It has been more than three years since I last published an article on LinkedIn. Since my brother committed a suicide, I gave up writing to focus exclusively on my family and the Firm. Writing takes time & energy. I had neither left. During those three years, you were hundreds to write me and to check on me. Thank you all and I apologize if I didn’t reply to each & every one. Today, we are launching our LinkedIn newsletter ‘FMCG CEOs: Managing For Growth’, a bi-weekly newsletter on CEO insights in the FMCG/ CPG industry. It is good to be back sharing. We hope you will enjoy those few lines.

Each quarter, we review in detail the published results of the top 55 public FMCG companies, the top grocery retailers & the world largest e-commerce pure players. We analyze their performance and review their progress on their strategies. 2022 results are now all in. Here are our take on 2022 in ten key messages & charts.

‘Things are never as bad or as good as they seem’ ― Tony Hsieh

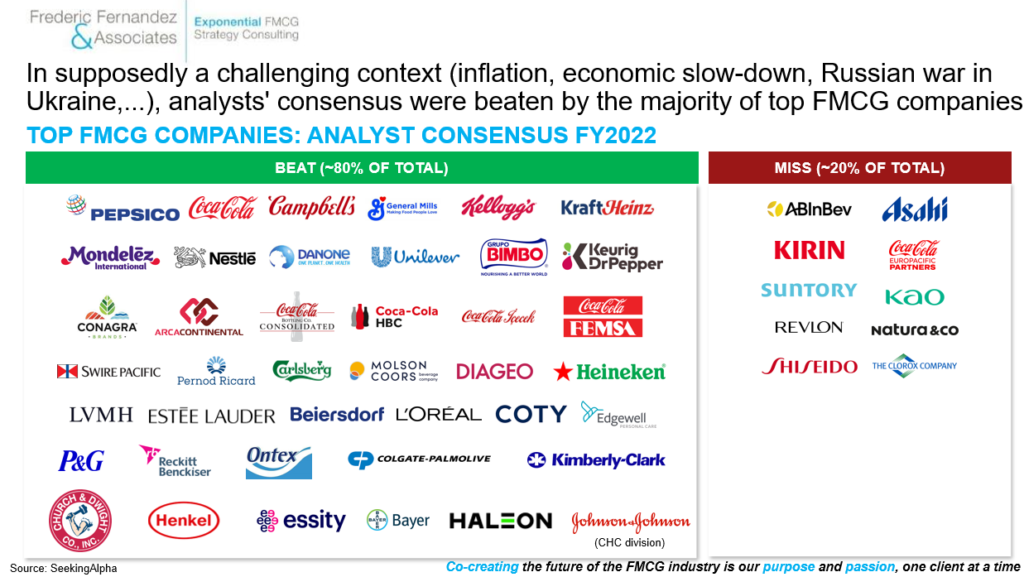

1) 80% of top listed FMCG companies beat the 2022 full-year analysts’ consensus against all odds

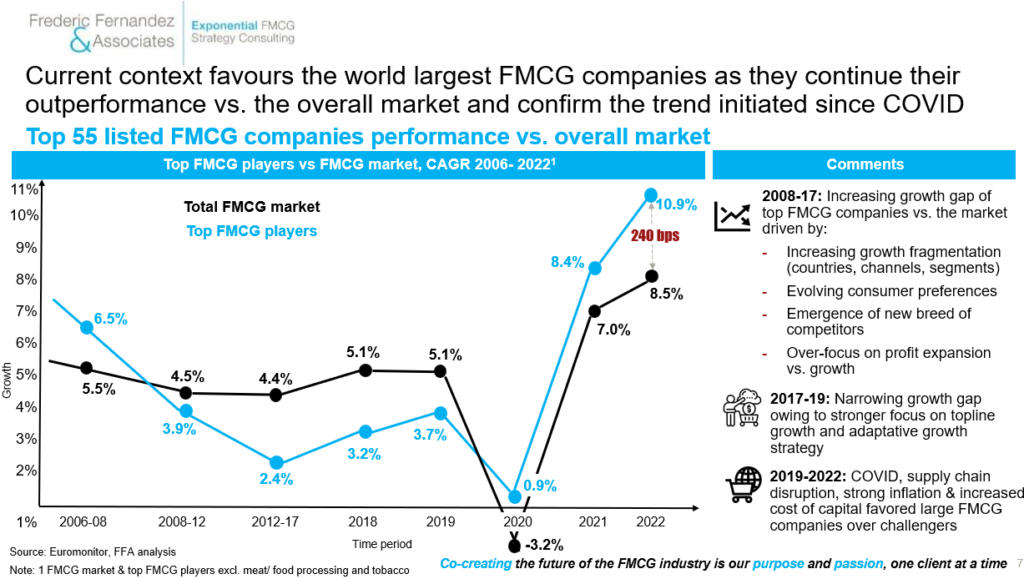

2) Current context (inflation, supply chain disruption…) coupled with a sharper focus on topline growth initiated from 2018 explain the world largest FMCG companies outperformance vs. the overall FMCG market

