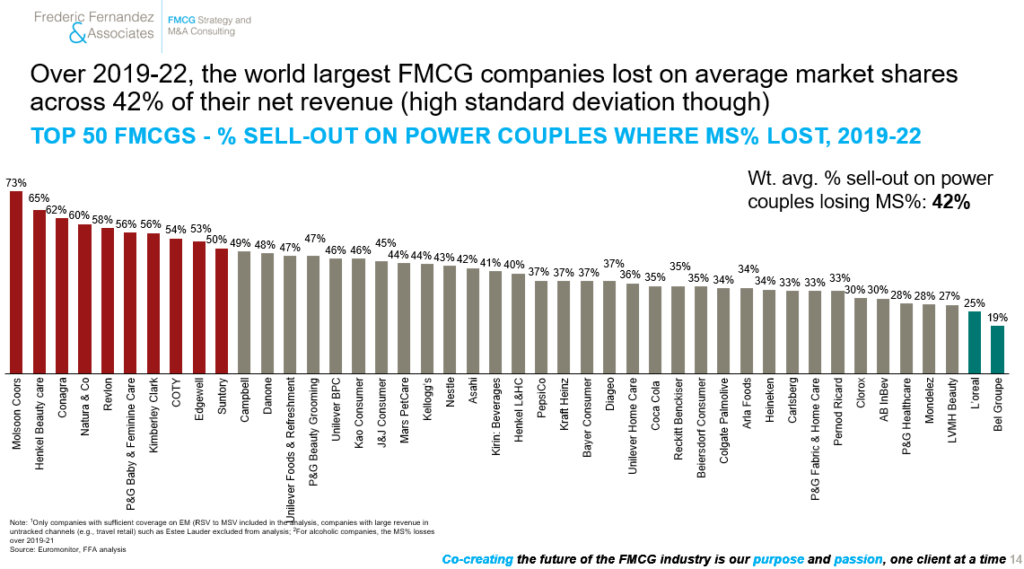

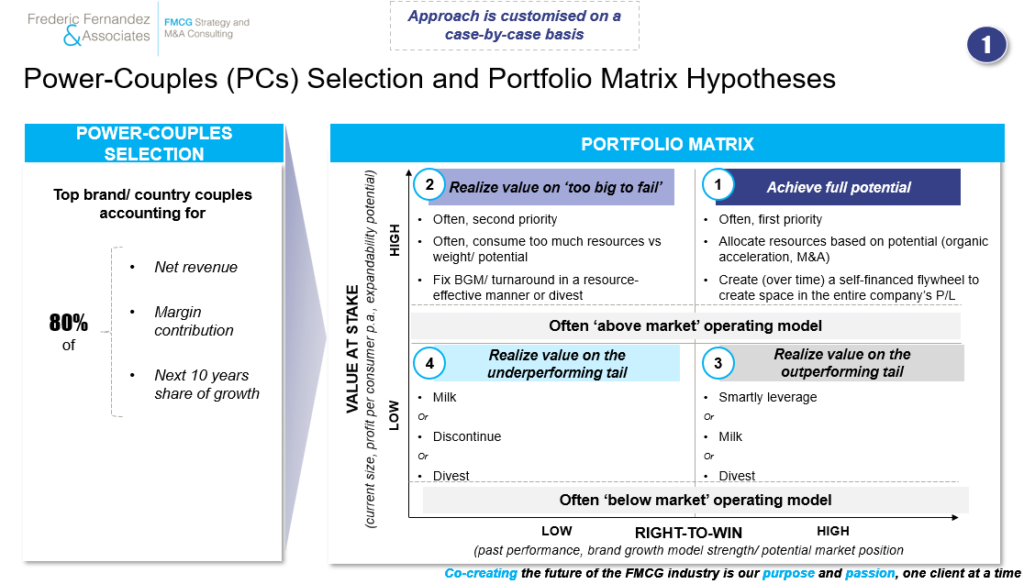

5) We see an enhanced risk for market share erosion across the world largest FMCG companies in a context their power-couples (brand/ country) are concentrated (10% to 25% of them account for 80% of net revenue) and already 20% of FMCG companies have been losing market share over 50%+ of their portfolio (42% on average for the world top 50 FMCG companies) over 2019-22. This number is expected to worsen in 2023

