‘Face reality as it is, not as it was or as you wish it to be’ Jack Welch

There has been rightly much debate lately on DTC and its possible demise in the FMCG industry. In this article, we explore the following questions:

- Who have been the DTC winners & losers in the FMCG industry? (M&A, build initiatives)

- What have been the key learnings?

- How to succeed with DTC (build initiative, M&A, turnaround of existing asset)?

- What is the future of DTC?

To answer those questions, we analyzed:

- 1000+ FMCG DTC M&A transactions

- The main DTC initiatives (build & acquisition) of the world largest FMCG companies

- The world top FMCG DTC companies strategies & results

Here is our perspective in seven key messages. As usual, all of the below include only public information to protect our clients’ confidentiality:

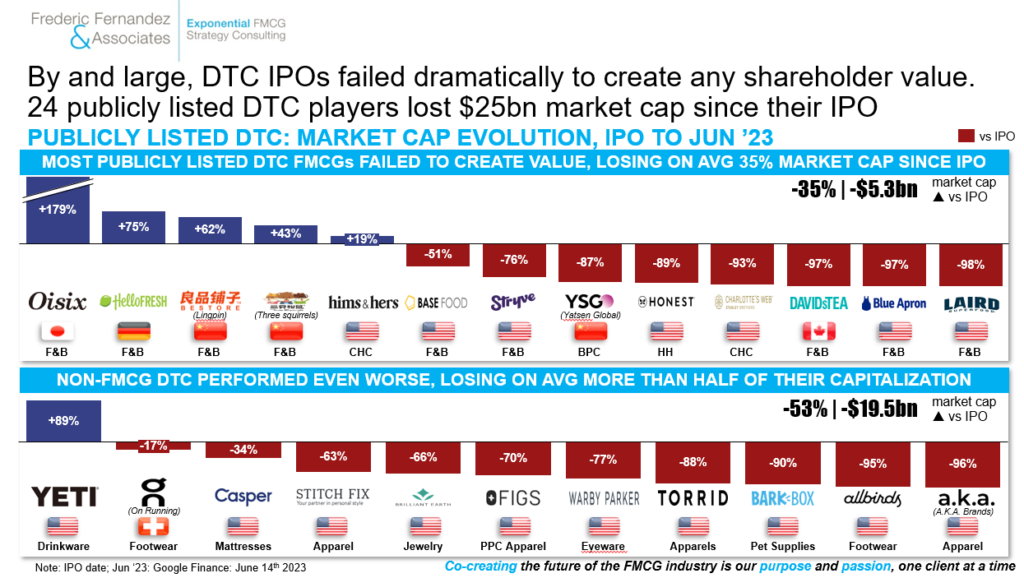

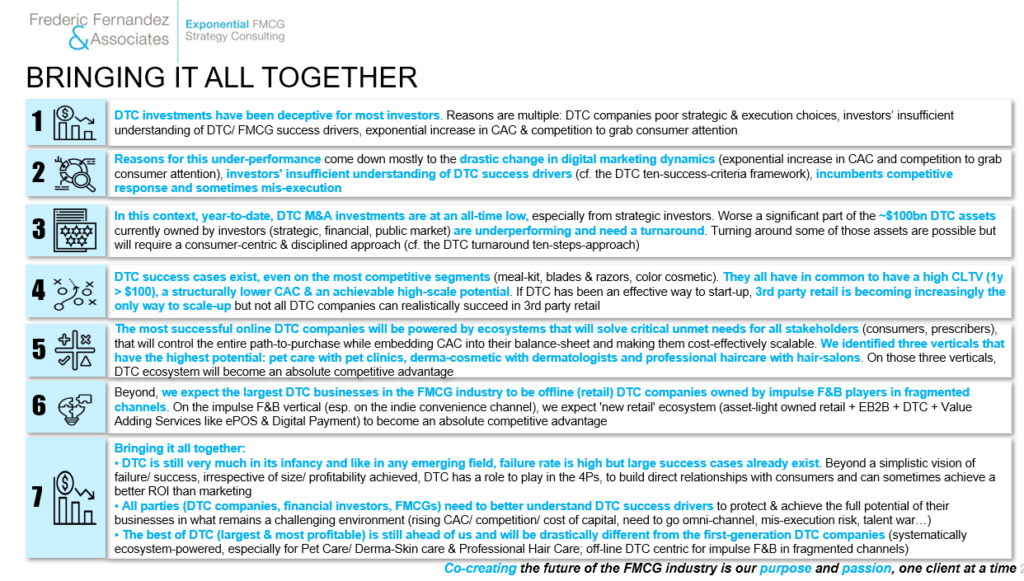

Key message #1: Most (FMCG) DTC investments have been deceptive for investors (stock market performance post IPO, failure rate of strategic acquisitions, failure rate of build initiatives, challenges faced by the companies that are still under private ownership)

i. Most (FMCG) DTC IPOs have failed, for now, to create any shareholder value

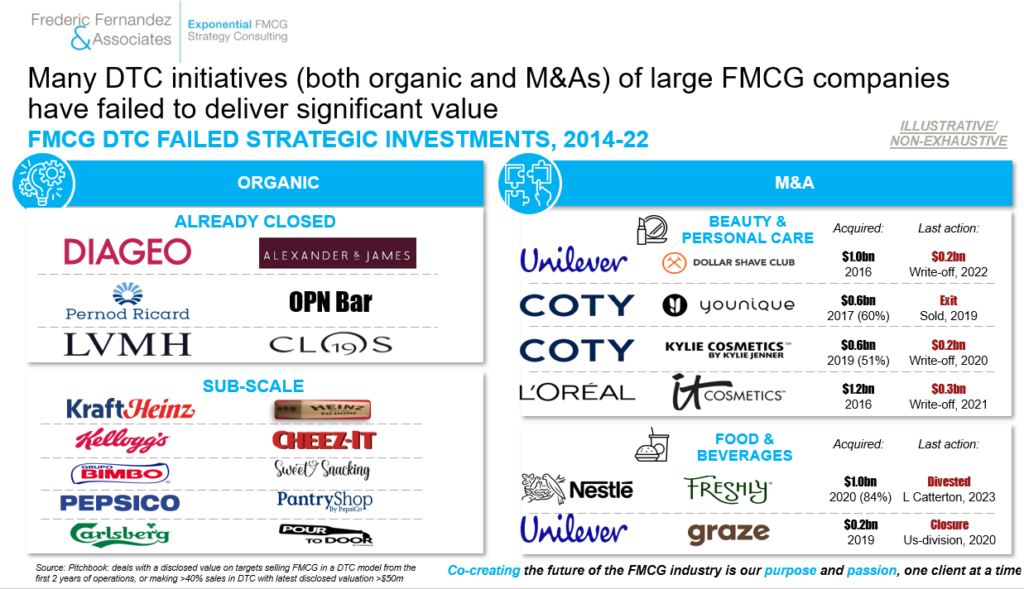

ii. Most DTC M&As and Build initiatives completed by large FMCG companies failed to deliver significant value, although one could argue some have been useful marketing tactics to drive awareness/ consideration/ some purchase & gather consumer insights

iii. Reasons for DTC M&A failures are multiple and many could have been avoided with a rigorous consumer-centric due diligences process