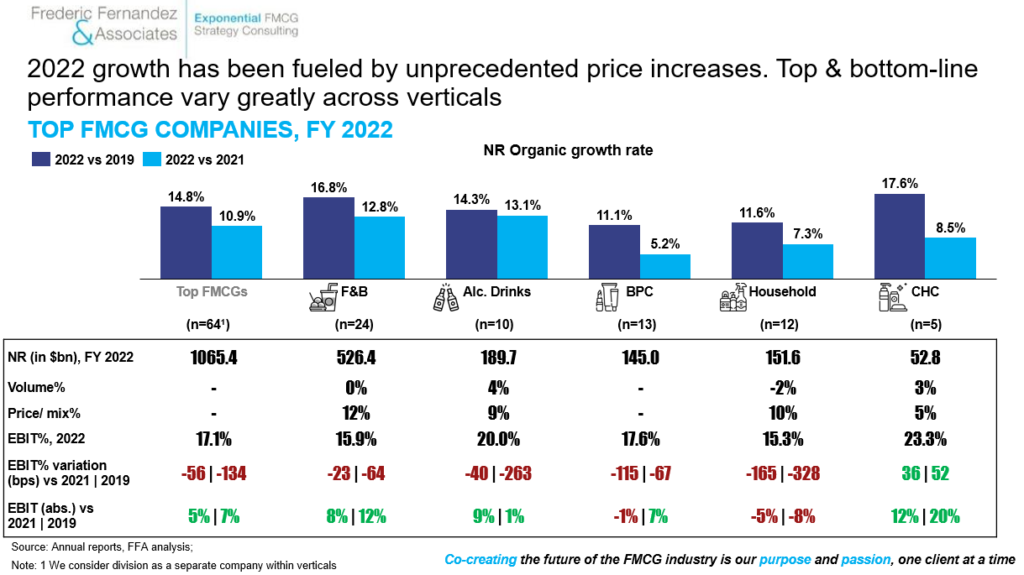

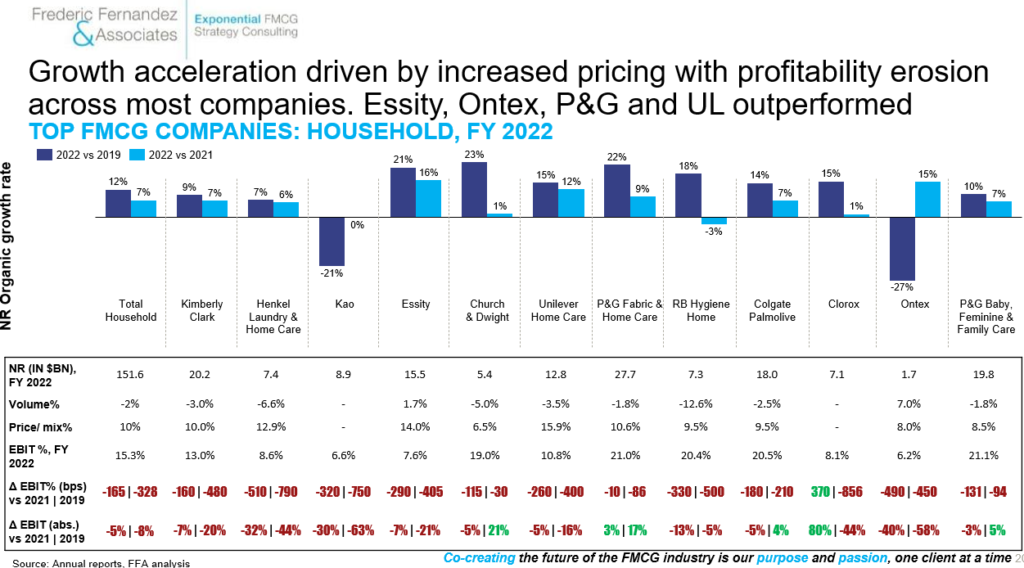

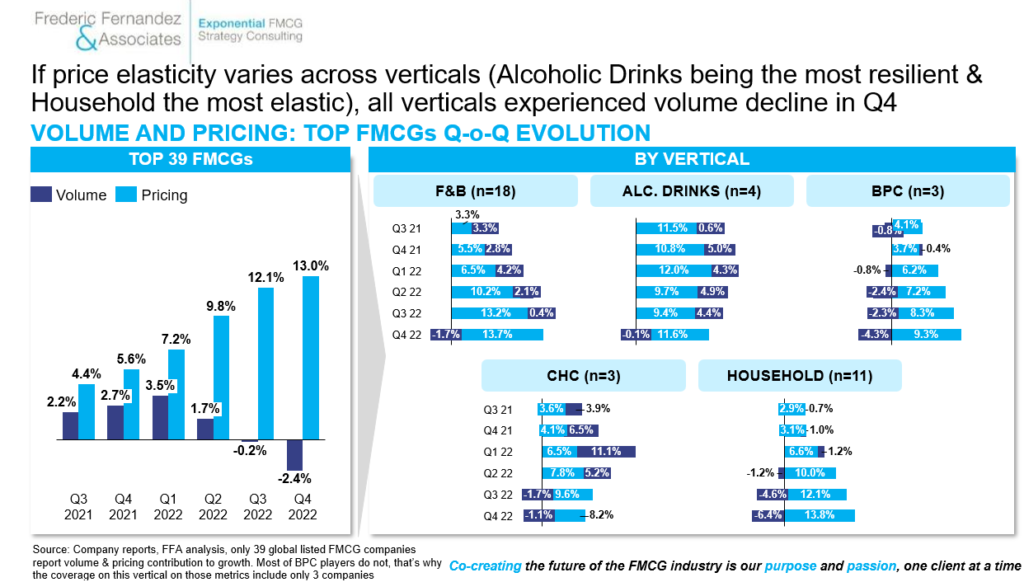

3) A historic 2022 vintage driven by unprecedented price increase and strong bottom-line resilience. Contrasting situations across verticals

Few general comments:

- The top FMCG companies have overall recovered in 2022 for the first time their absolute pre-COVID profit level. The Household vertical is the only exception

- If profitability slightly eroded overall (-56bps vs. 2021), absolute EBIT grew significantly (+5%) illustrating the ability of most FMCG companies to navigate & benefit from high inflation environment (P&L with high gross margin %, even if price increase % barely covers COGS % increase, the overall absolute growth margin per transaction grows strongly)

- Most verticals performed strongly:

i) F&B managed to implement a 12% net price increase on average while protecting volume

ii) Alcoholic Drinks posted very strong & balanced performance highlighting the resilience of beer & spirits categories and their lower price elasticity

