‘Change before you have to’ – Jack Welch

To join the >11,000 FMCG executives that receive already all our FMCG CEOs Insights (posts & articles like this one), sign-up to our newsletter at the following link: FMCG CEOs: Managing For Growth

We usually do not cover Q1 and Q3 earnings calls and we choose rather to focus on full-year and H1 as Q1 and Q3 tend to be less information-rich (fewer companies report their full P&L and some very rare even do not report quarterly) and then less interesting. This Q3 is an exception

Our strategic thesis:

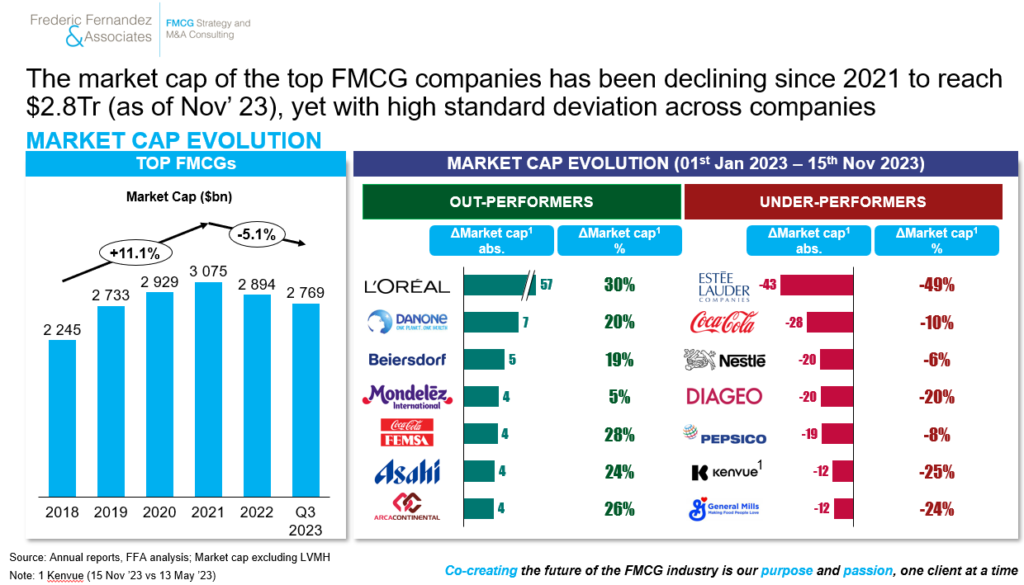

Q3 2023 earnings in the FMCG industry will likely be remembered as a Turning Point in this decade as:

