‘And the beat goes on, still moving strong on and on’ The Whispers, 1979

Welcome back from the summer break. If you missed it, that was the summer hit we could hear in most Q2 earning calls of the world top listed FMCG companies -(we strongly recommend you to click on the below link and to listen to the tune while you read the below article):

Here is our take on H1 2023 results of the world largest listed (top 60) FMCG companies in 20 key charts/ messages:

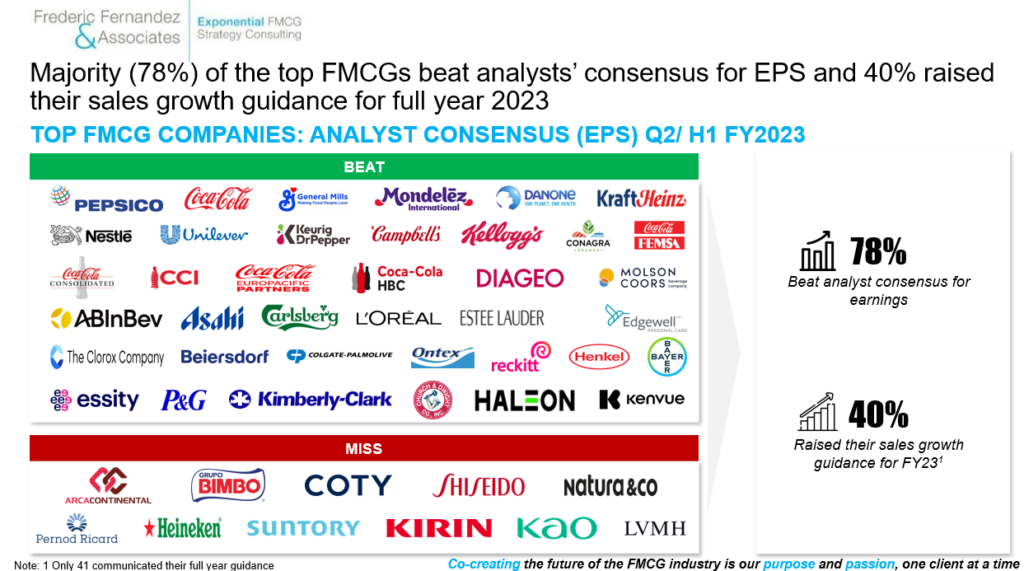

1) Majority (78%) of the top FMCGs beat analysts’ consensus for earnings (EPS) and 40% raised their sales guidance for FY23

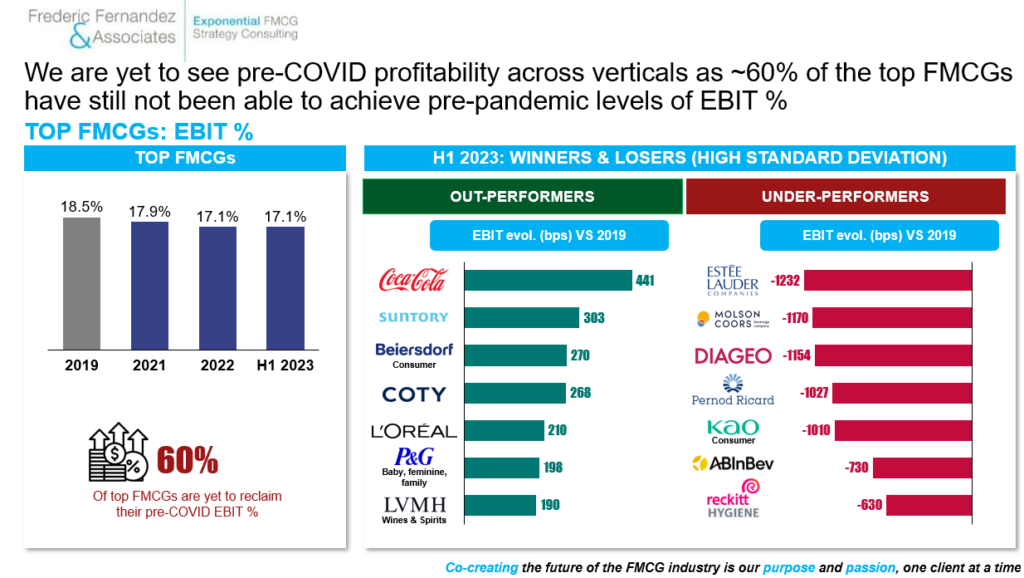

2) 60% of the world top listed FMCG companies still display a profitability below pre-pandemic level, especially on alcoholic drinks and on few very specific names (Estee Lauder and Reckitt). BPC fares on average better. The Coca-Cola Company performance is remarkable and translates its unique pricing power

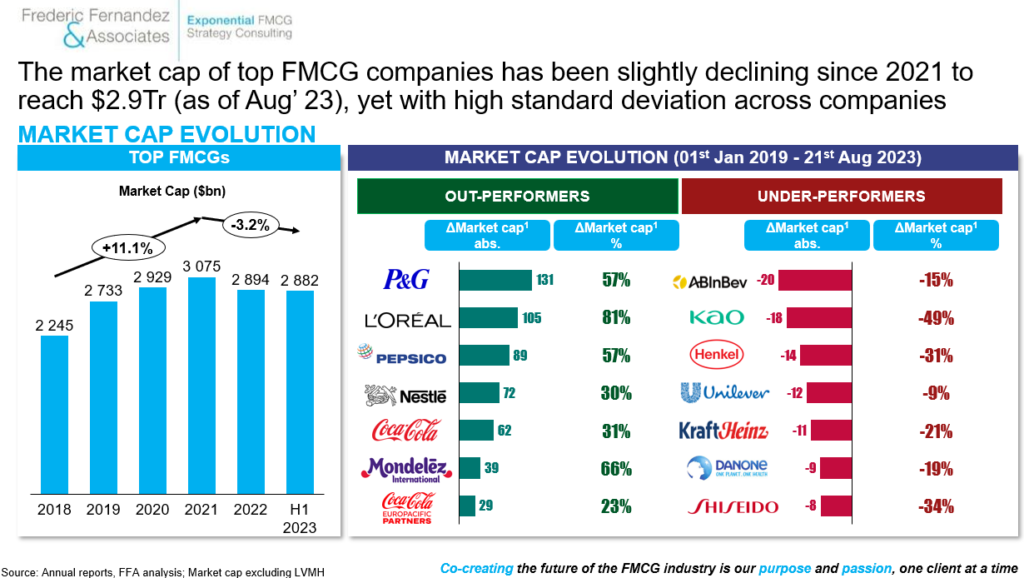

3) This standard deviation in profitability performance drove also the great standard deviation in stock price performance over the same period. If we except ABI & Unilever (UL) that underpeformed for company’s specific reasons (ABI-SAB Miller deal/ deteriorating profitability for ABI; weaker organic growth than peers/ poor ROI on M&As for UL), the world largest FMCG companies (Nestle, P&G, Coca-Cola & their bottlers, PepsiCo, L’Oreal, Mondelez) outperformed