iii) Consumer Health Care benefited strongly from the Cold & Flu season while implementing a 5% net pricing

iv) Beauty Personal Care delivered a strong performance in a context China & Travel Retail suffered from a strong COVID-related disruption in Q4

v) Household remains the most challenged vertical within the FMCG industry (higher price elasticity, eroding margin)

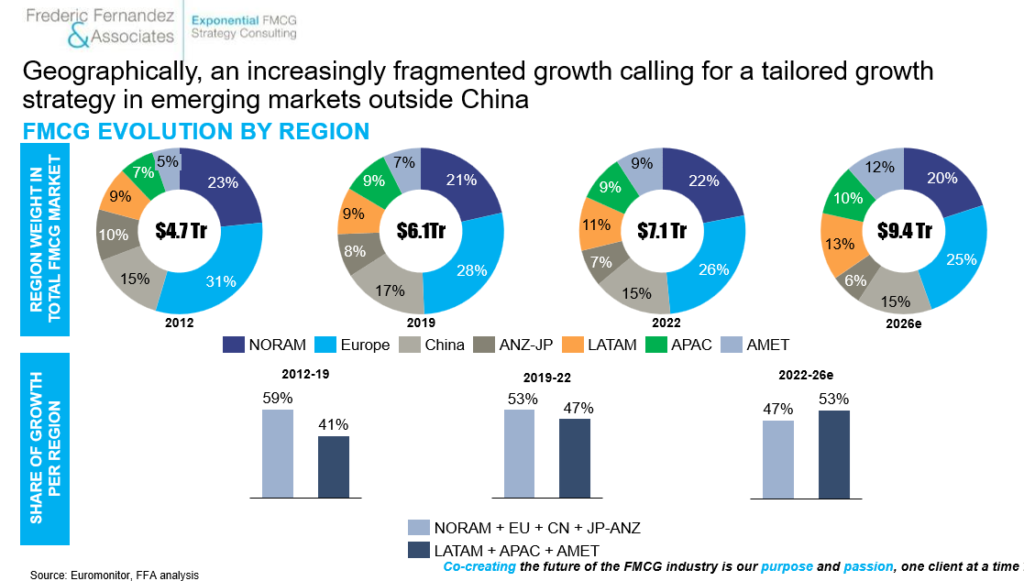

4) Increasing geographic growth fragmentation requiring a sharpened focus on emerging markets outside China

Global FMCG market is less and less dependent on the three traditional North America/ Europe/ China pillars. COVID-19 accelerated this transition. Based on Euromonitor projection, LATAM/ APAC excl. China/ AMET (Africa Middle East Turkey) are now expected to account for 53% share of growth in the FMCG industry over 2022-26. The overall is calling for a dedicated growth strategy on emerging markets outside China.

