‘The further backward you look, the further forward you can see’ – Winston Churchill

Our strategic thesis:

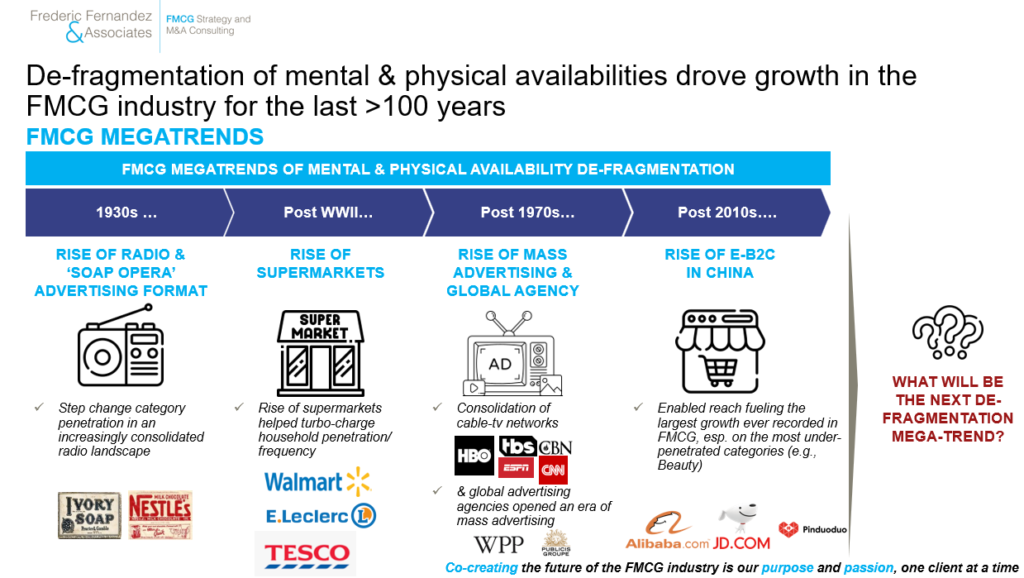

- Exponential de-fragmentation of mental & physical availability = exponential growth

- De-fragmentation of the sources of physical & mental availability have been fueling FMCG growth (penetration & frequency gains) for more than a century (from ‘soap operas’/ radio in the 1930s though the rise of supermarkets/ cable TV post WWII to the rise of B2C ecommerce – especially in China)

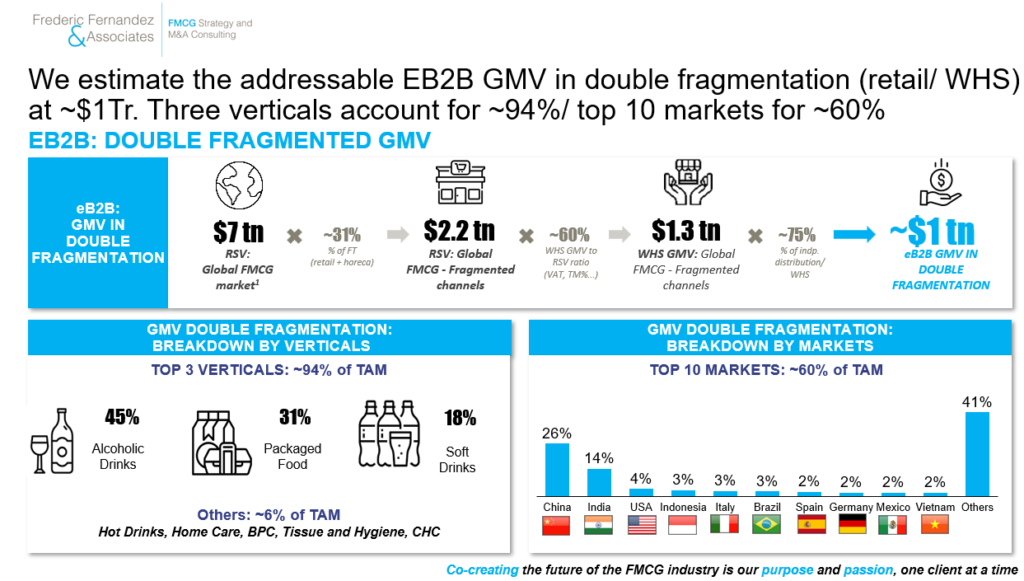

- If ecommerce continues to be a de-fragmentation driving force, especially in Emerging Markets, one question has been haunting us for years now: what will be (if anything) the next mega-trend of mental & physical availability de-fragmentation? We think it will be eB2B in fragmented channels (traditional trade, independent convenience, HORECA) in environment where the wholesale structure is the most fragmented. Globally it represents a ~$1Tr EB2B GMV pie

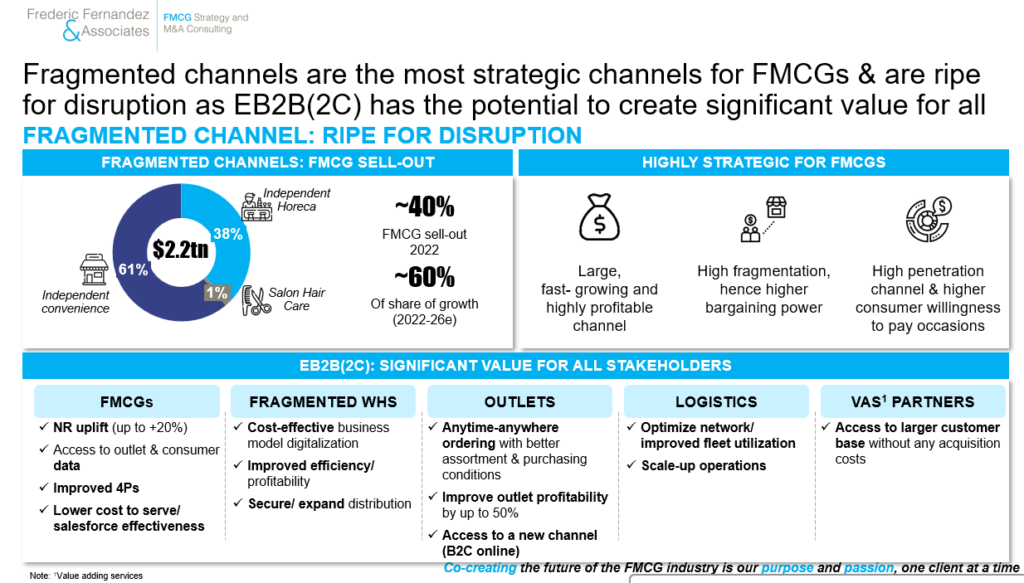

- Those channels account for >40% total FMCG sell-out but >60% of share of growth. E-B2B (direct digital ordering between an end customer & a platform) has the potential to digitize those often ineffective value chains & create value for all stakeholders (customers, suppliers, consumers & wholesalers)

