‘Insanity is doing the same thing over and over again & expecting different results’ Albert Einstein

Almost half of the growth in the FMCG industry over 2022-26 will take place in Emerging Markets (EMs) outside China. Those markets will deliver a $1 Trillion incremental sell-out value over this period. In those markets, not only the world largest FMCG companies (top 55 listed) have a significantly lower market share than in developed markets (24% less on average), but the immense majority of them have also been underperforming (losing market shares) there for the last decade. Time has come to manage for outperformance in EMs, here is our perspective on this strategic opportunity and how to address it.

Winning in Emerging Markets, especially beyond China, is becoming a must-win battle. Here is why:

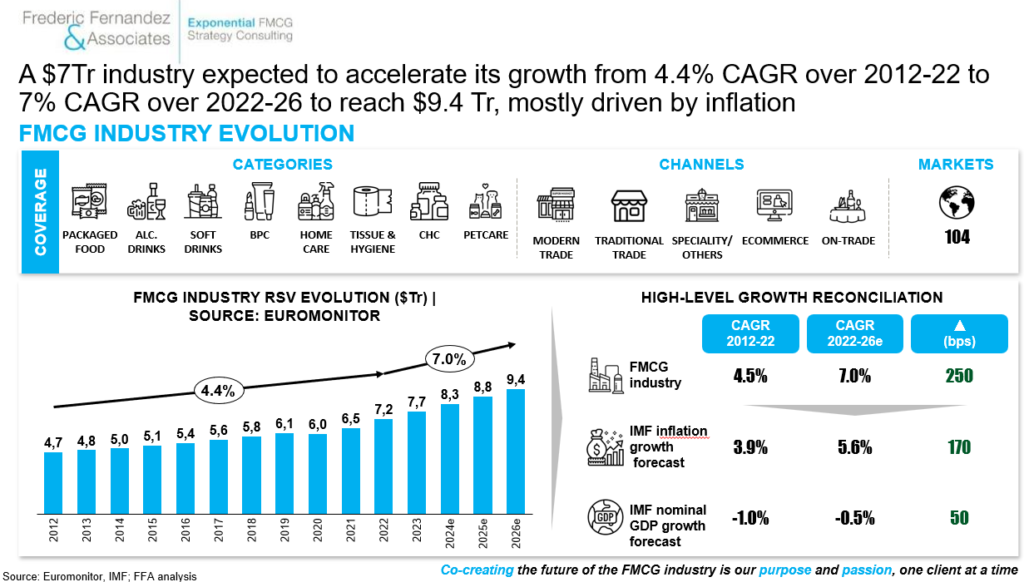

i) The FMCG industry is expected to grow from $7.2 to 9.4Tr sell-out over 2022-26 at a 7% CAGR, ie. a 250bps acceleration vs. 2012-22, mostly fueled by higher inflation