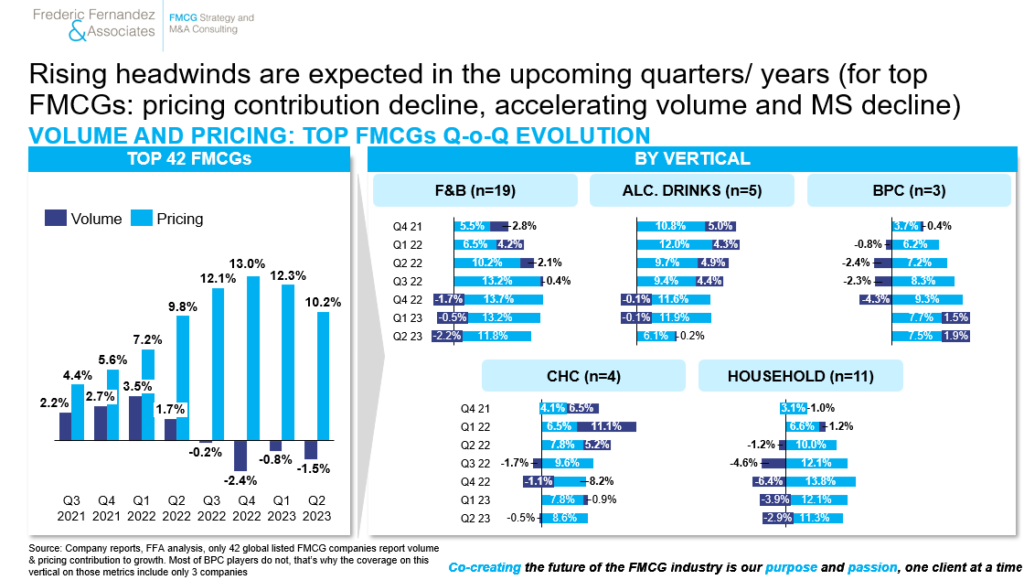

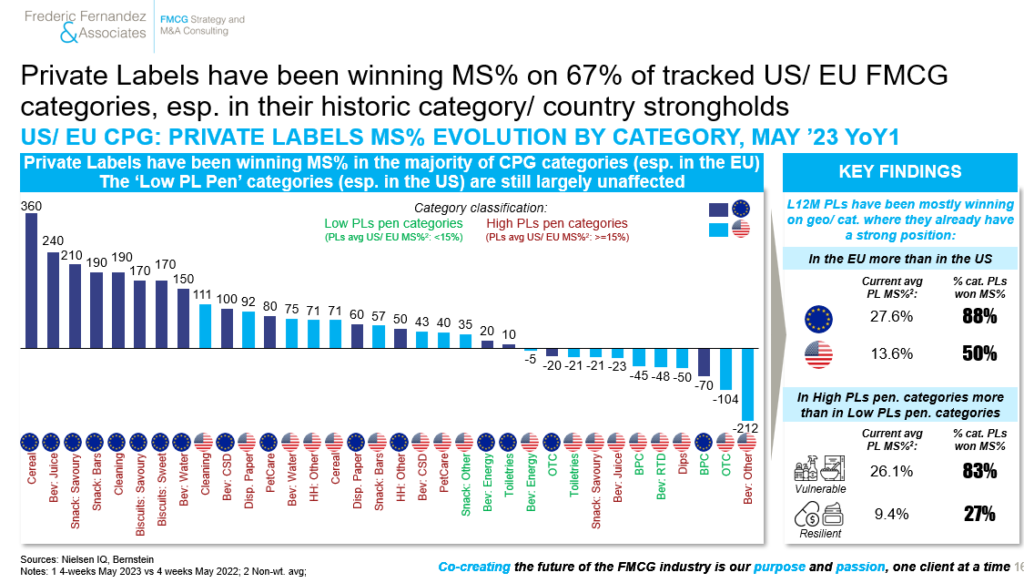

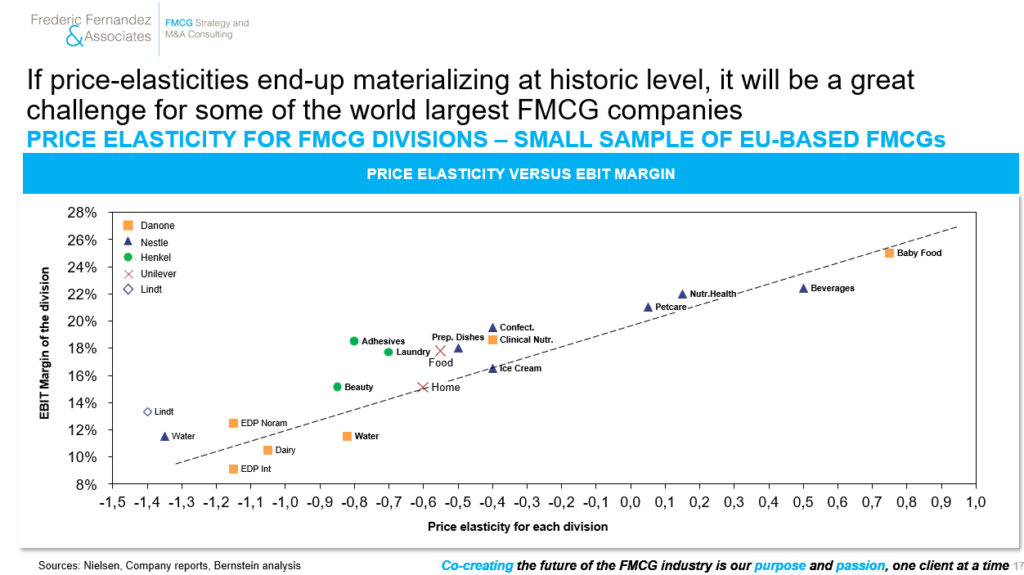

6) Pricing gains have started to decrease while price elasticities have just started to kick-in. Private labels have been gaining shares (although mostly for now in their strongholds). If price-elasticities end-up