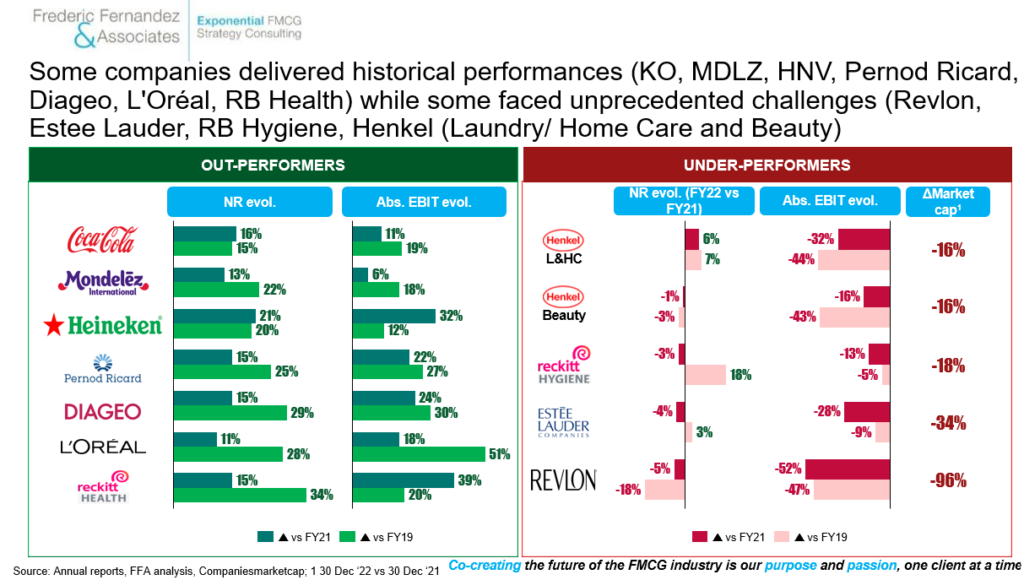

5) Some companies delivered historical performances (Coca-Cola, Mondelez, Heineken, Pernod Ricard, L’Oreal, RB Health) while some faced unprecedented challenges (Revlon, Estee Lauder, RB Hygiene, Henkel Laundry & Home Care and Henkel Beauty)

Six companies posted historic results combining strong volume & pricing growth while growing the bottom-line. Few highlights (non-exhaustive):

i) Coca-Cola confirmed one more time the formidable strength of its business model (high demand resilience driven by unique demand generation capabilities, low price elasticity & strong RGM capabilities) posting a 16% top-line growth (+5% volume & +11% pricing). It has now fully passed the COVID turbulences top & bottom-line wise

ii) Heineken impressed in 2022. Its Evergreen transformation (cost reduction – organization, manufacturing footprint; sharpened focus on growth – portfolio, working media increase, innovation – Heineken Silver #1 innovation in Europe total FMCG industry in 2022) initiated by Dolf Van Den Brink in 2020 delivered outstanding results (21% top-line growth, +7% volume & +14% pricing, EBIT absolute grew by almost 1/3 vs 2021)

iii) Mondelez was the only Food company to post both volume (+3%) & pricing (+10%) growth while growing EBIT absolute. The transformation work initiated by Dirk Van de Put since Q4 2017 (focus on snacking, sharpened portfolio with active M&A/ divesture, increased consumer centricity, leaner & more focused organization…) continues to yield impressive results (+70% stock price in 5 years)

iv) L’Oreal keeps impressing. Its 2022 absolute top-line and bottom-line are now respectively 28% and 51% greater than in 2019 (+60% stock price since end 2019). Despite COVID-related disruption in China over Q4, it continued to outperform the global Beauty market with strong growth (+11%) across all geographies/ divisions. It is even more remarkable that Estee Lauder in the meantime posted their worse FY results in a decade

Four companies faced unprecedented challenges in 2022:

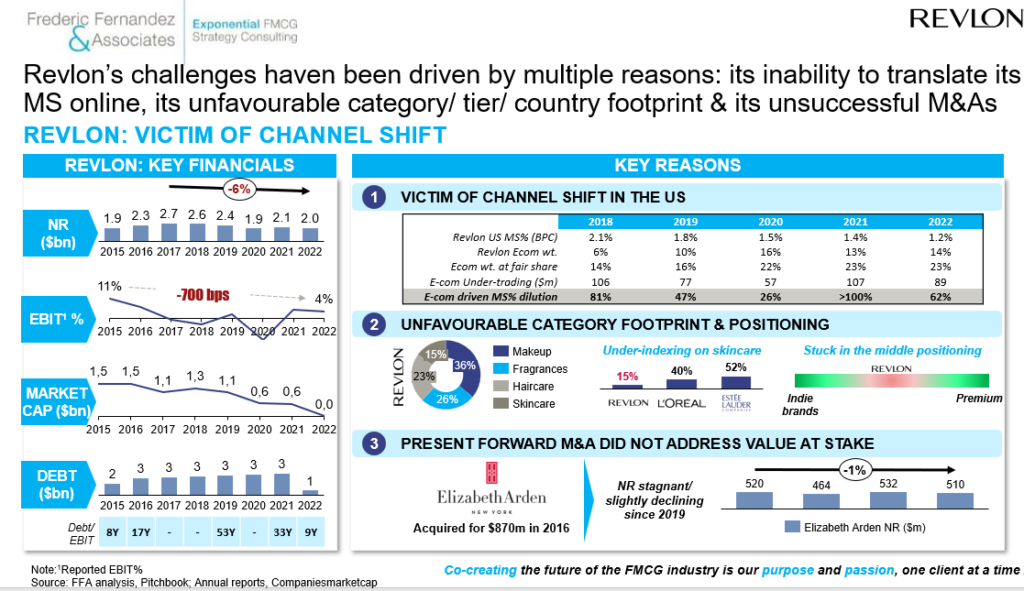

i) Revlon was placed under Chapter 11 and lost 96% of its market cap in 2022 alone. Multiple factors explain this situation

ii) If we except Revlon’s exceptional case, Estee Lauder suffered more than any other Beauty companies mostly because of its dependency on Travel Retail, offline China & US businesses. Its top-line declined by 3% whereas L’Oreal & Coty both grew by 11% in 2022 (a historic 1400 bps growth differential). Recent acquisitions have been underperforming (sometimes even discontinued like Becca) and saw a new round of write-offs in 2022. Stock price lost 1/3 of its value in 2022

iii) 2022 was a challenging year for Henkel Consumer Goods business. If its challenges on Beauty are not new (consistently underperforming the BPC vertical over the last years), the increasing difficulty of the Laundry & Home Care division both on top-line (underperforming now significantly P&G Laundry & Home Care and Unilever Home Care) and bottom-line front (Henkel L&HC EBIT % halved from 16% in 2019 to 8% in 2022 whereas P&G Laundry & Home care EBIT remained around the 21% mark) is both worth noting and concerning

iv) RB Hygiene Home saw its net revenue declining (-3%) despite a 13% net pricing gain making it the worst performing Household business among the top FMCG companies, mostly driven by the post-Covid ‘normalization’ of Lysol/ Dettol. Except the decline in Lysol, Household would have posted a +5% net revenue growth in 2022

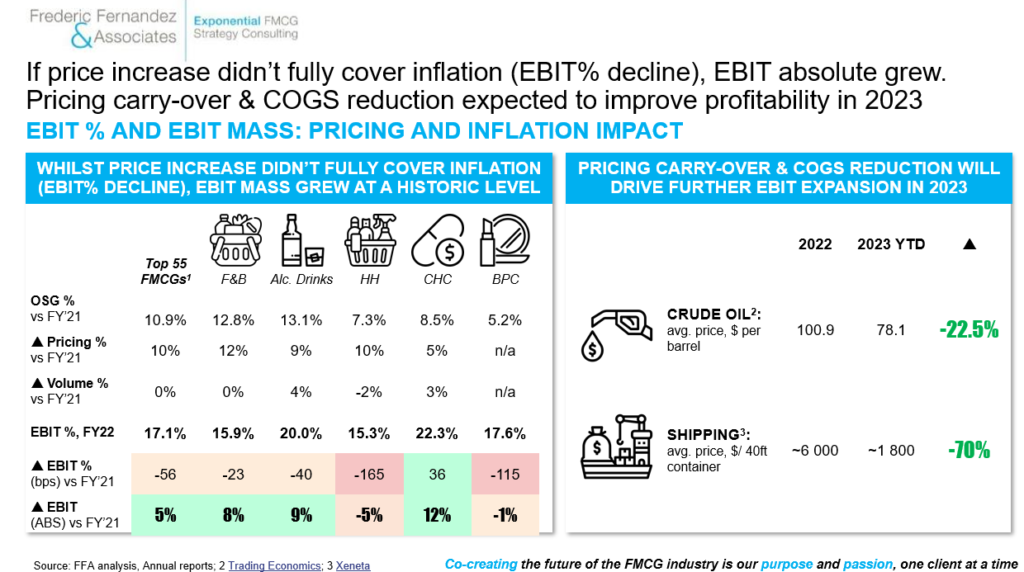

6) Whilst price increase didn’t fully cover (for now) commodities inflation (EBIT % declined), absolute EBIT grew significantly. Profitability expansion expected in 2023 with 2022 pricing carry-over & some COGS reduction

