‘The best way to predict the future is to create it’ Peter Drucker ‘

Welcome back. We hope you all had a relaxing & happy Christmas break and we wish you the very best for this New Year.

We start the year with a publication on the key strategic questions that will shape 2024 & our key predictions for the year ahead

Six Strategic Questions That Will Shape 2024:

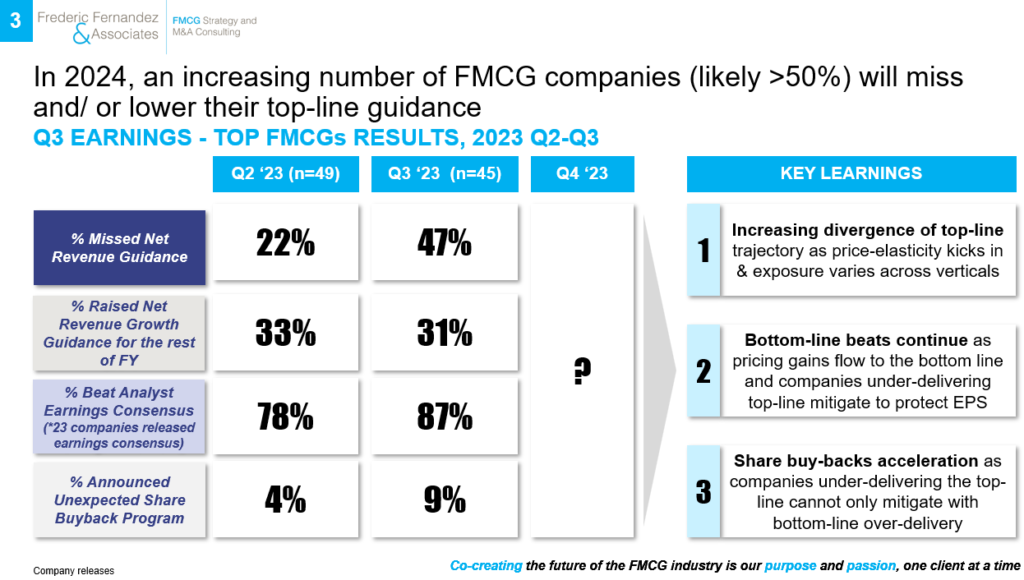

1) In a context of price gains annualization, accelerating price elasticity driven volume decline (47% of the world top listed 50 FMCG companies missed their revenue guidance in Q3 2023 releases against only ~20% in the six previous quarters), increasingly scarce resources (greater focus on profit improvement/ share buy-back to fuel EPS) & wide acknowledgement that the only sustainable driver of shareholder value is organic growth:

How to dramatically & sustainably accelerate organic growth with high ROI? (cf. the below publication for our detailed perspective)

‘Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!’ – Lewis Carol, Alice In Wonderland