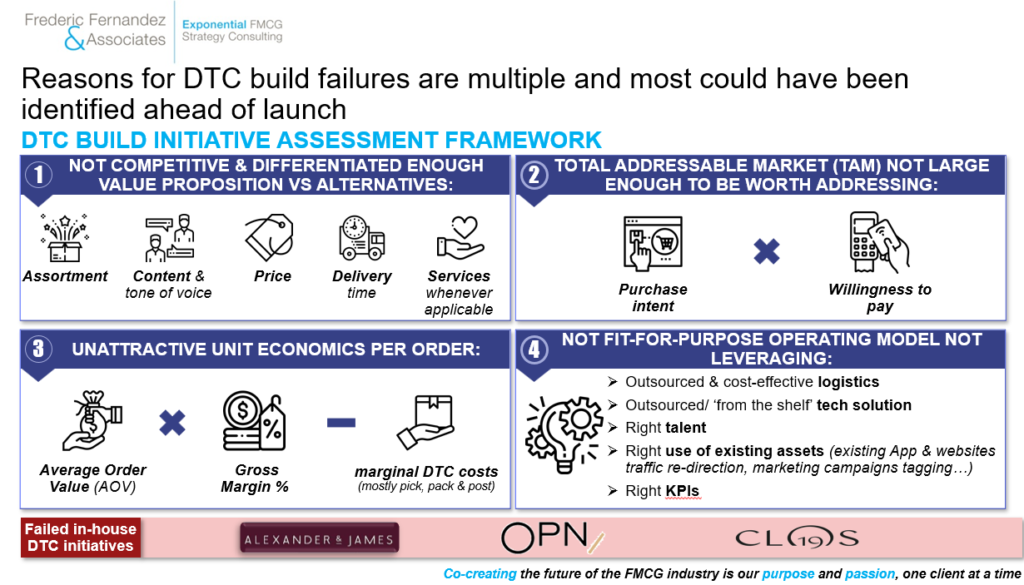

iv. DTC Build initiatives failures are usually explain by at least one of its four factors: not competitive & differentiated enough value proposition vs. alternatives, not large enough total addressable market to make it worth addressing, unattractive unit economics or not fit-for-purpose operating model

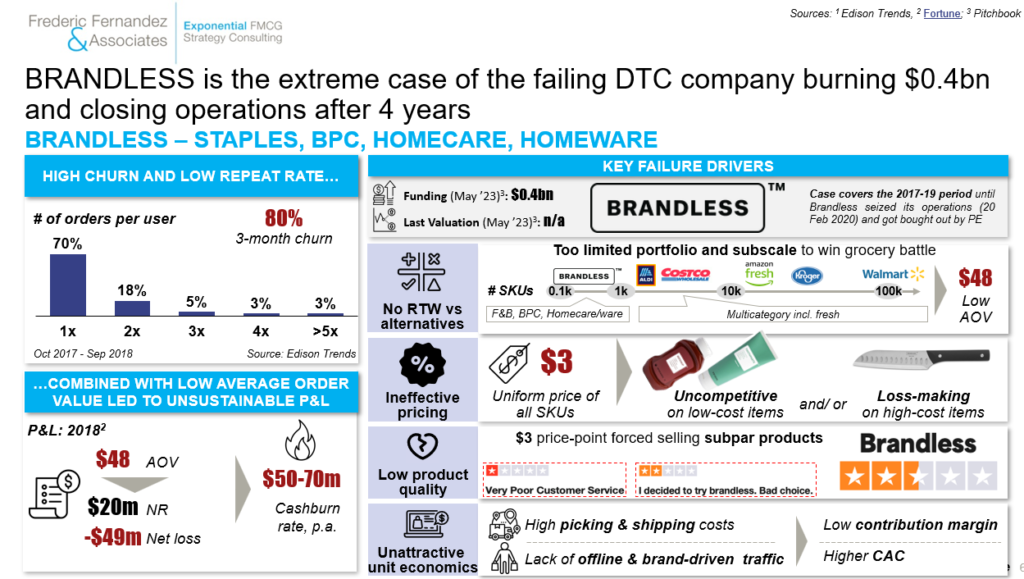

iv. BRANDLESS has been the extreme case of the failing DTC company (no right-to-win vs. alternatives, poor product quality & service, poor unit economics and funded by a Tech fund – Soft Bank – with limited FMCG understanding)

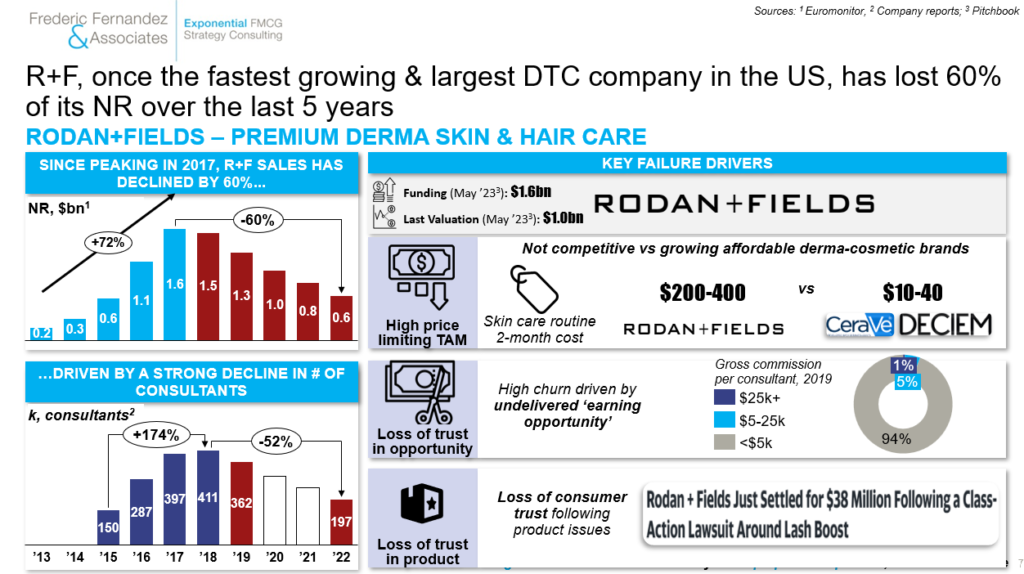

v. Rodan+Fields, once the fastest growing & largest DTC company (and largest skincare brand) in the US, has lost 60% of its NR over the last 5 years