materializing at full historic level, it will be a large challenge for some of the world largest FMCG companies

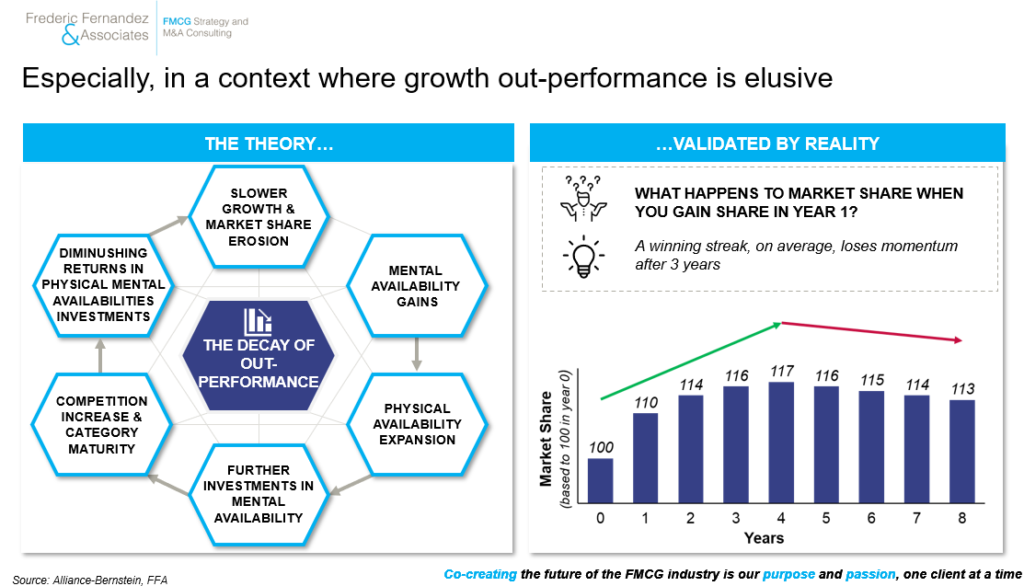

7) In this context, our fear is a return of the (often hard-to-escape) Value Destruction/ Shrinking-To-Glory Trap. Especially in a context growth outperformance is elusive/ hard to sustain