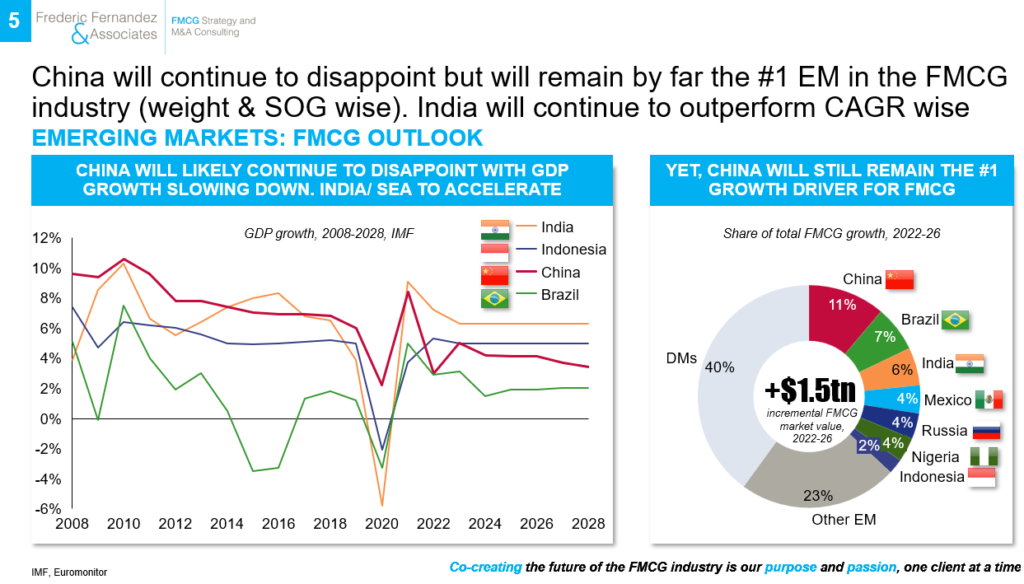

2) In a context where Emerging Markets are increasingly strategic (close to 50% of global FMCG market, 2/3 share of its global growth, where the world top 50 FMCGs have significantly lower market share, where they lost more market shares than in developed markets, where challenges are unique – retail & media fragmentation, different consumer preferences…) and at a time there is a greater need than ever to diversify away from China:

How to specifically drive growth/ profit outperformance in Emerging Markets outside China? (cf. the below publication for our detailed perspective)

‘Insanity is doing the same thing over and over again & expecting different results’ Albert Einstein

) In a context Ecommerce contribution remains significant (~22% steady share of growth on average with great standard deviation ranging from ~50% for Pet Food/ Beauty through ~30s% for Consumer Health/ Diapers to ~5-15% for the rest – F&B, Household), external environment becomes tougher (lower ecommerce growth, higher competition, increasingly fragmented & rapidly evolving e-customers landscape, higher pressure on profitability from the world largest pure players, Amazon ever growing importance) & the Ecommerce strategies of the world top 50 FMCGs need often deep updates (unsustainable targets, out dated where-to-play/ how-to-win choices, insufficient consumer-back approach, unsustainable investment level with insufficient ROI, enhanced risk of omnichannel value destruction):

How to update our Ecommerce strategy to outperform & maximize incremental omnichannel value? (cf. the below publication for our detailed perspective)

“While most people understand first-order effects, few deal with second- and third-order effects. Unfortunately, virtually everything interesting in business lies in fourth-order effects and beyond’ – Jay W. Forrester (1918-2016, pioneering American computer engineer and systems scientist)

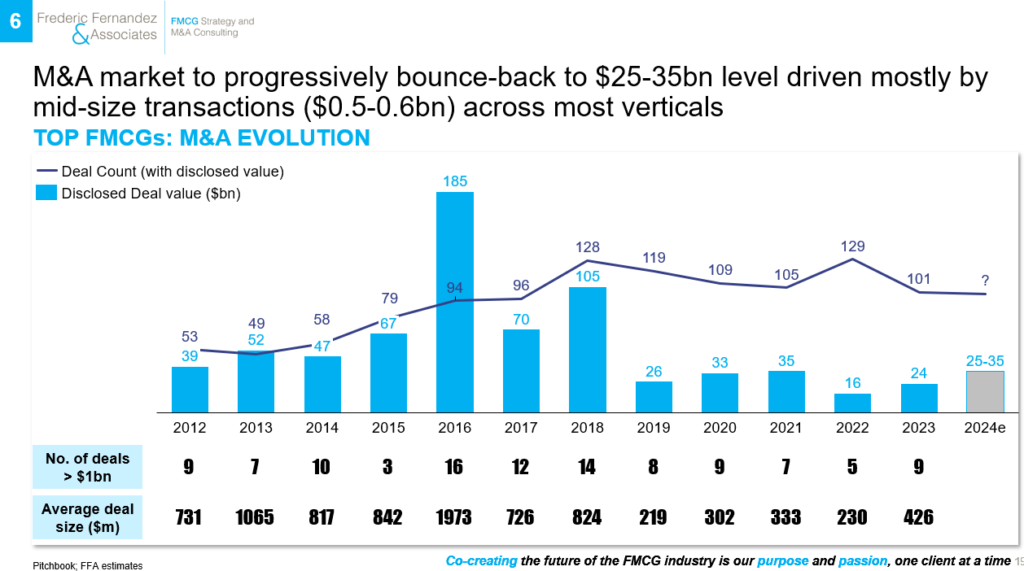

4) In a context the M&A market becomes increasingly interesting (increasing number of attractive targets with compressed valuations, lowering – yet still high – interest rates) but where risks remain abundant (majority of M&A transactions over the last decade did not pay-back, majority of current assets on the market have no future-proof value creation case):

