‘While most people understand first-order effects, few deal with second- and third-order effects. Unfortunately, virtually everything interesting in business lies in fourth-order effects and beyond’ – Jay W. Forrester (1918-2016, pioneering American computer engineer and systems scientist)

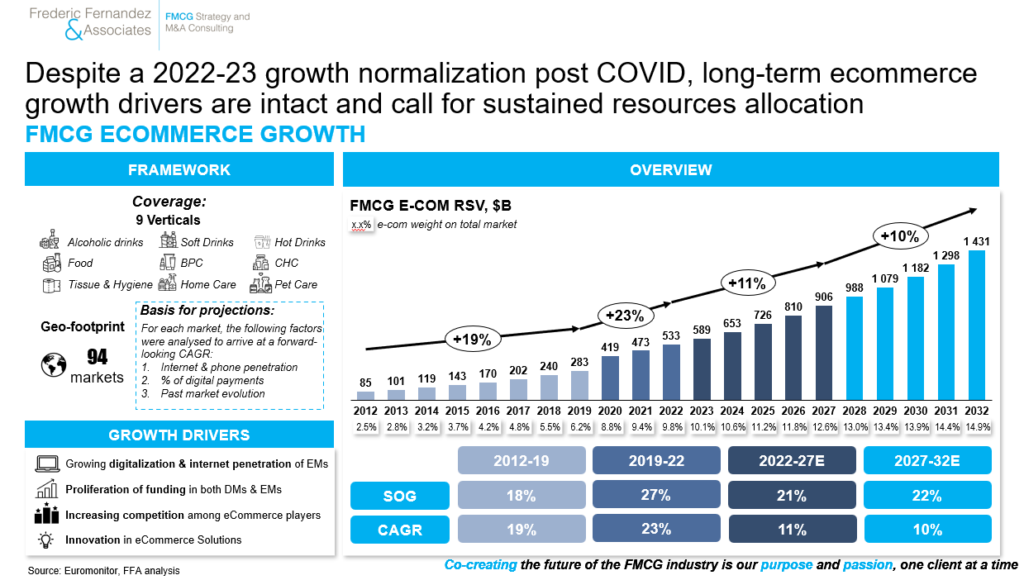

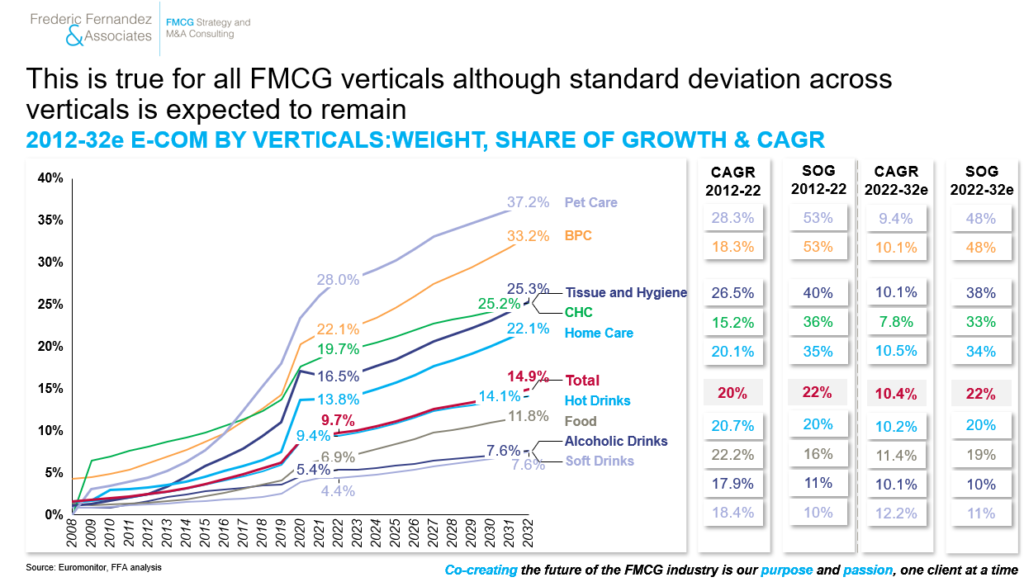

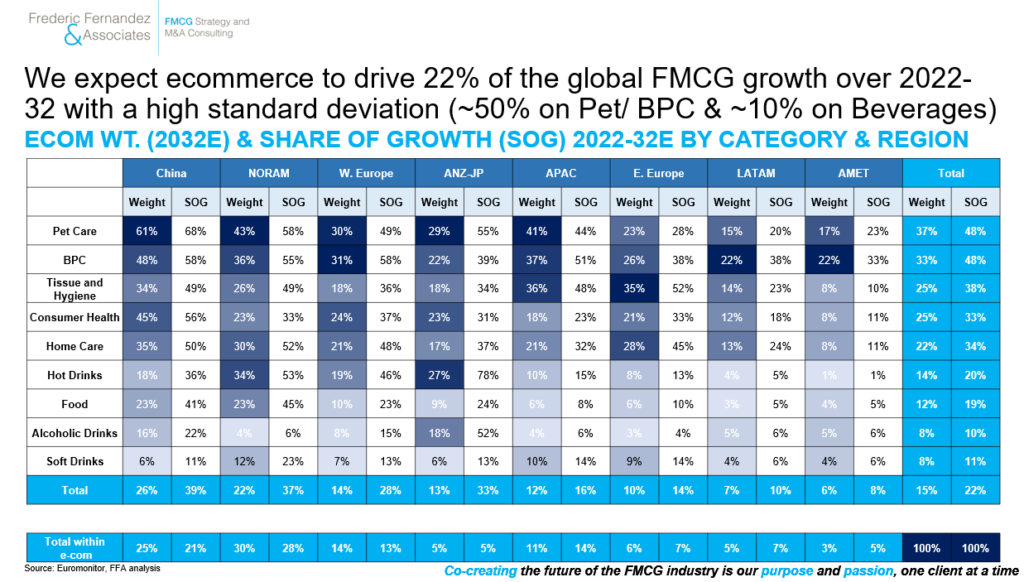

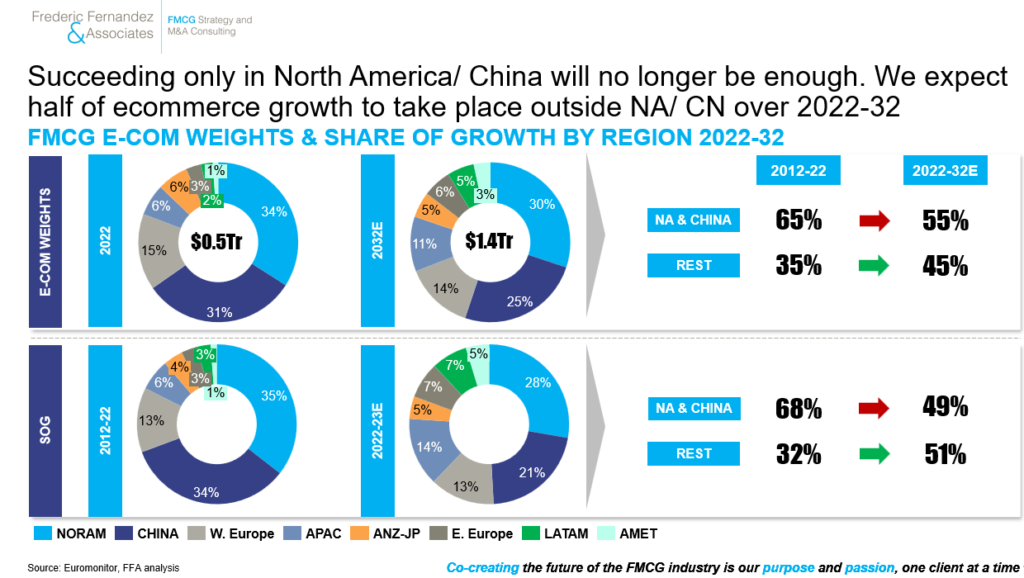

Over the last decade (2012-22) & especially since COVID-19, ecommerce became progressively a must-win battle across ALL verticals in the FMCG industry (although its weight/ share of growth varied greatly across categories/ regions). Unprecedented resources were allocated (global/ local multifunctional ecommerce teams were appointed supported by incremental promotion/ media investments, sometimes – large – acquisitions were made).