8) Our concerns have materialized with Q3 earnings (prelim results) where we see all the patterns of the Shrinking-To-Glory Trap (increasing number of companies missing their top-line, no one missing their bottom-line, acceleration of stocks buy-backs to drive EPS…)

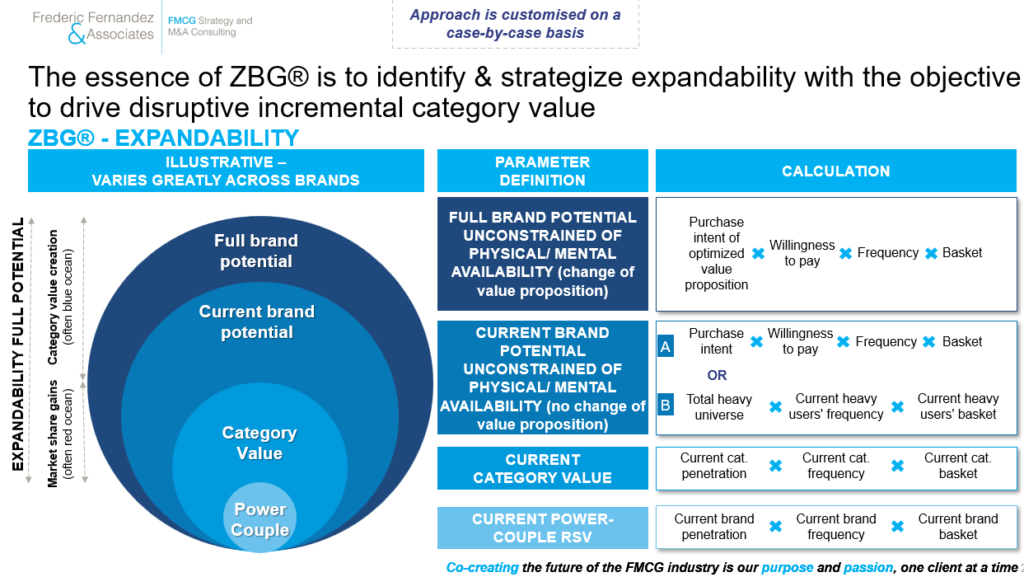

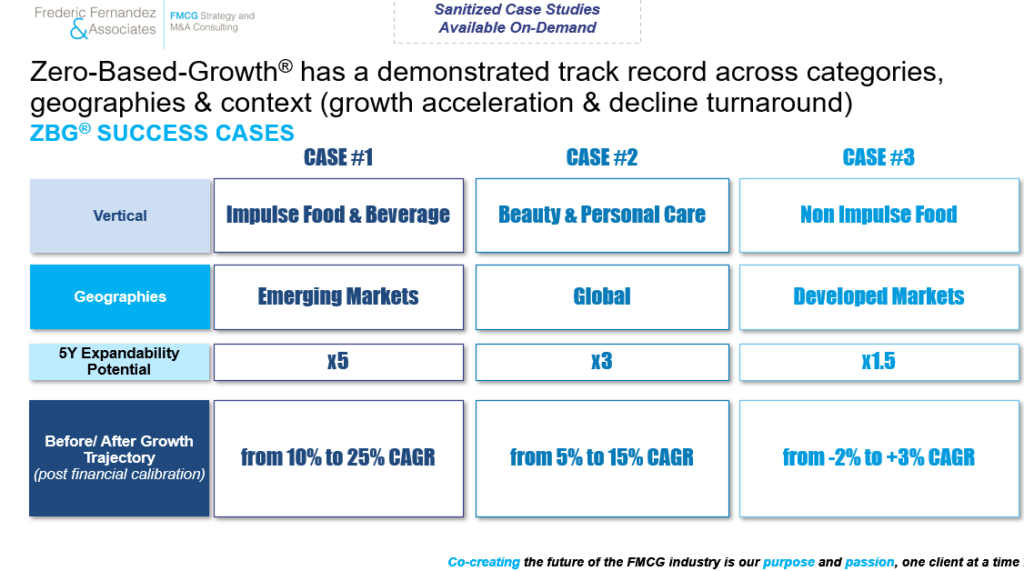

9) In this context, we see the case to double-down on organic growth but with a drastically different, holistic, granular & consumer-centric approach. This is what we call: Zero-Based-Growth®. The essence of ZBG® is to identify & strategize expandability with the objective to drive disruptive growth, that is often incremental to the category