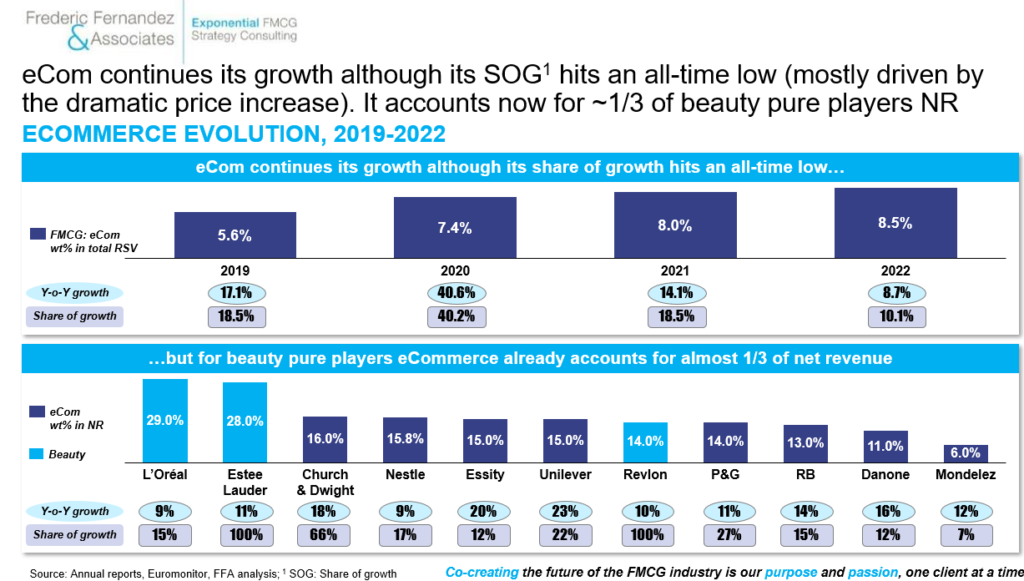

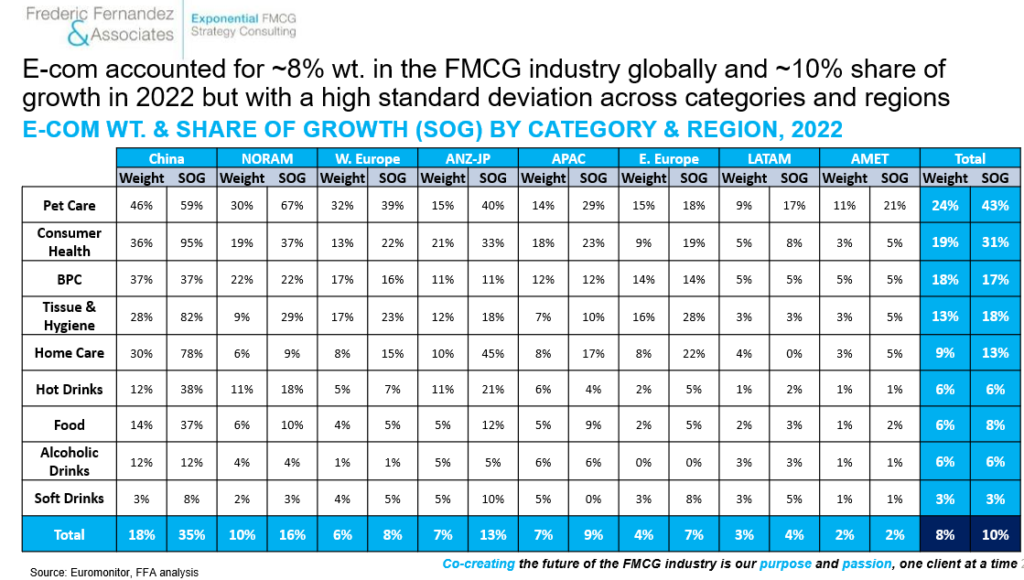

7) (B2C) e-commerce continues its growth although its share of growth hits an all-time low (driven by the unprecedented price increases boosting overall growth and the post COVID growth normalization). Ecommerce accounts now for almost 1/3 of beauty pure players net revenue and shows great standard deviation across vertical/ region calling more than ever for a granular strategy at segment/ country level

