‘Face reality as it is, not as it was or as you wish it to be’ Jack Welch

There has been rightly much debate lately on Plant-Based (PB) in the FMCG industry. In this article, we explore the following questions:

- What is PB & its main segments?

- How much funding did the vertical attract overall & across its sub-segments? Which companies attracted the most funding?

- How large is PB today? How does it compare with last years’ predictions?

- What have been the strategies pursued by all players (Start-Ups, Large FMCGs, Large Quick Service Restaurants – QSR – chains) with which results to-date?

- What have been consumers expectations/ experience with PB?

- Who have been the Winners & Losers of the vertical? Why?

- What PB assets’ investors/ owners should do to protect/ enhance the value of their investments?

- Can water/ CO2 true costing radically change PB price vs. alternatives?

- What is reasonably the future of the PB vertical and what needs to be true for it to be successful?

To answer those questions, we analyzed:

- 1000+ FMCG Plant-Based M&A transactions & Assets

- The main initiatives (build, partnership & acquisition) of the world largest FMCG companies

- The strategies & results of the world top listed PB companies

- All available secondary consumer research on PB

Our ‘one-minute’ strategic thesis:

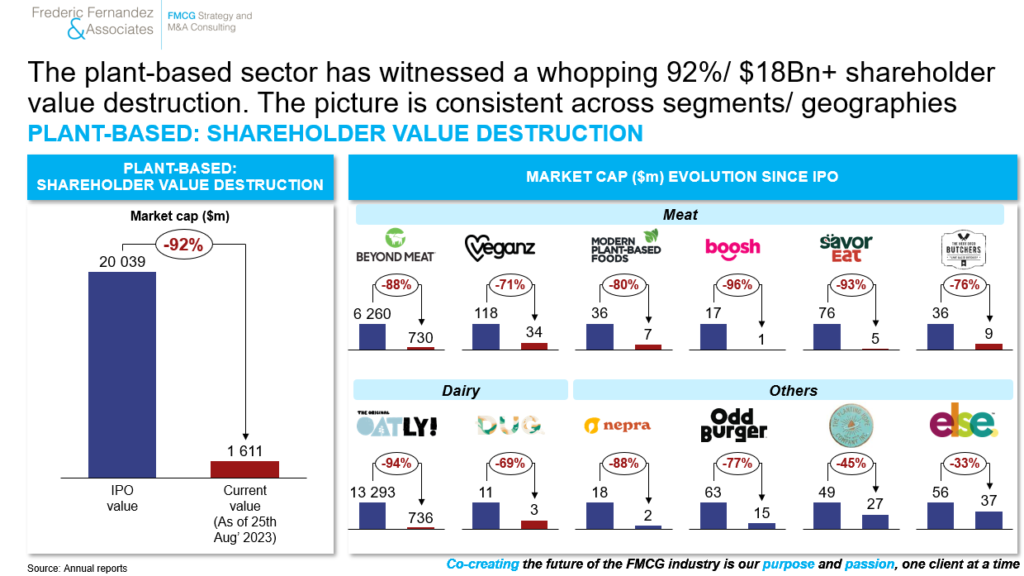

- Despite having a huge potential (large consumer needs, large TAM & profit-pool), PB overall failed to-date to deliver on the large consumers’ & investors’ expectations (92% shareholder value destruction to-date on public listed assets, high companies mortality rate, retail delisting)

- Today, most of the PB assets are ‘as-is’ not future-proof (consumer value propositions stuck in the middle: no taste/ texture/ price/ nutritional value advantages vs. alternatives with a sustainability advantage that is too often not a #1 driver for consumers; low ROCE for investors: poor unit margin, high CAPEX, low operational scalability)

- If water/ CO2 true costing has the potential to drastically change PB consumer price perception vs. its natural animal protein alternatives, it is unlikely to happen in the near-future

- To address their potential, PB companies will have to leverage technology & nature’s full potential to first create tangible value for consumers and then overcome their margin & operational challenges. Planet needs it, consumers want it

- Time for PB investors to understand PB’s success drivers to protect/ enhance the value of their investments. Exciting times

Here is our detailed perspective in five key messages/ 25 charts. As usual, all of the below include only public information to protect our clients’ confidentiality.