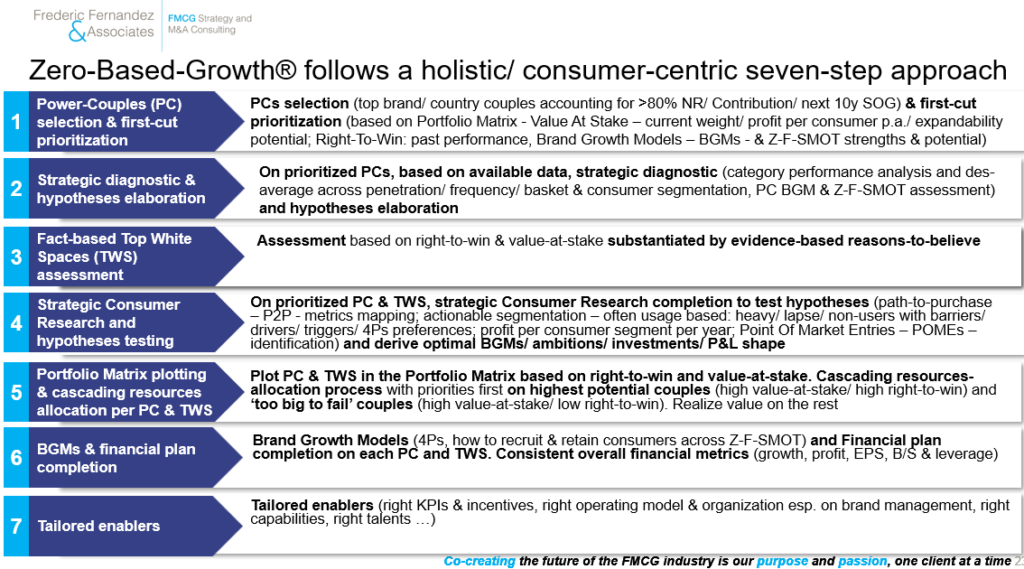

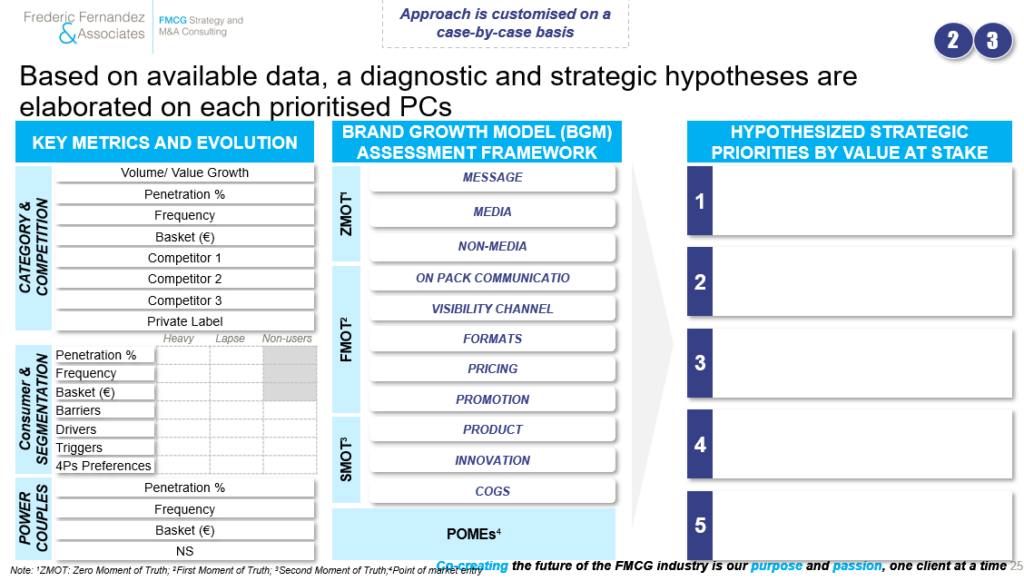

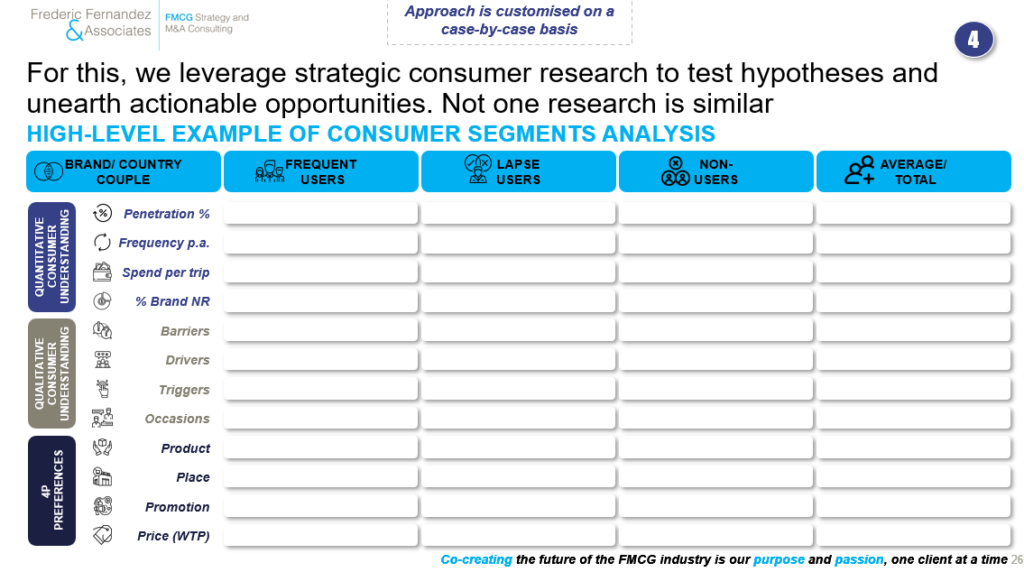

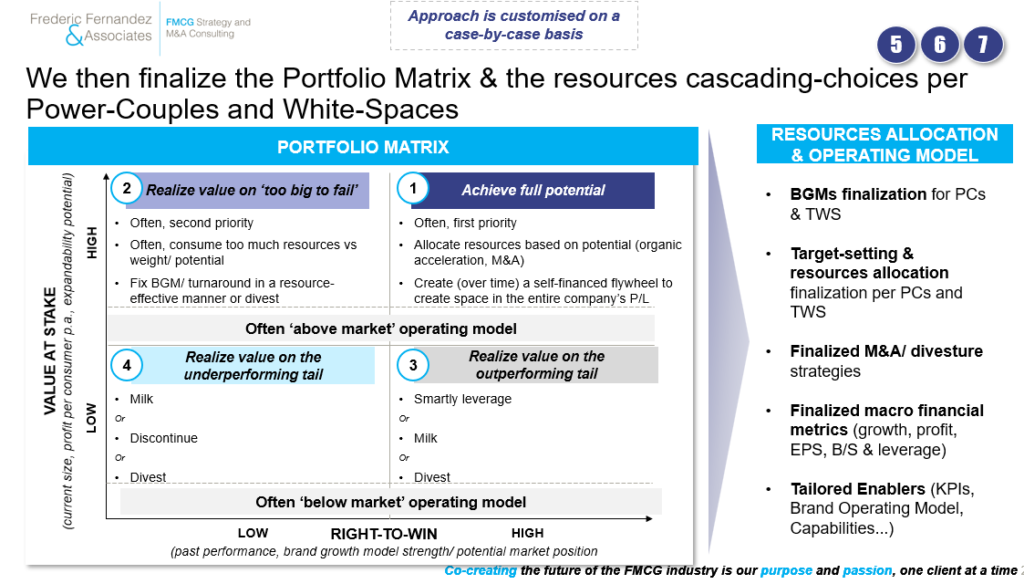

10) ZBG® follows a rigorous seven-step approach. From selecting Power-Couples (the top brand/ country couples accounting for >80% revenue/ profit/ future growth) through analyzing their brand growth model performance (across Zero-First-Second-Moment-Of-Truth) leveraging systematic strategic consumer research & segmentation to finally applying a holistic portfolio management deeply rooted in a disciplined value-at-stake/ right-to-win assessment. ZBG® is not only a new strategic approach, it requires also new KPIs (market share on total addressable market vs. current category size), new capabilities (strategic path-to-purchase management & segmentation) and sometimes a different operating model (integrated 4Ps ownership with a strong Brand Management function). Results are transformative

We need to learn from the last decade. We need to anticipate this ‘Shrinking-To-Glory’ cycle. The excess of ZBB (Zero-Based-Budget) doomed the 2014-2020 period. Our hope is that ZBG® will be one of the key enabler of growth & EPS outperformance over this coming decade