How to leverage M&A to complement effectively and with high ROCE our organic growth strategy? (cf. the below publication for our detailed perspective)

FMCG CEOs: 2012-22 M&A Winners & Losers Or Breaking The Code Of Successful M&A In The FMCG Industry

‘Price is what you pay. Value is what you get’

‘Be fearful when others are greedy and greedy when others are fearful’

Warren Buffet

5) If the above priorities focus on the short-/mid-term, what are the few initiatives that should continue to be prioritized considering their high ‘future-back’ (long-term) value-at-stake?

- For FMCG companies with large exposure to fragmented channels (mostly Food & Beverage, Professional Beauty), we favor EB2B that we predict will be a key enabler to protect & expand share of profit capture in those highly strategic/ profitable fragmented channels

How to leverage EB2B to protect & expand our share of profit in fragmented channels? (cf. the below publication for our detailed perspective)

FMCG CEOs: Could This Be The Largest Strategic Opportunity In The FMCG History?

‘The further backward you look, the further forward you can see’ – Winston Churchill

- On Pet Care, Beauty, Consumer Health & Premium Coffee, we still see large unrealized value behind DTC & sometimes ecosystems: from eliminating low right-to-win organic initiatives through turning around or divesting acquired DTC assets to start differentiated DTC value propositions on the largest & most DTC friendly brands that have the potential to deliver large incremental omnichannel value

How to make DTC worth doing & how to maximize its incremental omnichannel value? (cf. the below publication for our detailed perspective)

‘Face reality as it is, not as it was or as you wish it to be’ Jack Welch

6) Last but not least, we see a large future-back value-at-stake (combined risks & opportunities) behind Sustainability, mostly through true-costing/ taxation of Water & CO2 but also sometimes through natural resources availability (agricultural products, water in some specific regions). Our models suggest a profit at stake of up to 50% on some FMCG categories. In this context, it is critical to have a detailed & fact-based perspective on the following questions:

- What is qualitatively (key drivers) & quantitatively (EBIT at stake) the different level of value at stake behind Sustainability depending on different scenarios of true taxation & regulation/ scope enforcement?

- What are the opportunities to create holistic value across the value chain (consumers, other stakeholders), and then turn Sustainability risks into opportunities?

- What should be a holistic, commensurate to the value at stake & gradual strategic response (considering the significant value at stake and the fact that most initiatives will not deliver a pay-back until (if?) true taxation kicks-in)?

Those are uncomfortable & difficult questions. The FMCG industry, like many others, has been ‘subsidized’ by (almost) free natural resources (CO2, water but not only) which enabled us to propose cost-effective products to masses despite them being extremely resources-intensive. Unless we understand finely our value at stake, deeply rethink our products, supply chains & iterate from the holistic consumer job to be done, we will not be able to solve it. This is our exciting challenge. We will share a publication detailing our point of view over H1 2024

Unless we understand finely our value at stake, deeply rethink our products, supply chains & iterate from the holistic consumer job to be done, we will not solve it. This is our exciting challenge

Six Predictions For 2024:

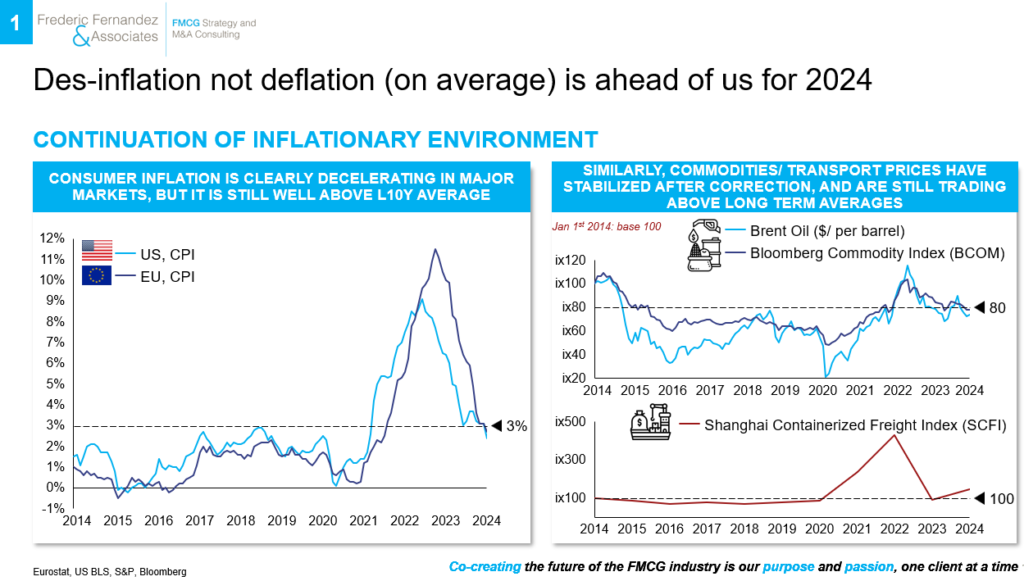

1) Des-inflation not deflation (on average) is ahead of us for 2024

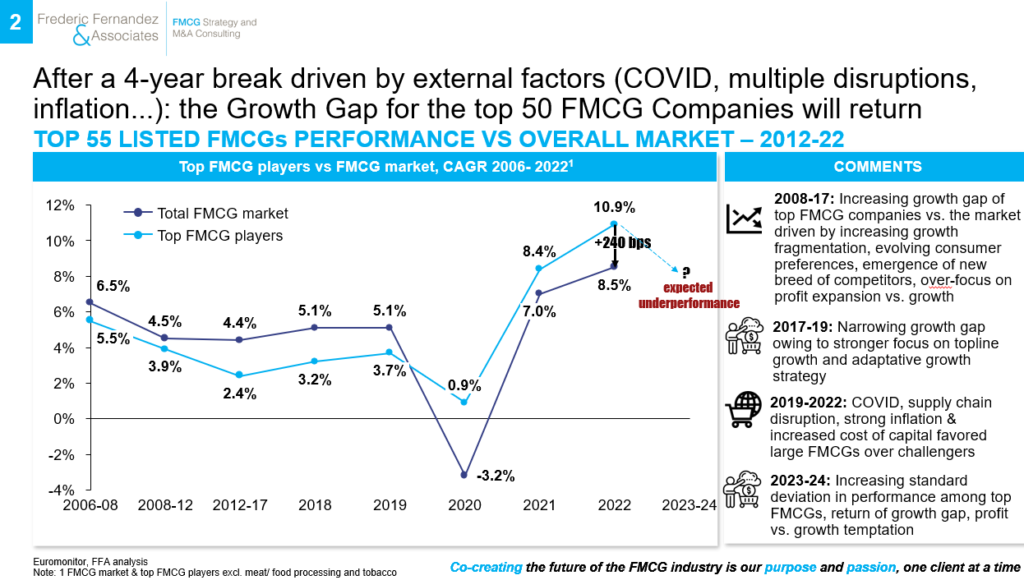

2) After a 4-year break driven by external factors (COVID, multiple disruptions, inflation…), the Growth Gap (on average) for the world top 50 FMCG Companies will return

3) In 2024, an increasing number (and a majority, ie >50%) of the top 50 FMCG companies will miss and lower their top-line guidance