Enjoy the read

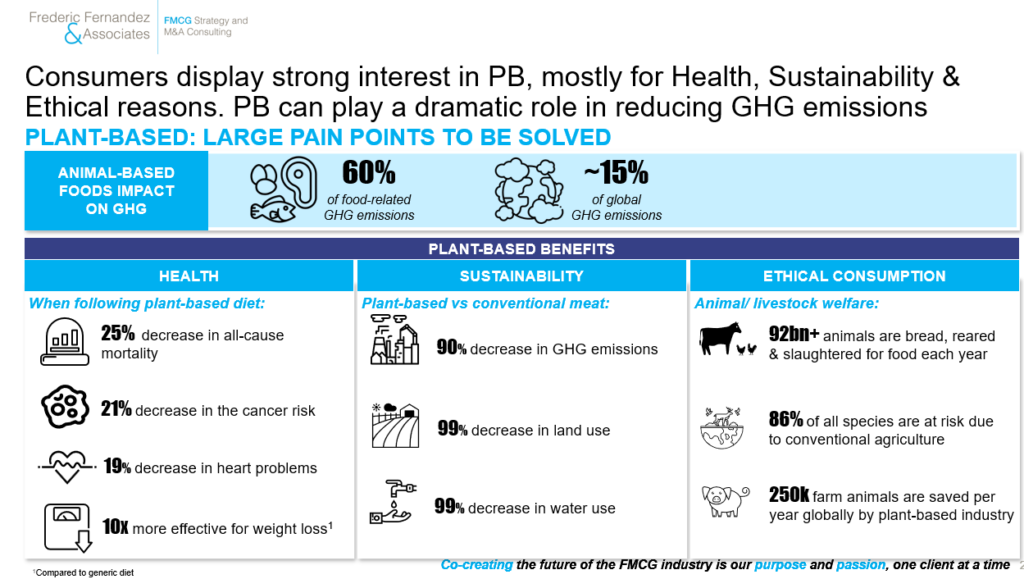

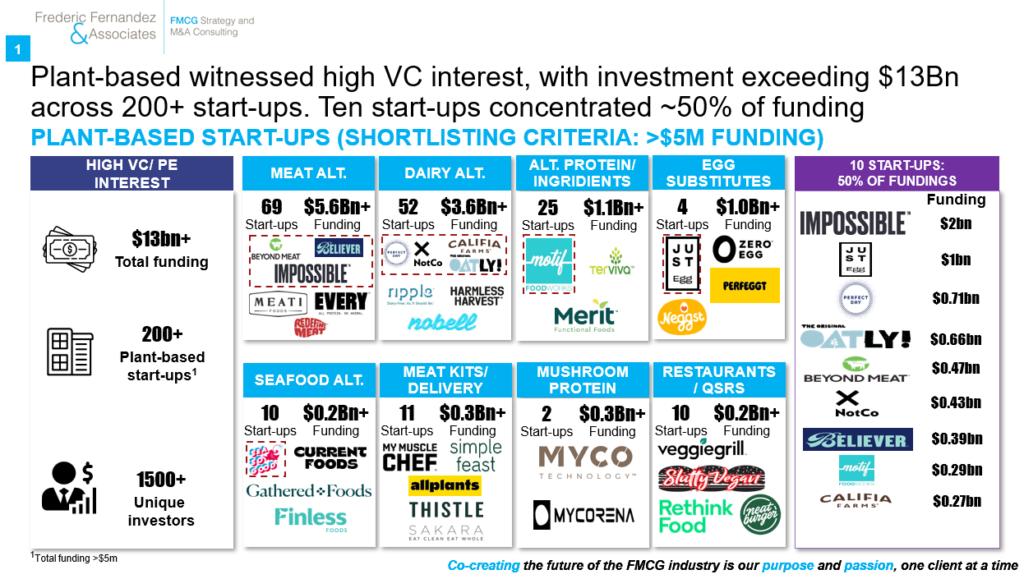

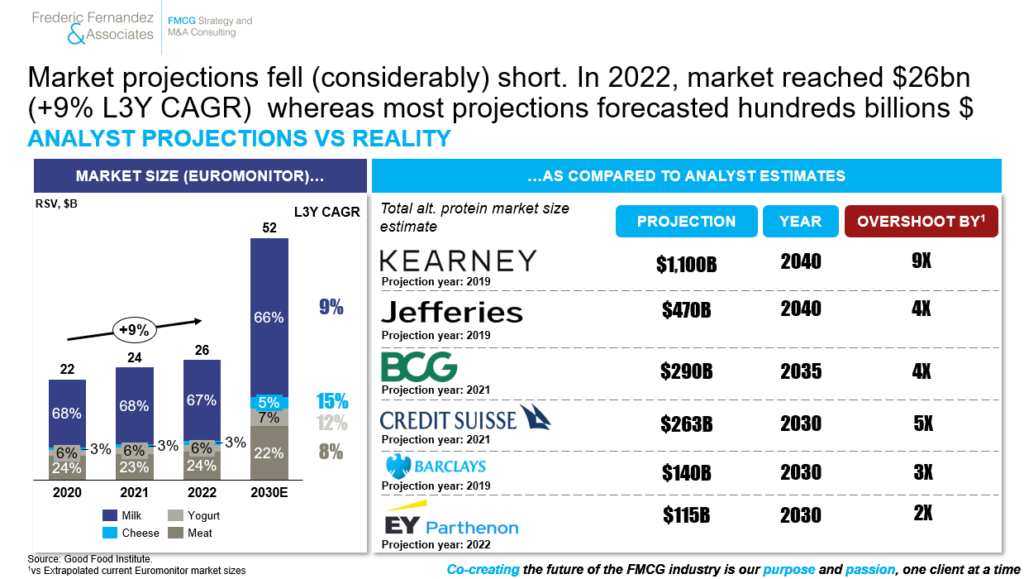

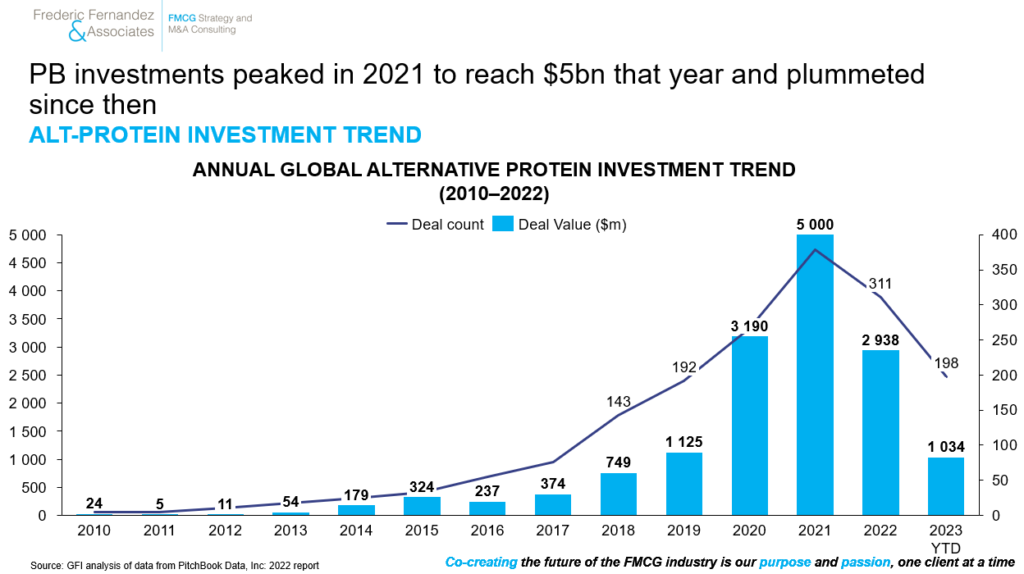

Key message #1: Plant-based (PB) hype: The rise of the plant-based wave has been fueled by strong consumer interest mostly for Health, Sustainability (animal protein accounts for 15% of GHG) & Ethical reasons that led to heightened interest from VCs ($13bn+/ 200+ start-ups/ 1500+ unique investors), large FMCGs (acquisitions/ stakes, joint ventures as well as organic initiatives) as well as leading Quick Service Restaurants chains (QSRs) (PB items in menus). At such, most projections forecasted hundreds billions $ market size but fell rather considerably short as the market has reached only $26bn (+9% L3Y CAGR) in 2022

i) Consumers display strong interest in PB, mostly for Health, Sustainability & Ethical reasons. PB can play a dramatic role in reducing GHG emissions

ii) Plant-based witnessed high VC interest, with investment exceeding $13Bn across 200+ start-ups. Ten start-ups concentrated ~50% of funding

iii) Market projections fell (considerably) short. In 2022, market reached $26bn (+9% L3Y CAGR) whereas most projections forecasted hundreds billions $

iv) PB investments peaked in 2021 to reach $5bn that year and plummeted since then

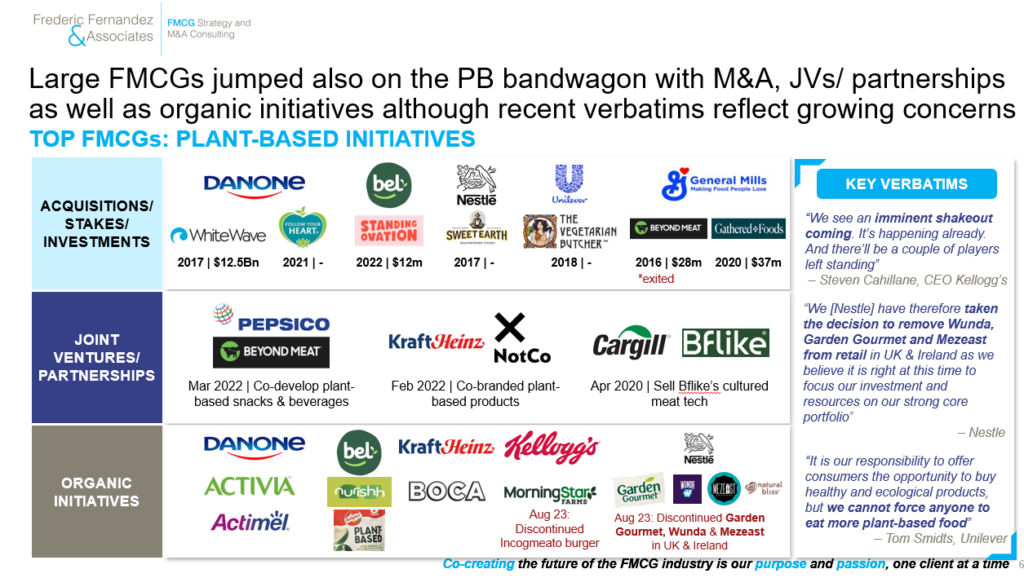

v) Large FMCGs jumped also on the PB bandwagon with M&A, JVs/ partnerships as well as organic initiatives. Recent C-level verbatims reflect growing concerns