- Value at stake is tremendous:

i) Over the short-term, it can help improve significantly sales (anytime ordering, suggestive ordering, easier financing for the outlet owner)

ii) Over the mid-term, it can help generate data to drastically improve distribution, assortment segmentation & salesforce effectiveness step-changing physical/ mental availability at scale

iii) Over the long-term, it can unlock new revenue opportunities through offering value adding services (VAS) like Financial services, ePOS, data monetization & in-fine unlock the “Graal TAM” (EB2B2C) from EB2C enablement to franchise retail

- What is exciting is that it is the first ever de-fragmentation mega-trend in our industry on which (some) FMCG companies have a high right-to-win (mostly the world largest Food, Beverage & Alcoholic Drinks FMCG companies). That’s simply unprecedented & that’s not just words, it is already a reality (cf. ABI’s BEES progress)

- Success will come down to the ability of few FMCG companies to fully understand at C-level this historic opportunity, finely understand their right-to-win (country/ channel/ eB2B model/ customer value proposition) & execute with excellence in sync with the Core at pace & at-scale

- This race will shape the future of the FMCG industry. Exciting times

Here are our detailed perspective on this unprecedented opportunity & how to address it in 20 key messages/ charts:

1) Exponential de-fragmentation of mental & physical availability = exponential growth. De-fragmentation has fueled our industry growth for >100 years

2) Fragmented channels are highly strategic for the FMCG industry (60% share of global growth, often profit accretive & are a key lever to maximize penetration/ frequency esp. on the highest willigness-to-pay occasions) and EB2B has the potential to create value for all stakeholders

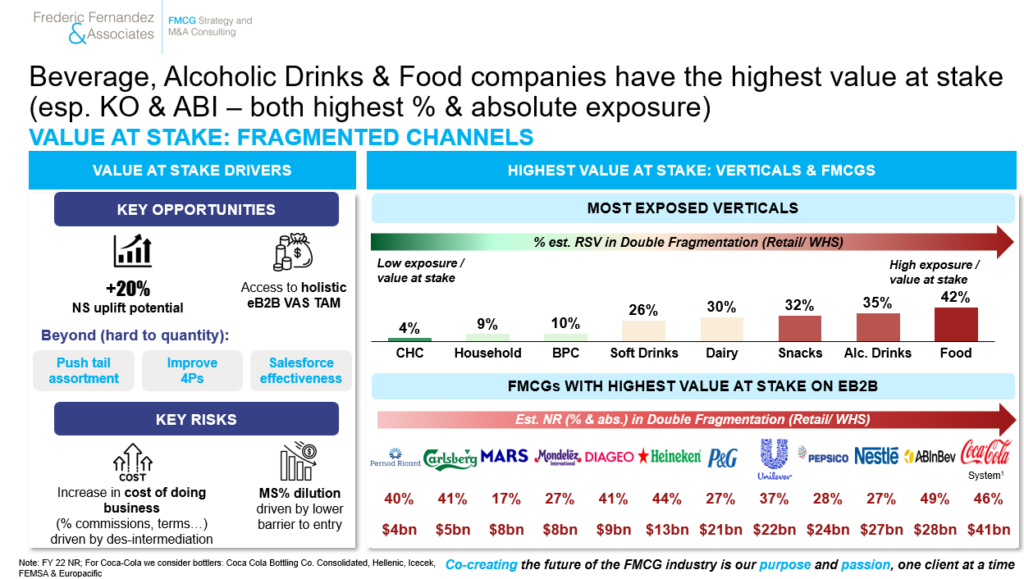

3) EB2B represents both a high opportunity (volume uplift on same store, broader reach, ability to improve 4Ps/ salesforce effectiveness through access to sell-in data, access to a wider TAM) and a high risk if not addressed (desintermediation, deflation, market share dilution). Beverage, Alcoholic Drinks & Food companies have the highest value at stake