The objective was to ‘lead’ or at least ‘catch-up’.

Those ‘nascent’ ecommerce strategies enabled most FMCG companies to approach their ‘fair share’.

In a now rapidly evolving context (to name few):

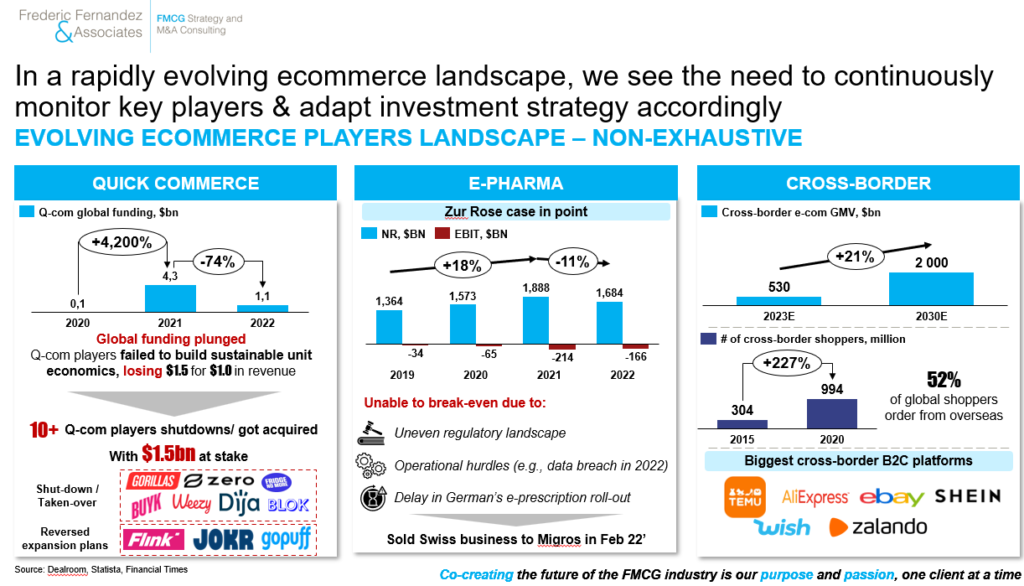

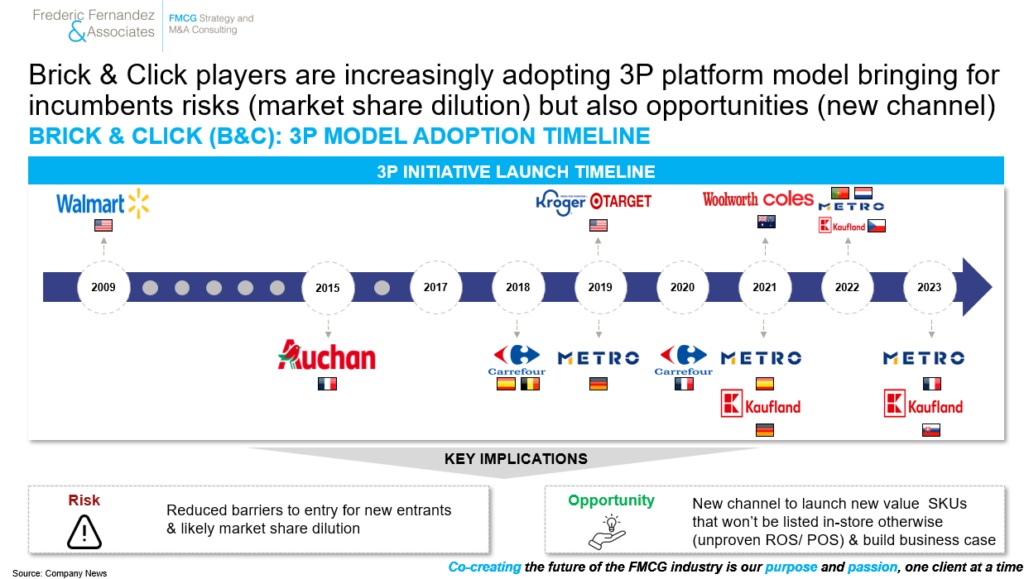

- Externally: lower ecommerce growth, increasing competition, stronger focus on volume growth, evolving ecommerce landscape and key players’ strategies, rising deflationist pressure from (r)etailers

- Internally: basic foundations in place with early successes but with sometimes unsustainable targets & investments levels, with where-to-play/ how-to-win choices that need to be deeply updated, and with negative ripple effects on customers profitability & on our other channels that need to be actively managed

We see the case to review ecommerce strategy in our industry. This is the objective of this publication:

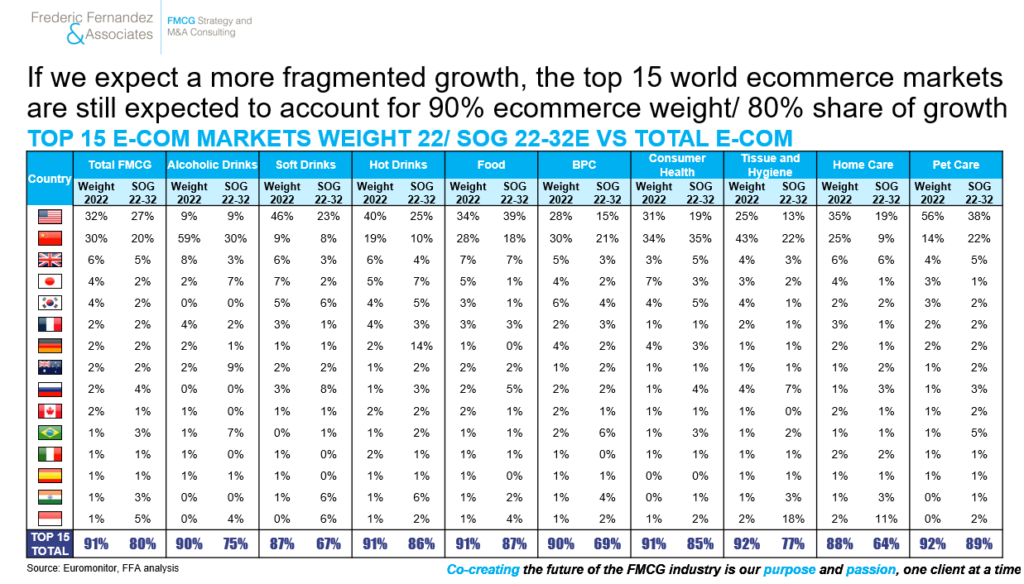

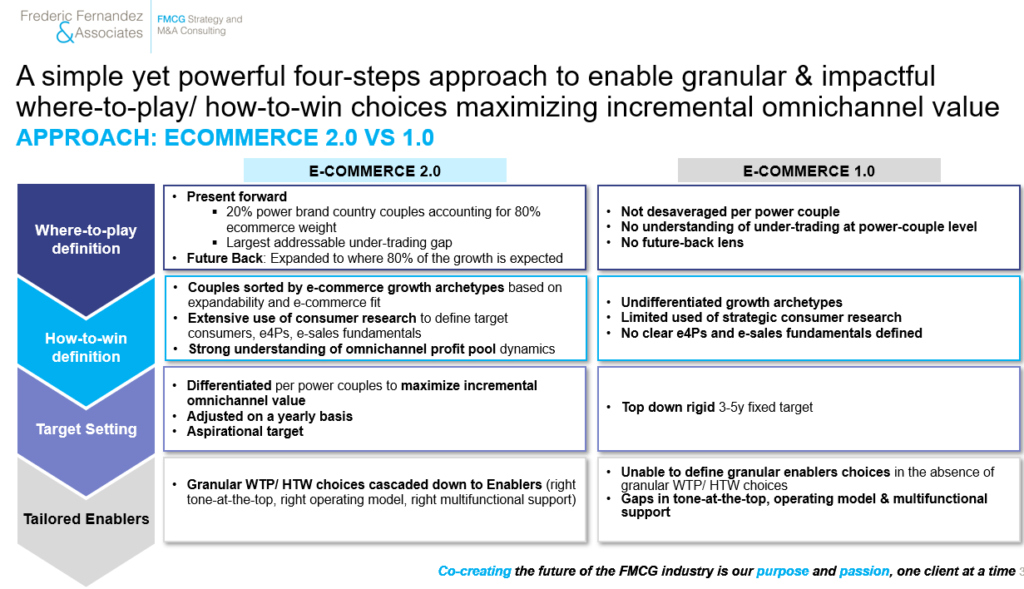

- We reviewed the last decade of global ecommerce data per country/ segment level (>5000+ couples), isolated granular growth drivers & attempted to predict the next decade of ecommerce growth at segment/ country level

- We analyzed the relationship between ecommerce growth and the evolution of the world largest FMCG companies market shares across >5000+ couples & channel profitability to understand omnichannel value creation dynamics

- We reviewed the strategic framework of the world largest ecommerce players and the strategic implications for FMCG companies

- We leveraged our first-hand experience in strategizing ecommerce for 7 of the 20 world largest FMCG companies to isolate not only industry’s best practices but also most common pitfalls

The outcome is this article:

FMCG CEOs: Why Do We Need To Update Now Our Ecommerce Strategies Or How To Maximize Ecommerce Incremental Omnichannel Value – The Rise Of Ecommerce 2.0

Exciting & decisive times. Enjoy the read

We see at least 7 reasons why we need now to update our ecommerce strategies:

1) Reason #1: Despite a 2022-23 growth normalization post COVID-19, long-term ecommerce growth drivers are intact and call for sustained resources allocation

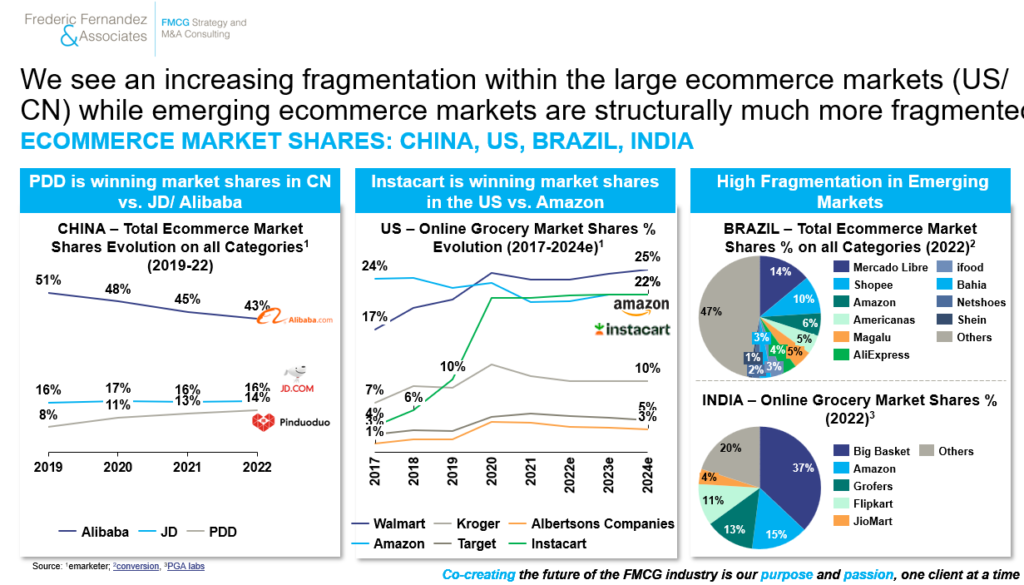

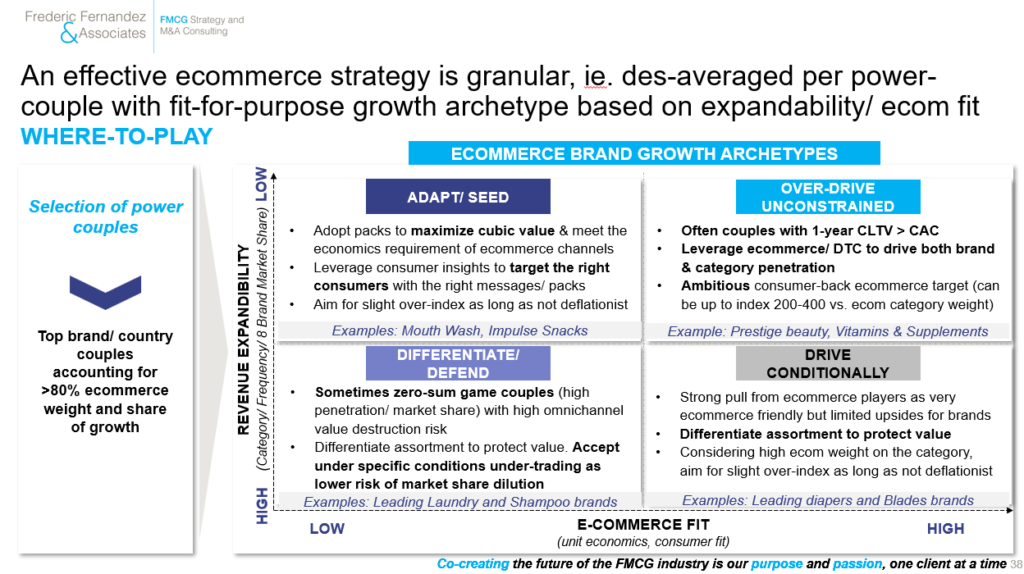

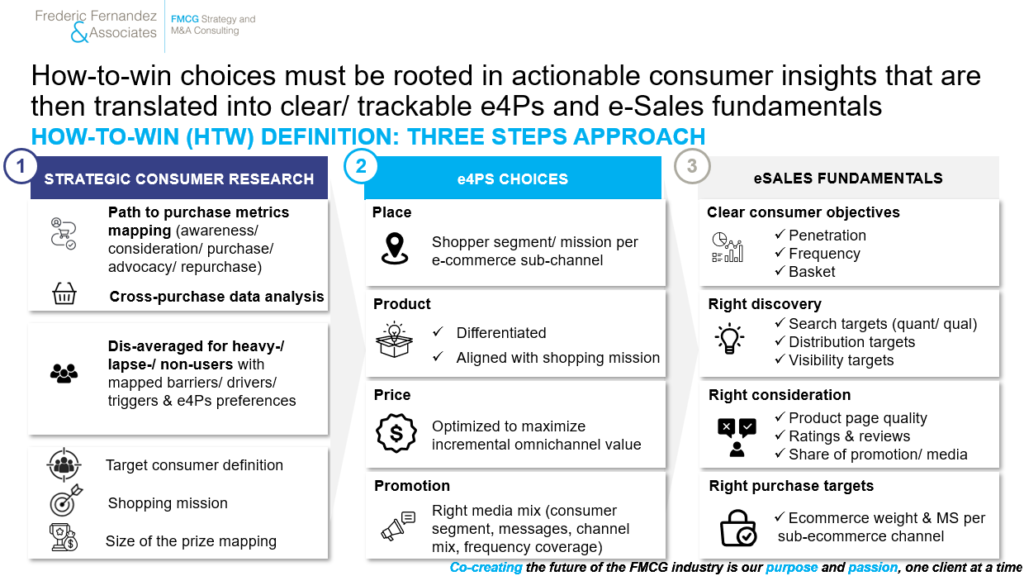

2) Increasing ecommerce growth fragmentation & an ever evolving landscape call both for a dynamic redefinition of where-to-play (WTP)/ how-to-win (HTW) choices