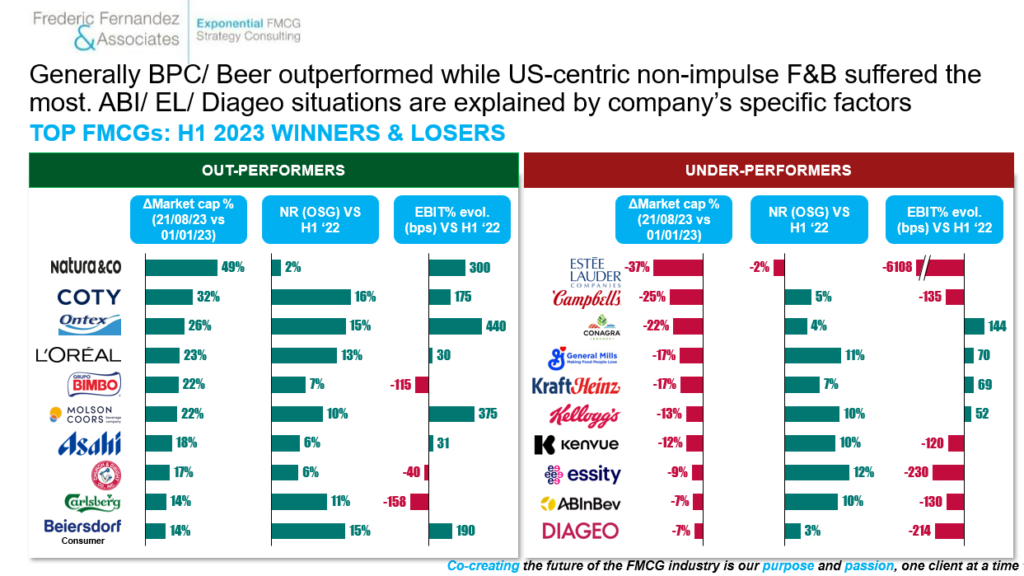

4) In H1 2023, generally Beauty Personal Care (BPC) & Beer players emerged as key winners (market cap growth wise) while US-centric non-impulse F&B suffered the most. ABI/ Estee Lauder/ Diageo situations are driven by company’s specific factors (US boycott for ABI, continuous underpeformance in CN/ US for EL…)

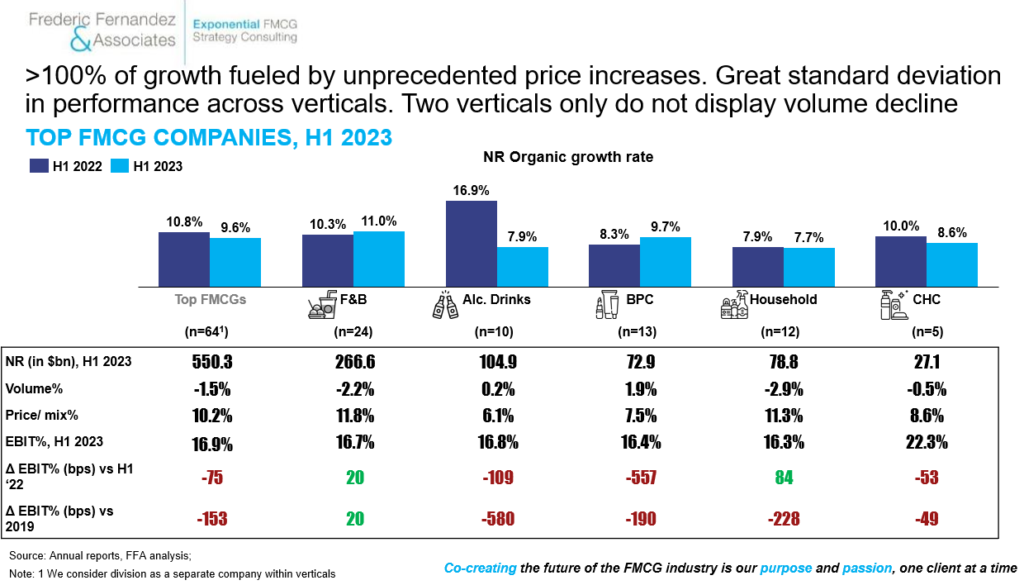

5) >100% of growth in H1 2023 has been fueled by unprecedented price increases. Great standard deviation in performance across verticals. Unsurprisingly, two verticals only do not display volume decline (BPC & Alcoholic drinks) whereas Household and F&B have been comparatively the most price-elastic (still displaying very low price elasticity vs. historic data though)

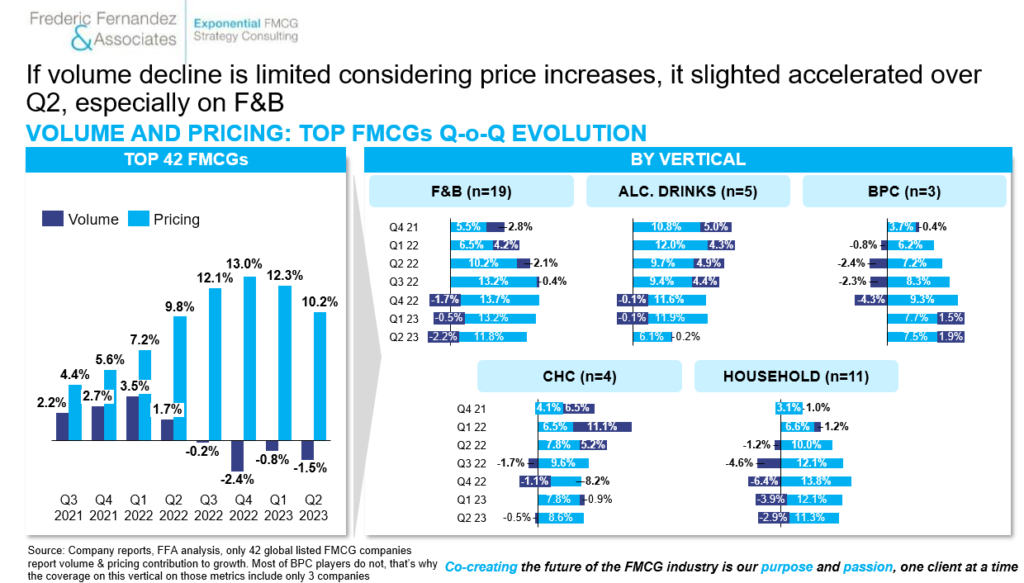

6) If volume decline is still limited considering the taken price increases, this decline slighted accelerated on average over Q2, which was all driven by the F&B vertical