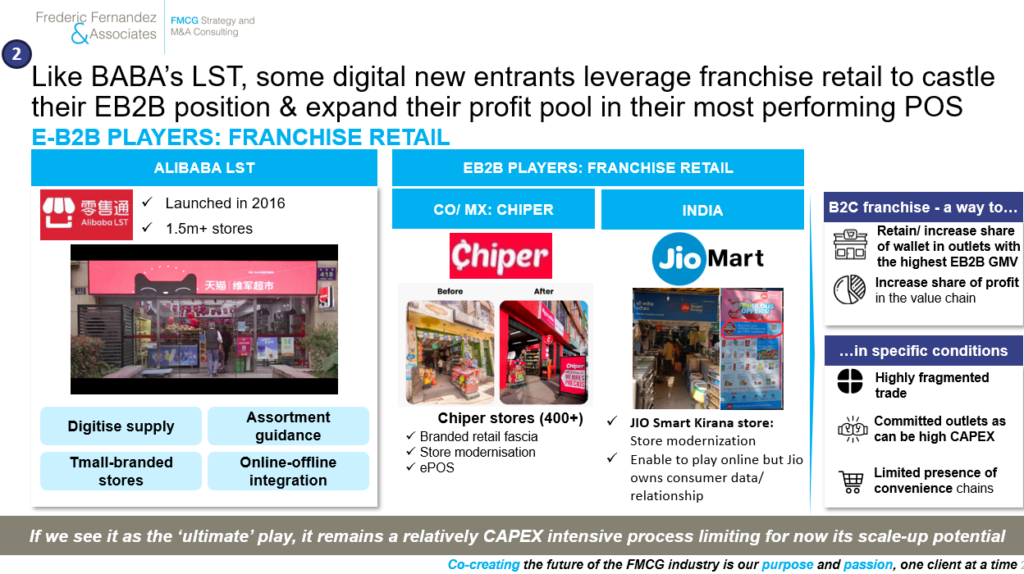

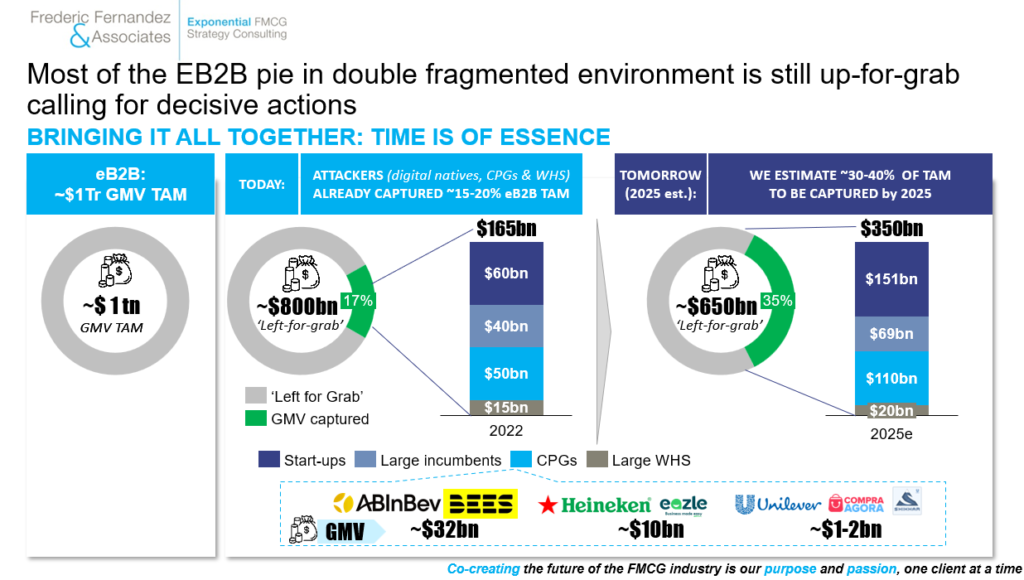

4) EB2B needs double fragmentation (retail AND wholesale) to thrive. We estimate the ‘up-for-grab’ EB2B GMV at ~$1 Trillion. 93% sits on three verticals (alcoholic drinks, packaged food & soft drinks). 60% of this ‘up-for-grab’ GMV sits in 10 markets

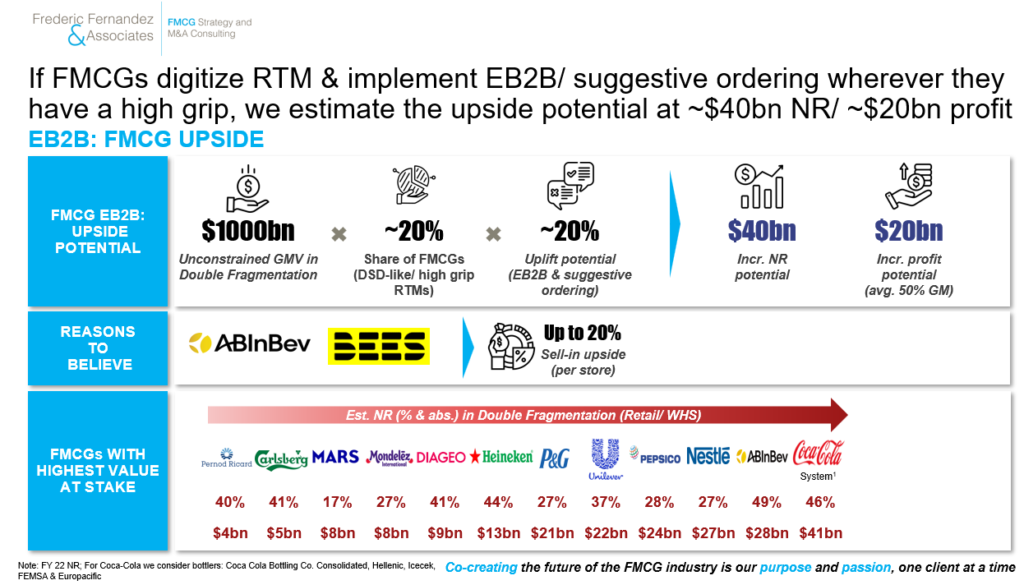

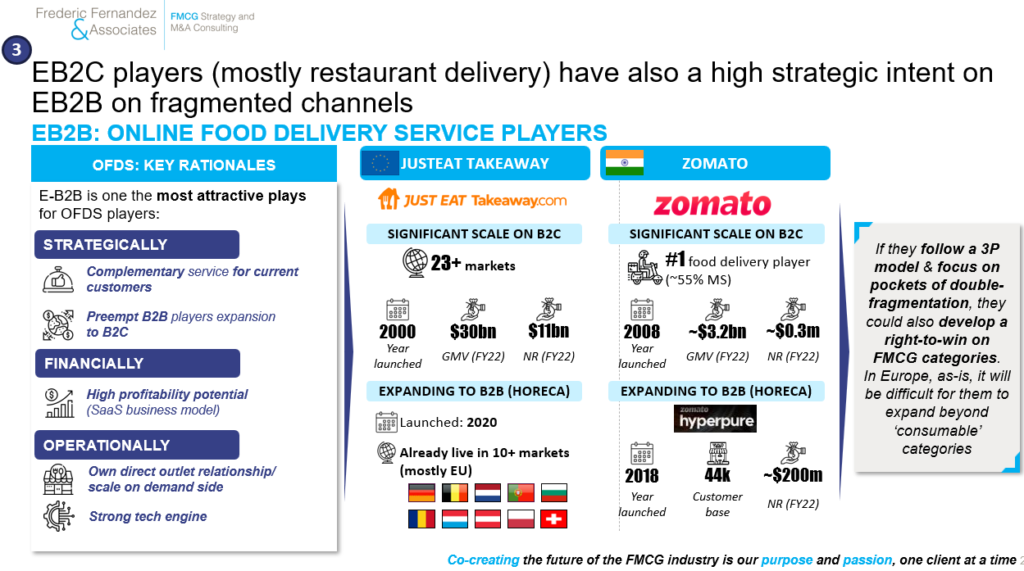

5) If FMCGs digitize RTM & implement EB2B/ suggestive ordering wherever they have a high grip, we estimate the upside potential at up to ~$40bn NR/ ~$20bn profit. We estimate that ~12 FMCG companies are best placed to address this opportunity