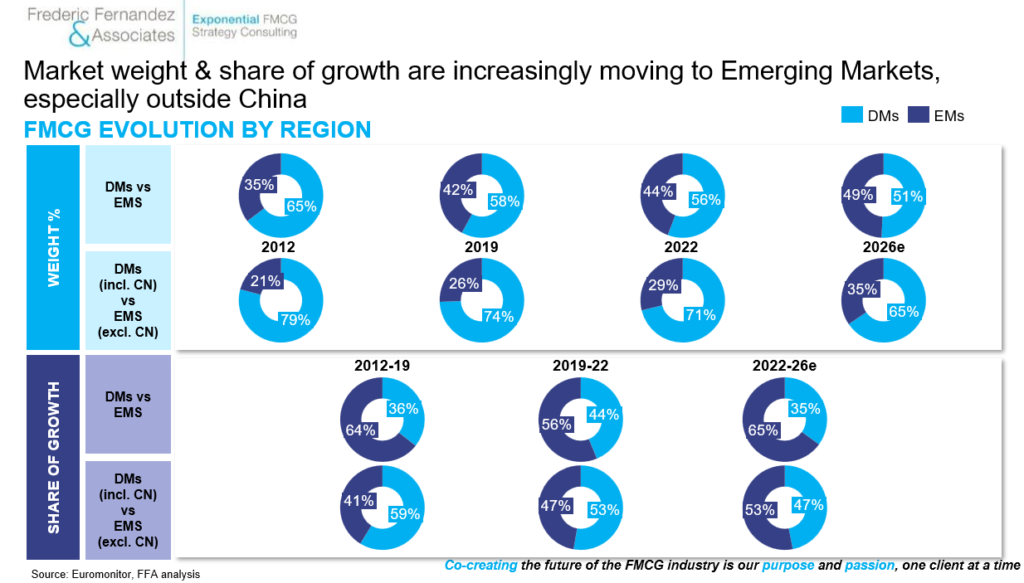

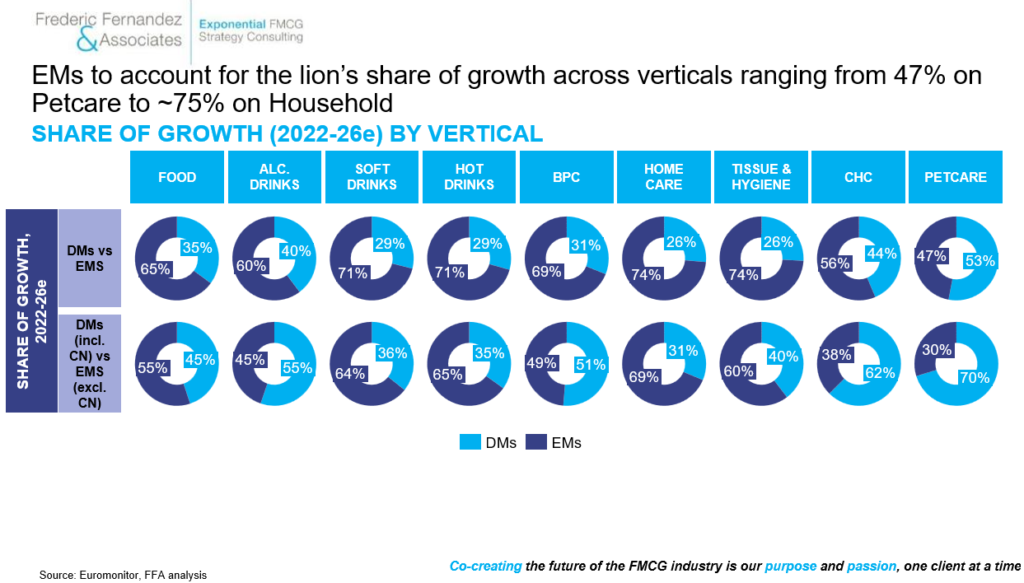

ii) EMs are increasingly the present & the future of the FMCG industry, on average but also for all verticals. Half of the global FMCG market will sit in EMs by 2026 and they will represent 2/3 of the global projected growth over 2022-26. EMs excluding China will represent almost half of the global share of growth over this period which represents a $1Tr growth opportunity

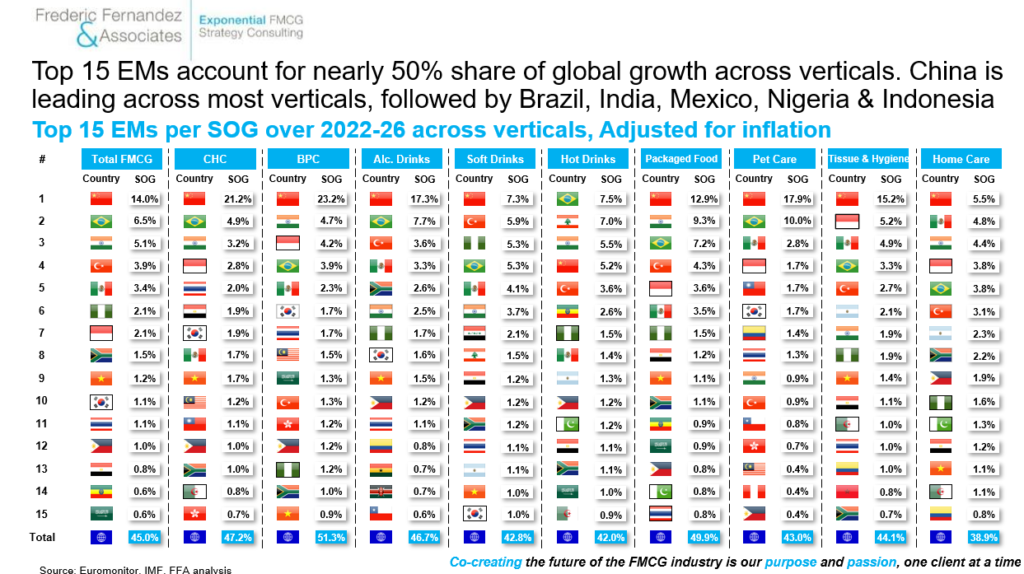

iii) The top 15 EMs account for almost 50% of the global FMCG market share of growth, which is also true for most FMCG verticals

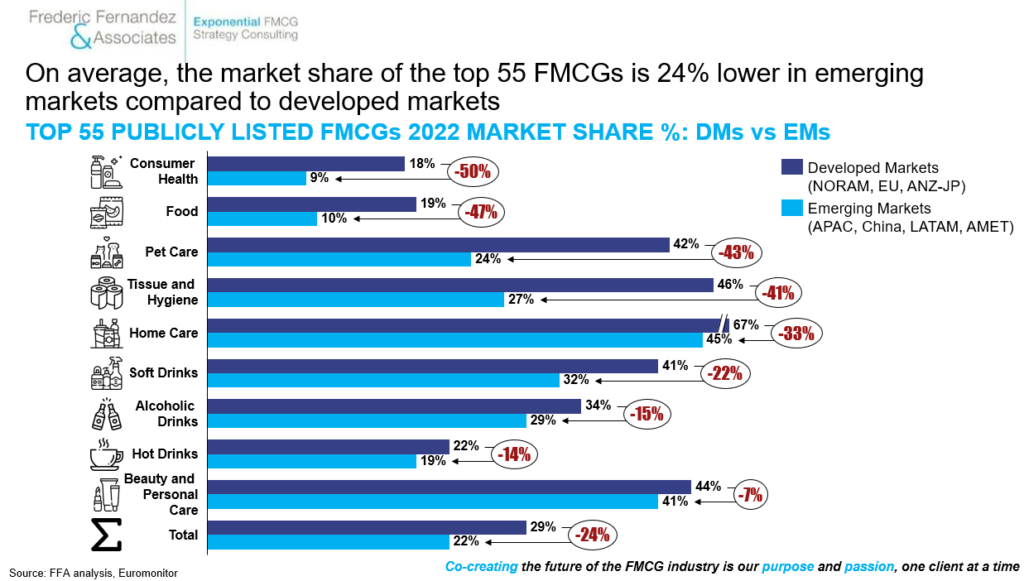

iv) The world largest FMCG companies (top 55) have on average a much lower market share in Emerging Markets (EMs) (24% lower – but up to ~50% lower on CHC & on PetCare) than in Developed Markets (DMs), making in theory the opportunity even greater than this $1Tr if outperformance can be achieved