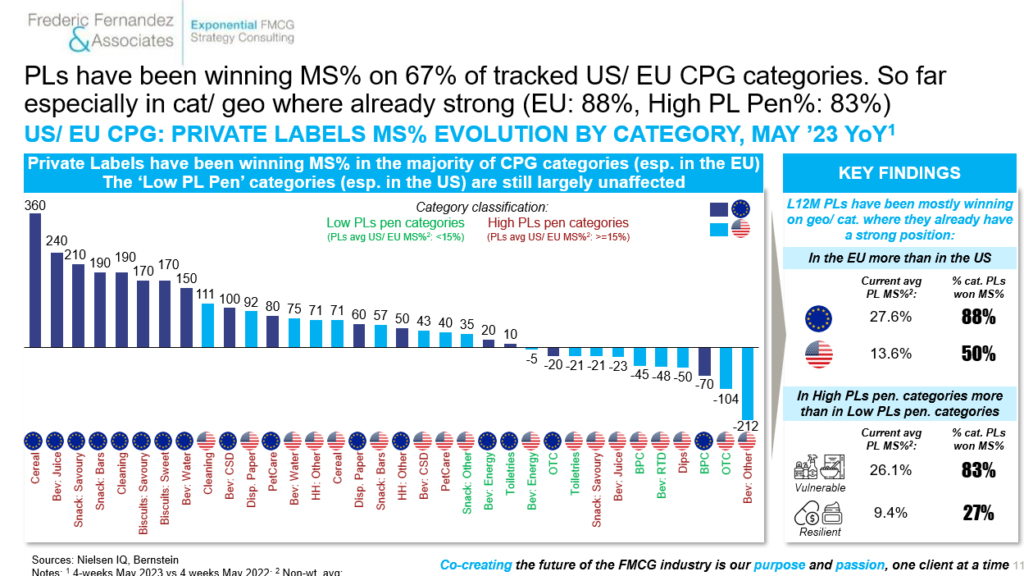

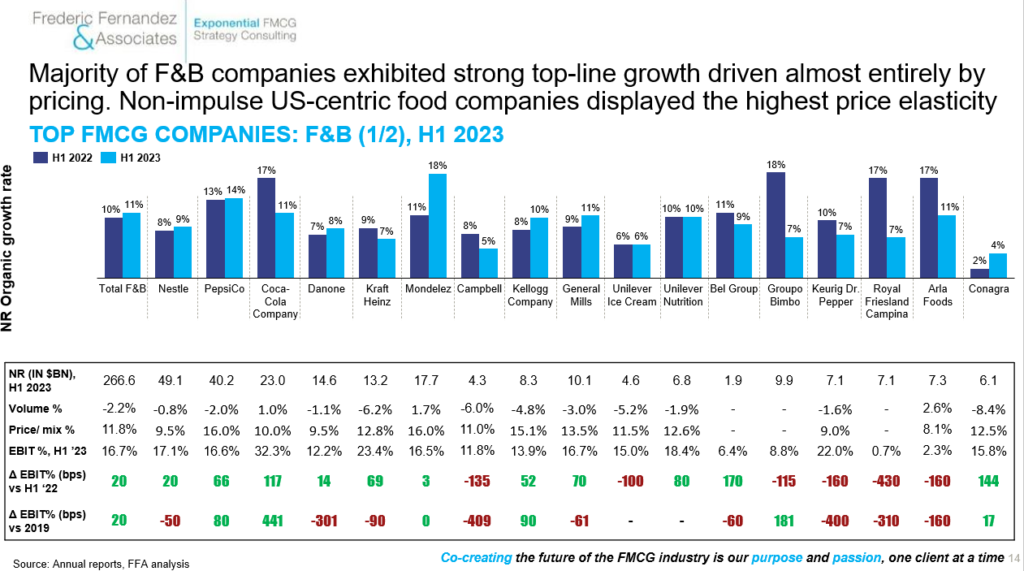

7) Private labels (PLs) are taking advantage of the current context to gain shares in 2/3 of the FMCG categories in US/ EU, especially on the category/ region couples where they are historically strong (EU F&B and Household). If PLs progress in the US, their shares are still half (~14%) of what they are in EU (~28%)

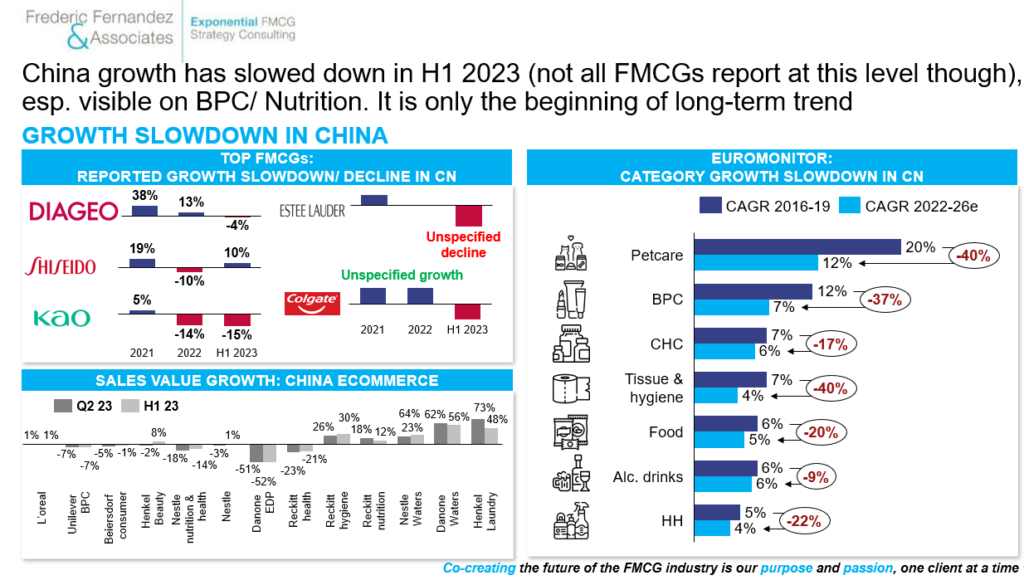

8) Diversifying away from China, especially on Infant Nutrition and BPC remain a priority for the world largest FMCG companies in a context of structural slowdown

9) Double-clicking on F&B, majority of companies exhibited strong top-line growth driven almost entirely by pricing. Non-impulse US-centric food companies displayed the highest price elasticity. Coca-Cola results are remarkable top & bottom-line wise