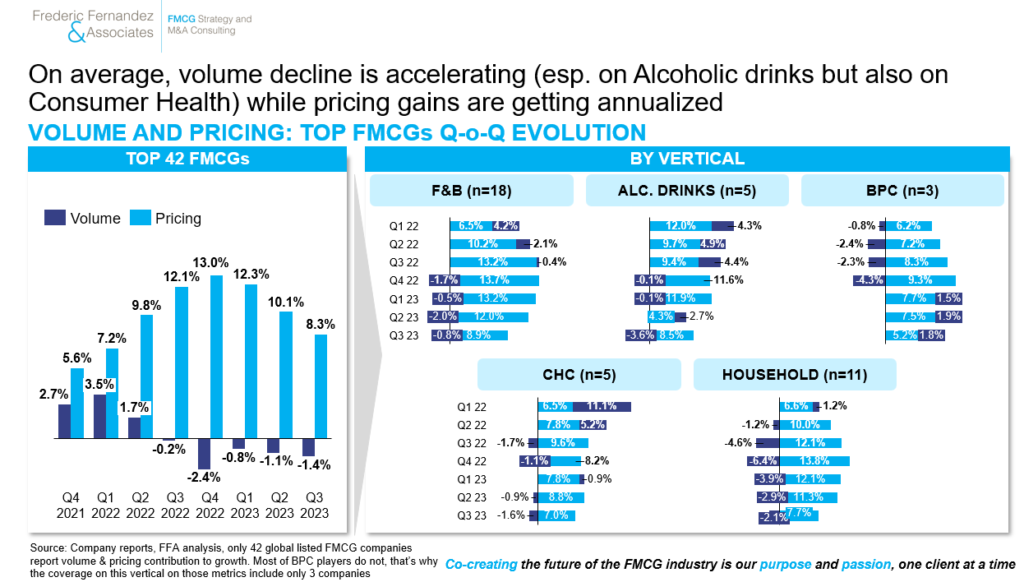

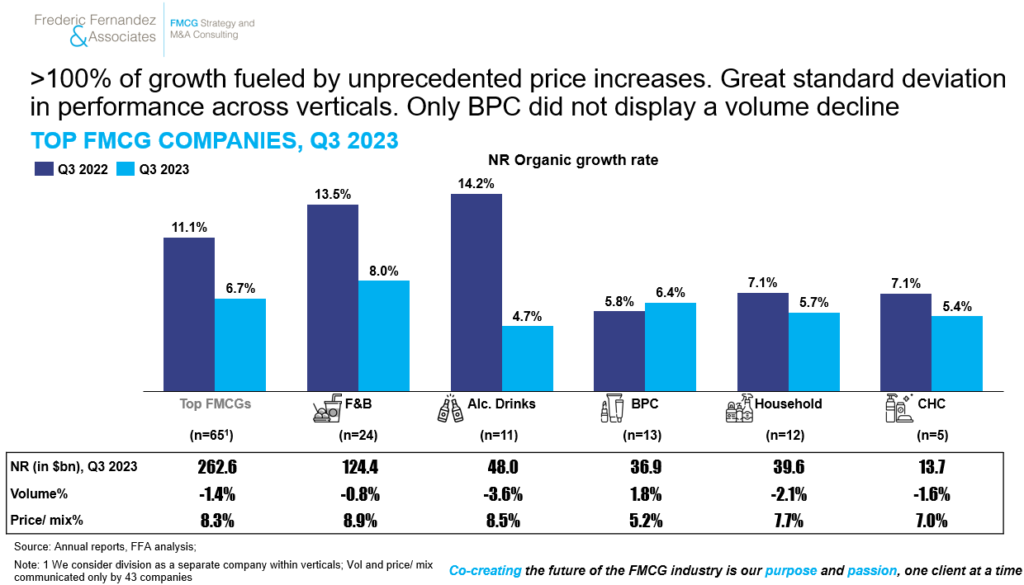

- Pricing gains are getting now annualized & volume losses are accelerating across the majority of verticals (although in a different proportion)