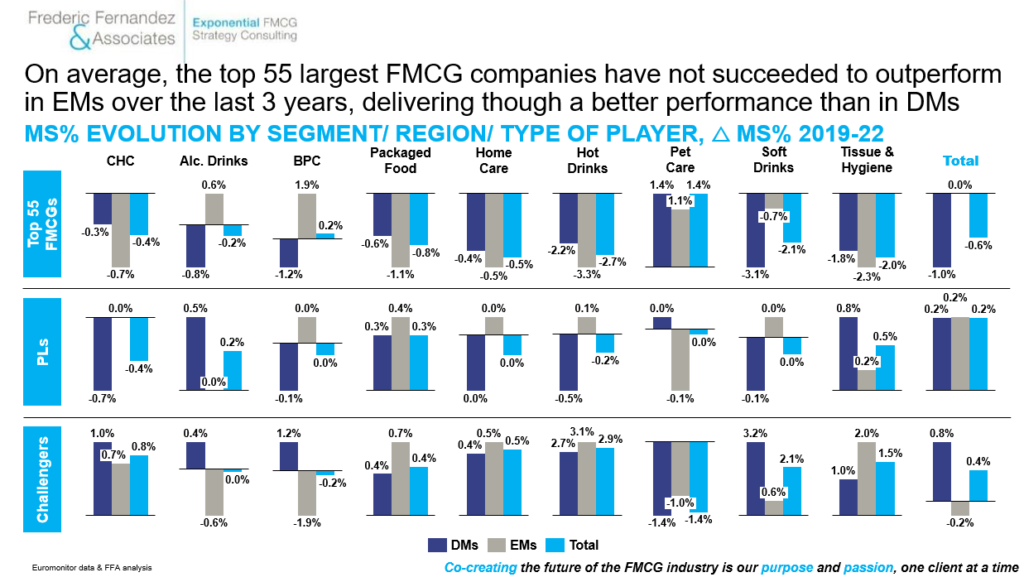

v) On average the world largest FMCG companies (top 55) have over 2019-22 not been outperforming in EMs, despite delivering there a better performance than in DMs

To summarize, EMs are large & faster growing, the world largest FMCG companies are not only under-trading there (much lower market share than in DMs) but they are not making any progress to bridge this gap.

What are the reasons behind this situation?

- EMs, especially excluding China, are extremely fragmented (the entire APAC region excl. CN + AMET region, ie. 100+ markets = the FMCG market value of China)

- Consumers are different (they have stronger local preferences) & highly heterogeneous (great standard deviation in income per capita, preferences can vary greatly across regions within a same country)

- Retail & media landscapes are different (still extremely fragmented) making it much more difficult to create physical & mental availabilities at scale

- Large FMCG companies have insufficiently tailored their strategies (where-to-play/ how-to-win) to outperform in those markets (their strategies are too often adapted from DMs strategy, instead of being built bottom-up to achieve outperformance in EMs)

- Risk-adjusted returns in many EMs can be less attractive (high ‘betas’ markets with high political, econimical, social instabilities) than in DMs. At such less resources get proportionally allocated there

- When resources are allocated to EMs, EMs regional Presidents have to take many more bets than in DMs to diversify/ hedge their ‘countries’ risks diluting their resources and impacting their expected returns

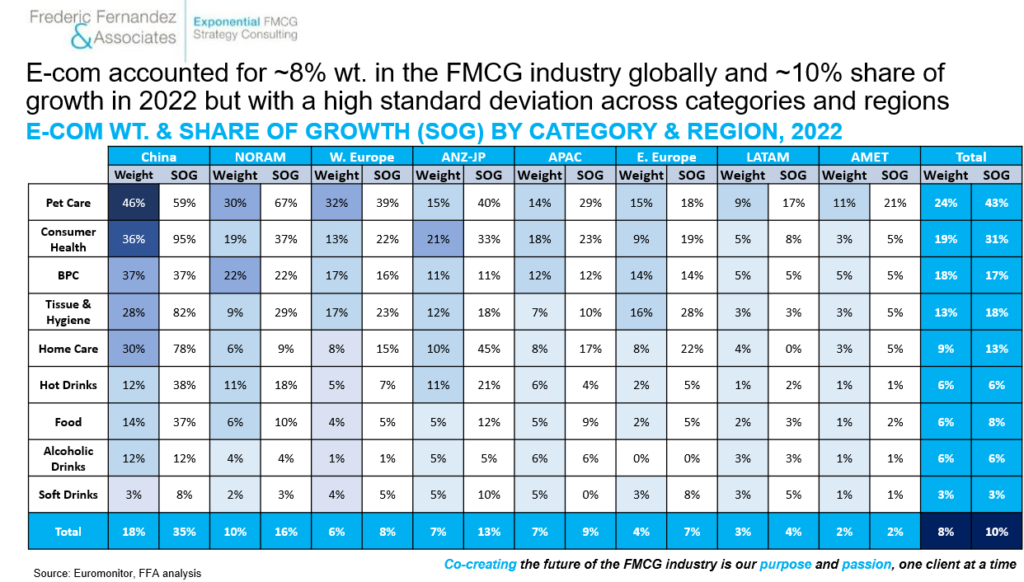

If there are interesting learnings from large FMCG companies in China (how to make product innovation & communication locally relevant, how to leverage digital/ ecommerce to drive physical & mental availabilities in a highly fragmented environment), the China situation with its high ecommerce penetration (880m unique Chinese consumers shop on Tmall every month) and weight (18% weight in the total FMCG industry) remain an exception within EMs (rest of APAC is at 7%, LATAM is at 3% & AMET at 2%)