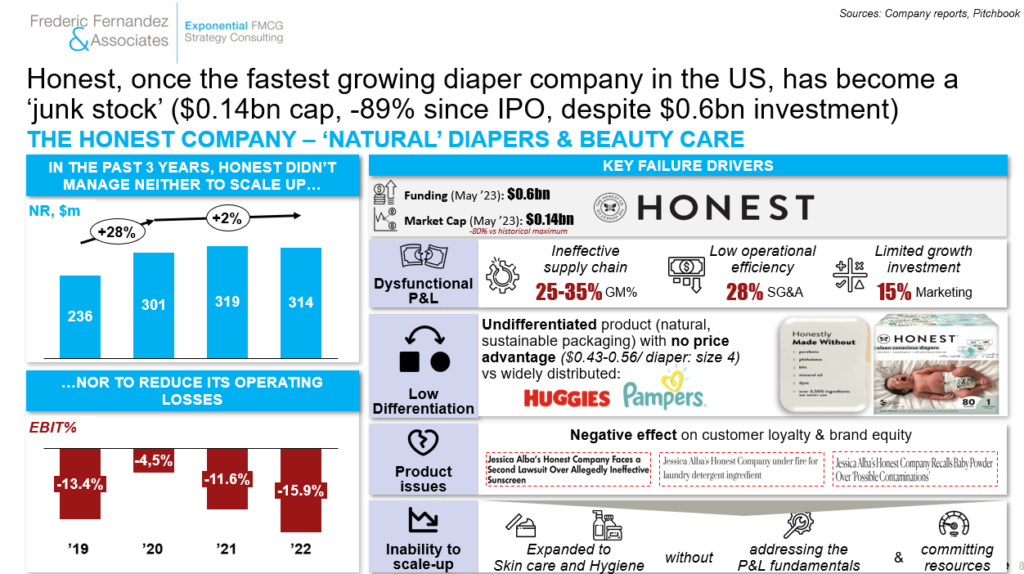

vi. HONEST, once the fastest growing diaper company in the US, has become a ‘junk stock’ ($0.14bn cap, -89% since IPO, despite $0.6bn investment)

vii. GLOSSIER, once the fastest growing brand in Beauty, has lost some of its consumer/ product focus and has seen its NR plateauing over the last 4 years

Key message #2: Reasons for this under-performance come down mostly to the drastic change in digital marketing dynamics (exponential increase in CAC and competition to grab consumer attention), investors’ insufficient understanding of DTC success drivers, incumbents competitive response and sometimes mis-execution

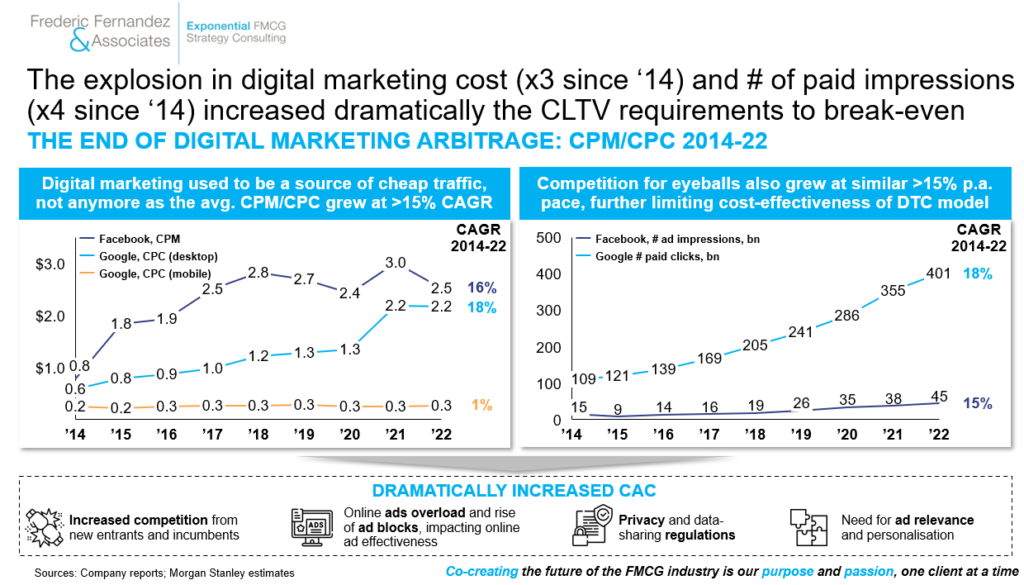

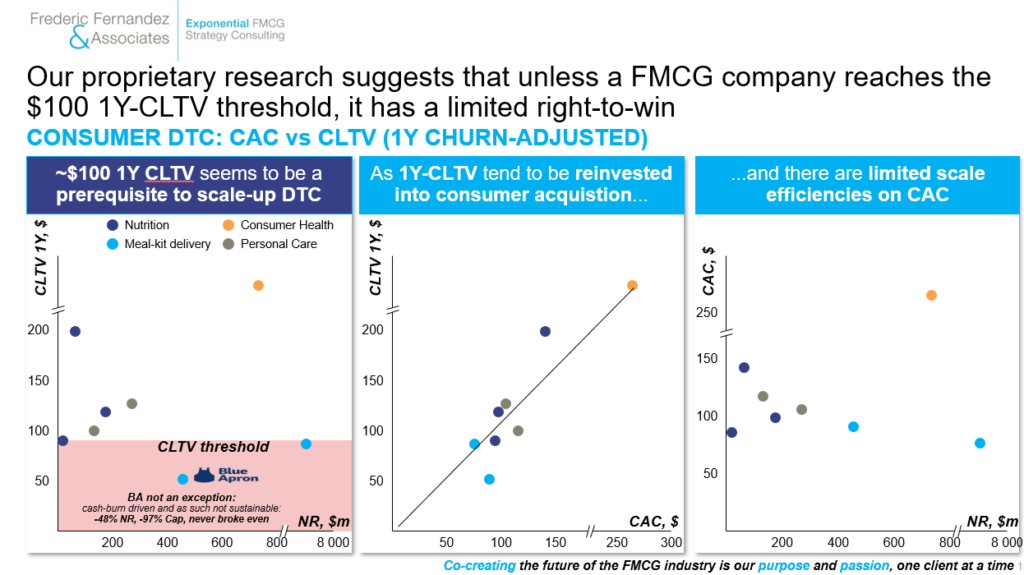

i. The increase in digital marketing cost (x3 since 2014) and explosion of paid impressions (x4 since 2014) have considerably increased the CLTV requirements for DTC companies to be successful