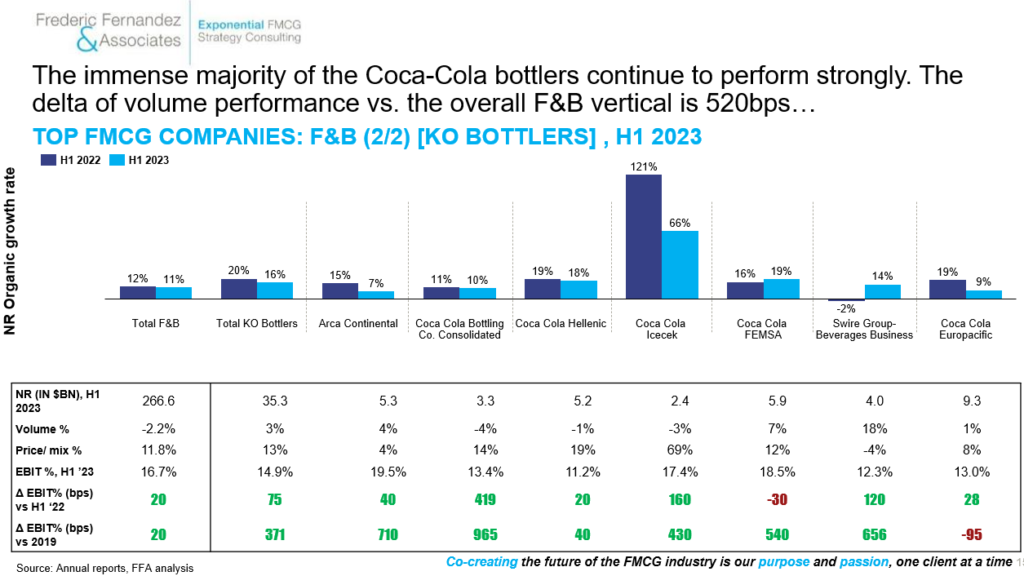

9) What is true for the Coca-Cola Company is also true for all its bottlers

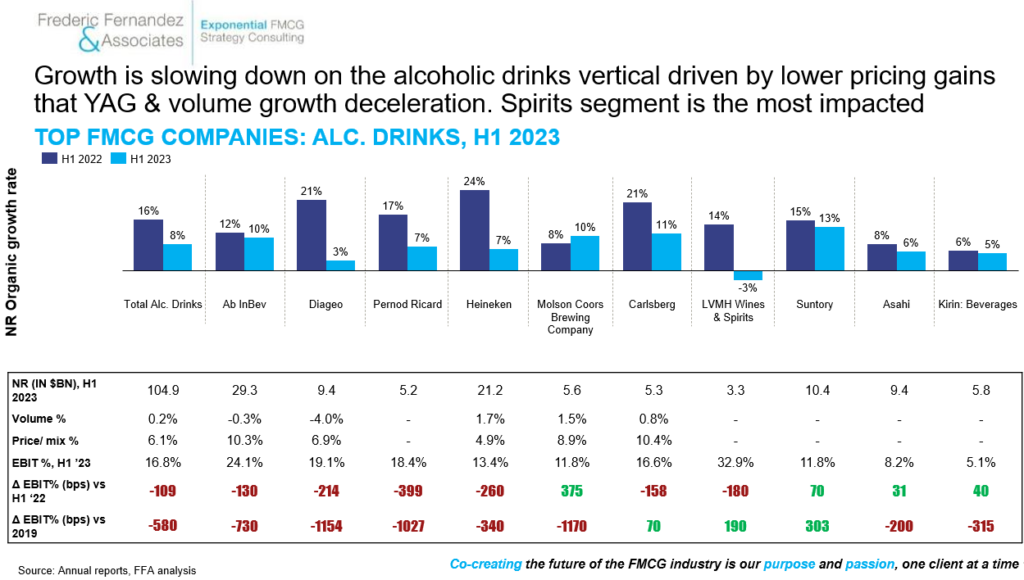

10) On alcoholic drinks, growth is slowing down driven by lower pricing gains & volume growth deceleration vs. YAG. Spirits segment is the most impacted. ABI is remarkably resilient in a context its main market/ brand (BudLight/ US) has been taking prolonged double digit losses following the Mulvaney’s social media backlash/ boycott

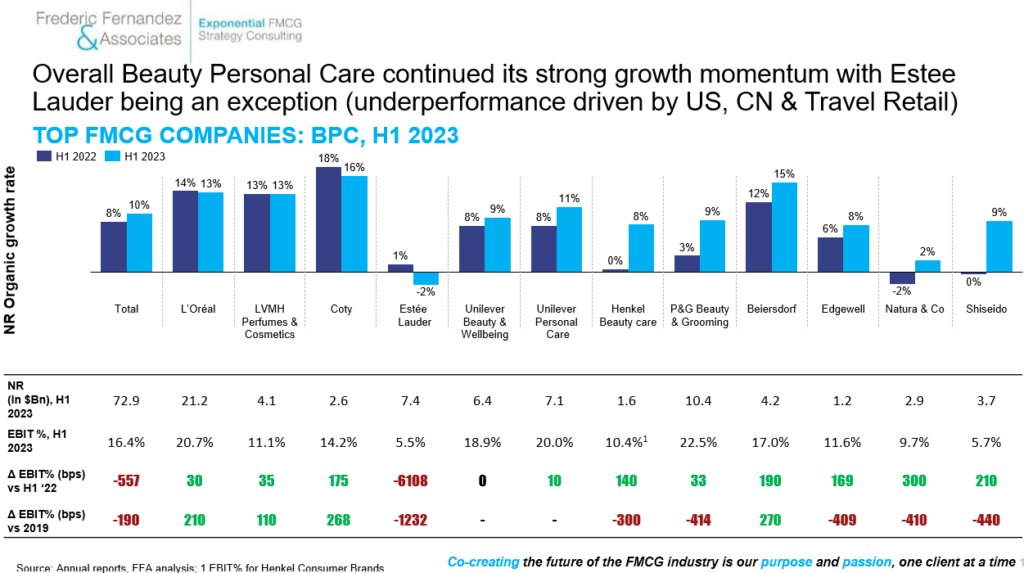

11) Overall Beauty Personal Care (BPC) continued its strong growth momentum with Estee Lauder being an exception (underperformance driven by US, CN & Travel Retail). L’Oreal continues to impress. Coty confirms its turnaround. Beiersdorf accelerates

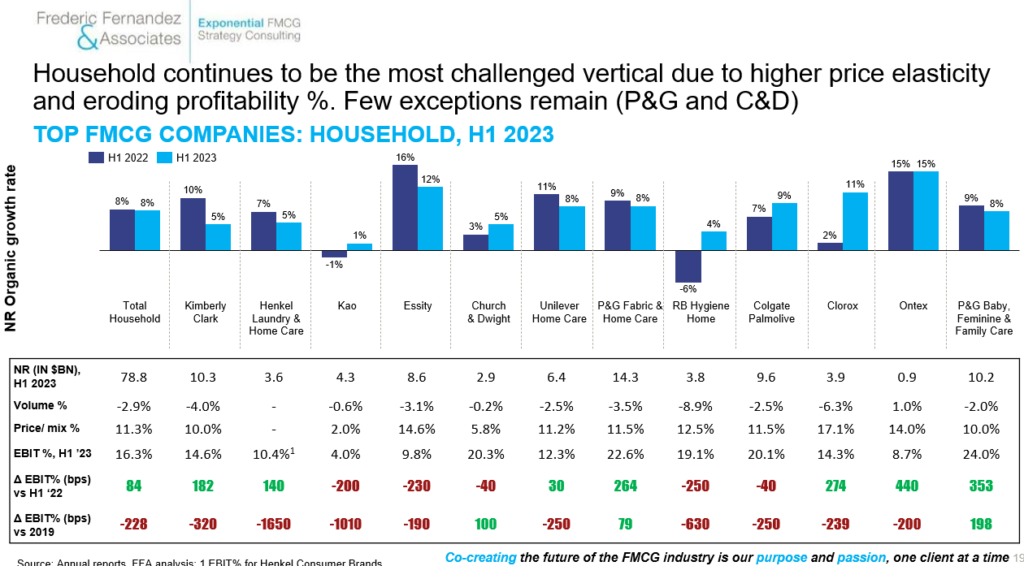

2) Household continues to be the most challenged vertical due to relatively higher price elasticity and eroding profitability %. Few exceptions remain (P&G and C&D). Henkel & KAO suffer the most