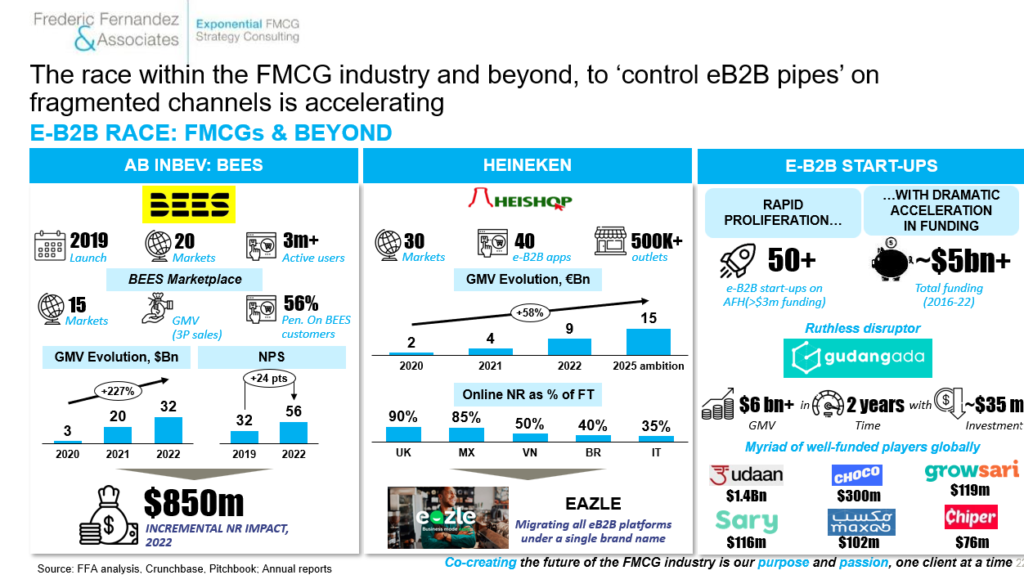

8) The race to control the eB2B ‘pipes’ in fragmented channels (40% of the global FMCG market, much more for Beverage players) is accelerating creating unprecedented risks (deflation, market share dilution for incumbents) & opportunities (lowered barriers-to-entry for challengers) for all FMCGs

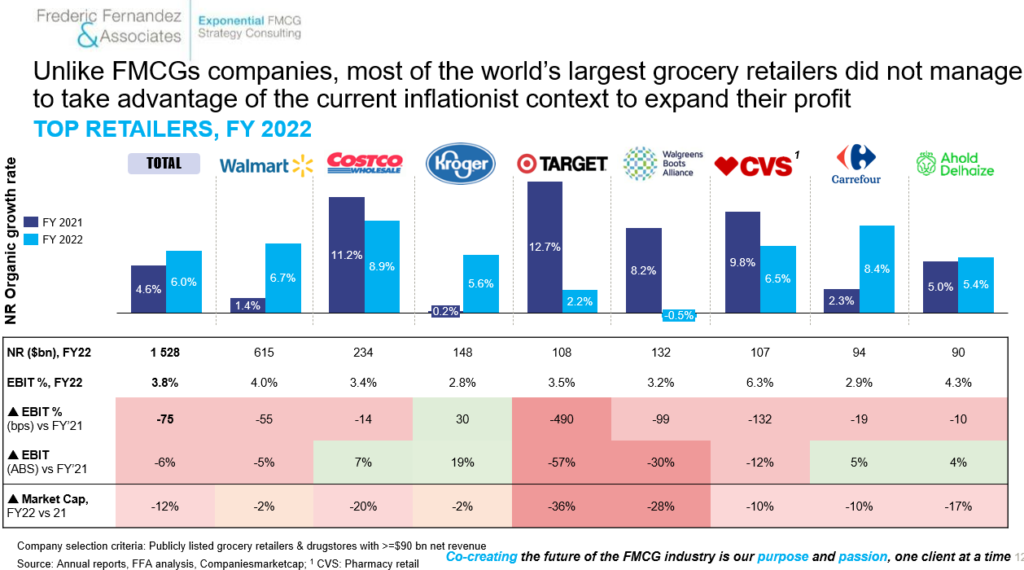

9) Unlike FMCG companies, the world largest grocery retailers did not manage to take advantage of the current inflationist situation to expand their profit in absolute. Also, unless FMCG companies, they are unlikely to be in a position to expand significantly their profitability in 2023