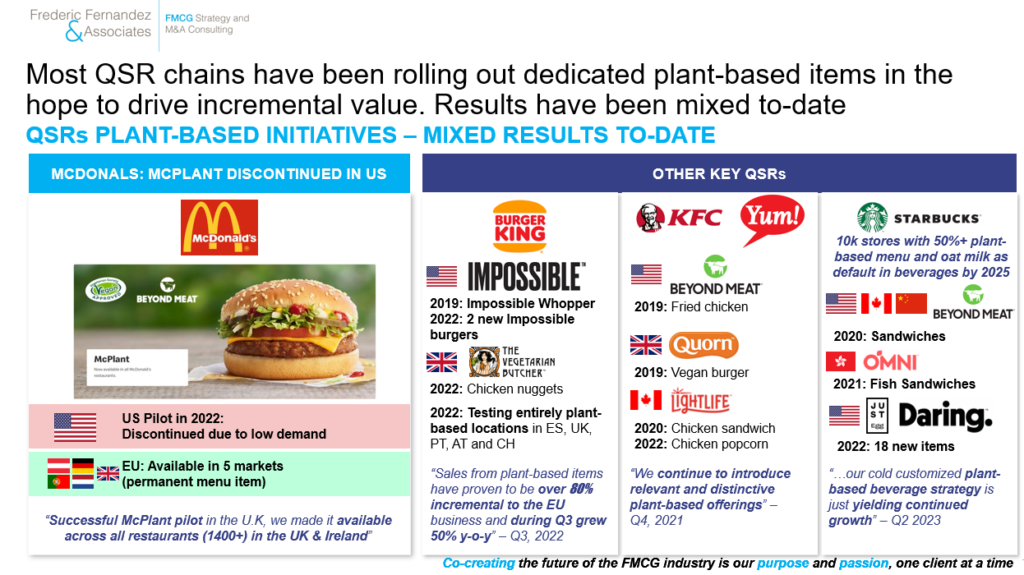

vi) Most Quick Service Restaurants (QSR) chains have been rolling out dedicated plant-based items in the hope to drive incremental value. Results have been mixed to-date with the biggest failure being with McDonald’s in the USA

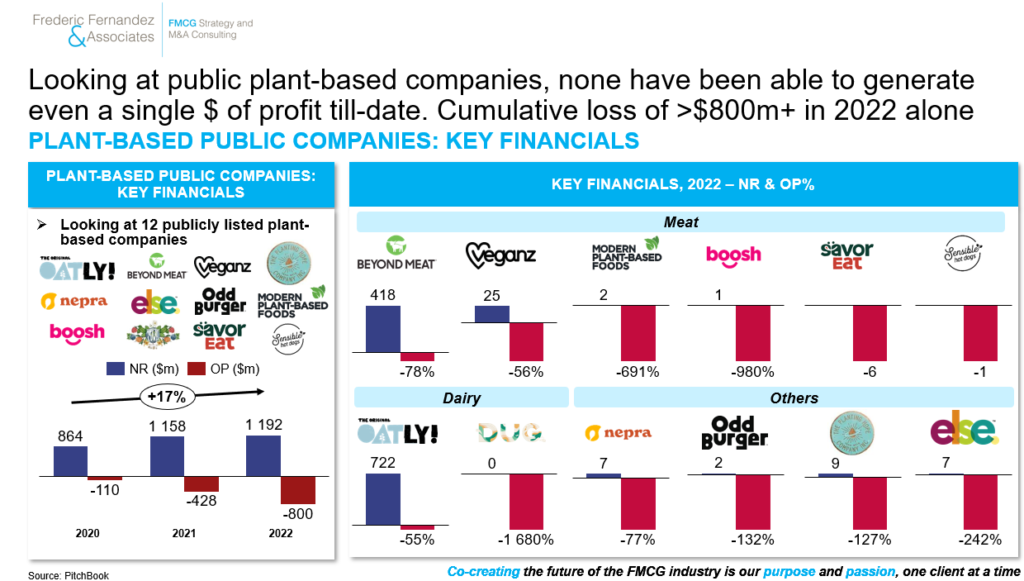

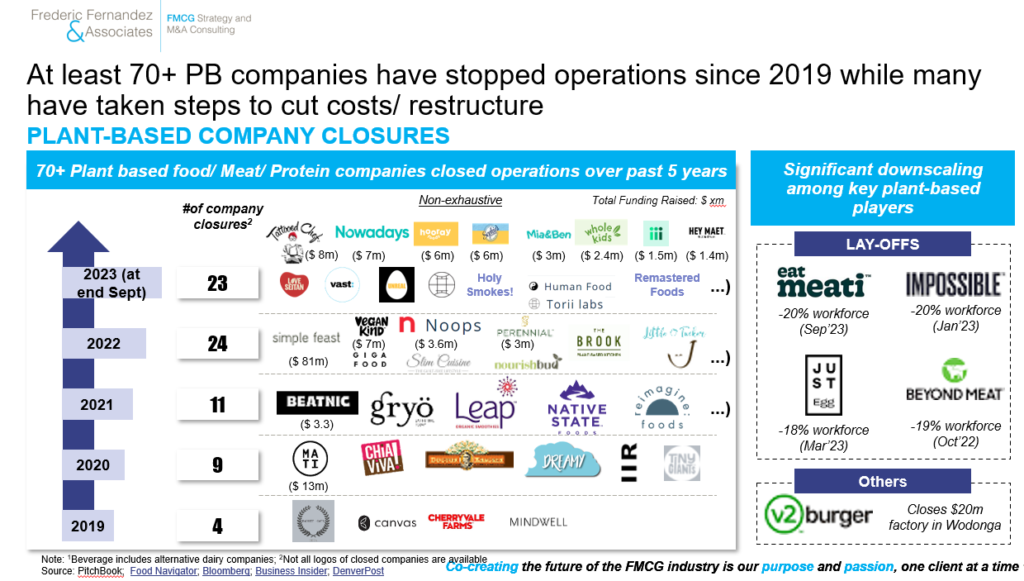

Key message #2 – PB companies have for now failed to deliver value: looking at public PB companies (n=12), none have been able to generate even a single $ of profit till-date (on the contrary, they reported cumulative loss of >$800m+ in 2022 alone). At such, those companies witnessed a whopping 92%/ $18Bn+ of shareholder value destruction (since their IPO). The picture is consistent across segments/ geographies and further validated by 70+ PB companies closures since 2019 while many are actively taking steps to cut costs/ restructure to stay afloat

i) Looking at public plant-based companies, none have been able to generate even a single $ of profit till-date. Cumulative loss of >$800m+ in 2022 alone

ii) The plant-based sector has witnessed a whopping 92%/ $18Bn+ shareholder value destruction. The picture is consistent across segments/ geographies

iii) At least 70+ PB companies have stopped operations since 2019 while many have taken steps to cut costs/ restructure