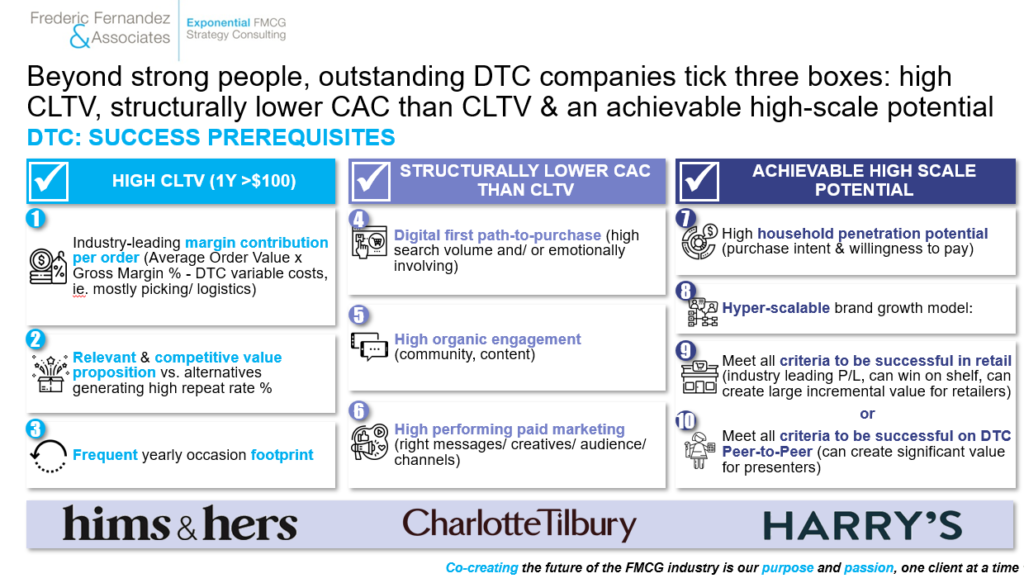

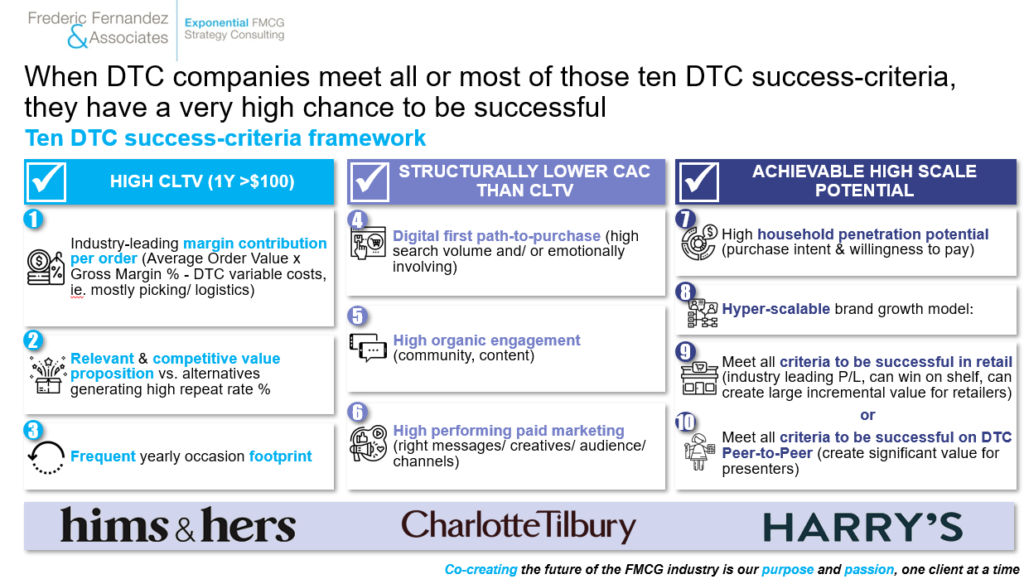

ii. Still too few investors understand thoroughly DTC success drivers (beyond strong people naturally): a high CLTV (1y > $100), a structurally lower CAC than 1y CLTV and an achievable high-scale potential

iii. Our research shows that unless a DTC company reaches the $100 1y-CLTV mark, it has limited chance to succeed

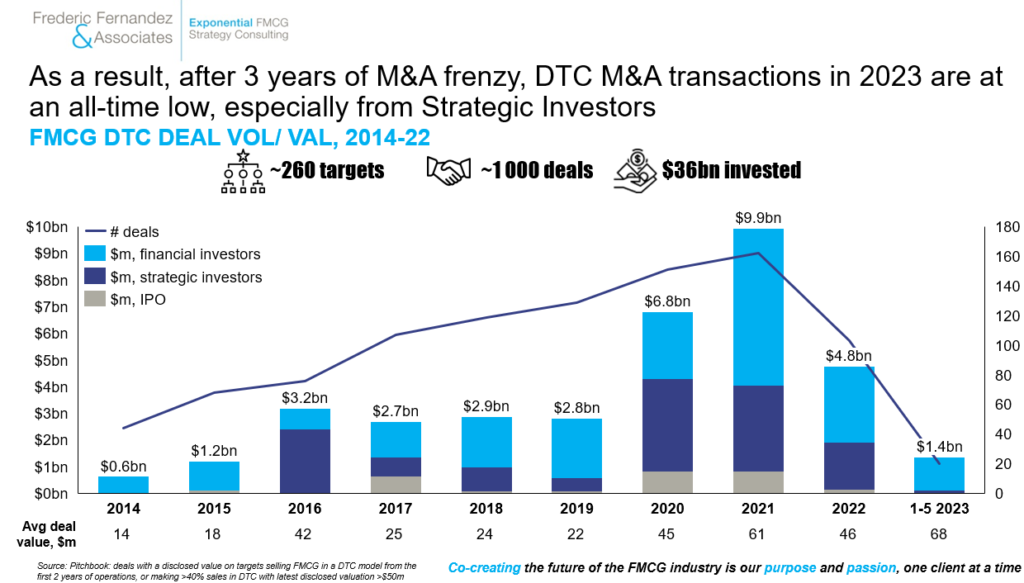

Key message #3: In this context, year-to-date, DTC M&A transactions are at an all-time low. Worse a significant part of the ~$100bn DTC assets currently owned by investors (strategics, financial, public market) are underperforming and need an urgent turnaround

i. Year-to-date, after three years of M&A frenzy, DTC M&A transactions are at an all-time low, especially from Strategic investors