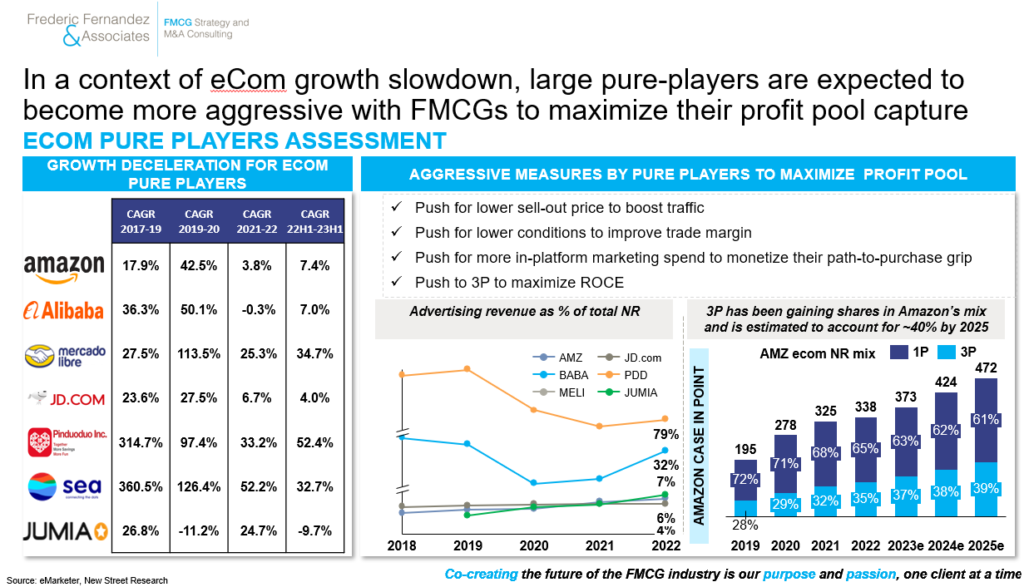

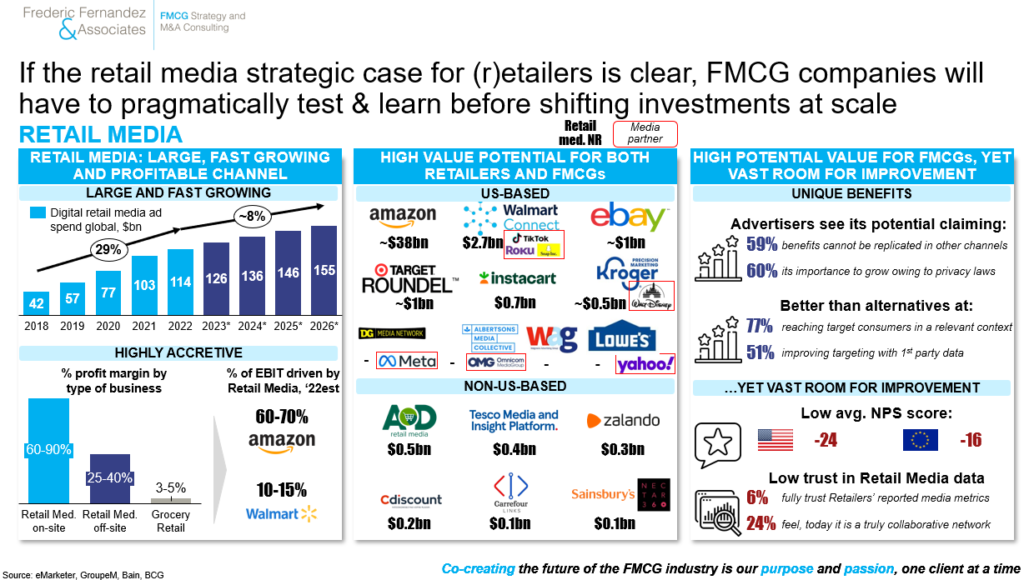

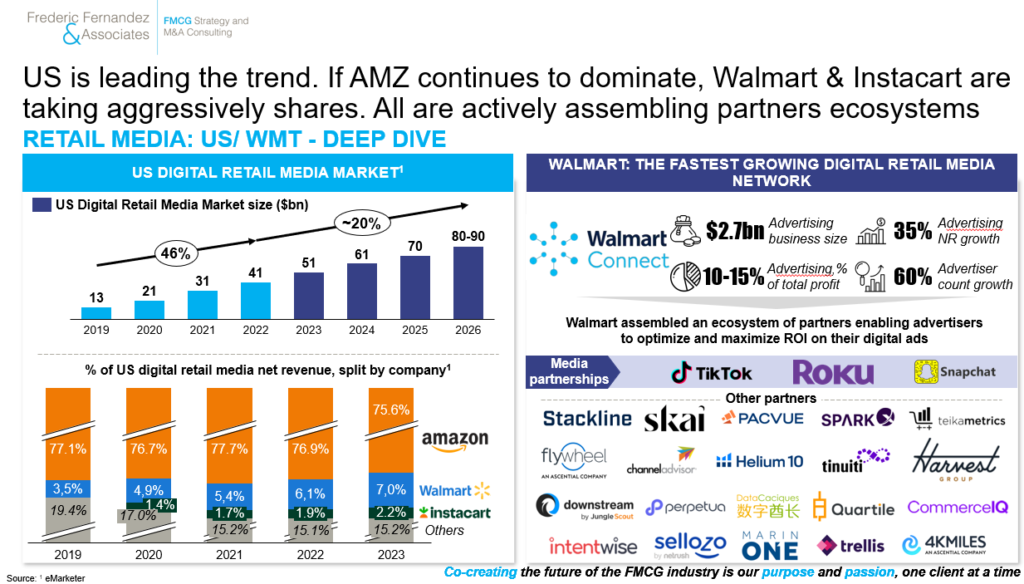

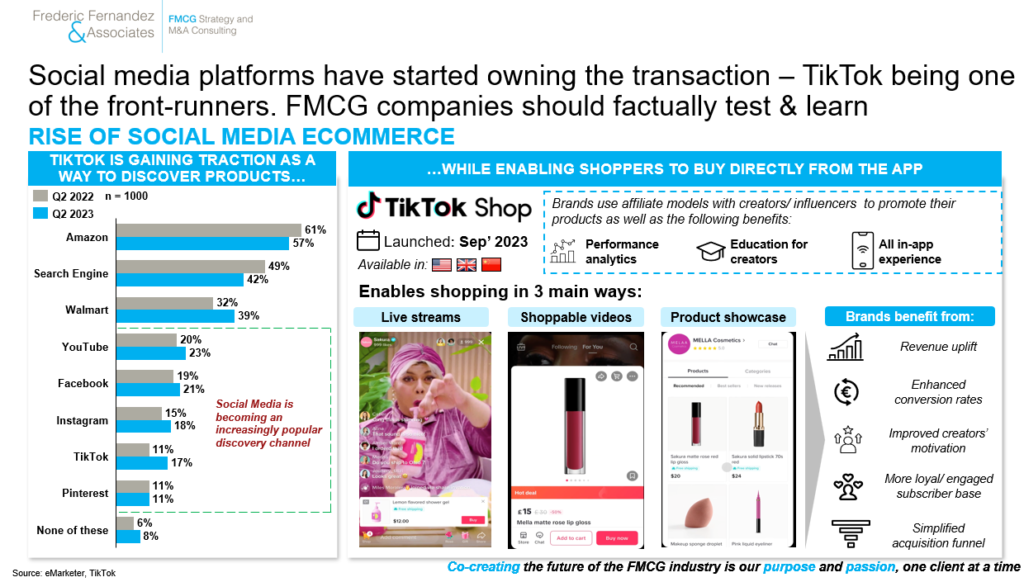

3) Evolving strategic choices of the world largest ecommerce players (all trying to control/ monetize their grip over the end-to-end path-to-purchase & adopt 3P models to increase their share of profit/ ROCE in an overall slower growth environment) bring both risks/ opportunities that need to be carefully strategized

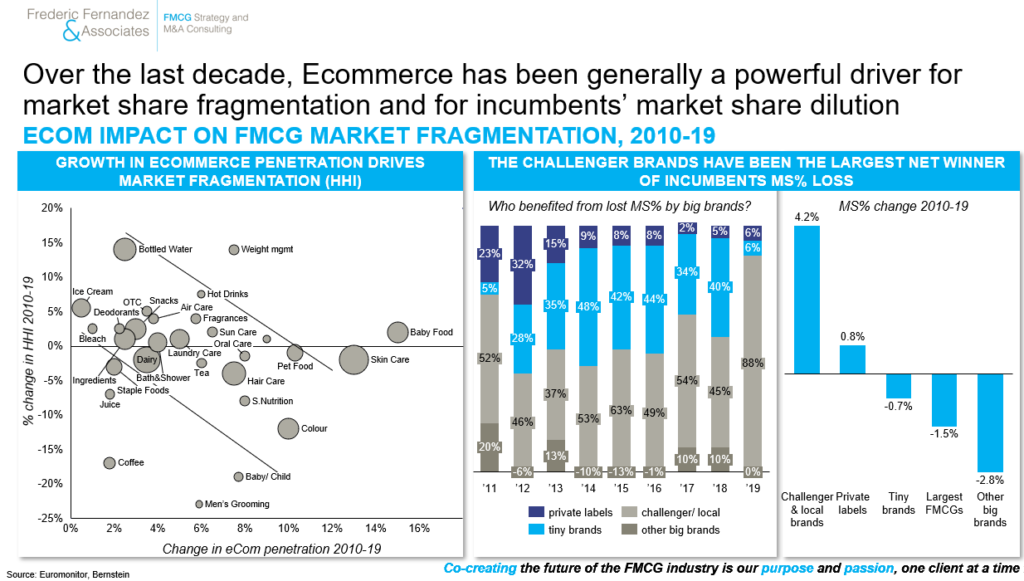

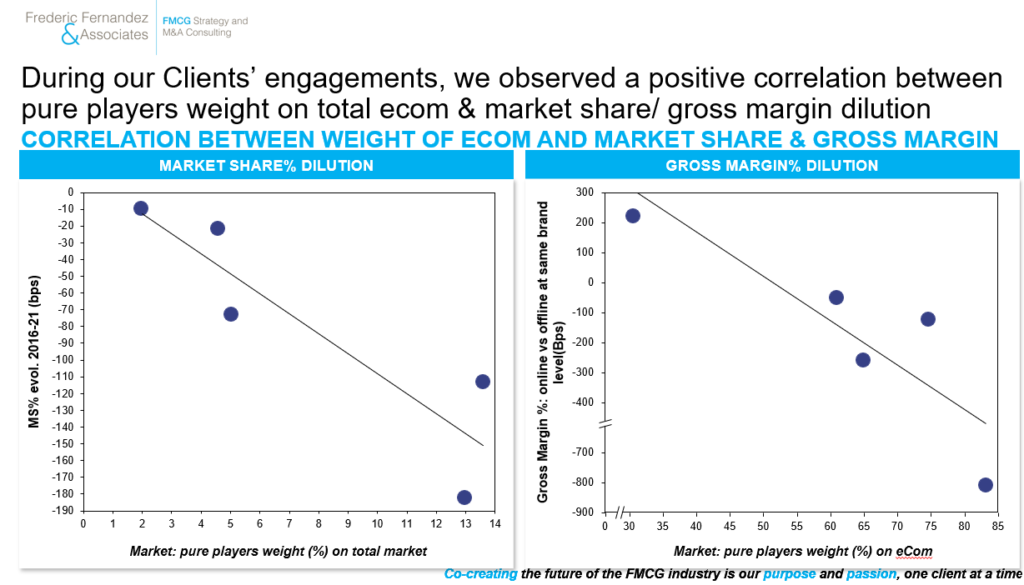