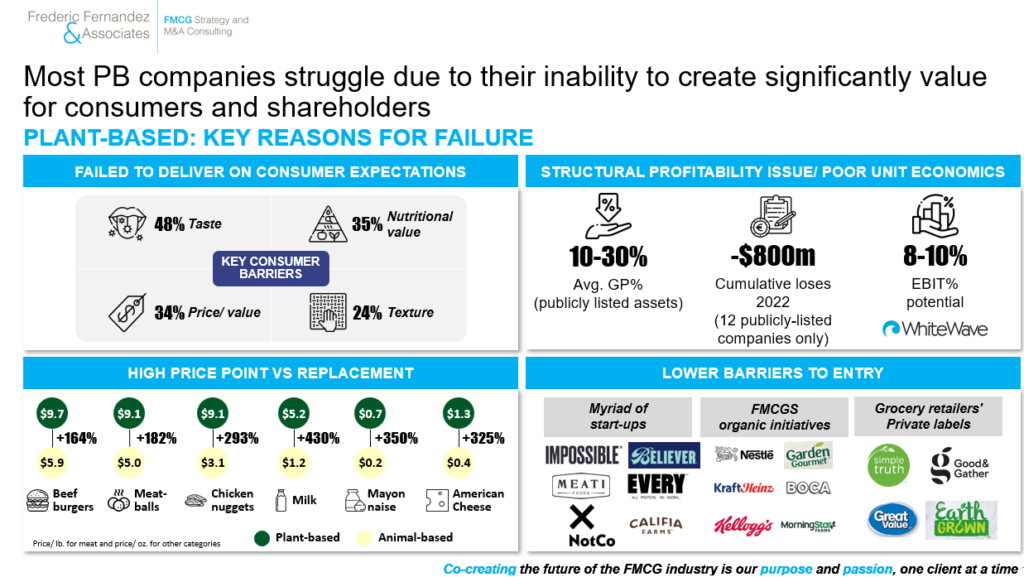

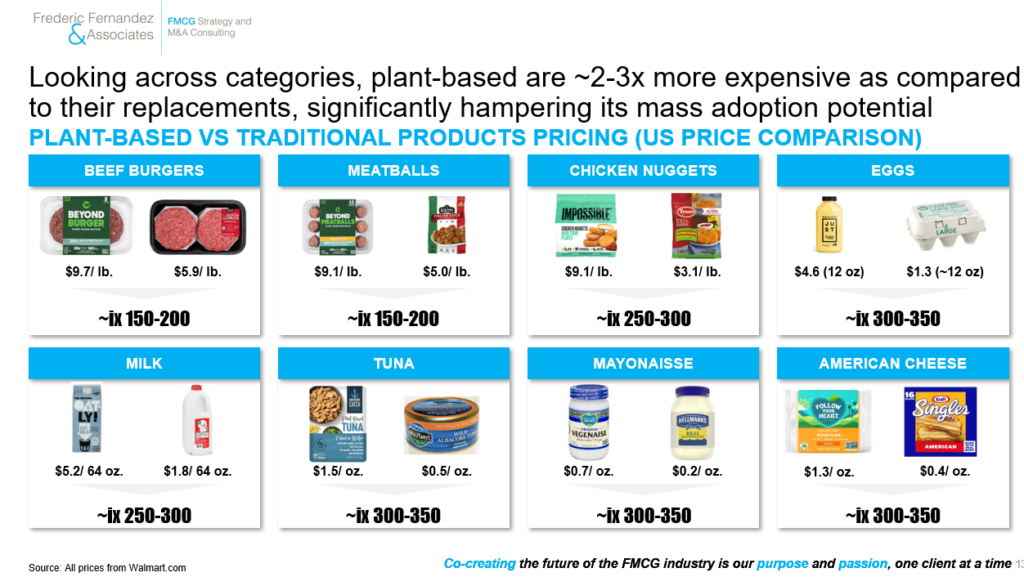

Key message #3 – Key reasons for failure: while the first-wave of plant-based companies experienced high consumer interest/ trial rate, they have largely struggled due to their inability to create value for consumers, especially on taste (#1 barrier) and price (on avg,. 2-3x more expensive vs alternatives) despite displaying better sustainability credentials while facing structural profitability challenges (low gross margin %: 10-30%) and increasing competition from grocers’ private labels testimony of the relative low barriers to entry of the segment

i) Most PB companies struggle due to their inability to create significantly value for consumers and shareholders

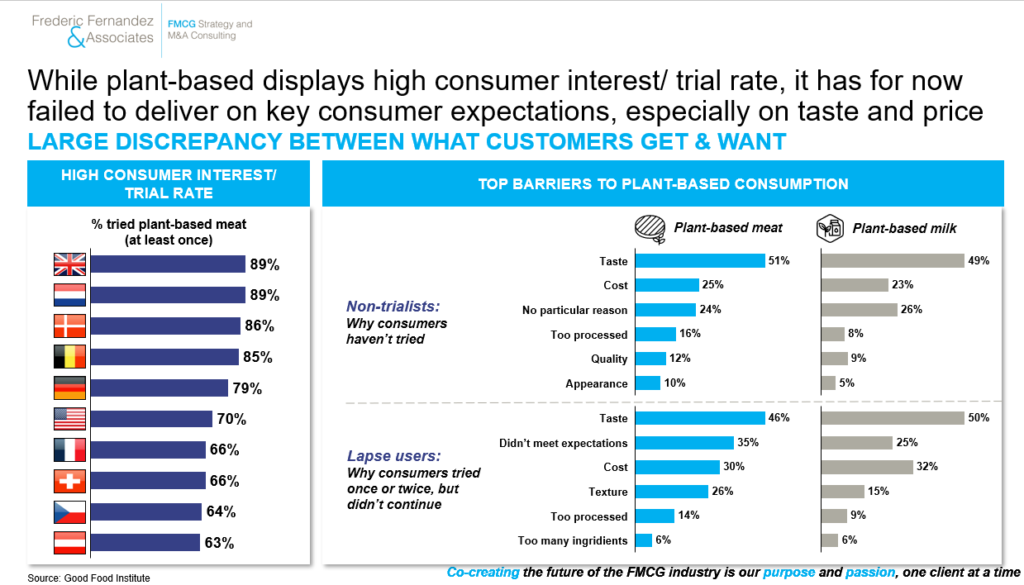

ii) While plant-based displays high consumer interest/ trial rate, it has for now failed to deliver on key consumer expectations, especially on taste and price

iii) Looking across categories, plant-based are ~2-3x more expensive as compared to their replacements, significantly hampering its mass adoption potential