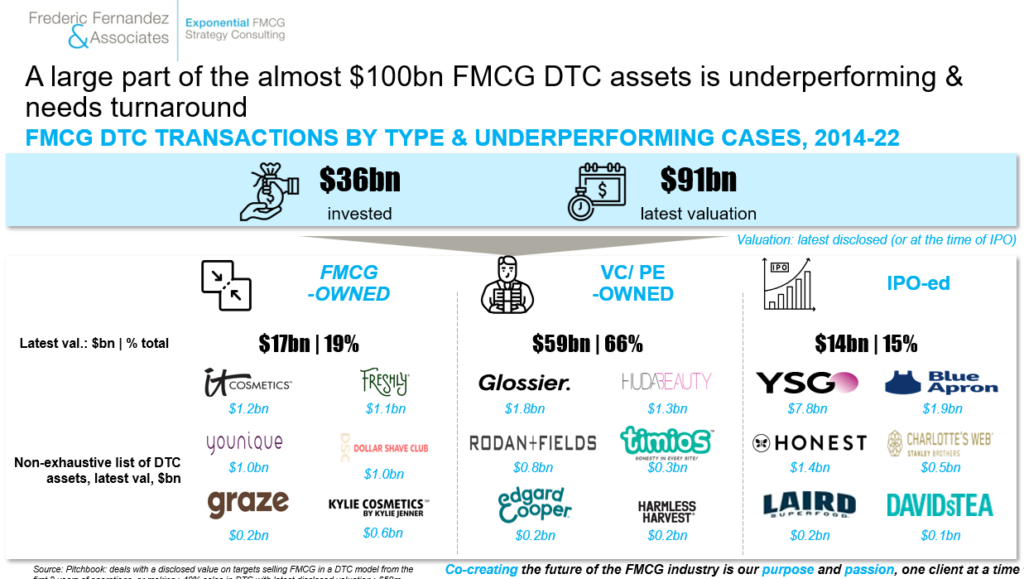

ii. A large part of the nearly $100bn FMCG DTC assets is underperforming & needs urgent turnaround

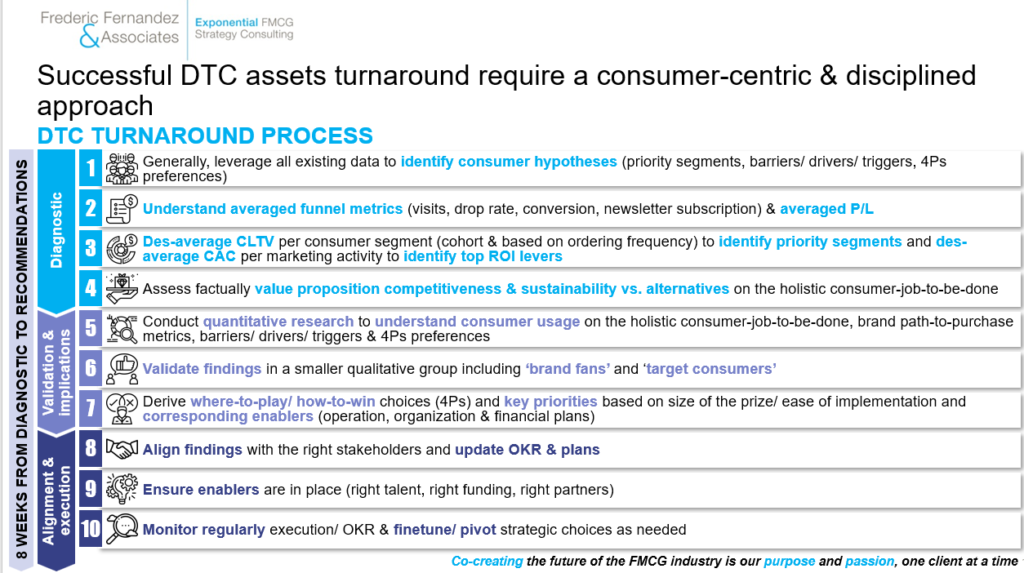

iii. Turning around some of those assets are possible but it will require a consumer-centric & disciplined approach

Key message #4: If some of the world most successful DTC companies are not public and have never received any funding, some ‘public’ success cases exist (growing, profitable/ about to break-even), including on some of the most competitive categories (meal-kit, color cosmetic, blades & razors). Those companies have in common to meet most of our ‘ten DTC success-criteria’. If DTC has been an effective way to start-up, 3rd party retail is becoming increasingly the only way to scale-up, to increase penetration & lower CAC but not all DTC companies can succeed in 3rd party retail

i) Those companies have in common to meet most of our ‘ten DTC success criteria’

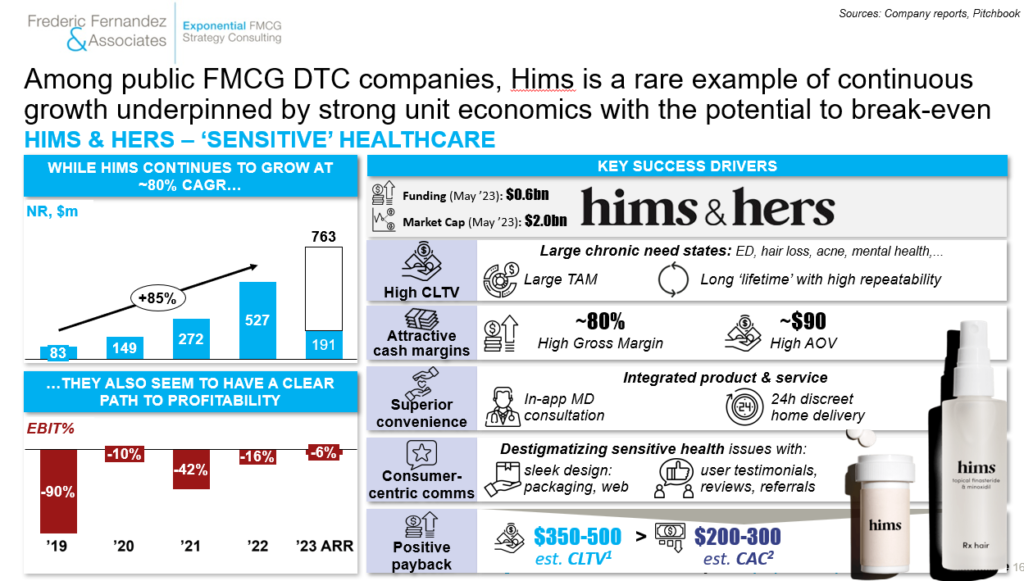

ii. Among US FMCG DTC public companies, Hims & Hers is a rare example of shareholder value creation and continuous growth on embarrassing consumer health categories (erectile dysfunctionment, hair loss, acne, mental health…) underpinned by strong unit economics & creative comms. with the potential to break-even