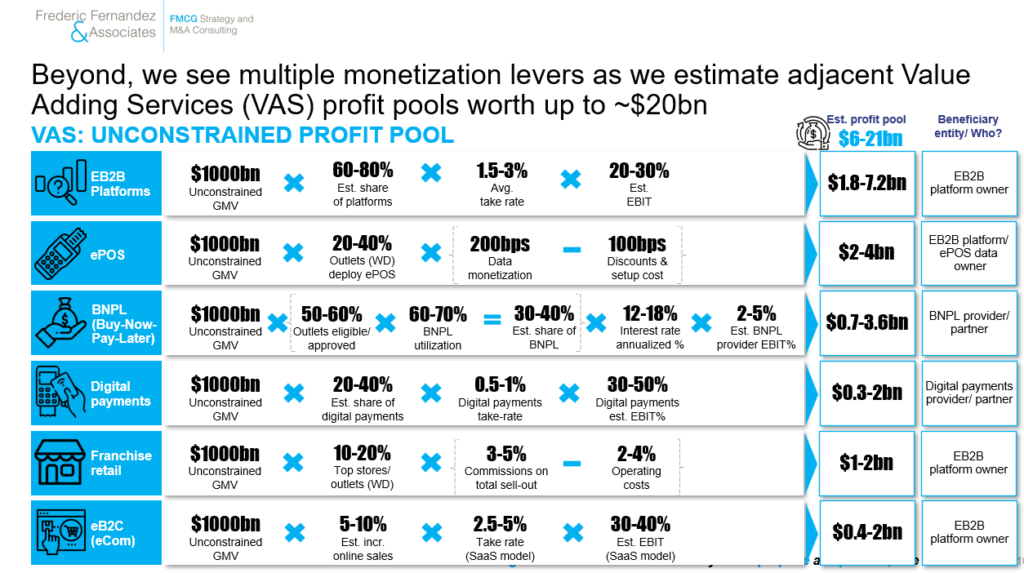

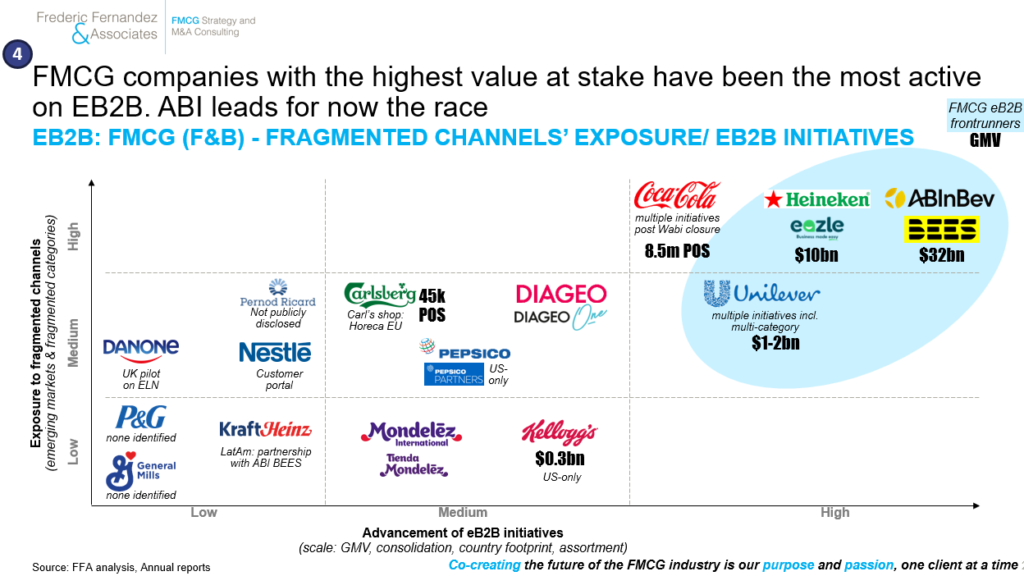

6) Beyond, we see multiple monetization levers as we estimate adjacent Value Adding Services (VAS) profit pools worth up to ~$20bn

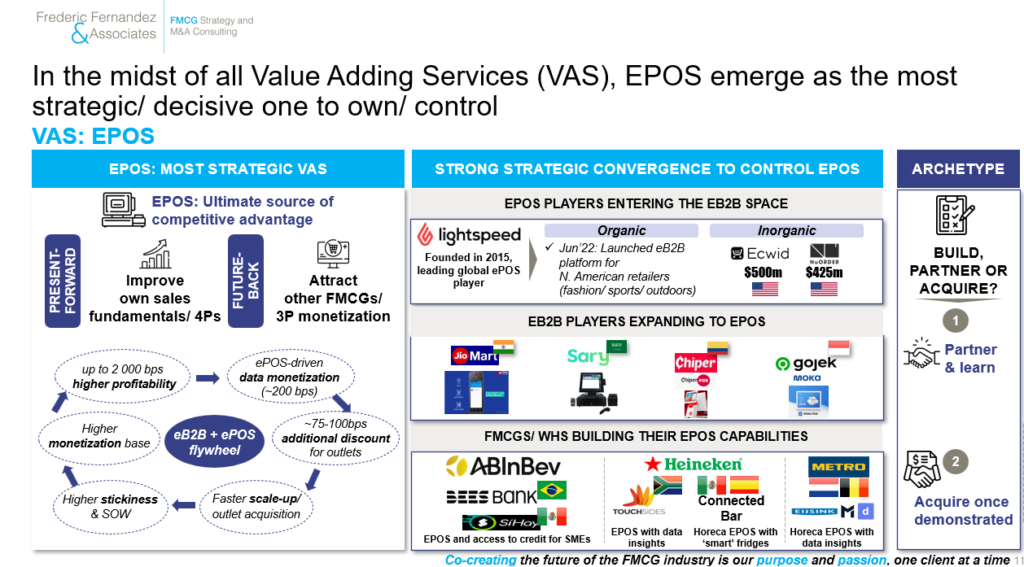

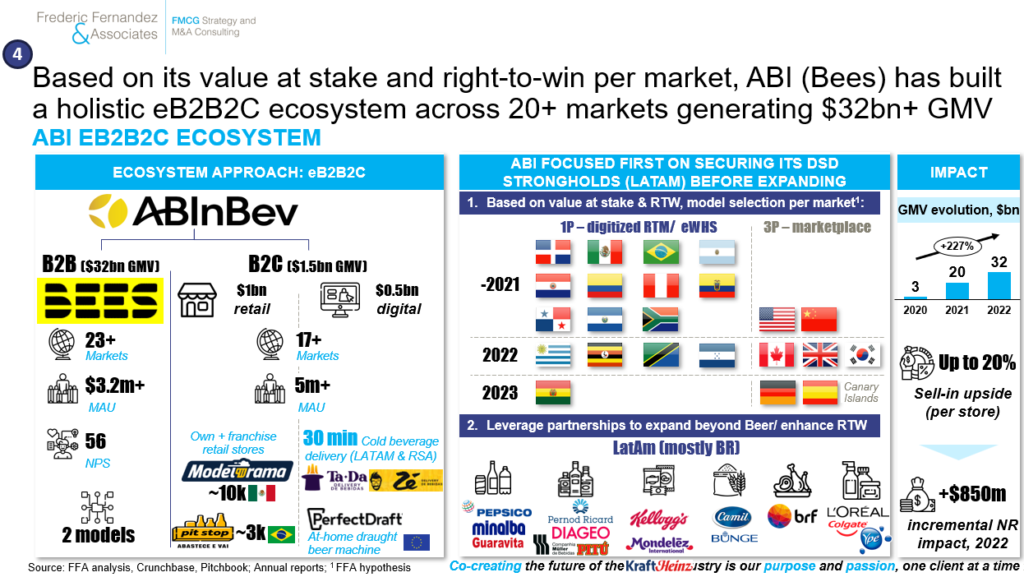

7) In the midst of all Value Adding Services (VAS), EPOS emerge as the most strategic/ decisive one to own/ control to access sell-out data & to own the POS/ consumer financial transaction