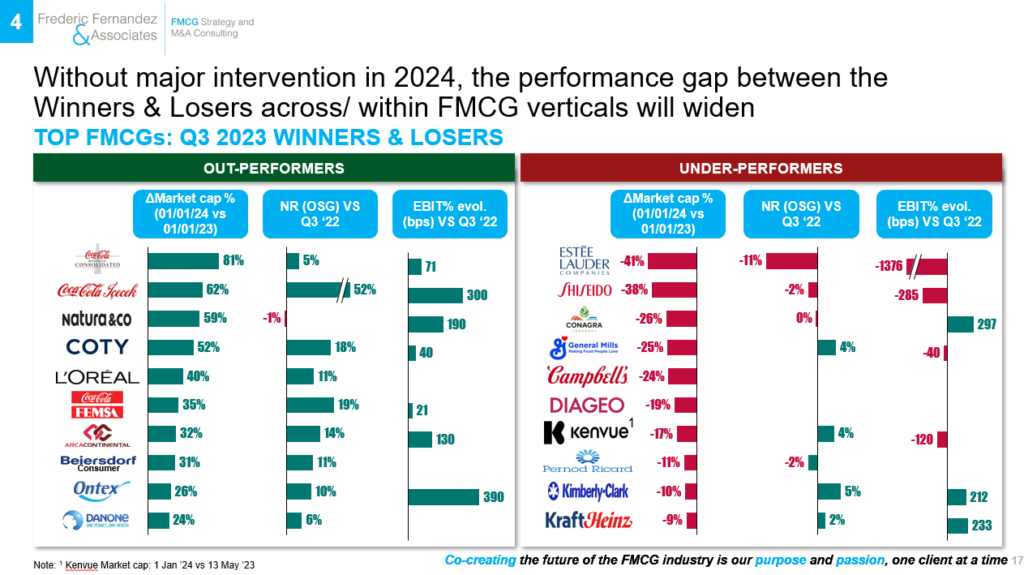

4) Without major intervention in 2024, the performance gap between the Winners & Losers across/ within FMCG verticals will widen

5) China will continue to disappoint but will remain by far the #1 EM in the FMCG industry (weight & share of growth wise). India will continue to outperform CAGR wise. But an outperforming India still deliver half of the global share of growth than a slowing down China. Saying it differently: for now, the next China is China

6) M&A market to progressively bounce-back to $25-35bn level driven mostly by mid-size ($0.5-0.6bn) transactions (the ones that have delivered historically the highest ROCE on average) across most verticals

As Peter Drucker used to write: ‘The best way to predict the future is to create it’

As this year starts, we could not be happier to:

- Do what we do (help the world largest FMCG companies winning today while renewing their competitive advantages to win tomorrow)

- The way we do it (one client engagement at a time and through our thought-leadership publications & conversations)

- With our amazing team

- And the support of our amazing Clients

We are very grateful. We can’t wait to live another very exciting & decisive year with you all

Wishing again to all an amazing year! Decisive & exciting year ahead

Get in touch:

To follow Frederic, please click Here, To start a conversation, email at: frederic@fredericfernandezassociates.com

To get the full deck of this publication (that also includes the decks of all above mentioned articles), please write us at contact@fredericfernandezassociates.com

To subscribe to our newsletter and receive all our CEOs Insights, sign-up at the following link: FMCG CEOs: Managing For Growth

About the Firm:

Frederic Fernandez & Associates (FFA) is a global bespoke Strategy Consulting Firm exclusively focused on Organic Growth (Zero-Based-Growth® approach), Digital GTM (Ecommerce 2.0®, DTC & Ecoystems and EB2B) and M&A serving the world largest FMCG companies. Its purpose is to help its clients win today while renewing their competitive advantages to win tomorrow. 14 out of the top world 20 largest FMCG companies are repeat Clients.

The Firm’s team intervenes all across the globe and across all FMCG categories. To know more about the Firm, please visit our website: www.fredericfernandezassociates.com

No FFA employees own any stocks or financial instruments of any FMCG companies or companies mentioned in the above article. All the above information are public information