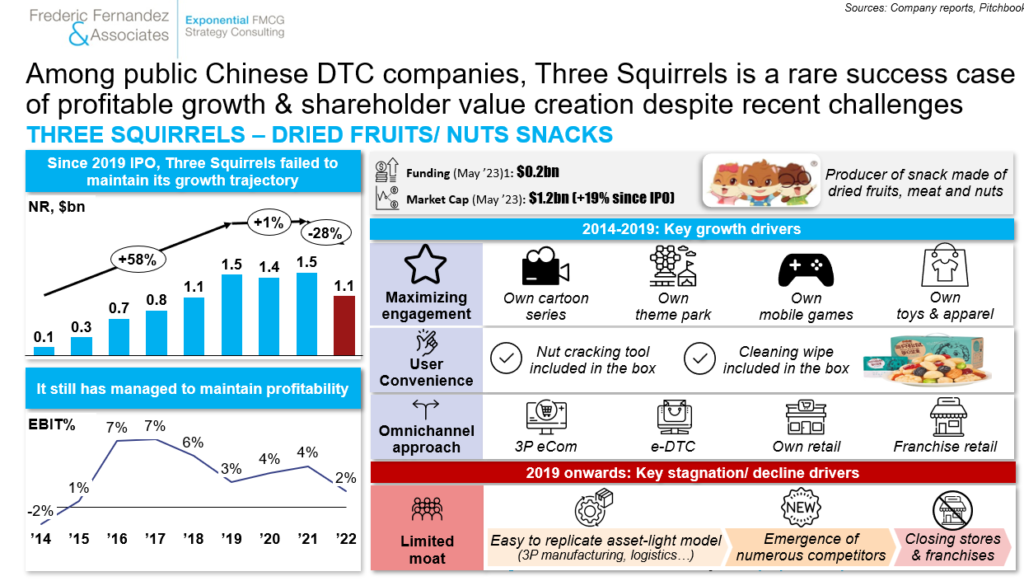

iii. Among public Chinese DTC companies, Three Squirrels (nuts & dried fruits snacks) is a rare success case of profitable growth & shareholder value creation despite recent challenges

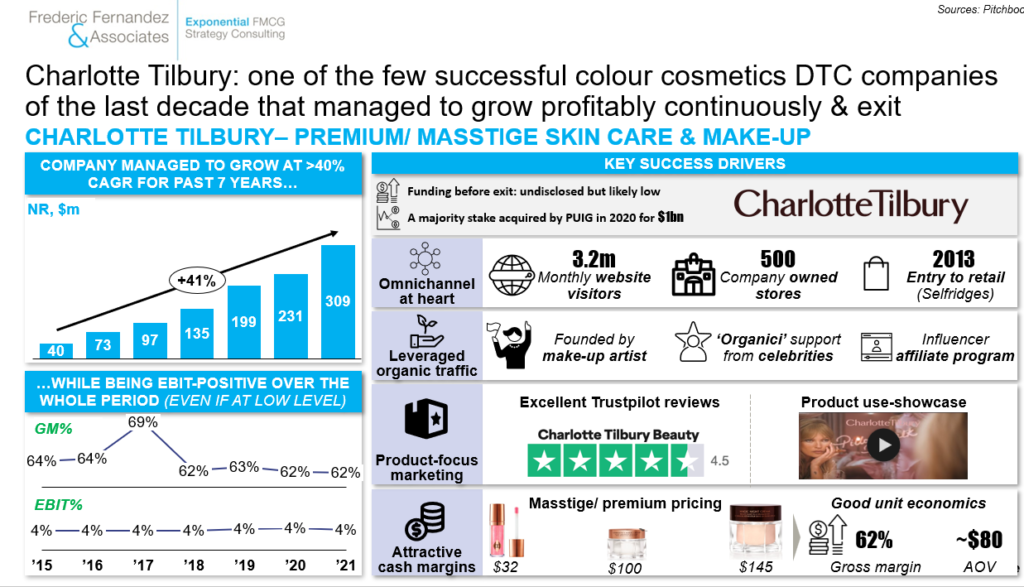

iv. Charlotte Tilbury: one of the few successful colour cosmetics DTC companies of the last decade that managed to sustainably grow profitably & exit

Charlotte Tilbury Pillow Talk launch video (2022, 0.6m views):

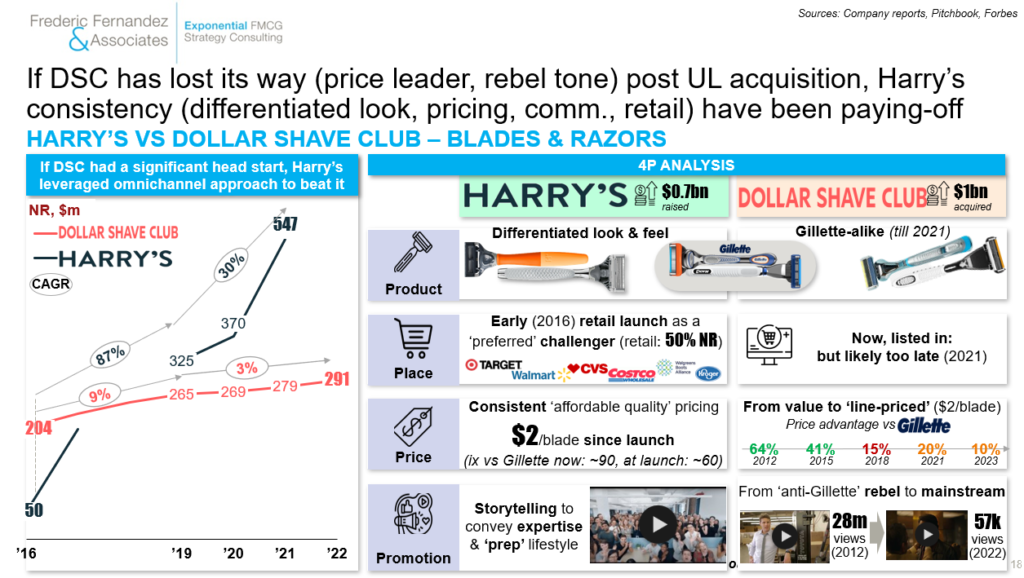

v. Harry’s & Dollar Shave Club (DSC), two US-based DTC blades & razors players, have pursued drastically different paths with different results to-date. DSC lost its way (price leader, rebel tone) post UL acquisition while Harry’s consistency (differentiated look & feel, slightly cheaper than Gillette, challenger communication, early retail expansion) has been paying-off