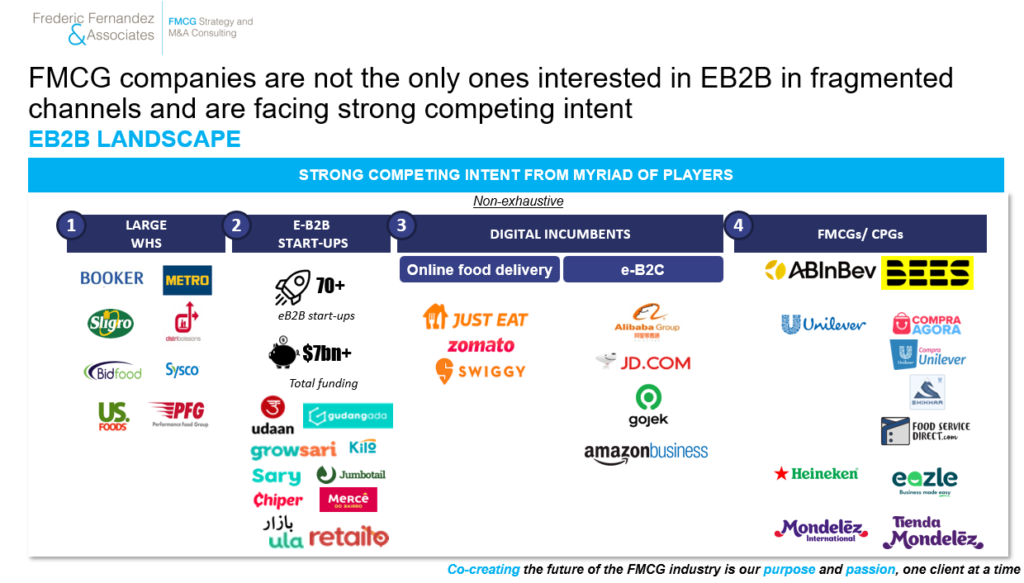

8) FMCG companies are not the only ones interested in EB2B in fragmented channels and are facing strong competing intent. All those parties have a varying right-to-win depending to the market structure they operate in

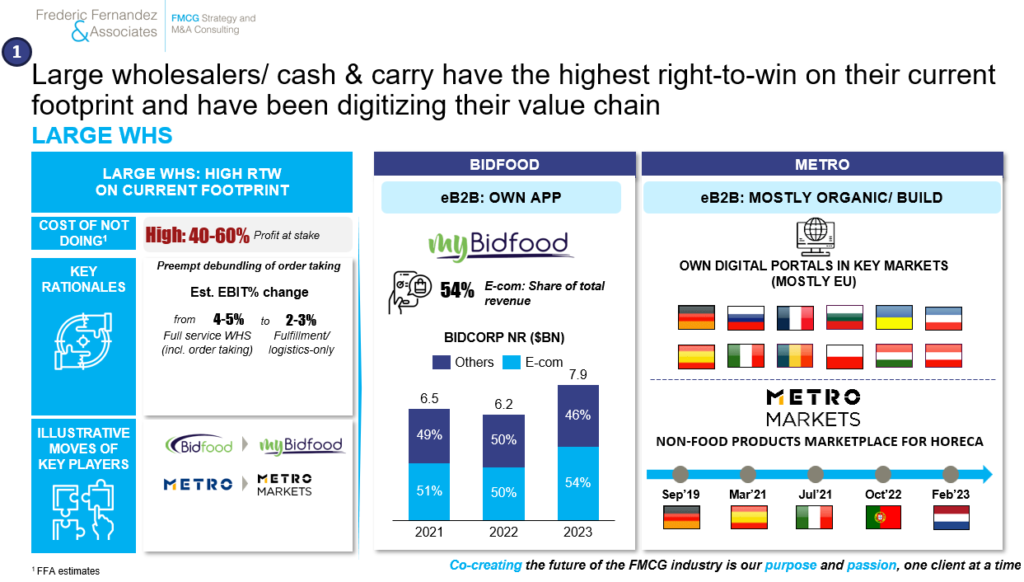

9) Large wholesalers/ cash & carry have the highest right-to-win on their current footprint and have been digitizing their value chain. Their geographic ‘lift & shift’ potential is however, ‘as-is’, limited

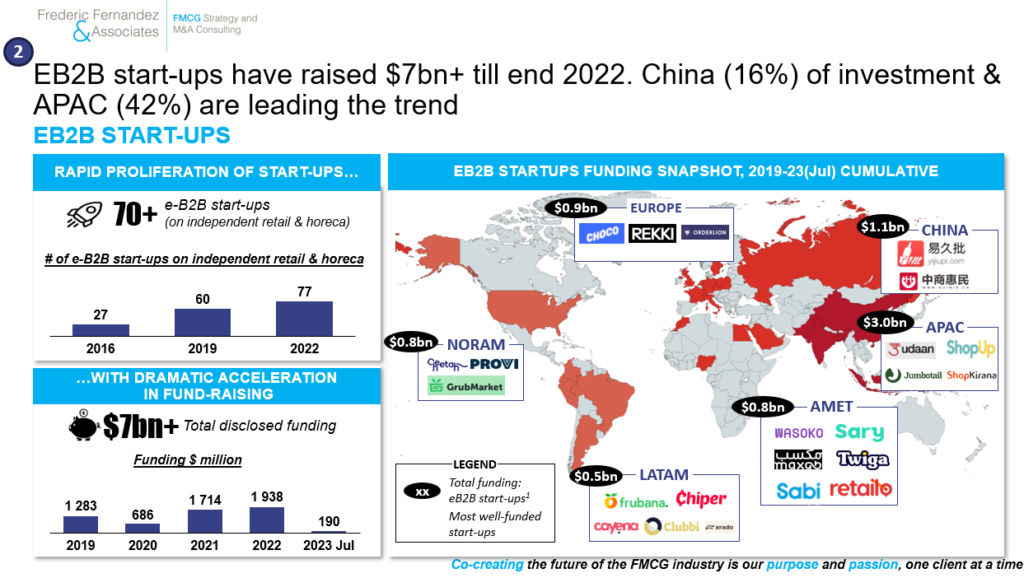

10) EB2B start-ups have raised $7bn+ till end 2022. Asia (58% of investments) are leading the trend. Other regions are now catching-up