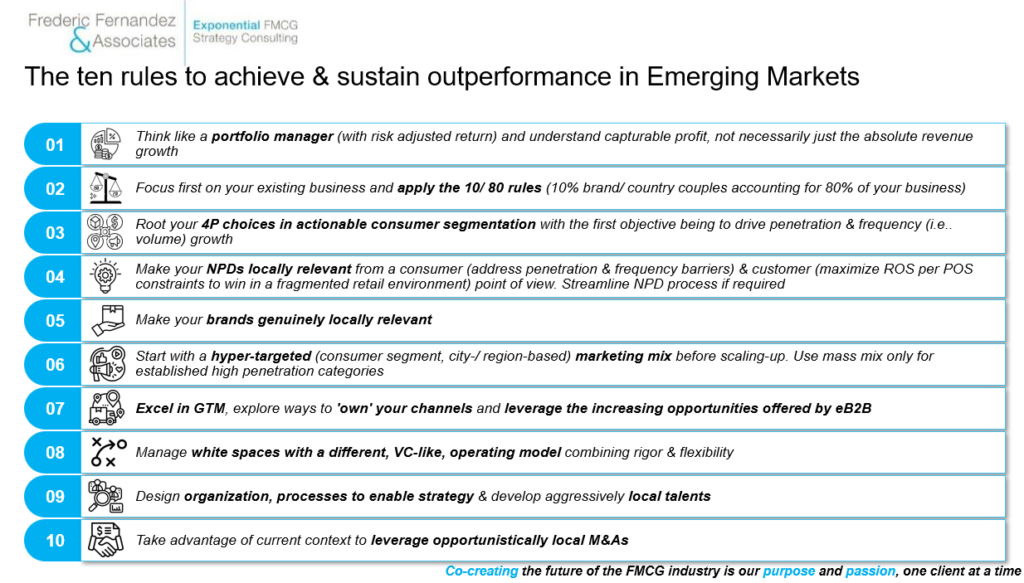

Over the last 6 years, half of our engagements took place in emerging markets. Here is our perspective on the ten rules to achieve & sustain outperformance in EMs.

Rule #1: Think like a portfolio manager (with risk adjusted return) and understand capturable profit, not necessarily just the absolute revenue growth

It is critical to understand finely profit pools in EMs, not just absolute revenue growth and to have a clear view on the following questions:

- What is the absolute gross margin (GM) $ value per SKU (and not %) for each power SKU per transaction? Per year per consumer?

- How many consumers would be interested/ willing-to-pay on each power SKU? Hence what would be the Total Potential GM?

- Can this theoritical Total Potential GM be addressed profitably, ie. what has been the average cost to recruit one consumer and how does it compare to the gross margin of one year consumption?

- If profit can be made, how much can it be really protected (currency fluctuation, political, tax…)?

- Out of the remaining profit, how much can it realistically be rapatriated?

Successful FMCG companies in EMs understand finely the answers to all those questions to derive their risk adjusted return and allocate resources on this basis.

Launching a premium dermo-cosmetics brand in tier-one pharmacies in Gulf is a radically different business case than launching a mass laundry brand in sachets in Nigeria.

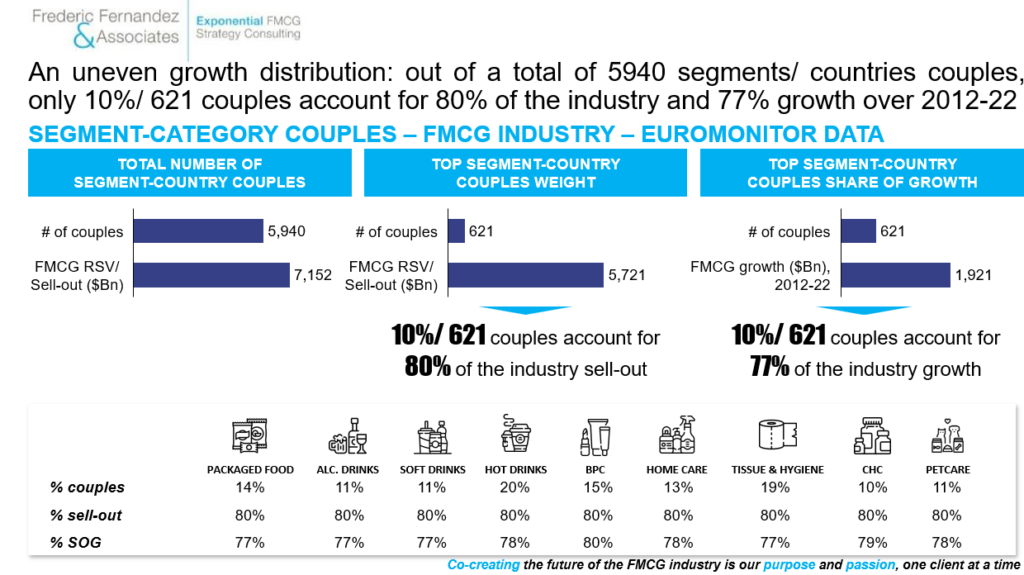

Rule #2: Focus first on your existing business and apply the 10/ 80 rules. Our research over the 2012-22 period shows that ~10% couples account on average for 80% of sales