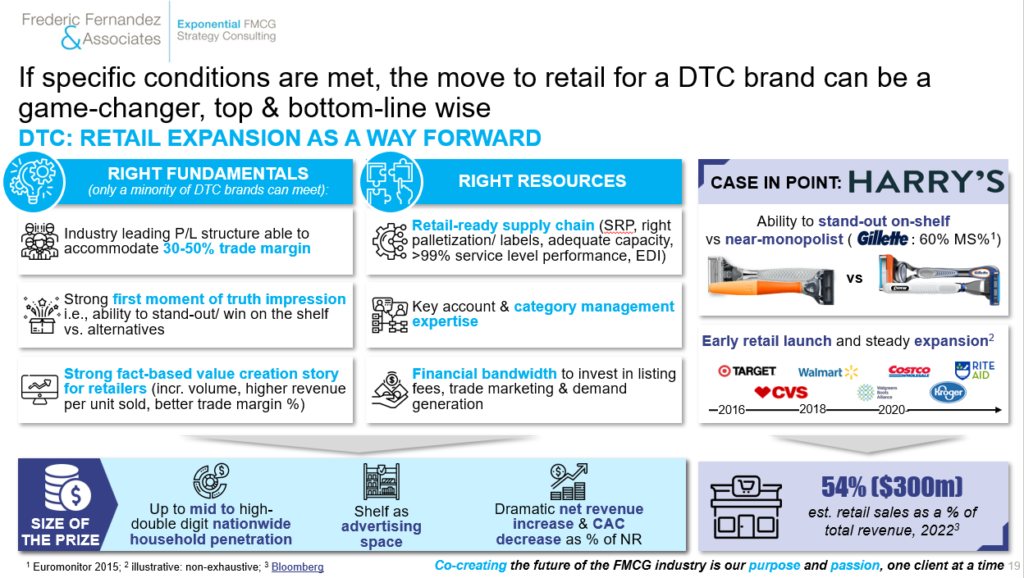

vi. If specific conditions are met, the move to retail for a DTC brand can be a game-changer, top- & bottom-line wise. A minority of DTC companies can realistically meet those conditions (industry leading P/L structure, ability to win on the shelf, value creation potential for retailers)

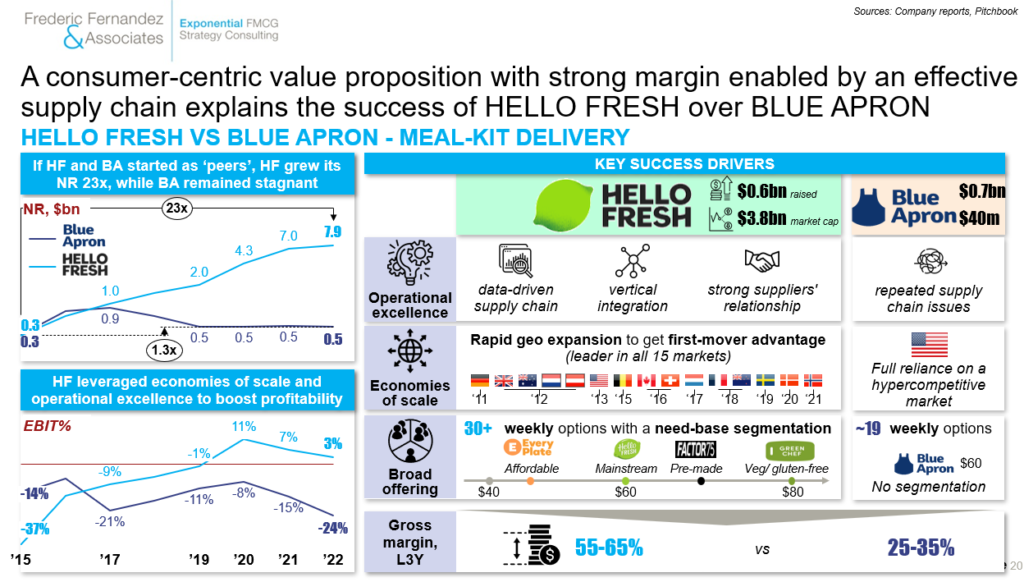

vii. A large unmet need addressed by a consumer-centric value proposition with strong unit economics & enabled by an effective supply chain explain the success of HELLO FRESH over BLUE APRON on the highly competitive meal-kit delivery market in the US

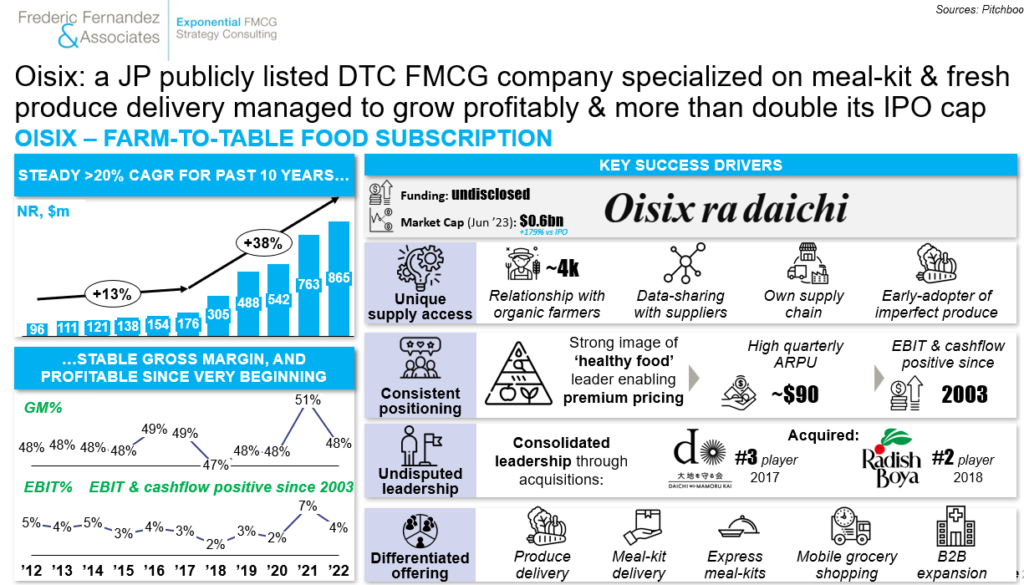

viii. In Japan, Oisix, a public local fresh food & meal-kit delivery DTC player, managed to grow profitably & more than double its cap since IPO