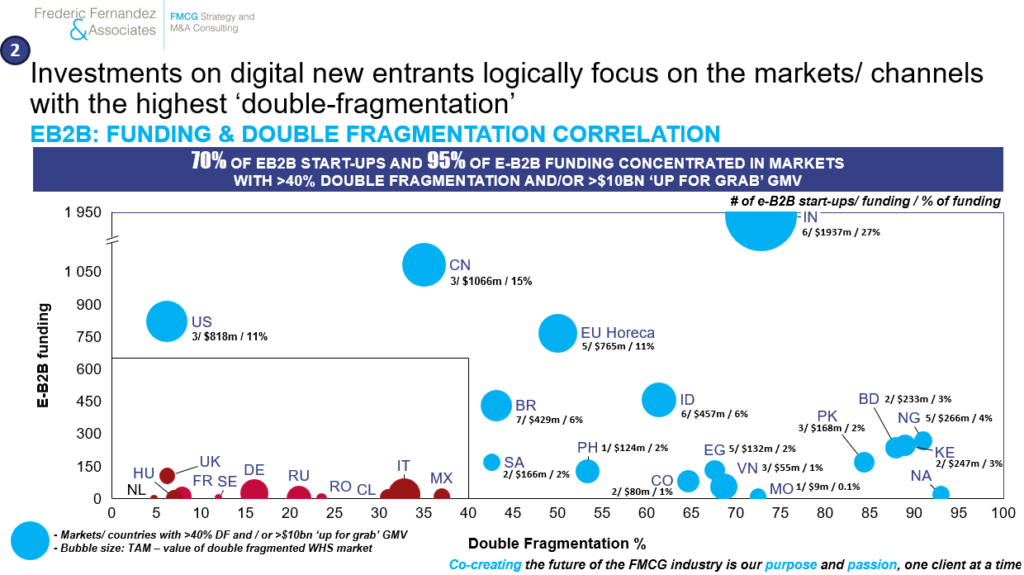

11) Investments from digital new entrants logically focus on the markets/ channels with the highest ‘double-fragmentation’

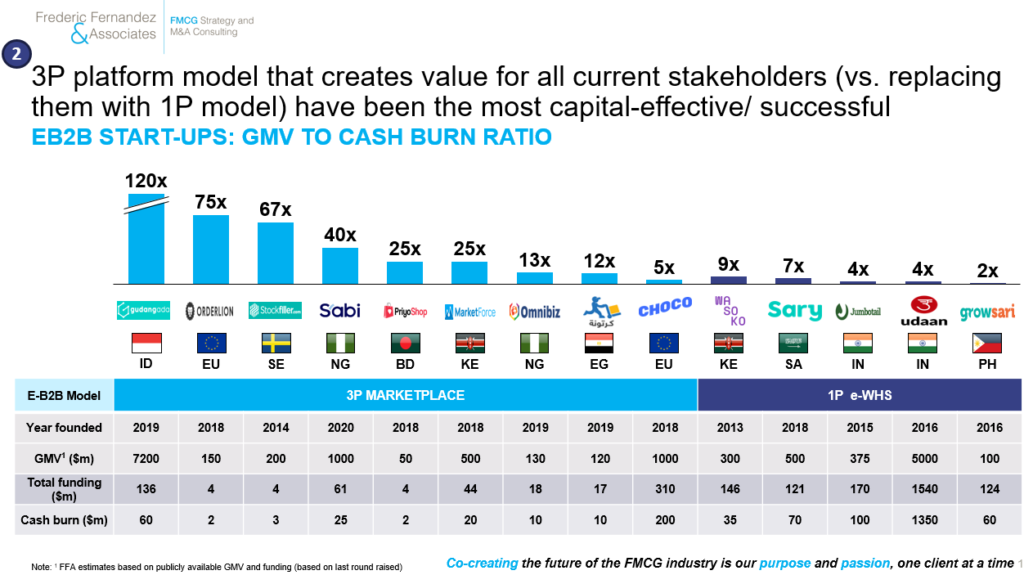

12) 3P asset-light platforms model that create value for all current stakeholders (vs. replacing wholesalers, ie. with 1P model) have been to-date the most capital-effective/ successful

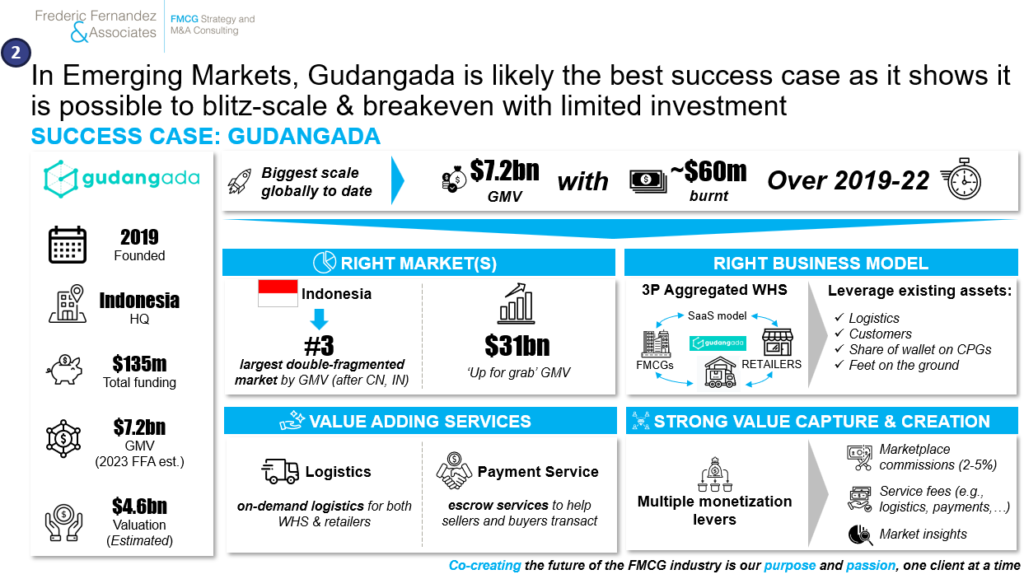

13) In Emerging Markets, Gudangada is likely the best success case as it shows it is possible to blitz-scale & breakeven with limited investment