4) Ecommerce & pure players in particular have been historically a powerful driver of market share dilution & sometimes gross margin erosion for incumbents. Upcoming changes will only accelerate this trend calling for an increased focus on managing incremental omnichannel value

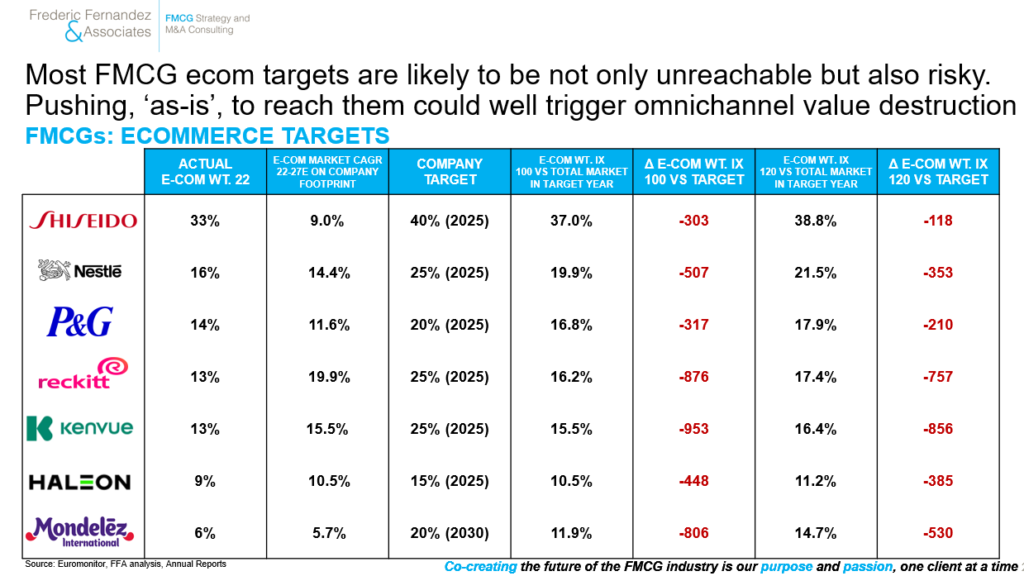

5) The ecommerce targets (2025 and sometimes 2030) of the world’s largest FMCG companies are not only unreachable for most but also dangerous as they could lead to ineffective resources allocation & omnichannel value destruction