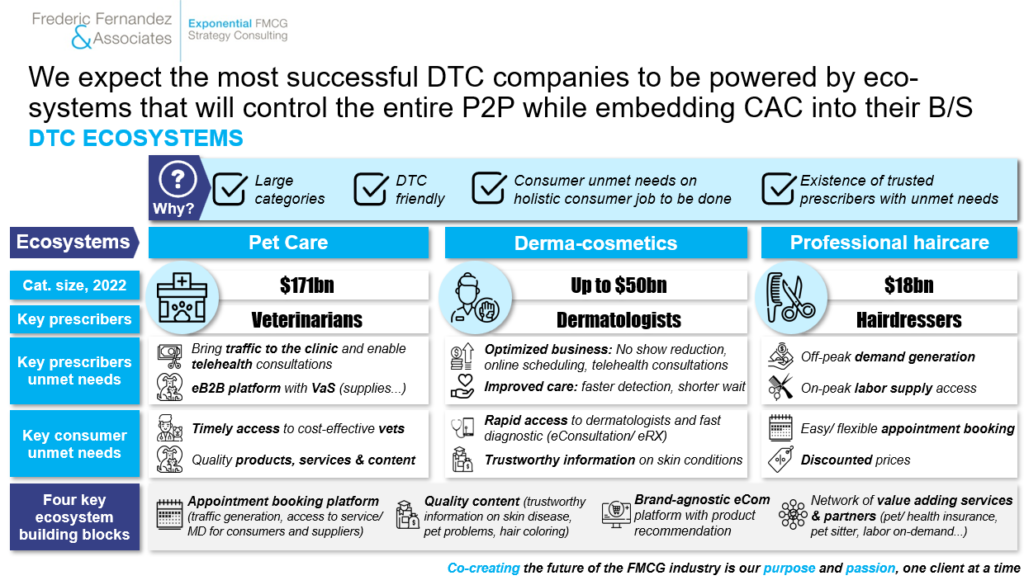

Key message #5: The most successful online DTC companies will be powered by ecosystems that will solve critical unmet needs for all stakeholders (consumers, prescribers), that will control the entire path-to-purchase while embedding CAC into their balance-sheet and making them cost-effectively scalable. We identified three verticals that have the highest potential: pet care with pet clinics, derma-cosmetic with dermatologists and professional haircare with hair-salons. On those three verticals, DTC ecosystem will become an absolute competitive advantage. Future winners will control first the prescribers path-to-purchase

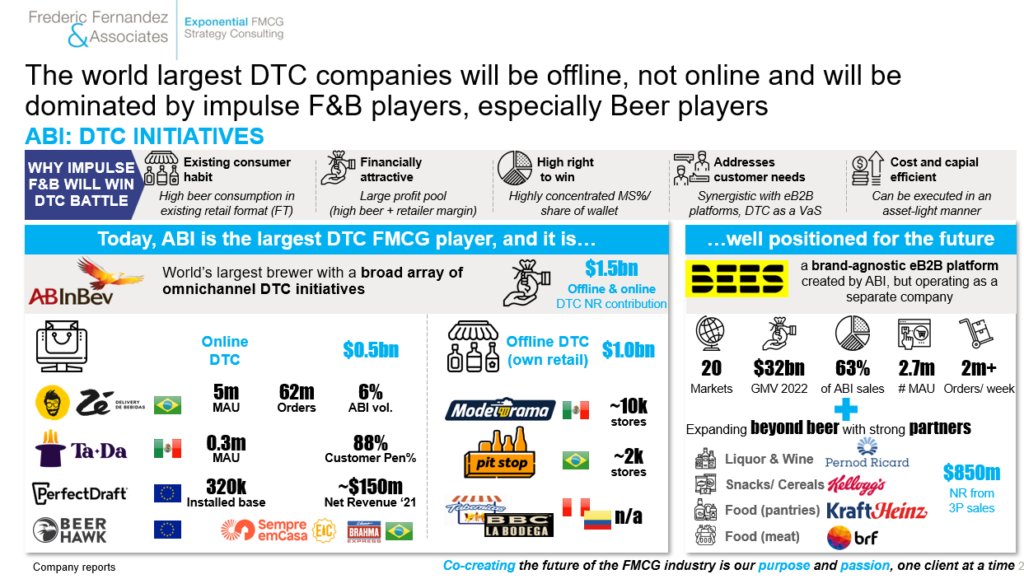

Key message #6: Beyond, we expect the largest DTC businesses in the FMCG industry to be offline (retail) DTC companies owned by impulse F&B players. On the impulse F&B vertical, we expect ‘new retail’ ecosystem (asset-light owned retail + EB2B + DTC + Value Adding Services like ePOS & Digital Payment) to become an absolute competitive advantage. ABI DTC net revenue already amounts to $1.5bn p.a. ($1bn through its owned stores & $0.5bn through its online DTC)

Key message #7, bringing it all together:

- DTC is still very much in its infancy and like any emerging field, failure rate is high but large success cases already exist within the FMCG industry. Beyond a simplistic vision of failure/ success, irrespective of size/ profitability achieved, DTC can have a balancing role to play in the 4Ps on some specific brand/ country couples, to build direct relationships with consumers and complement effectively marketing and R&D efforts

- All parties (DTC companies, financial investors, FMCG companies) need to better understand DTC success drivers to protect & achieve the full potential of their assets/ investments in what remains a challenging environment (rising CAC, rising competition, increasing cost of capital, need to explore omni-channel opportunities to scale-up cost-effectively, mis-execution risk, talent war…)

- There will always be new & upcoming successful DTC companies as there will always be unmet consumer needs that large FMCG companies will initially fail to detect & address

- The best of DTC (largest & most profitable) is still ahead of us and will be drastically different from the first-generation DTC companies (systematically ecosystem-powered, especially for Pet Care/ Derma-Skin care & Professional Hair Care; off-line DTC centric for impulse F&B in fragmented channels with EB2B(2C) business model)

Maybe Mark Twain’s words would be the most appropriate to then describe DTC: ‘The reports of my death have been greatly exaggerated’

Decisive & exciting times

To get all our FMCG CEO insights, please sign-up to your bi-weekly newsletter:

To get the PDF deck of this article, please email us at: contact@fredericfernandezassociates.com

#fmcg #cpg #strategy #ceoinsights #dtc

To follow Frederic, please click Here, To contact him, email at: frederic@fredericfernandezassociates.com

About Frederic Fernandez & Associates (FFA):

FFA is a global bespoke Strategy and M&A Consulting Firm exclusively focused on the FMCG industry across all key verticals (Food & Beverage, Alcoholic Drinks, Beauty & Personal Care, Household, Consumer Health Care, PetCare, non-Tobacco nicotine RRP). Its purpose is to help its clients win today while renewing their competitive advantages to win tomorrow. The Firm helps the CEOs and the Boards of the world’s largest FMCG companies on selected areas: Growth and Profit acceleration, M&A (buy-side & sell-side), New Retail/ EB2B/ Ecommerce/ DTC strategies. The Firm’s head office is located in Zug in Switzerland. The Firm’s team intervenes all across the globe. So far, 13 out of the world top 20 FMCG companies have been repeat clients

To know more about the Firm, please visit its website: www.fredericfernandezassociates.com

No FFA employees own any stocks or financial instruments of any FMCG companies or companies mentioned in the above article. All the above information are public information.