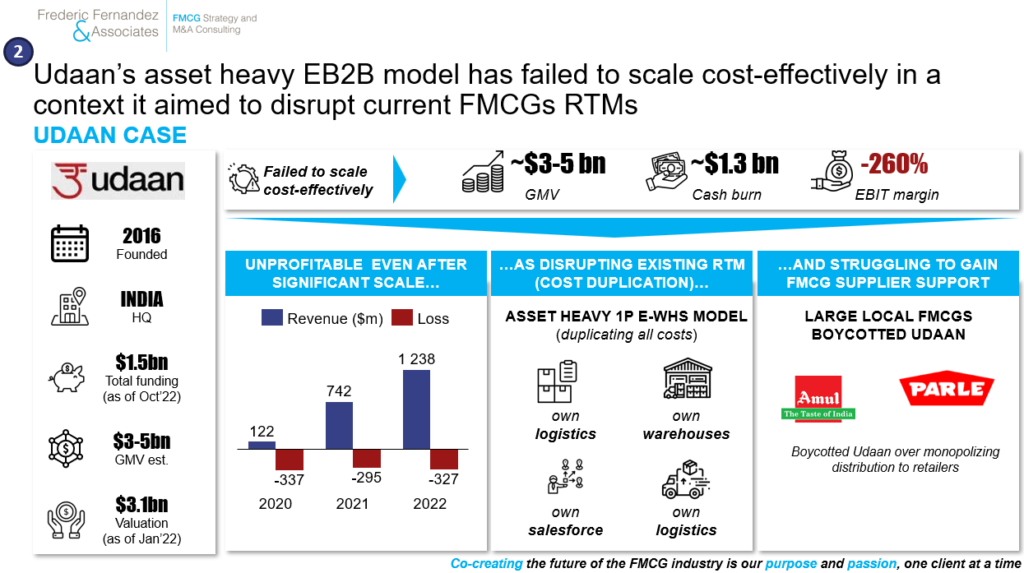

14) In India, Udaan’s asset heavy EB2B model has failed to scale cost-effectively in a context it aimed to disrupt current FMCGs RTMs

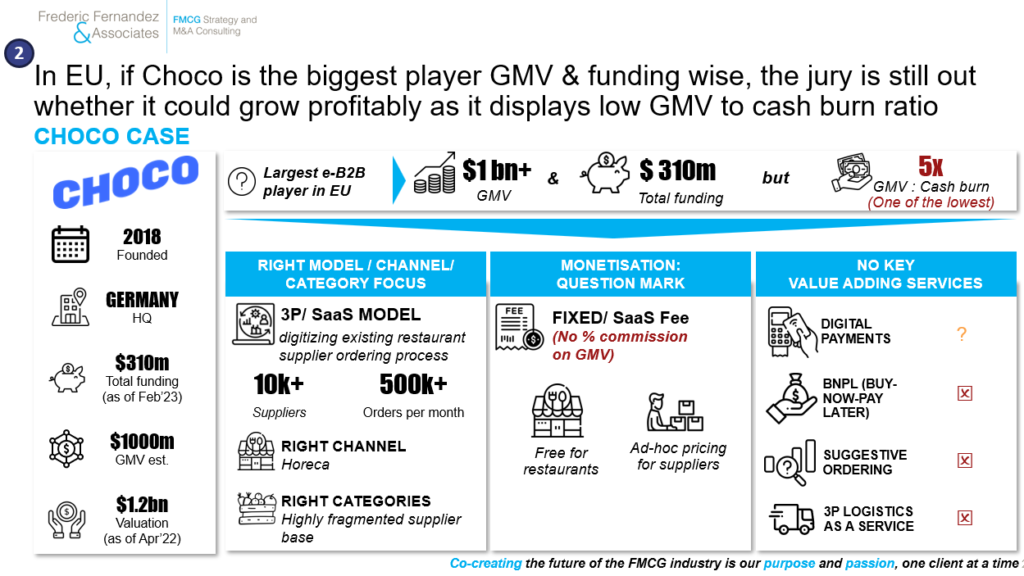

15) In EU, if Choco is the biggest player GMV & funding wise, the jury is still out whether it could grow profitably as it has displayed to-date some of the world lowest GMV to cash burn ratio

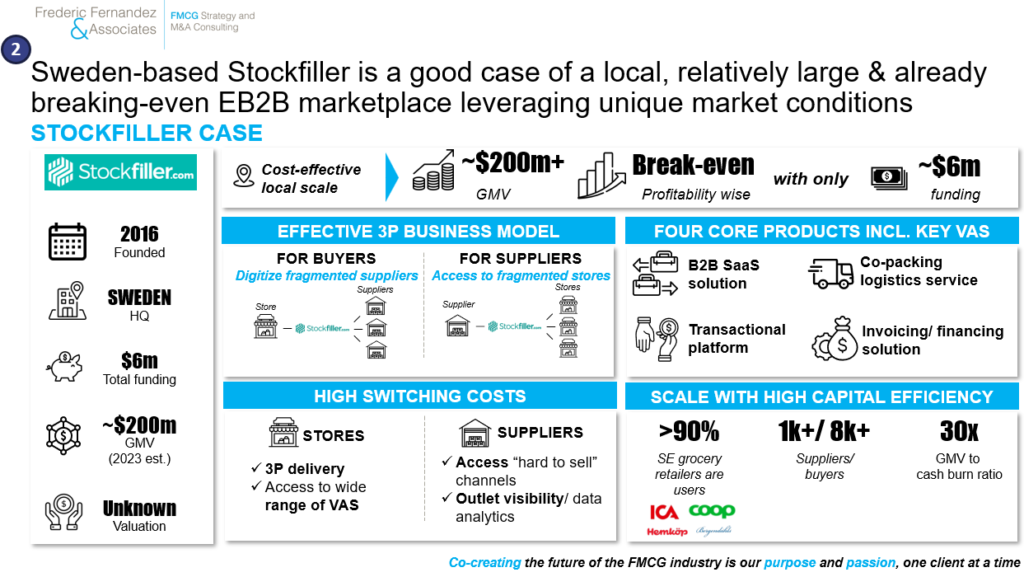

16) Sweden-based Stockfiller is a good case of a local, relatively large & already breaking-even 3P EB2B marketplace leveraging unique market conditions (digitizing the high share of direct purchase made by local stores at the largest grocery chains)

17) Like BABA’s LST, some digital new entrants leverage franchise retail to castle their EB2B position & expand their profit pool in their most performing POS. This is not for most, for now at least, a scalable play considering the required CAPEX