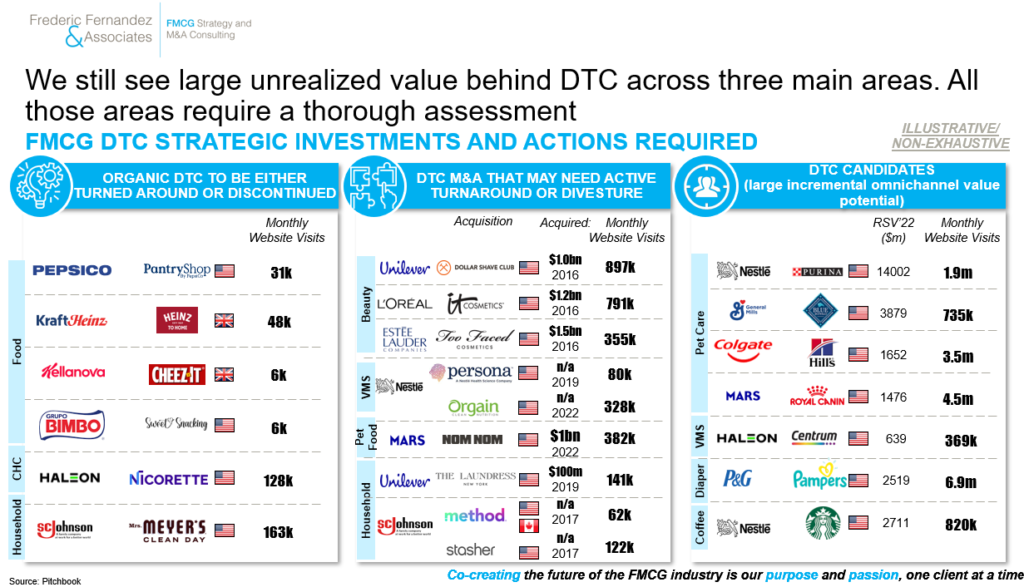

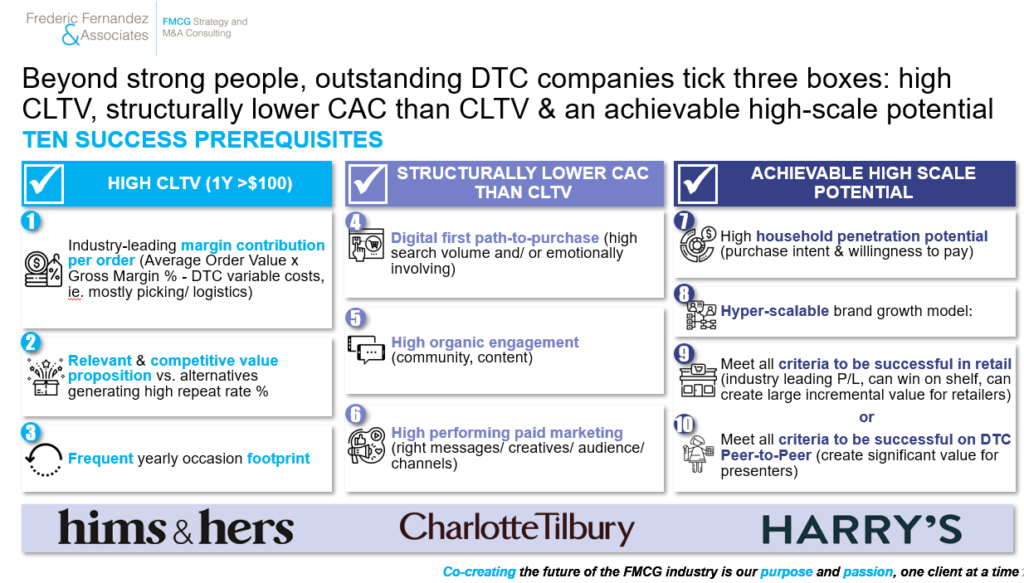

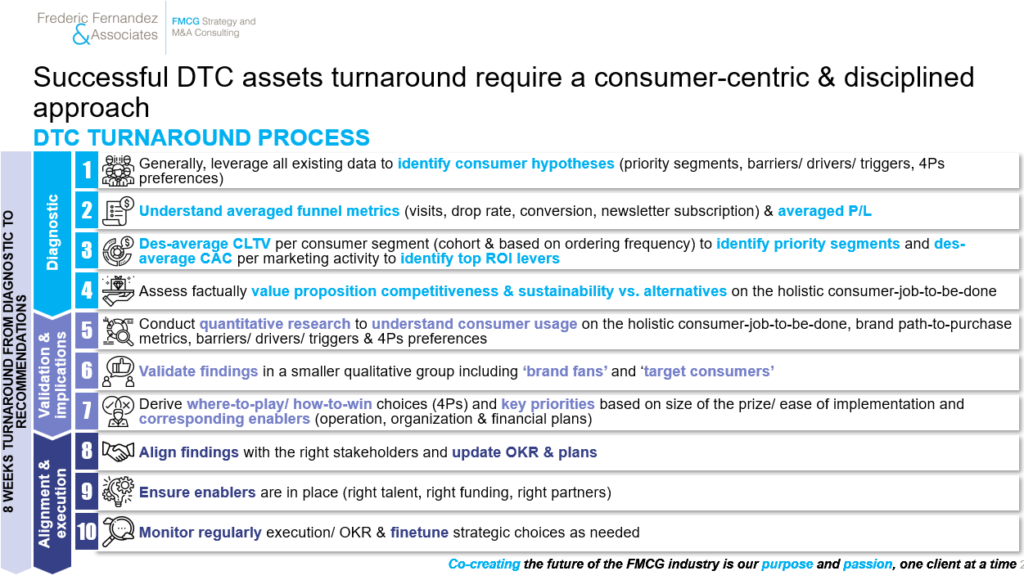

6) There is still a large unrealized value behind DTC (from organic initiatives with low potential through underperforming acquisition to under-leveraged large DTC-friendly brands). The overall too often executed in siloed/ out-of-sync with the overall ecommerce strategy under-optimizing resources allocation & incremental omnichannel value creation

More on DTC in our previous publication: FMCG CEOs: Is DTC Dead?