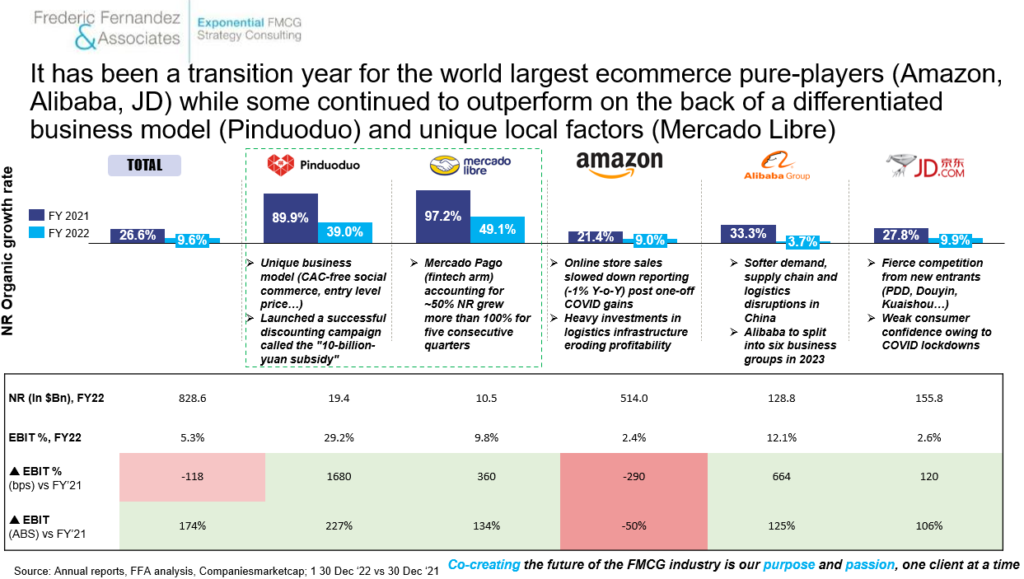

10) It has been a transition year for the world largest ecommerce pure-players (Amazon, Alibaba, JD) while some continued to outperform on the back of a differentiated business model (Pinduoduo) and unique local factors (Mercado Libre)

All eyes will be focused in 2023 on the ‘elephant in the room’: consumer price elasticity. Rarely in the history of our industry, so much pricing has been taken in one-go at such a global level. If impact remains mostly invisible to-date, the sequential decline in quarterly volume growth in 2022 suggests that 2023 volume development could be challenging

We expect the most price elastic segments in 2023 to be: Household, Food, Water and Mass Beauty. While we expect Alcoholic Beverage, Soft Drinks, Premium Beauty, Premium Coffee, PetCare & Consumer Health to be the most resilient.

Bringing it all together, if 2022 has been an exceptional vintage for most FMCG companies, key challenges remain for 2023:

i) How consumer price elasticity will evolve in a context of elevated pressure on purchasing power? How consumers will react (down-trading to private labels, to smaller packs, to bigger packs, to discounters…)? All those different down-trading have different implications for FMCG companies

ii) Will FMCG COGS reduce significantly as suggest year-to-date multiple indicators (oil, transportation, key commodities)?

iii) How retailers will react if those COGS reduction materialize? Will they ask for the first time ever for some list price reduction? In a context of eroding absolute profit, will they toughen negotiations with FMCGs?

iv) Will 2022 underperformers manage to turnaround performance in 2023 (Henkel Consumer, Estee Lauder, Revlon, RB Hygiene)?

v) How successful will FMCG companies be in accelerating growth in emerging markets, especially outside China in a context of ever growth fragmentation?

vi) Will any FMCG company follow Revlon as a victim of the channel shift in 2023?

vii) Who will win the EB2B race on fragmented channels? Can F&B FMCGs afford not to play? What would be the consequences for the winners/ losers & for the entire FMCG industry?

viii) Which FMCG companies will take the most advantage of the current M&A context and compressed multiples/ valuations?

Exciting year ahead.

‘Things are never as bad or as good as they seem’ ― Tony Hsieh

#fmcg #cpg #strategy #ceoinsights #mergersacquisitionsdivestitures #growth

To follow Frederic, please click Here, To contact him, email at: frederic@fredericfernandezassociates.com

About the author:

Frederic Fernandez is a strategic advisor in the FMCG industry. He is the Managing Director and Partner of Frederic Fernandez & Associates (FFA) a global bespoke Strategy Consulting Firm exclusively focused on the FMCG industry. Its purpose is to co-create the future of the FMCG industry, one client at a time. The Firm helps the CEOs and the Boards of the world’s largest FMCG companies on selected areas: Growth and Profit acceleration, New Retail/ EB2B/Ecommerce/ DTC and M&A (buy-side & sell-side). The Firm’s head office is located in Zug in Switzerland. The Firm’s team intervenes all across the globe. To know more about the Firm, please visit its website: www.fredericfernandezassociates.com

No FFA employees own any stocks or financial instruments of any FMCG companies or companies mentioned in the above article. All the above information are public information.