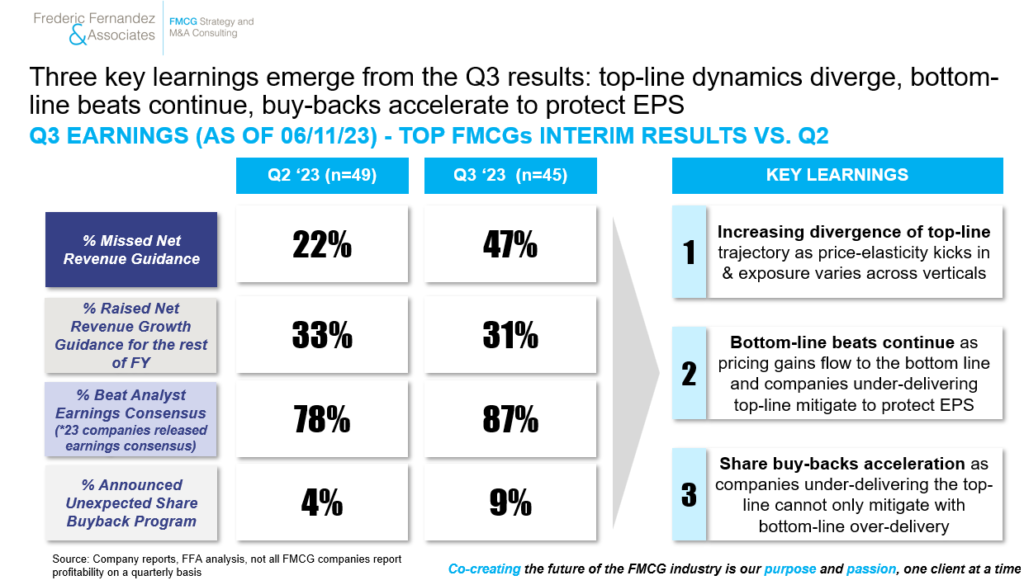

- Top-line performance divergence accelerates across (e.g. Impulse F&B & Beauty vs. Rest)/ within (Food, Household or even Beauty) verticals with the number of FMCG companies that missed their top-line guidance this quarter that more than doubled (to 47%) while the number of FMCG companies that increased their top-line guidance remained stable (~30%). The overall signals a widening gap between Winners & Losers

- Bottom-line out-performance (beats) accelerates (now 87% of our coverage) as pricing gains fall through the bottom-line

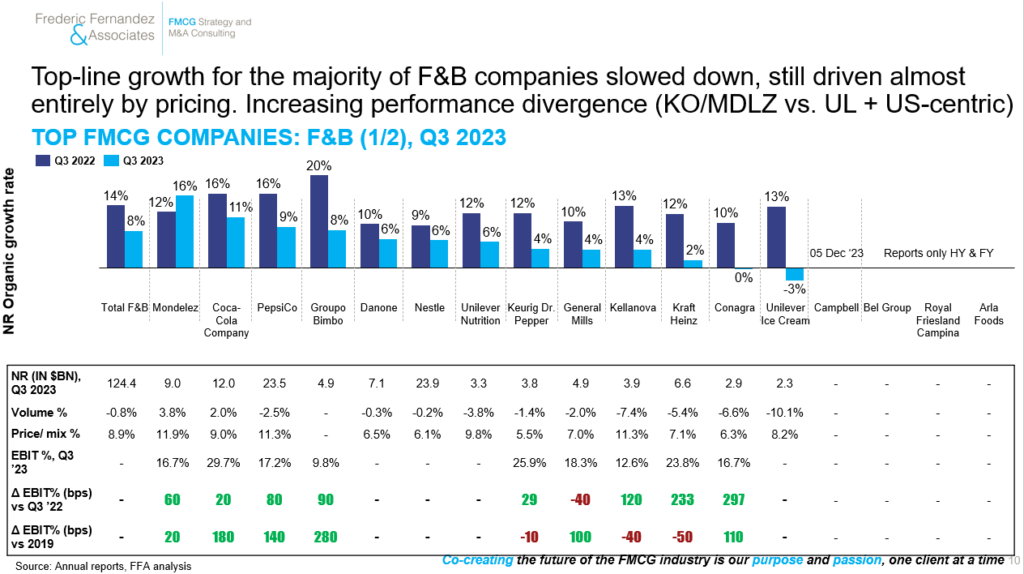

- An increasing number of FMCG companies leverage large-scale stock buy-back programs to drive future EPS growth signaling the difficulty to sustain the current EPS algorithm & anticipating increasing challenges on organic growth

We are now seeing the pattern of an upcoming ‘Shrinking To Glory’ cycle with an increasingly challenging top-line environment (for most) & an increasing temptation to drive EPS through profitability improvement/ shares buy-back. In this context, we should remember about the hard learned lessons of the last decade. More on this in the key messages for 2024 at the end of this publication.