Building physical & mental availability from scratch in a fragmented environment can be very difficult. Focus first on your existing business. The more you operate in a fragmented environment, the greater is the need to focus. We dissected 10 years of FMCG data (2012-22) and reviewed performance across ~6k segments/ countries couples. On average 10% of the couples account for 80% of sales. Identify those couples, adjust this selection to ensure that it represents also 80% share of growth of the market & 80% of your profit

Rule #3: Root your 4P choices in actionable consumer segmentation with the first objective being to drive penetration & frequency (ie. volume) growth

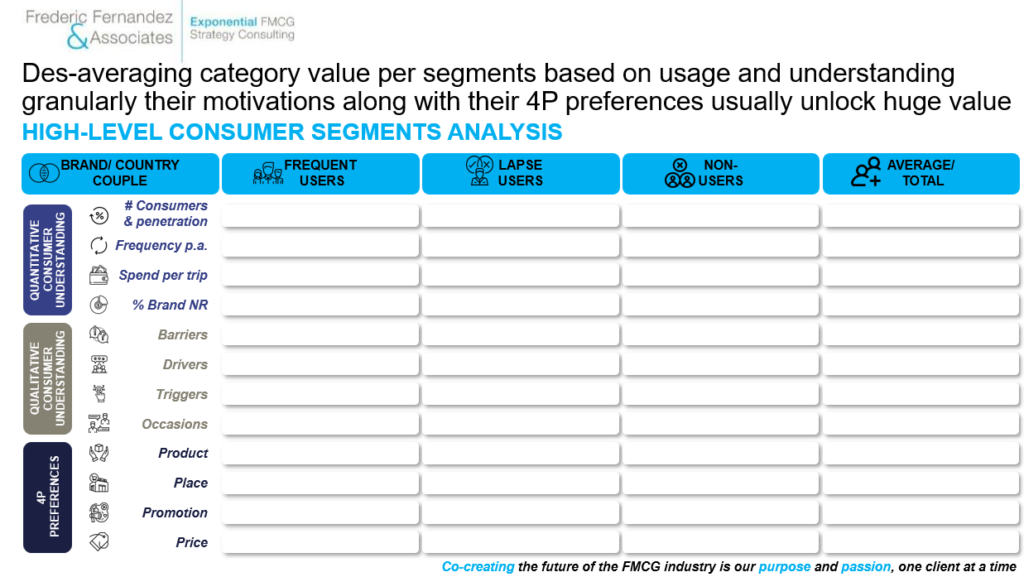

Most of the recent growth in DMs have been driven by premiumization and sometimes we forget that the first growth driver in the history in our industry is penetration. It is particularly true in EMs where most categories display both significant penetration AND frequency improvement potential. Adopting a simple yet actionable segmentation (frequent users, lapse-users, non-users) while uncovering barriers/ drivers/ triggers/ occasions/ 4Ps (especially willingness-to-pay) preferences for each segment usually unlock huge value.

Specifically understanding precisely:

- Who are the frequent users? How many are there in my market? How do I recruit them effectively?

- What are the top barriers for lapse-users & non-users? What does it take to address those barriers?

Rule #4: Make your NPDs locally relevant from a consumer (address penetration & frequency barriers) & a customer (maximize ROS per POS constraints) point of view. Streamline NPD process if required

If DMs managed to grow mostly through new ranges proliferation/ premiumization, EMs require often few high(er) penetration potential SKUs that can deliver a high rate of sales (ROS) per POS to succeed in a high-frequency store environment. Sometimes, EMs are forced to launch NPDs from DMs. EMs should be in control of their NPDs pipeline and they should have their own dedicated regional innovation capabilities.

Price is often a critical driver in EMs. Understanding finely product attributes preferences per key consumer segments & investing selectively behind the most important ones while promoting them aggressively can be a winning strategy.

Rule #5: Make your brands locally relevant

This is critical and this goes much beyond having a local brand ambassador. The most successful brands have a story strongly anchored in local markets.

This is the case of SK-II (the P&G premium skincare brand) that succeeded with its ‘Left-Over Women’ (Chinese terms for unmarried women aged over 25) campaign in China to grow 3x in 3 years from $337m in 2017 to almost $1bn sell-out in 2020

Patanjali, an Ayurvedic Indian multi-categories local FMCG player, started in 2006 and reached in 2022 $3bn net revenue (x2 since 2020) owing to multiple factors (Ayurvedic trend, Indian look & feel, cheaper than branded alternatives, unique distribution network)

Rule #6: Favor hyper targeted marketing tactics focused on specific consumer segments in specific geographic areas over a mass mix. Replicate/ scale when successful

A mass marketing mix is often inadequate in EMs because of the media fragmentation and the comparatively lower penetration potential (depending the category). In those environments, the premium for consumer-centricity (knowing finely the target consumer, its barriers/ drivers/ triggers), creativity & ruthless geographic focus are even much higher than in DMs.