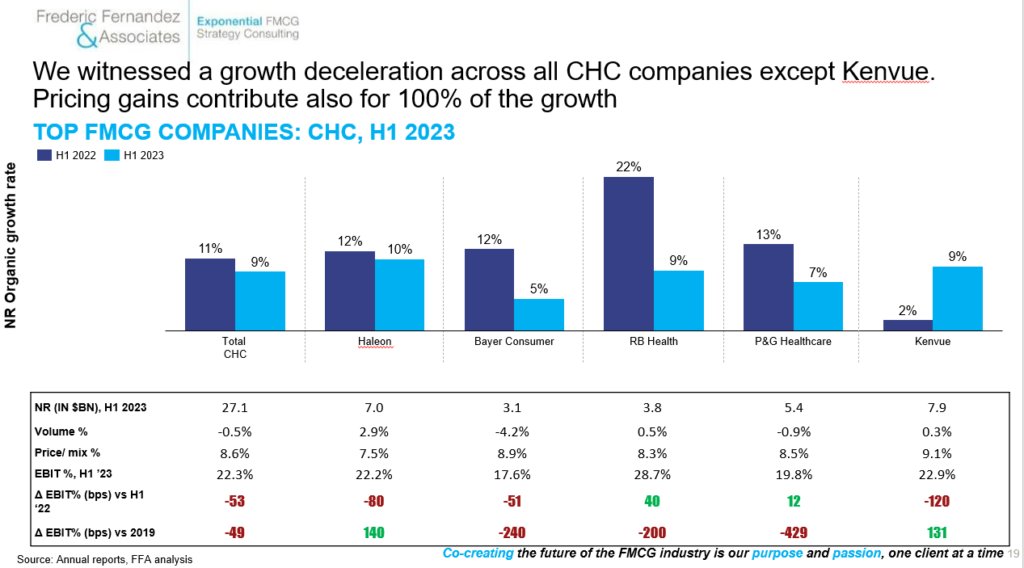

13) We witnessed a growth deceleration across all Consumer Health Care (CHC) companies except Kenvue. Pricing gains contributed also for 100% of the growth. Bayer Consumer underperformed peers (mostly driven by Nutritionals & Digestive Health, partly explained by supply chain issues)

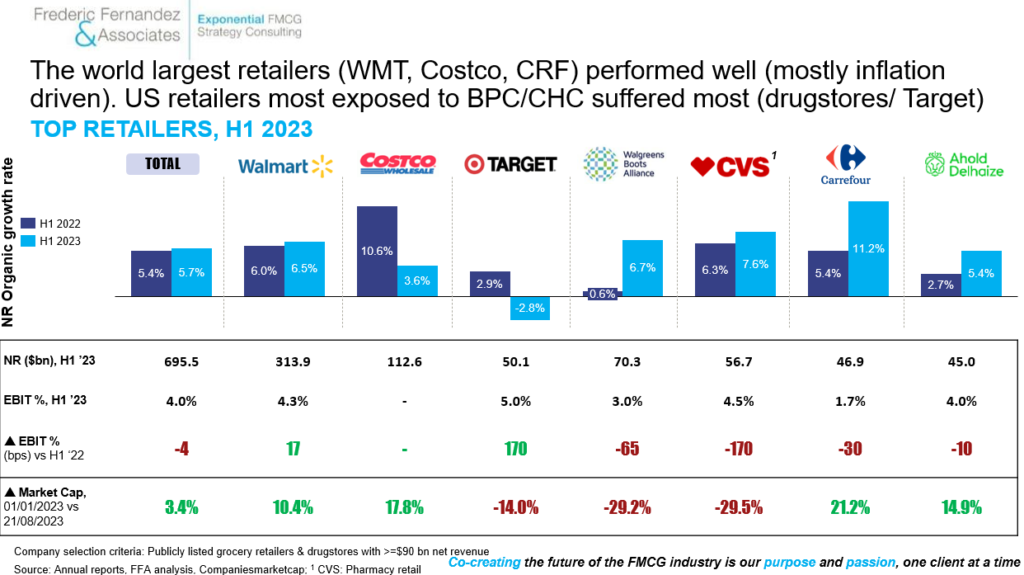

14) The world largest retailers (WMT, Costco, CRF) performed well (mostly thanks to inflation). The retailers the most exposed to BPC/ CHC in the US suffered most (CVS/ WBA/ Target). Most retailers did not expand profitability at a time the world largest FMCG companies did. This along with decreasing commodities prices make us think that H2 2023/ 2024 negotiations will be extremely challenging

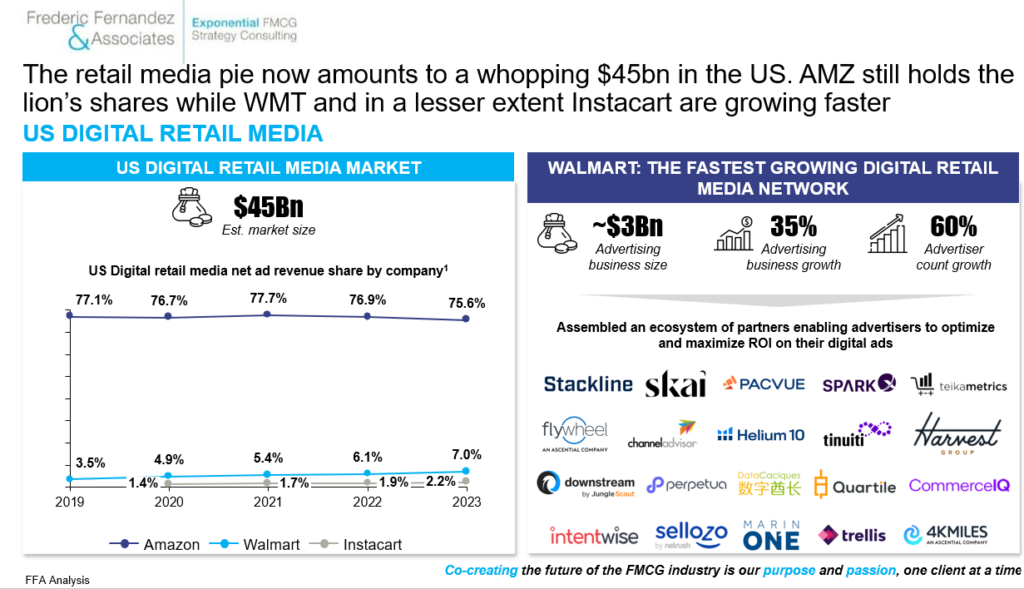

15) The retail media pie now amounts to a whopping $45bn in the US. AMZ still holds the lion’s shares while WMT and in a lesser extent Instacart are growing faster