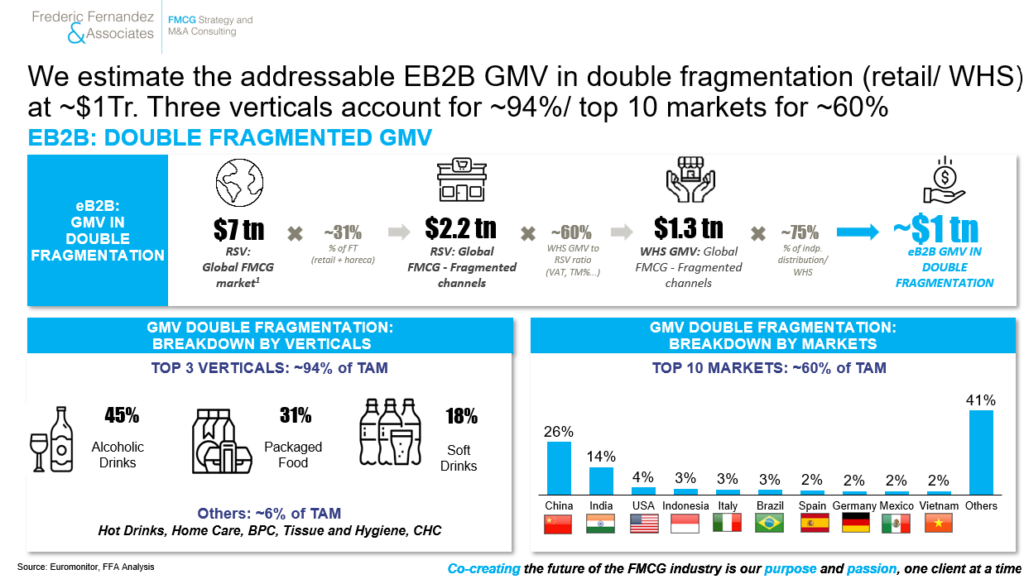

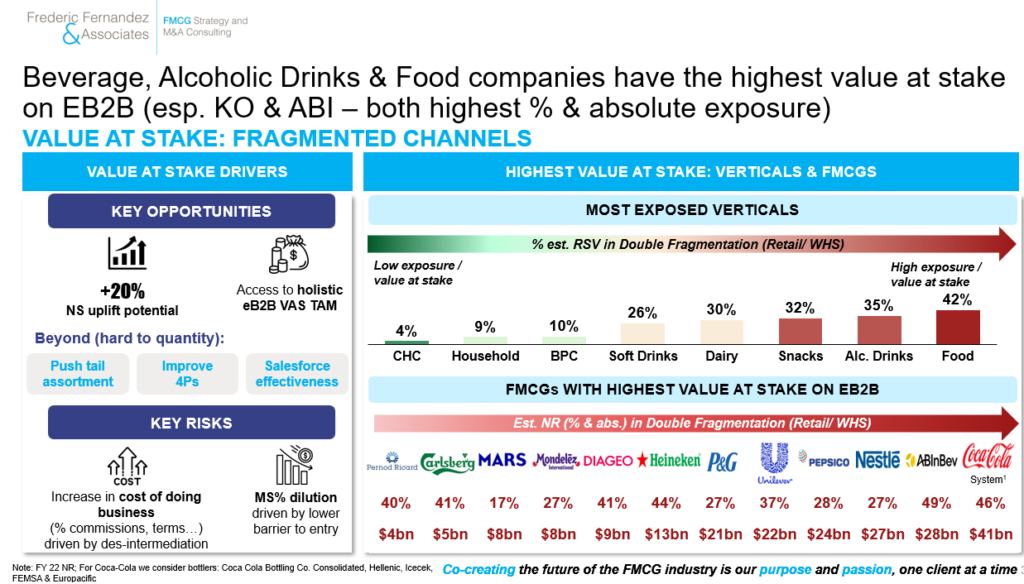

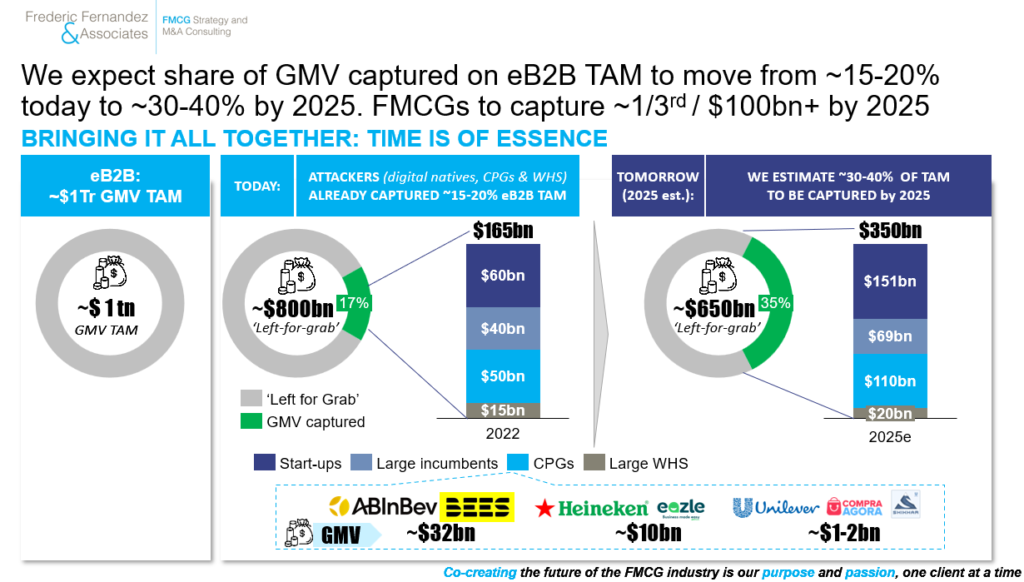

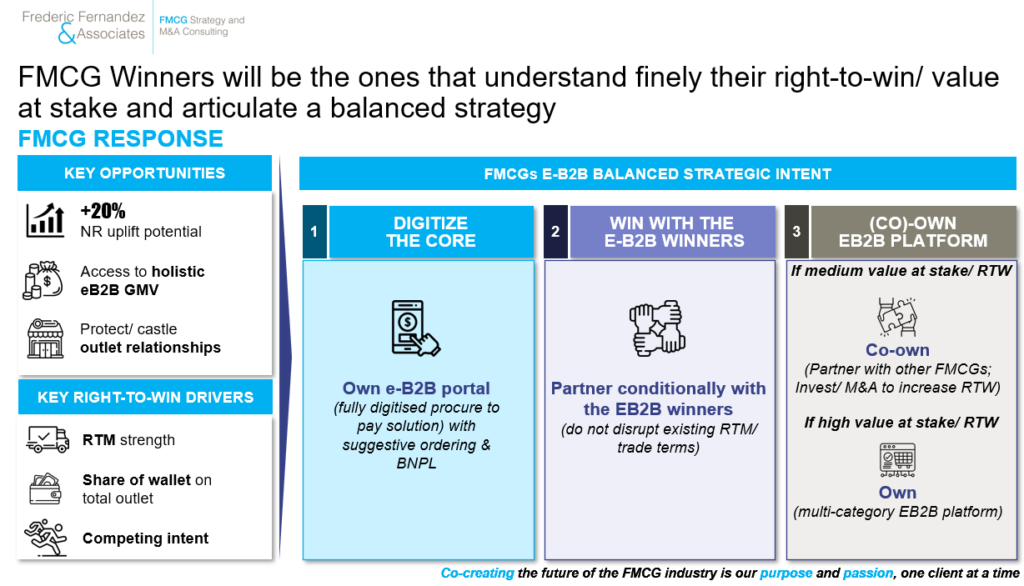

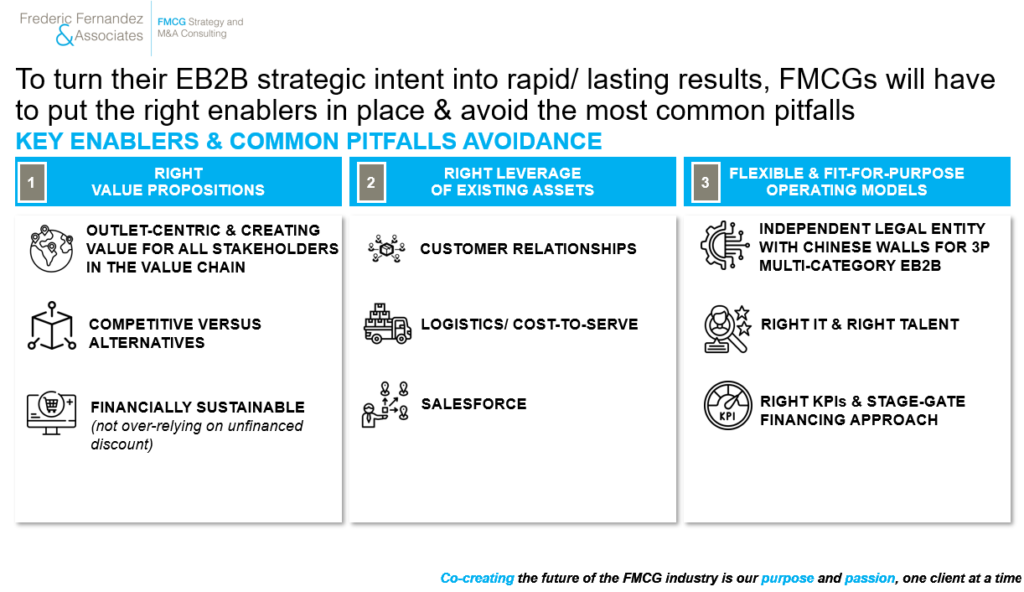

7) There is still a large unrealized value behind EB2B(2C) (poor understanding of value at stake & right-to-win, absence of granular strategic intent des-averaged across the top country/ channel couples in actionable EB2B(2C) archetypes) in a context most of the EB2B related TAM is still ‘up-for-grab’. The overall too often executed in siloed /out-of-sync with the overall ecommerce strategy (especially the EB2B ‘win with the winners’ part & the B2C part) under-optimizing resources allocation & incremental omnichannel value creation