Few examples (non-exhaustive of all possible brand growth models in EMs):

i) The education/ sampling model amplified by digital KOL works well on under-penetrated categories that require explaining. This is the case for feminine hygiene. P&G sanitary napkins brand Whisper in India have been extremely successful synchronizing education-sampling-KOL digital marketing/ store listing at a very local level before scaling. It is a model that can work well also on Consumer Health or on heavily regulated categories where ATL communication is restricted (e.g. how BAT drives nicotine pouch & e-cigarette in EMs)

ii) The impulse Food & Beverage model. This is a model that is synchronizing locally ATL/ BTL investments across channels (on-trade/ off-trade) leveraging heavily local sponsorships, outdoor advertising & lifestyle influencers. It is a model that has been working well on beer generally acros Africa, Asia & LATAM. Objective is to be visually omni-present, especially on point of sales & consumption and to ‘buy’ progressively distribution exclusivity

Those models are also leveraged in DMs. What is critical in EMs is to hyper-focus efforts because of the retail/ media fragmentation, the limited shelf space in traditional trade & the unevenly distributed penetration potential.

Rule #7: Go-to-market (GTM) with discipline (right direct/ indirect set-up with right partners/ execution) while exploring opportunities to ‘own’ your channels and leveraging increasing opportunities offered by EB2

We distinguish three levels of RTM execution in EMs:

i) Get the RTM basics right: that’s the immense majority of the value at stake for most players

There is no success in EMs without a strong GTM. It starts with a balanced direct/ indirect set-up, clear routes design, strong local partners (distributors, wholesalers…), an effective salesforce and a focus on the right channels/ customers (prioritized per weight & share of growth). The overall executed with excellence while tracking the right KPIs (weighted distribution, picture of success assortment, availability, salesforce productivity, re-ordering frequency…) enabled by the latest technology (digital ordering, AI-enabled assortment compliance tracker…)

ii) Own your channel: few FMCG companies have a right-to-win there, but when they do, opportunities can be large

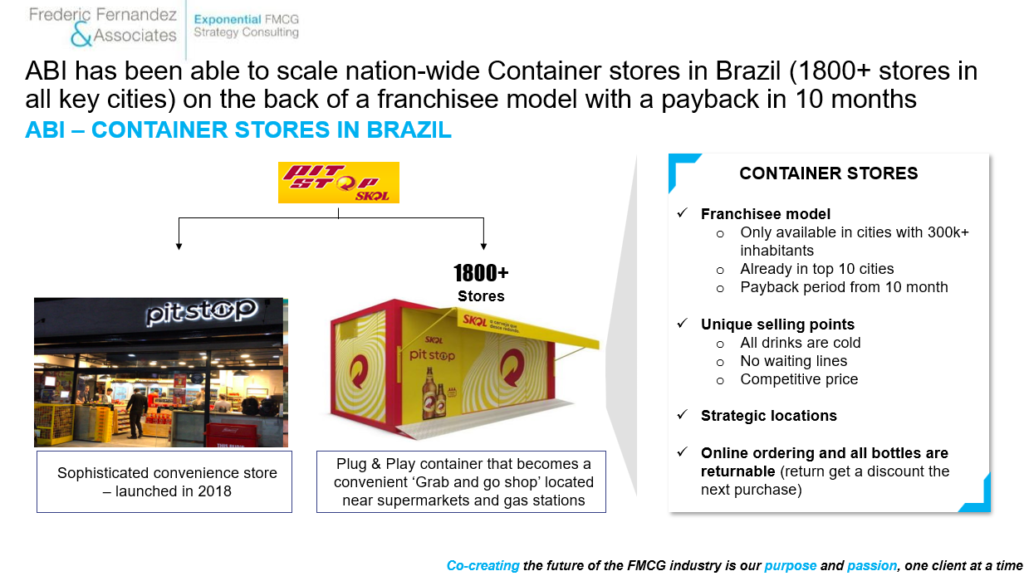

We wrote earlier in this article that one of the reason for Patanjali’s success was to have their own stores. Closer to us, ABI has been successful with its own retail initiatives, especially in LATAM where it has a wide range of own retail programs. If its largest operation is in Mexico (ABI operates 10k+ Modelorama beer stores), our favourite ABI retail format is PitStop in Brazil, a container beer store format that is low-CAPEX, that is operated with a very scalable franchise-model, that enables online ordering and that displays fast pay-back (10 months).

We chose ABI PitStop model but Heineken has its own retail format in Mexico that is also well performing (SIX). Unilever has been successful with its own direct-selling organization, Shakti, in India (160k presenters). Multiple cases exist and those creative RTM strategies are a fantatic 2-in-1 strategy (great way to create both create physical & mental availability) in often a very profitable (double dip on own & retail margin) and high ROI manner (franchise-model)

iii) Leverage holistically the possibilities offered by eB2B:

Consolidation of retail & media landscape has been fueling FMCG growth for more than a century:

- In the 1930s, ‘soap opera’ (think P&G), aired in an increasingly consolidated radio landscape, step-changed category penetration in the US

- Post WWII, the rise of supermarkets (think Leclerc) helped turbo-charge FMCG growth

- Post 1970s, the consolidation of cable-TV networks opened an era of mass-advertising

- In the 2010s, the rise of B2C e-commerce in China (ALIBABA & JD) has enabled to reach 100s of million households, fueling the largest growth ever recorded in our industry, especially on the most under-penetrated categories (e.g. Beauty)