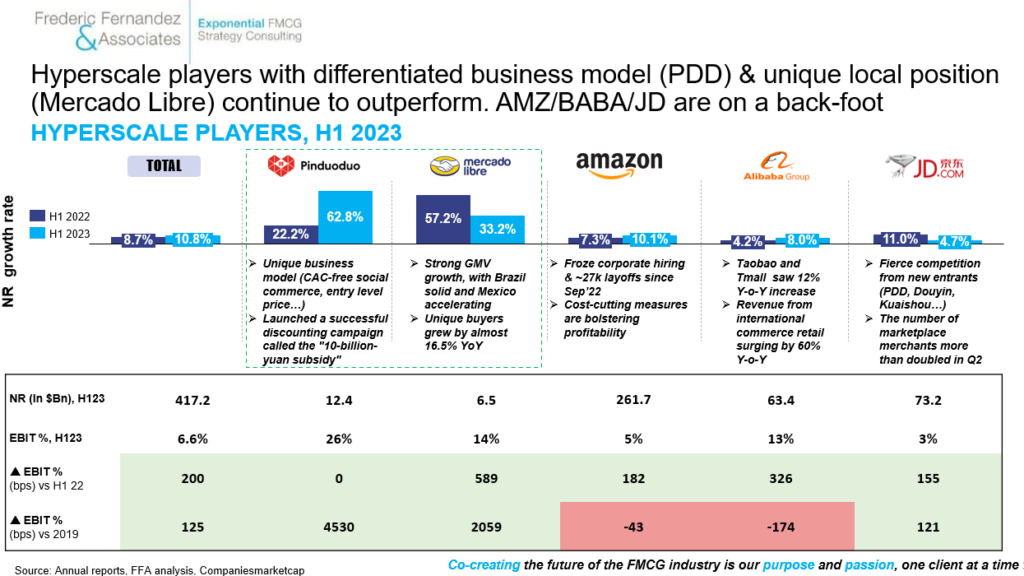

16) Ecommerce players with differentiated business model (PDD) & unique local position (Mercado Libre) continue to outperform (although growing from a much smaller base). AMZ/ BABA/ JD are increasingly on a back-foot, growing modestly while improving profitability

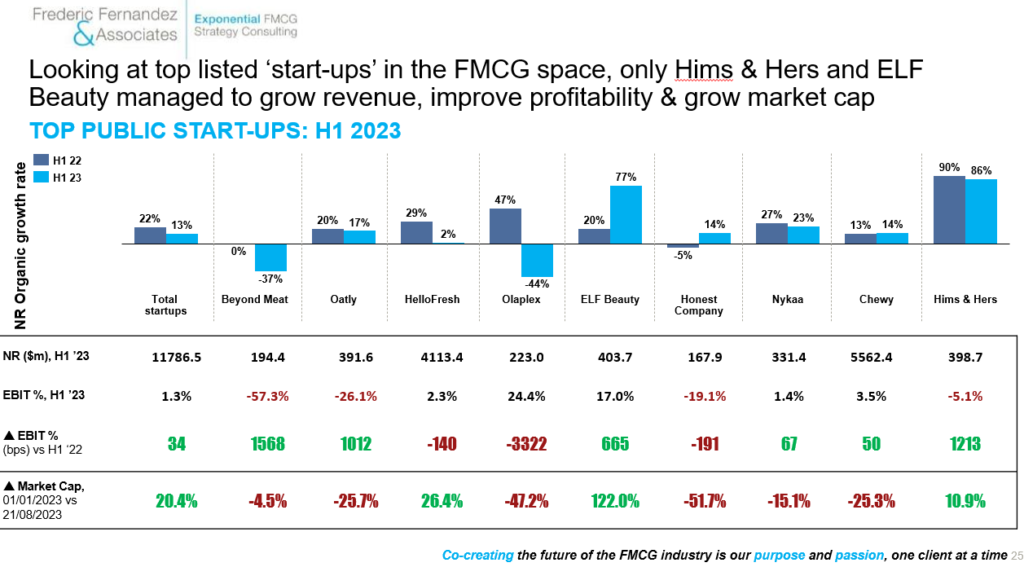

17) Looking at the top listed ‘start-ups’ in the FMCG space, only Hims/Hers and ELF Beauty managed to grow revenue, improve profitability & grow market cap. ELF confirms its amazing growth story with a stellar H1 which makes it increasingly a prime M&A target for the few companies that have the B/S for it ($7bn market cap + premium = ~$10bn mark). Plant-based performance (Beyond Meat/ Oatly) confirm the state of the vertical (not creating ‘as-is’ value for consumers & investors – more on this topic in an upcoming article to be published mid September). Olaplex disappointed (vs. high expectations/ base) althrough revenue scale & profitability level remain still remarkable in a challenging volume context (consumers lawsuits). Honest vertiginuous decline in market cap continues (now worth only $140m after having received for ~$600m of funding – 90% decline since IPO)

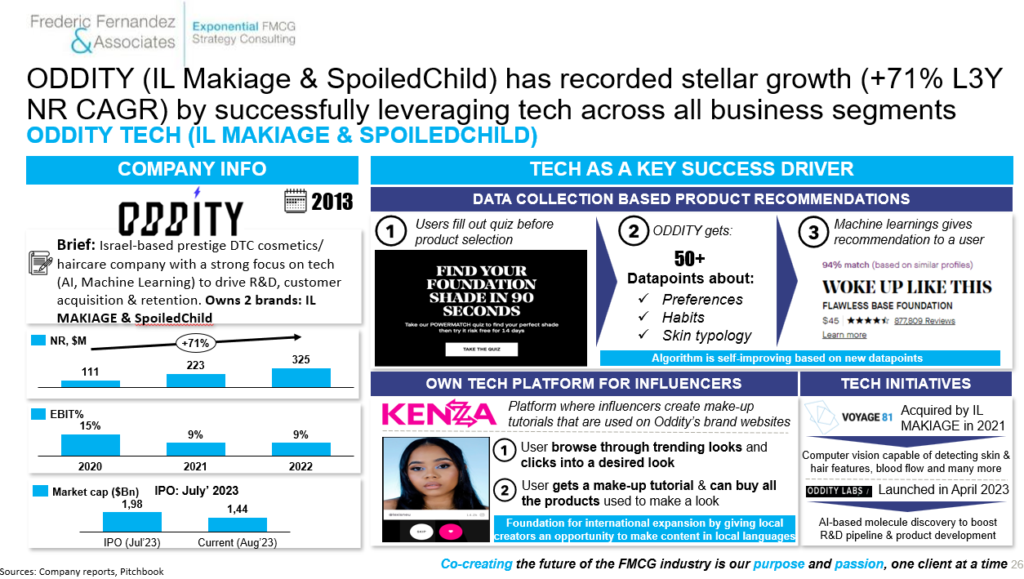

18) Oddity IPO got everyone’s attention in the Beauty industry. Its size, recent growth trajectory, P/L structure, CAC/ CLTV metrics & tech focus make it one of the assets to watch on the BPC vertical