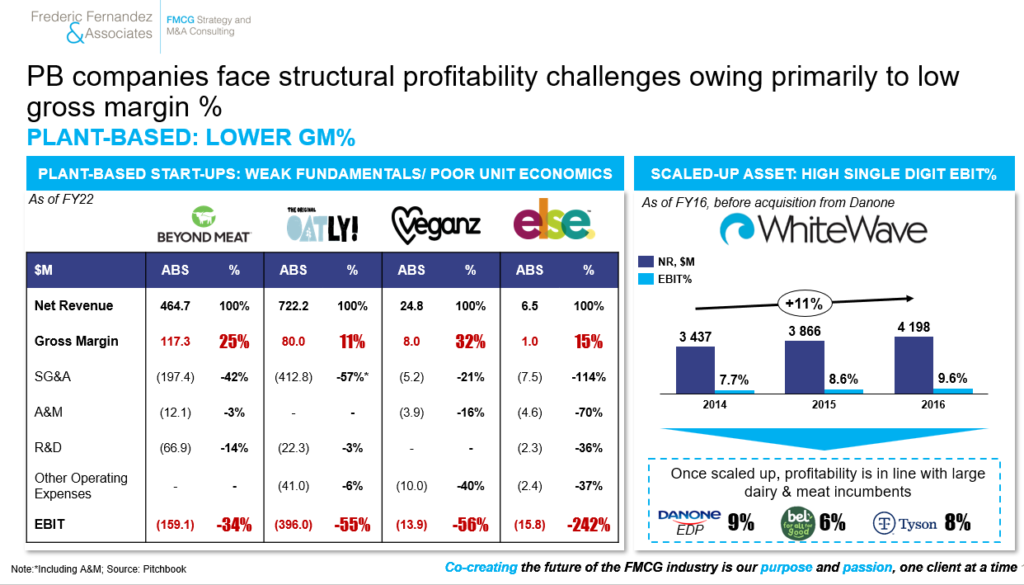

iv) PB companies face structural profitability challenges owing primarily to low gross margin %

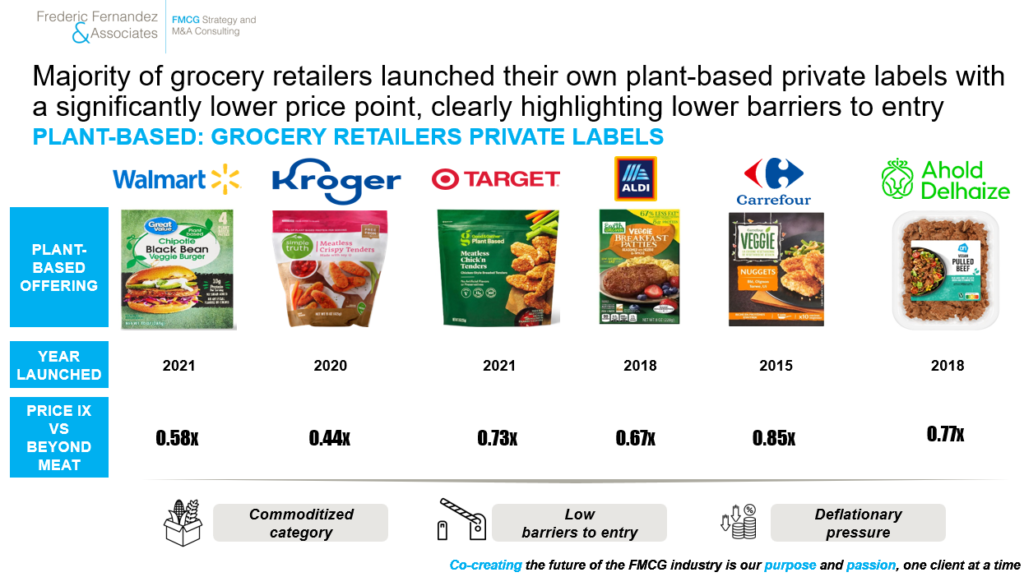

v) Majority of grocery retailers launched their own plant-based private labels with a significantly lower price point, clearly highlighting lowe barriers to entry

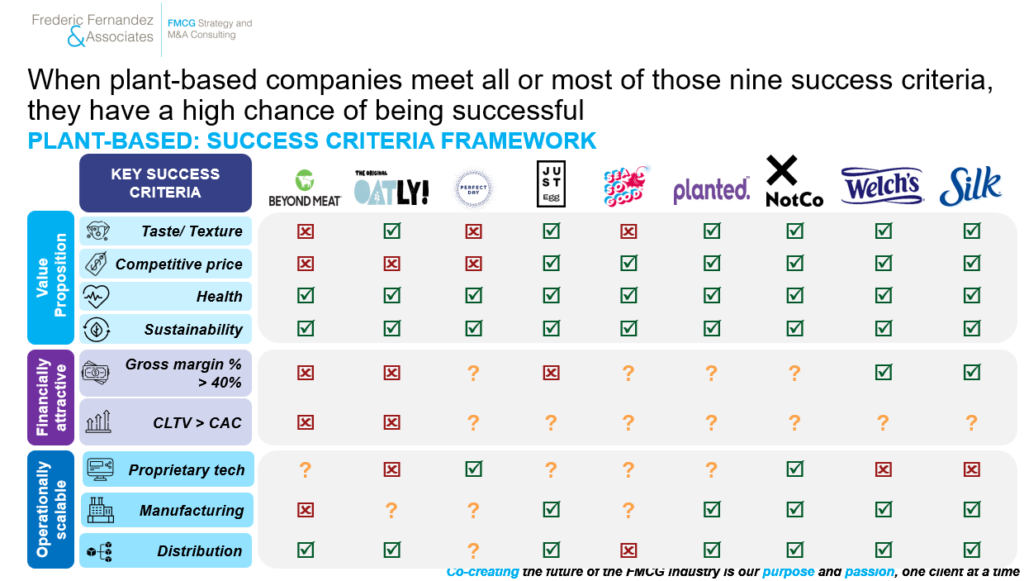

Key message #4 – Plenty of failures, very few success cases, and some are still question marks: we designed an assessment framework with nine critical success criteria across three key areas [(i) Value proposition, (ii) Financial attractiveness, and (iii) Operationally scalability] to analyse the most well-funded and well-known plant-based companies, if the jury is still out for many, we tend to see for now more failures (e.g., Beyond Meat, Oatly, Perfect Day, Just Egg), than successes (e.g., Welch Fruit snacks, Danone-Silk, Alpro) while some are still question marks (e.g., NotCo, Seasogood, Planted)

i) We designed a nine-criteria framework to assess plant-based assets & selected some of the most famous PB assets and we hand-picked few successful or at least promising ones