18) EB2C players (mostly restaurant delivery) have also a high strategic intent on EB2B on fragmented channels and have accelerated their EB2B initiatives, especially on categories that do not require a competitive cost-to-serve (consumables like napkins, uniforms…). We do not see those players winning on FMCG (low value/ high frequency) categories unless they partner with cost-effective ‘wheels’, which is the most likely to happen in high double fragmentation environment (e.g. Indonesia, India…)

19) FMCG companies with the highest value at stake have been the most active on EB2B. ABI leads for now the race

20) Based on its value at stake and right-to-win per market, ABI (BEES) has built a holistic eB2B2C ecosystem across 20+ markets generating $32bn+ GMV delivering already significant incremental value to its core business (+20% uplift). It is now scaling-up 3rd party partnerships

21) Most of the EB2B pie in double fragmented environment is still up-for-grab calling for decisive actions from companies with the highest value at stake

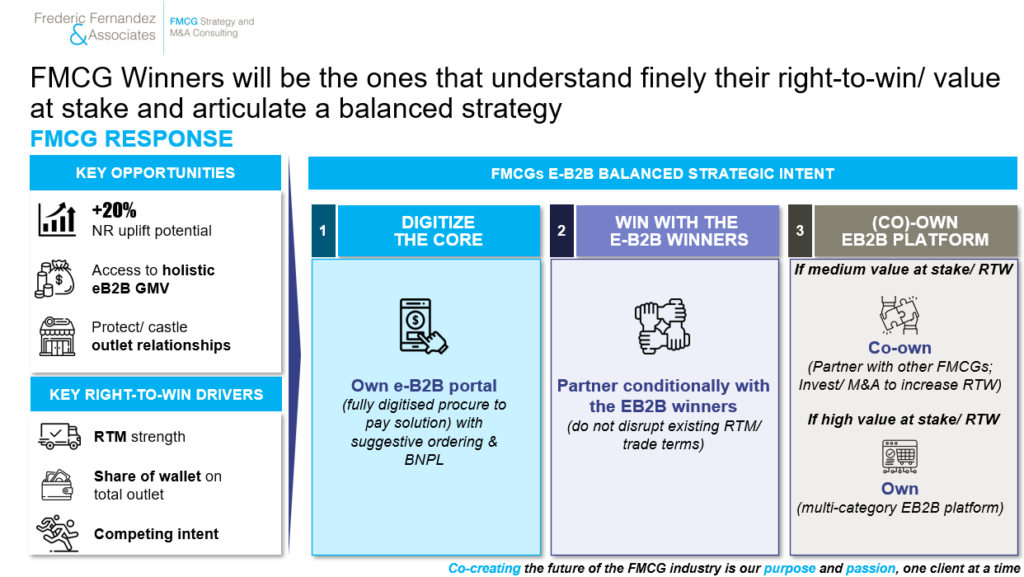

22) FMCG Winners will be the ones that understand finely their right-to-win/ value at stake and articulate a balanced strategy across digitizing their Core, win (conditionally) with the EB2B winners & (co)-own EB2B platform where they can develop a right-to-win

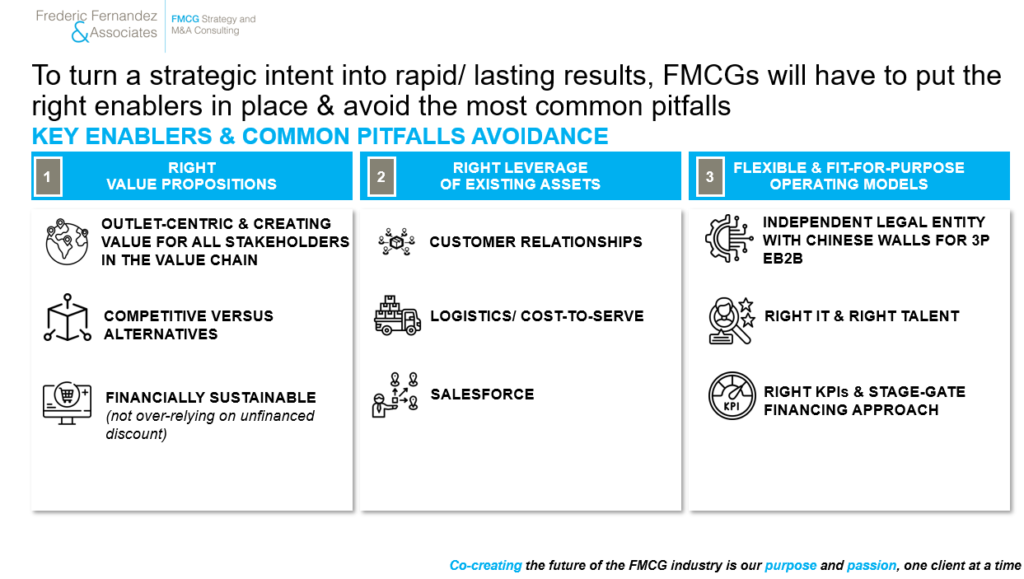

23) To turn a strategic intent into rapid/ lasting results, FMCG leaders will have to put the right enablers in place: design outlet-centric value propositions creating value for all stakeholders in the value chain and strike the right balance between leveraging their assets & adopting fit-for-purpose operating models

Bringing it all together:

The EB2B race to own fragmented channels will shape the future of the FMCG industry. As Winston Churchill wrote:

‘The further backward you look, the further forward you can see’

Exciting & decisive times

To follow Frederic, please click Here, To start a conversation, email at: frederic@fredericfernandezassociates.com

To subscribe to our newsletter and receive all our CEOs Insights, sign-up at the following link: FMCG CEOs: Managing For Growth

To get the full deck of this publication, please write us at contact@fredericfernandezassociates.com

About the Firm:

Frederic Fernandez & Associates (FFA) is a global bespoke Strategy and M&A Consulting Firm exclusively focused on Growth and M&A areas in the FMCG industry. Its purpose is to help its clients win today while renewing their competitive advantages to win tomorrow. 13 out of the top world 20 largest FMCG companies are repeat Clients.

Our passion is to co-create the future of the FMCG industry, one client at a time. The Firm helps the CEOs and the Boards of the world’s largest FMCG companies on selected areas: Growth and Profit turnaround, New Retail/ EB2B/ Ecommerce/ DTC and M&A (buy-side & sell-side). The Firm’s head office is located in Zug in Switzerland. The Firm’s team intervenes all across the globe. To know more about the Firm, please visit our website: www.fredericfernandezassociates.com

No FFA employees own any stocks or financial instruments of any FMCG companies or companies mentioned in the above article. All the above information are public information