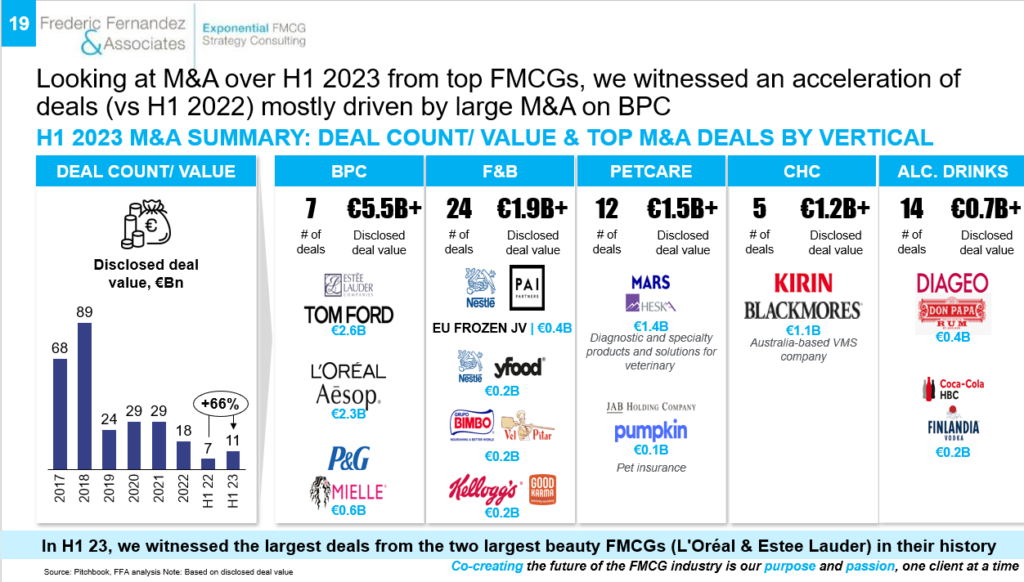

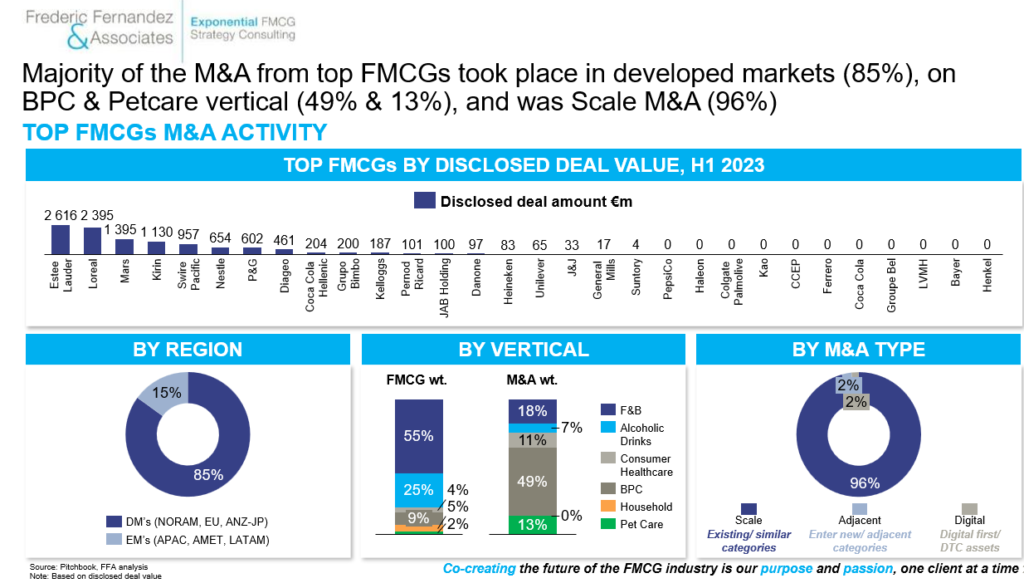

19) After a tough year 2022, M&A market is bouncing back (+66% deal value in H1 2023 vs. YAG at €11bn), mostly driven by ‘historic’ Beauty deals completed by Estee Lauder (Tom Ford – €2.6bn) and L’Oreal (Aesop, prestige skin care – €2.3bn) – both their largest transactions ever completed – while Petcare (Mars/ Heska – veterinary diagnostic – €1.4bn) and CHC (Kirin/ Blackmores – VMS – €1.1bn) verticals saw also large transactions taking place

20) Doubling down on what works: in a recovering M&A market, FMCG companies have been focusing increasingly on Scale M&A (existing categories): 96% in H1 2023 vs. 77% over 2012-22 as this type of transaction, especially on mid-size assets have delivered historically the highest ROI (cf. our recent publication on M&A for more perspective – FMCG CEOs: 2012-22 M&A Winners & Losers Or Breaking The Code Of Successful M&A In The FMCG Industry)

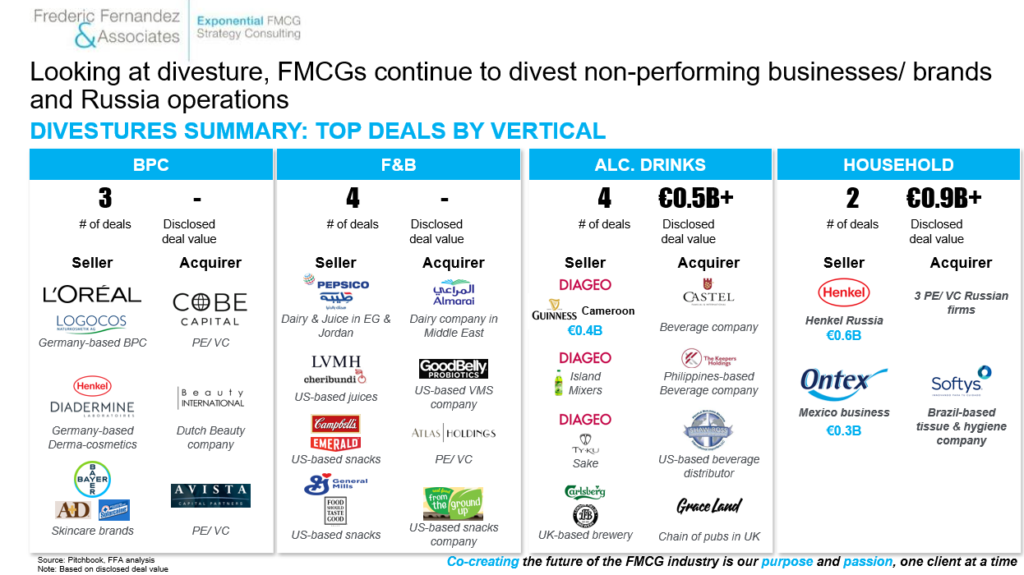

21) FMCG companies have continued to divest non-strategic and/ or under-performing assets (hard to scale small brands on BPC – L’Oreal/ Henkel/ Bayer – and Snacking – GenMills/ Campbells; non-core assets in emerging markets for Diageo in Cameroon, PepsiCo in Egypt/ Jordan or even Ontex in Mexico)