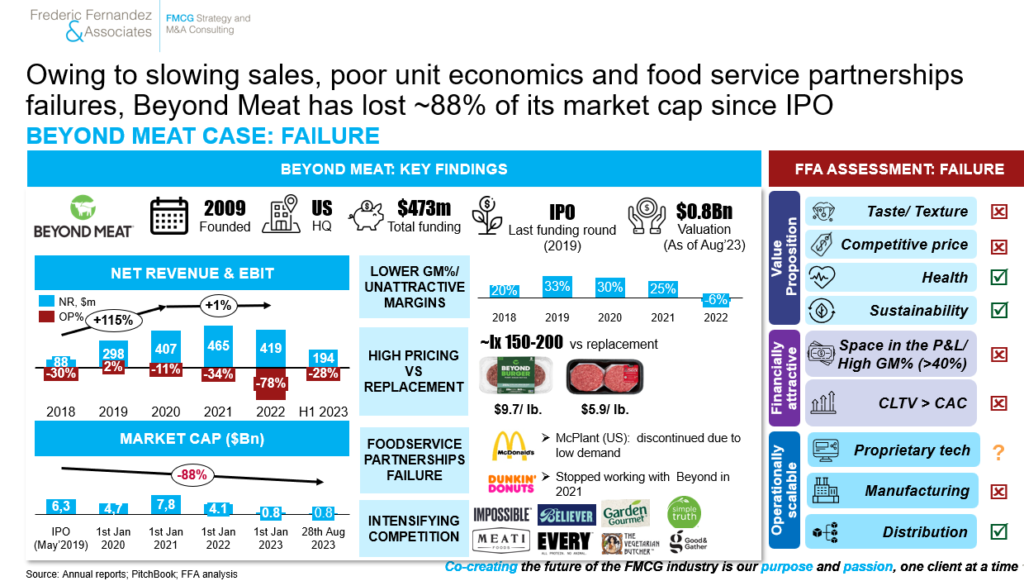

ii) Owing to slowing sales, poor unit economics and food service partnerships failures, Beyond Meat has lost ~88% of its market cap since IPO

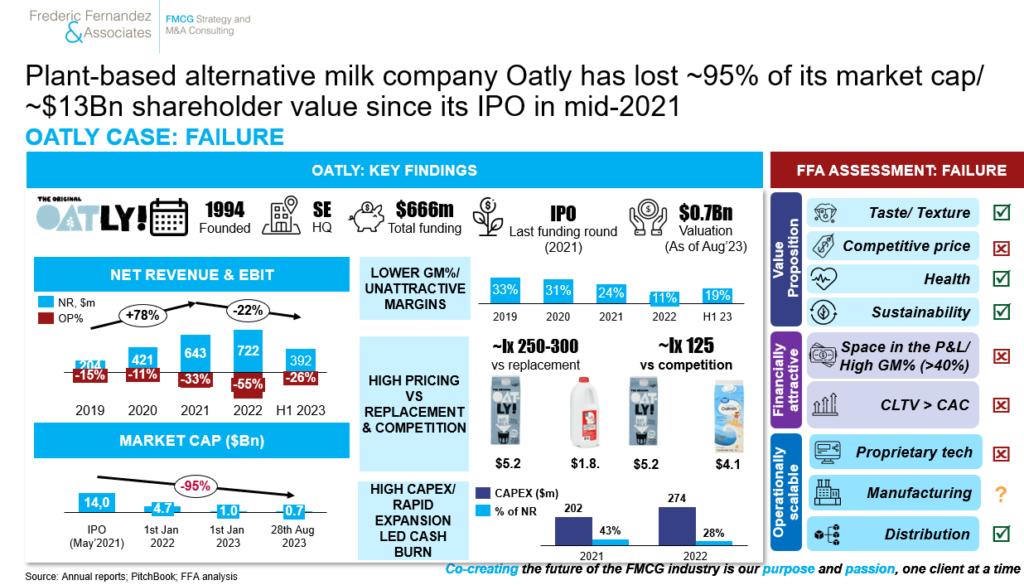

iii) Plant-based alternative milk company Oatly has lost ~95% of its market cap/ ~$13Bn shareholder value since its IPO in mid-2021

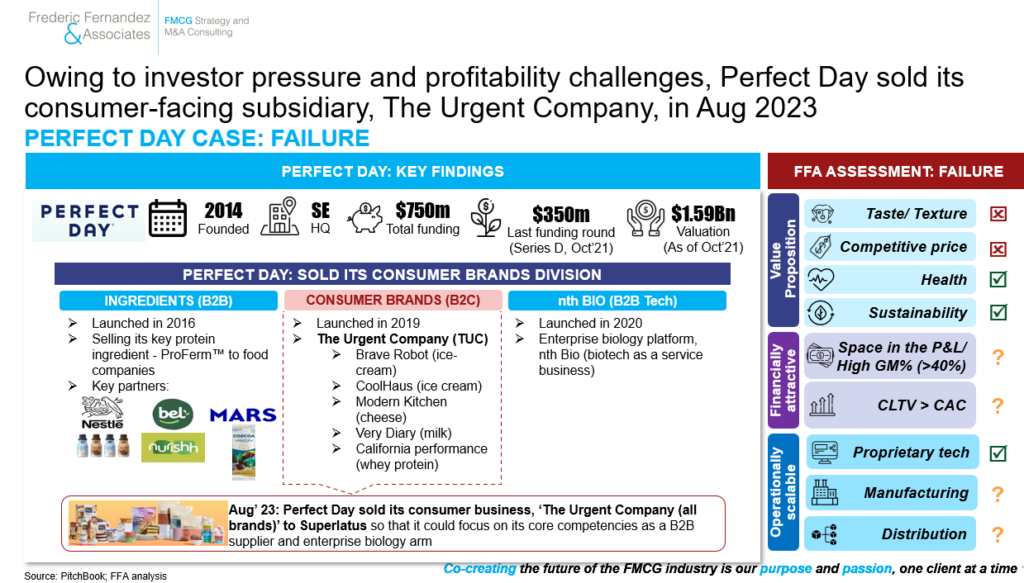

iv) Owing to investor pressure and profitability challenges, Perfect Day sold its consumer-facing subsidiary, The Urgent Company, in Aug 2023

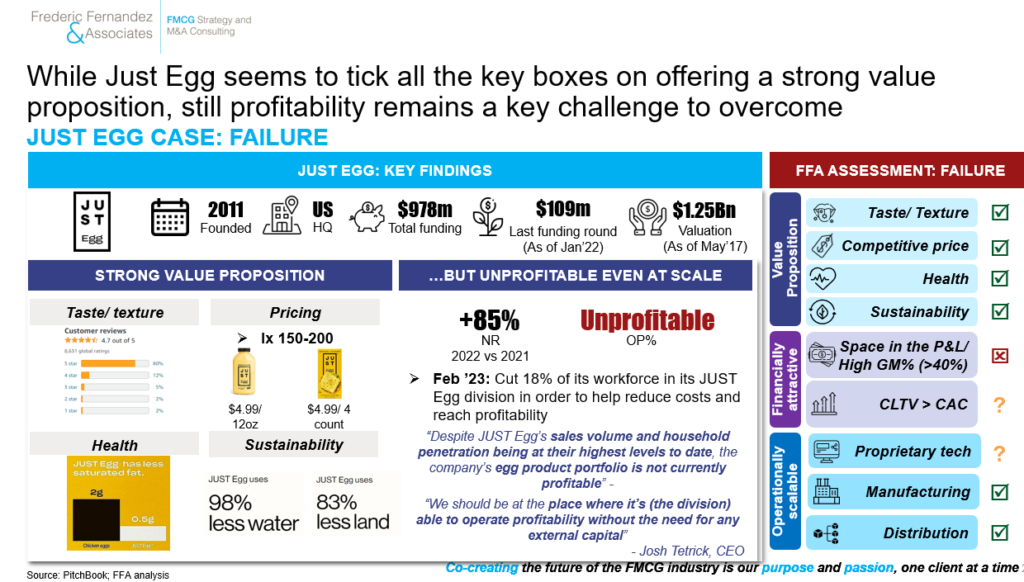

v) While Just Egg seems to tick all the key boxes on offering a strong value proposition, still profitability remains a key challenge to overcome