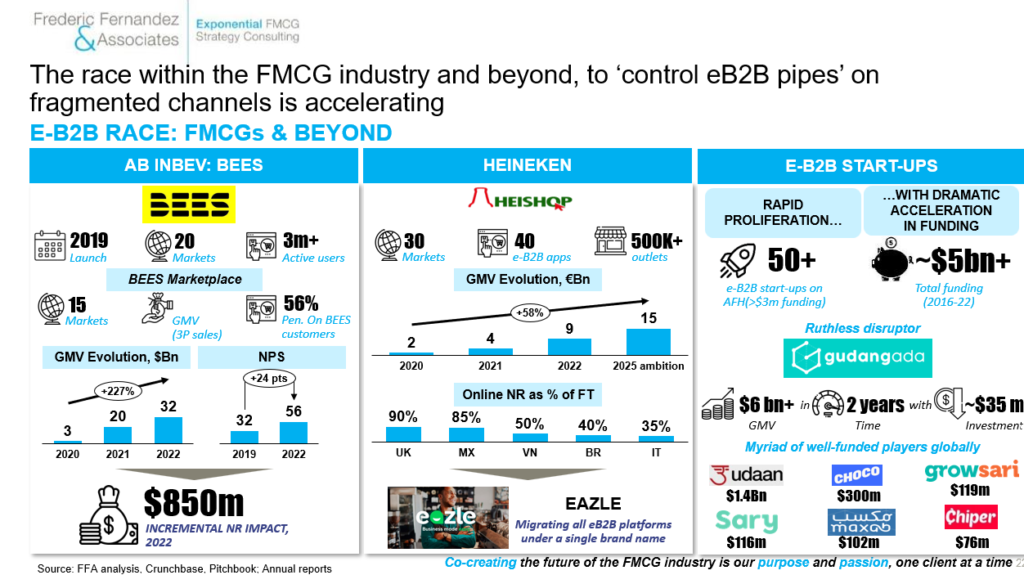

If there is still a lot of growth to get from China (cf. the spend per capita across most categories & the growth potential of the middle-class), one question has been haunting us for years now: what will be (if anything) the next mega-trend of mental & physical availability de-fragmentation? We think it will be eB2B in fragmented channels (traditional trade, indie convenience, HORECA).

E-B2B has the potential to digitize an ineffective value chain & create value for all stakeholders (customers, suppliers, consumers & sometimes distributors depending the eB2B model: 1P or 3P). Value at stake is tremendous:

- Over the short-term, it can help improve sales (anytime ordering & greater customer satisfaction)

- Over the mid-term, it can help generate data to drastically improve distribution & salesforce effectiveness

- Over the long-term, it can unlock new revenue opportunities through offering value adding services (VAS) like Financial services, ePOS & data monetization

What is exciting is that it is the first ever de-fragmentation mega-trend in our industry on which (some) FMCG companies have a high right-to-win (customer relationship, salesforce, share of wallet). That’s simply unprecedented & that’s not just words. It is already a reality. ABI reported in 2022 $850m incremental net revenue thanks to BEES (a 25% uplift), its eB2B platform. And it is still Day 1: ABI recorded $32bn GMV out of a $1Tr GMV global TAM with a huge scale-up potential on their geographies, on 3rd party categories & on VAS. In the meantime, other impulse F&B players are also accelerating like Heineken while EB2B start-ups proliferate.

Generally, FMCG companies face mostly three strategic plays:

i) Own (build or acquire) their EB2B marketplace (mostly reserved to the large impulse F&B players with a high share of wallet, with a 1P distribution model in the markets with a high % of fragmented channels)

ii) Partner with other parties (FMCG companies, distributors…) to enhance their stand-alone right-to-win but all parties need to have a very solid alignment on ambitions, strategy & resources

iii) Win with the winning EB2B marketplaces & participate at arm-length (JBPs with pay-for-performance terms to improve sales fundamentals) while accepting that at one point of time those platforms will charge an increasing middle-man commission %. Game is then to come in early and maximize counterparts

The eB2B race is on and players/ initiatives are proliferating & scaling. This race will shape the future of the FMCG industry, especially on the impulse F&B vertical.

Rule #8: Manage white spaces with a different, VC-like, operating model combining rigor & flexibility

White-spaces are a common strategic theme in EMs. They are always a high number of brands/ markets combination where a company is not playing. Sometimes there are even entire markets where a FMCG company is not present or insufficiently present (indirect export).

Few thoughts there:

If white spaces are intellectually appealing, they often require significant resources and those resources should never come at the expense of the existing business

- Priority on white spaces should always be to launch proven brands in already proven markets to build on existing strengths

- Going beyond those ‘proven brands/ markets’ combinations, white-spaces have a lot in common with Venture Capital (high uncertainty, J-curve revenue, initially loss-making…) and should be managed at such (stage-gate funding against clear milestones, periodical reviews enabling strategic adjustments & funding decisions, entrepreneurial talent with local expertise, growth KPIs…)

Too often, white-spaces are managed in the same way than the legacy business (same yearly budgeting & operational plan process, same talent, same KPIs…) and success rate is ultimately low. Best-in-class FMCG companies have a dual operating model to run their white-spaces bets.

Rule #9: Organization design, processes & talent need to ruthlessly follow strategy

Once a strategic intent is defined (where-to-play/ how-to-win/ ambitions/ financials), it is critical to have a hard look at organization design, key processes and talent to ensure those are aligned with the new strategic intent.