Bringing it all together, if H1 2023 has been another strong vintage for most FMCG companies, we see the following key themes emerging strongly for H2 2023/ 2024:

- How to sustainably drive penetration? Stacked price increases since 2019 average ~25%, (ie. we saw over 2019-22 price increases we normally see within a decade). Next year, in a context pricing gains will be annualized & price elasticity should have fully kicked-in, we expect growing volume decline and much tougher comps. In this context, volume growth is going to become an even more important topic. Generally, we see the need to adopt a systematic zero-based consumer approach to drive disruptive volume growth on the power couples (~10% of the brand/ country couples on average account for 80% of the revenue/ profit) through des-averaging penetration/ frequency/ basket per consumer segments and addressing granularly their key barriers/ drivers. As an industry, we need to diversify away from an innovation strategy that is still too singly focused on premiumization. We will come back on this in an upcoming article in H2

- How to navigate H2 2023 retailers price negotiations? Those negotiations will be more challenging as ever. Honesty, transparency & consumer centric categories value creation strategies (enabled by a zero-based consumer approach) will be critical in a context of falling commodities prices, eroding retailers margin & increasingly rationalized assortments

- How to diversify geographic growth engines in a context of structural slowdown in China? This is becoming increasingly critical. Again, if updating growth strategy in the power couples (~10% of the brand/ country couples accounting for 80% of the revenue/ profit) is a must-do, accelerating in Emerging Markets outside China is equally important (cf. our recent publication on the topic – FMCG CEOs: The $1 Trillion Race – Why Winning In Emerging Markets Outside China Has Become A Must-Win Battle & Ten Rules To Outperform). All FMCG companies must have a granular growth strategy for each of their top 10 Emerging Markets (India, Brazil, Mexico, Indonesia…) and M&A should be systematically reviewed

- How to take advantage of the current M&A environment? Generally, we see an opportunity for M&A arbitrage at a time the market has become much more of a buyer market. We favor: => Demonstrated mid-size assets (€0.5-5bn price tag) with at least low double-digit CAGR over the last 3 years and with demonstrated brand growth models ready to be scaled-up even if they still come at a relative premium vs. other assets => Emerging markets assets, especially for F&B, Alcoholic Drinks and Pet Care where the strategic rationale is the highest => The arbitrages on the most hyped segments (DTC, plant-based…) where the few good assets (e.g. some personalized beauty assets, some plant-based assets deliving value for consumers – great taste/ heathy/ reasonable price – & investors – leading margin %, high operational scalability) are penalized by the presence of a majority of non future-proof assets More on M&A in our latest publication: FMCG CEOs: 2012-22 M&A Winners & Losers Or Breaking The Code Of Successful M&A In The FMCG Industry

- Beyond the above, we see at least three topics where still sit significant value: => How to adapt e-commerce strategy to the current context? We see the need to update holistically e-commerce strategy at a time CAGR have significantly slowed down, the landscape has evolved and many teams are still chasing unreachable targets and outdated where-to-play/ how-to-win inherited from the 2019-22 period, too often burning their P/Ls in the process and destroying omnichannel value. We will come back on this topic in H2 with a dedicated publication => How to take fully advantage of EB2B to accelerate profitable growth in fragmented channels? We still see too many FMCG companies leaving too much money on the table on EB2B (mostly impulse F&B but not only) on the highly strategic fragmented channels because of their inability to strategize a well-balanced intent across build/ partner and sometimes acquire & implement rapidly/ at scale a fully digitized procure-to-pay platform with basic value adding services (mostly buy now pay later, suggestive ordering) => How to build profitable large-scale DTC business that creates omnichannel value? We continue to be surprised by the inaction (or the little action) of the owners of many large DTC friendly multi-billion brands that continue to refuse to go DTC to protect their retailers relationships while frustrating the millions of monthly consumers that visit their websites, being surprised to have websites with a 90%+ bounce rate and investing massive resources with limited success to bridge their penetration-to-market share gap. Success cases exist and there are often ways to articulate differentiated yet consumer-centric value propositions creating omnichannel value

Many may be surprised to not see AI in the above key themes. If we acknowledge it is an interesting area and if we understand the hype around it (and why some – consulting but not only – organizations fuel this hype), we fail to see for now how it can be part of the top three priorities of a FMCG CEO in the coming quarters. We will publish an article in H2 to objectively explore the strategic case for AI in the FMCG industry

Bringing it all together, H1 2023 has been another strong vintage for the FMCG industry. We see in the coming quarters an aggravating risk of volume decline, especially in the most price-elastic verticals, in a context pricing gains will be fully annualized putting significant pressure on the current ‘EPS growth algorithm’

If there are good reasons to be cautious & to complement current strategies with the above mentioned points (zero-based consumer strategy on top brand/ country couples, tailored strategies in top Emerging Markets, renewed focus on mid-size M&A & the few identified areas of arbitrage, adapted e-commerce strategy, large-scale profitable DTC & EB2B acceleration in fragmented channels), there is objectively no growth or profit scarcity in the FMCG industry. The long-term attractiveness of the FMCG industry, especially the investment case in the world largest FMCG companies, remains intact, simply the gap between the Winners & the Losers will likely widen.

Exciting times

To subscribe to our newsletter and receive all our CEOs Insights, sign-up at the following link: FMCG CEOs: Managing For Growth

To get the full deck of this publication, please write us at contact@fredericfernandezassociates.com

To follow Frederic, please click Here, To contact him, email at: frederic@fredericfernandezassociates.com

About the Firm:

Frederic Fernandez & Associates (FFA) is a global bespoke Strategy Consulting Firm exclusively focused on Growth and M&A areas in the FMCG industry. Its purpose is to help its clients win today while renewing their competitive advantages to win tomorrow. Our passion is to co-create the future of the FMCG industry, one client at a time. The Firm helps the CEOs and the Boards of the world’s largest FMCG companies on selected areas: Growth and Profit turnaround, New Retail/ EB2B/ Ecommerce/ DTC and M&A (buy-side & sell-side). The Firm’s head office is located in Zug in Switzerland. The Firm’s team intervenes all across the globe. To know more about the Firm, please visit its website: www.fredericfernandezassociates.com

No FFA employees own any stocks or financial instruments of any FMCG companies or companies mentioned in the above article. All the above information are public information