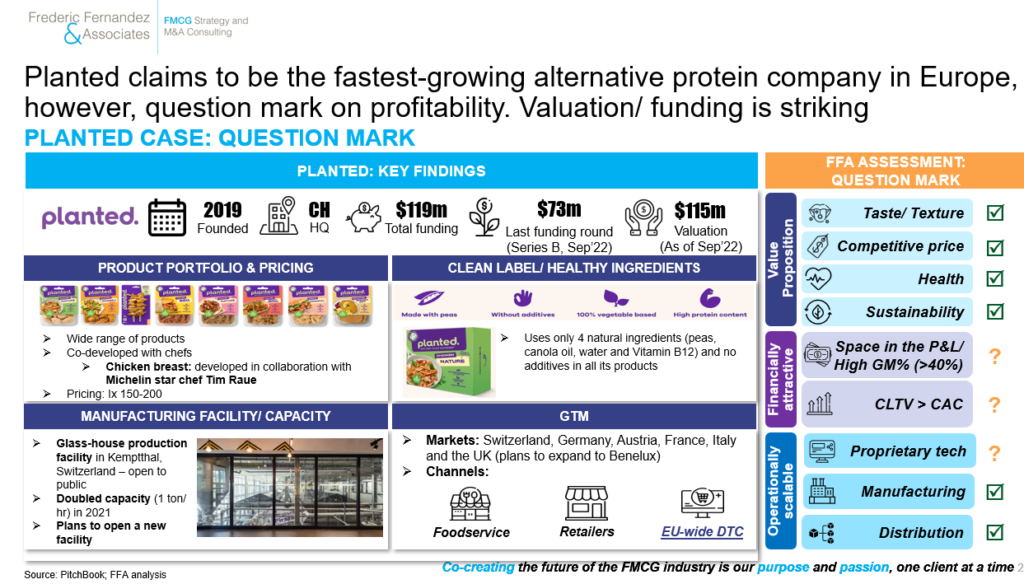

vi) Planted claims to be the fastest-growing alternative protein company in Europe, however, profitability of the business is unclear. Total funding vs. valuation is striking

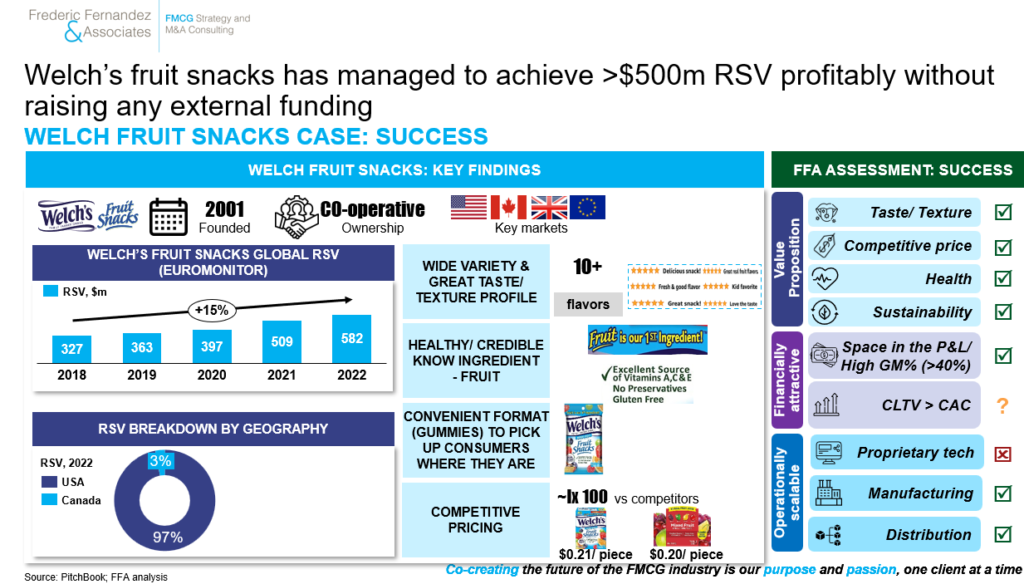

vii) Welch’s fruit snacks has managed to achieve >$500m RSV profitably without raising any external funding surfing the BFY/ natural snack trend

viii) Silk, a WhiteWave brand acquired by Danone in 2016 has been since then growing successfully largely driven by its strategic positioning based on taste and price

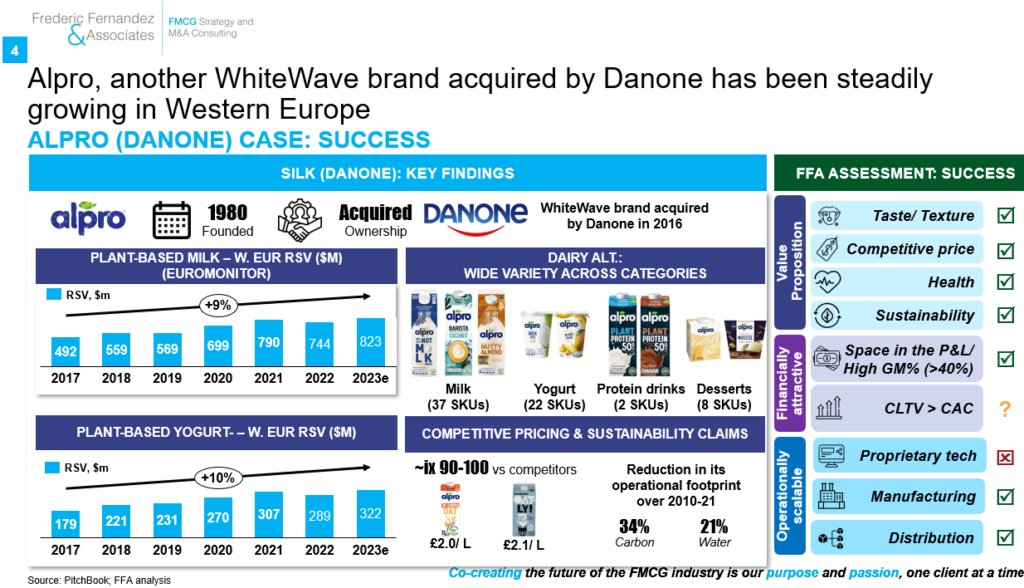

ix) Alpro, owing to its retail heritage, a wide portfolio covering need-states & Danone’s retail scale-up work have been recording a steady growth

Key message #5 – Perspective: Plant-based is not dead, it just needs to rise to the occasion. Sustainability credentials alone will not be enough to convince consumers. If true costing of water/ CO2 has the potential to change PB consumer price perception, PB builders/ investors should not count on it in a near future. To be successful, PB companies will have to create value for consumers (tasty, healthy, price premium worth paying for most consumers) & for investors (leading margin, operational scalability). Leveraging smartly Nature’s goodness in a consumer-centric manner along with thoughtfully leveraging technology (AI, cell-based meat) may well bring answers to those challenges. The Planet needs it. The consumers want it