If there is no one-size-fits-all, few classic themes & best practices exist:

i) Multi-country priority brands should be driven by the Cluster (e.g. LATAM, APAC…) local brands by local markets

ii) Resources allocation (FTEs, budget) should mirror expected country/ brand/ channel contribution in net revenue/ profit & share of growth and be led by Cluster top-down on the priority multi-country brands

iii) The largest markets (India, Brazil, Mexico…) should explore the opportunity to have an organization that mirror regional specificities to take in consideration different consumer needs, different portfolio & different competitive landscape. It is especially true on F&B and Alcoholic Drinks. A good case is how Nestle re-organized itself in India around 15 regional clusters to accelerate volume growth & rural penetration

iii) A significant budget reserve (low double digit %) should be kept at a central level to enable reinvestment based on results. Markets and brands teams should pitch quarterly for incremental budget. The overall should ensure a dynamic funds allocation while infusing a ROI culture

v) A strong local talent bench should be developed. Sustained long-term growth outperformance can take place only with strong local talents. It it critical to develop a plan to boost metrics across the pipeline (recruitment, promotion, export to some other regions), the latter is especially critical

Too many organizations still fail to translate effectively their strategic intent into an actionable organizational plan.

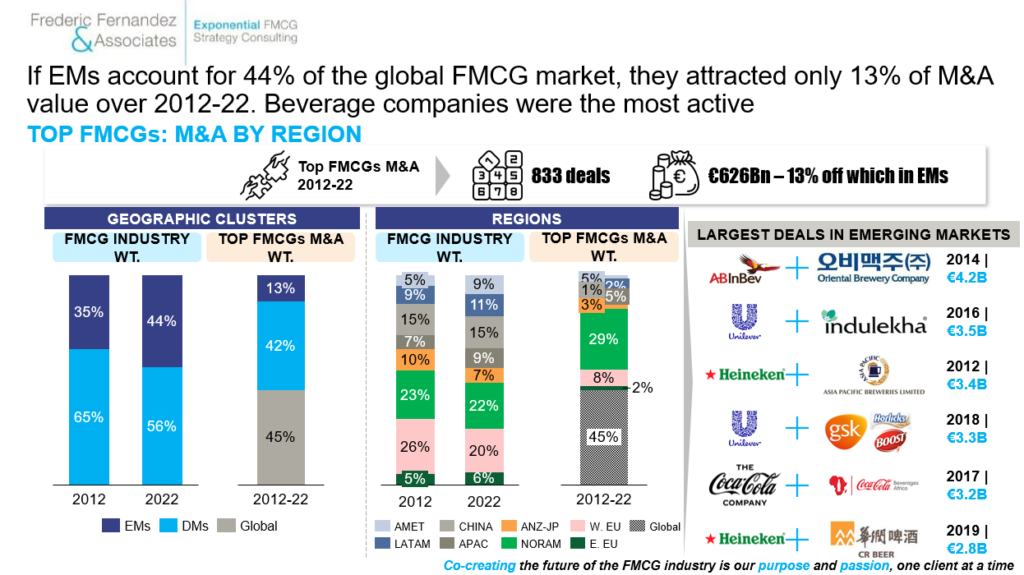

Rule #10: Take advantage of current context to leverage opportunistically local M&A

Except few large transactions on the F&B vertical (the latest being the Distell-Heineken deal in South Africa for €2.2bn), EMs are traditionally not a priority for M&A for the world largest FMCG companies.

We think the current macro-economic context will be more hardly felt in EMs (sustained high inflation, drastic increase in interest rate & cost of capital, more difficult access to financing) and will create unprecedented opportunities to acquire local players at a steep discount. At such global M&A teams should identify priority markets/ regions and empower them to come up with relevant M&A targets. We see local M&A in EMs as a key lever to leap-frog to critical mass in some strategic markets, especially in the most fragmented retail environments and for the verticals where local scale matters the most (Beverage).

Here is a summary of the ten rules of outperformance in EMs:

To sum it up, EMs have become an increasingly strategic battlefield for FMCG companies, especially outside China. The FMCG companies that will adopt bespoke localized strategy and master those rules will ultimately outperform. Time to learn from past the past, time to manage for outperformance. Exciting times.

‘Insanity is doing the same thing over and over again & expecting different results’ Albert Einstein

#fmcg #cpg #strategy #ceoinsights #mergersacquisitionsdivestitures #growth

To follow Frederic, please click Here, To contact him, email at: frederic@fredericfernandezassociates.com

About the author:

Frederic Fernandez is a strategic advisor in the FMCG industry. He is the Managing Director and Partner of Frederic Fernandez & Associates (FFA) a global bespoke Strategy Consulting Firm exclusively focused on the FMCG industry across all key verticals (Food & Beverage, Alcoholic Drinks, Beauty & Personal Care, Household, Consumer Health Care, PetCare, Tobacco-free Nicotine). Its purpose is to co-create the future of the FMCG industry, one client at a time. The Firm helps the CEOs and the Boards of the world’s largest FMCG companies on selected areas: Growth and Profit acceleration, New Retail/ EB2B/ Ecommerce/ DTC strategies and M&A (buy-side & sell-side). The Firm’s head office is located in Zug in Switzerland. The Firm’s team intervenes all across the globe. To know more about the Firm, please visit its website: www.fredericfernandezassociates.com

No FFA employees own any stocks or financial instruments of any FMCG companies or companies mentioned in the above article. All the above information are public information.