This is the challenge ahead of us. Exciting & decisive times

‘Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!’ – Lewis Carol, Alice In Wonderland

‘The real voyage of discovery consists not in seeking new landscapes but in having new eyes’ – Marcel Proust, In Search Of Lost Time

Get in touch:

To follow Frederic, please click Here, To hear more about ZBG® & start a conversation, email at: frederic@fredericfernandezassociates.com

To get the full deck of this publication, please write us at contact@fredericfernandezassociates.com

To subscribe to our newsletter and receive all our CEOs Insights, sign-up at the following link: FMCG CEOs: Managing For Growth

Upcoming event:

With the last one taking place pre-COVID in January 2020, our next exceptional FMCG CEOs conference will take place on Friday, January 12th 2024 in our Zurich office (10 Bahnhofstrasse, 8001 Zurich) from 10 am to 3 pm (breakfast & lunch will be served):

FMCG CEOs: Which Strategies Per Vertical To Outperform Over 2024-30? Per vertical (F&B, Alcohol Drinks, Beauty & Personal Care, Household, PetCare, Consumer Health, Non-tobacco Nicotine), we will cover:

- Performance drivers (organic growth, M&A…) & key learnings over the 2012-22 period

- Our perspective on outperformance for the 2024-30 period (Organic Growth, Emerging Markets, M&A, Sustainability, Ecommerce, DTC, EB2B & many more)

The attendance is strictly limited to 12-persons and the event is by-invitation only (for more information, email at: lea@fredericfernandezassociates.com). Personal invitation will be sent by mid-November

About the Firm:

Frederic Fernandez & Associates (FFA) is a global bespoke Strategy Consulting Firm exclusively focused on Growth (ZBG®), Digital GTM (Ecommerce 2.0®, DTC, & EB2B) and M&A serving the world largest FMCG companies. Its purpose is to help its clients win today while renewing their competitive advantages to win tomorrow. 14 out of the top world 20 largest FMCG companies are repeat Clients.

Our passion is to co-create the future of the FMCG industry, one client at a time. The Firm’s team intervenes all across the globe. To know more about the Firm, please visit our website: www.fredericfernandezassociates.com

No FFA employees own any stocks or financial instruments of any FMCG companies or companies mentioned in the above article. All the above information are public information