More on EB2B & fragmented channels disruption in our previous publication:

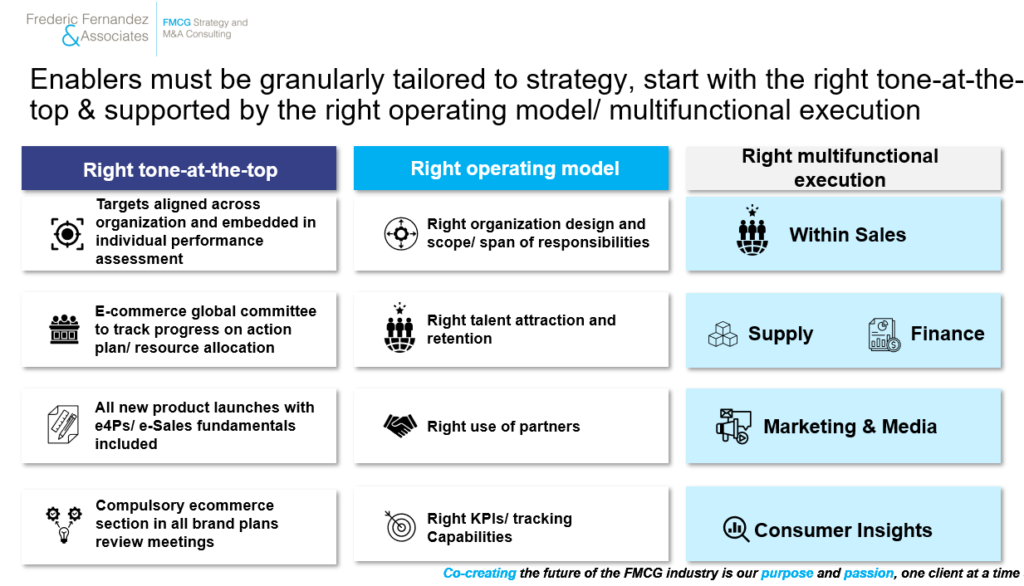

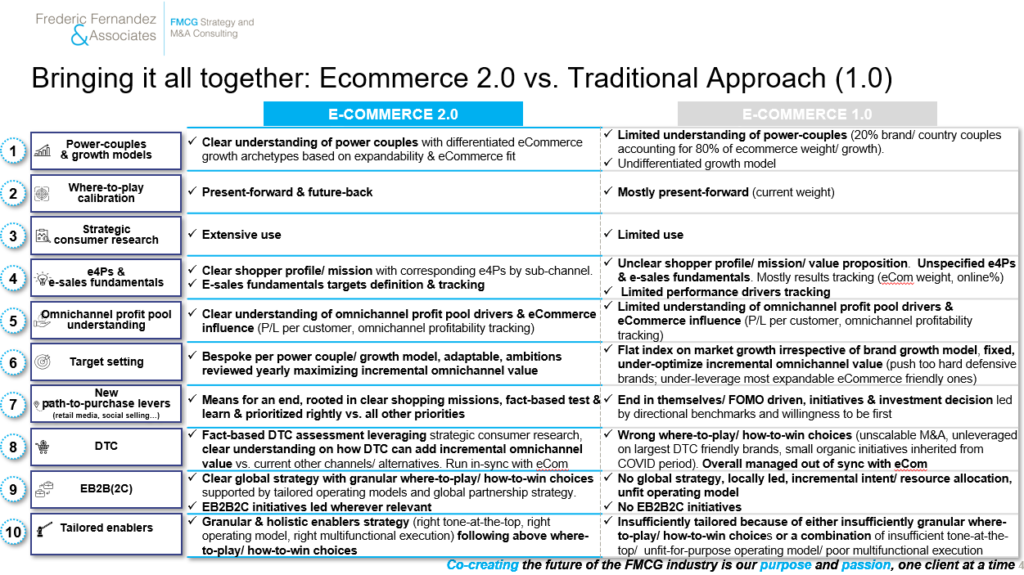

The overall calls for a new approach: introducing ecommerce 2.0, a consumer-centric, granular & integrated approach designed to maximize ecommerce incremental omnichannel value

The last decade in ecommerce was about building foundations & playing catch-up on ecommerce weight. The next decade will be about bringing high ROI incremental omnichannel value. This is our exciting challenge. Decisive times.

‘While most people understand first-order effects, few deal with second- and third-order effects. Unfortunately, virtually everything interesting in business lies in fourth-order effects and beyond’ – Jay W. Forrester (1918-2016, pioneering American computer engineer and systems scientist)

Get in touch:

To get the full deck of this publication, please write us at contact@fredericfernandezassociates.com

To follow Frederic, please click Here, To start a conversation, email at: frederic@fredericfernandezassociates.com

To subscribe to our newsletter and receive all our CEOs Insights, sign-up at the following link: FMCG CEOs: Managing For Growth

Upcoming event:

With the last one taking place pre-COVID in January 2020, our next FMCG CEOs conference will exceptionally take place on Friday, January 12th 2024 in our beautiful Gryffenberg House in Zurich (10 Bahnhofstrasse, 8001 Zurich) from 10 am to 3 pm (breakfast & lunch will be served):

FMCG CEOs: Which Strategies Per Vertical To Outperform Over 2024-30? Per vertical (F&B, Alcohol Drinks, Beauty & Personal Care, Household, PetCare, Consumer Health, Non-tobacco Nicotine), we will cover performance drivers (organic growth, M&A…) & key learnings over the 2012-22 period along with our perspective on outperformance for the 2024-30 period (Organic Growth, Emerging Markets, Ecommerce, DTC, EB2B, M&A, Sustainability & many more). The attendance is strictly limited to 12-persons and the event is by-invitation only (for more information, email at: lea@fredericfernandezassociates.com). Personal invitations will be sent by mid-November

About the Firm:

Frederic Fernandez & Associates (FFA) is a global Strategy Consulting Firm exclusively focused on Strategy, Growth and M&A areas in the FMCG industry. Its purpose is to help its clients win today while renewing their competitive advantages to win tomorrow. 14 out of the top world 20 largest FMCG companies are repeat Clients.

Our passion is to co-create the future of the FMCG industry, one client at a time. The Firm helps the CEOs and the Boards of the world’s largest FMCG companies on selected areas: Zero-Based Growth Strategies, Ecommerce/ DTC/ EB2B(2C) and M&A (buy-side & sell-side). The Firm’s head office is located in Zug in Switzerland. The Firm’s team intervenes all across the globe. To know more about the Firm, please visit our website: www.fredericfernandezassociates.com

No FFA employees own any stocks or financial instruments of any FMCG companies or companies mentioned in the above article. All the above information are public or anonymized information