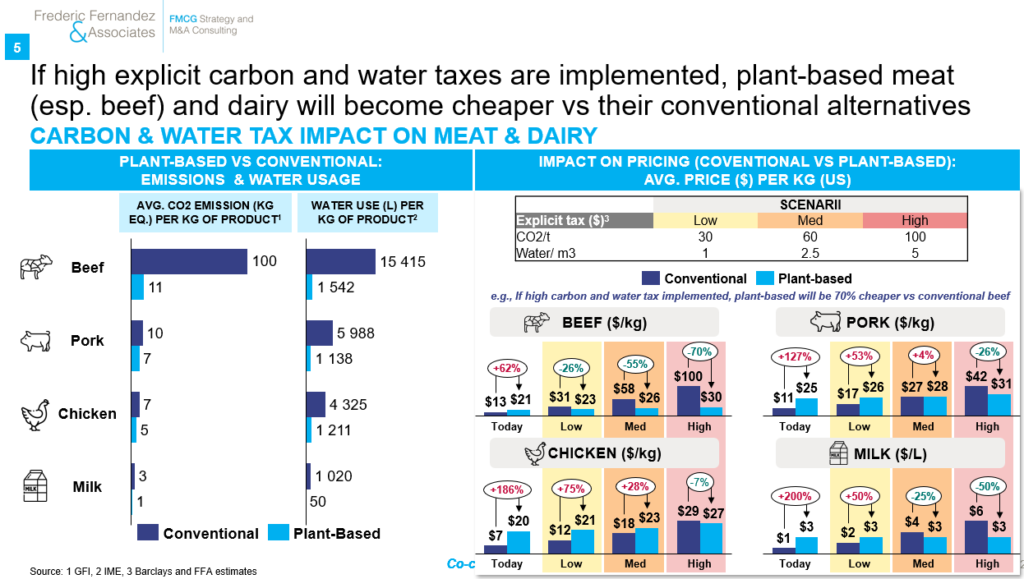

i) If true costing of water/ CO2 has the potential to change PB consumer price perception, PB builders/ investors should not count on it in a near future

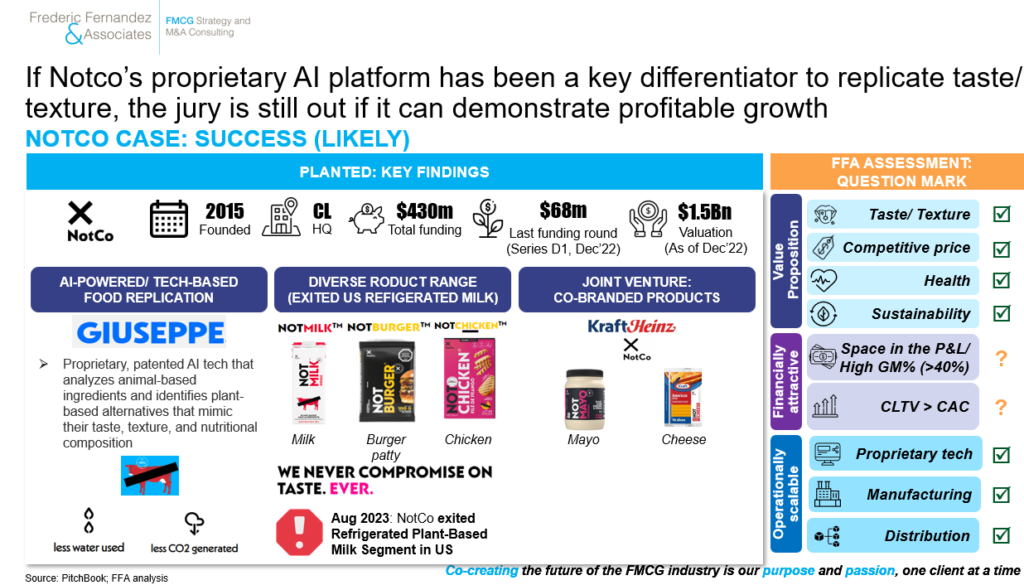

ii) If Notco’s proprietary AI platform has been a key differentiator to replicate taste/ texture, the jury is still out if it can demonstrate profitable growth

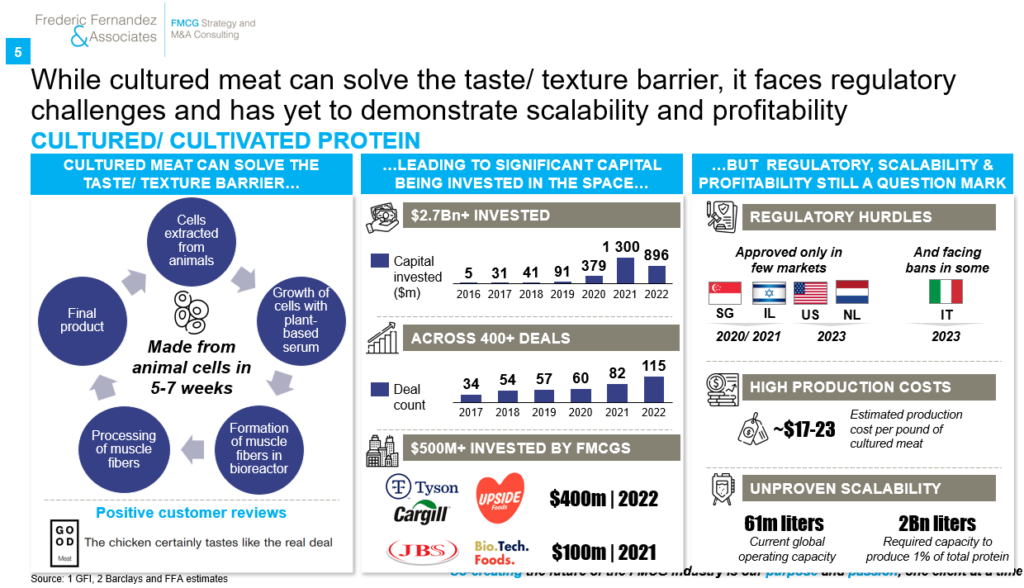

iii) While cultured meat can solve the taste/ texture barrier, it still faces regulatory challenges and has yet to demonstrate scalability and profitability

PB is not dead, it just needs to raise to the occasion. Planed needs it, consumers want it.

Exciting & decisive times.

To get the full deck of this publication, please write us at contact@fredericfernandezassociates.com

To follow Frederic, please click Here, To start a conversation, email at: frederic@fredericfernandezassociates.com

To subscribe to our newsletter and receive all our CEOs Insights, sign-up at the following link: FMCG CEOs: Managing For Growth

About the Firm:

Frederic Fernandez & Associates (FFA) is a global bespoke Strategy and M&A Consulting Firm exclusively focused on Growth and M&A areas in the FMCG industry. Its purpose is to help its clients win today while renewing their competitive advantages to win tomorrow. 13 out of the top world 20 largest FMCG companies are repeat Clients.

Our passion is to co-create the future of the FMCG industry, one client at a time. The Firm helps the CEOs and the Boards of the world’s largest FMCG companies on selected areas: Growth and Profit turnaround, New Retail/ EB2B/ Ecommerce/ DTC and M&A (buy-side & sell-side). The Firm’s head office is located in Zug in Switzerland. The Firm’s team intervenes all across the globe. To know more about the Firm, please visit our website: www.fredericfernandezassociates.com

No FFA employees own any stocks or financial instruments of any FMCG companies or companies mentioned in the above article. All the above information are public information