Here are the details of Q3 results in, as usual, few key messages/ charts:

1) Top-line divergence, bottom-line convergence & increasing use of shares buy-backs – all signal the beginning of a ‘Shrinking To Glory’ cycle

2) Pricing gains are getting annualized while volume decline is accelerating. Beauty Personal Care remains for now the most resilient

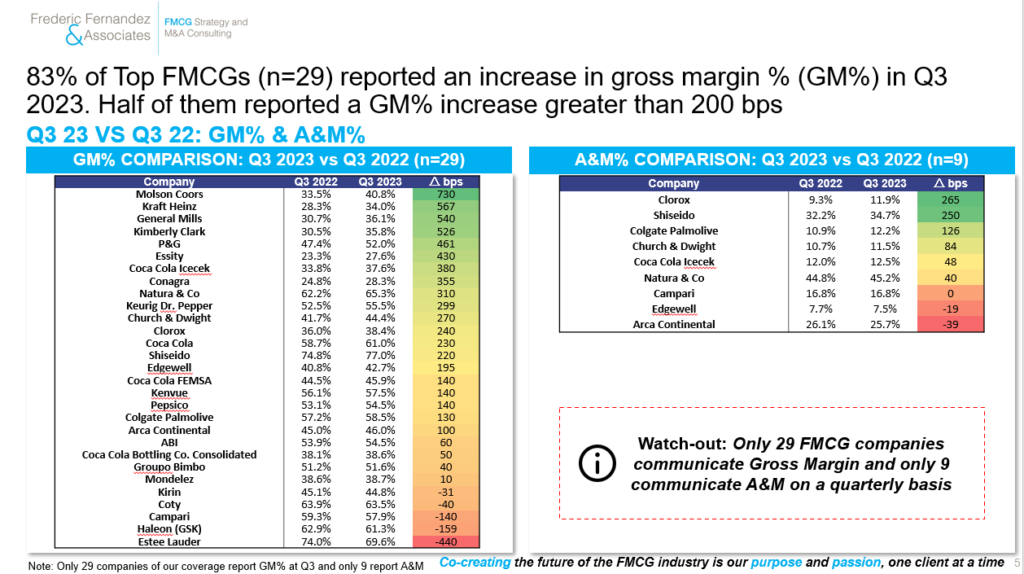

3) Out of the 45 FMCG companies in our coverage this quarter, 29 reported gross margin % this quarter. 83% of those 29 reported an increase of gross margin % vs. YAG. The expansion at some is dramatic (>500bps) with an average expansion of 200 bps

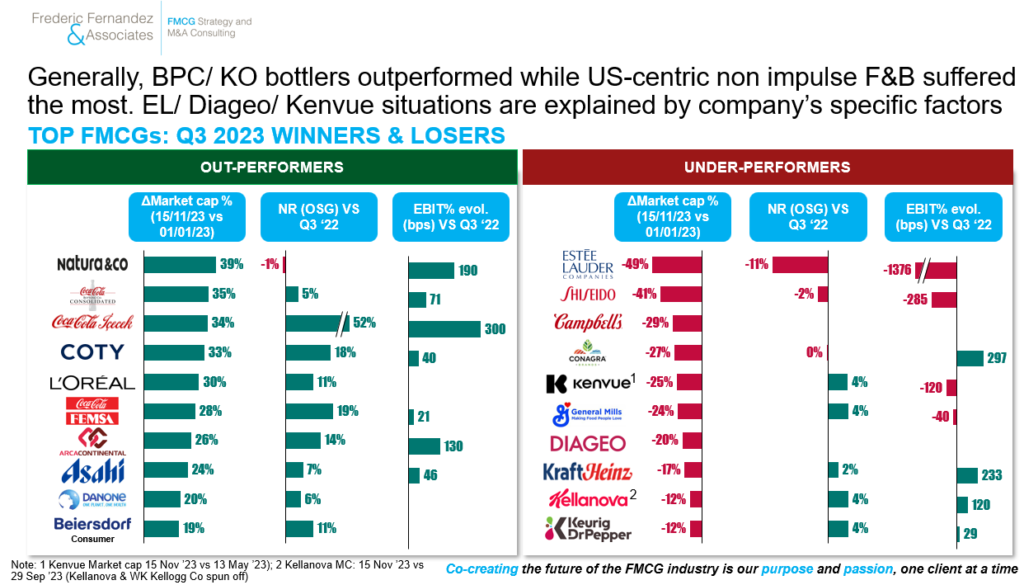

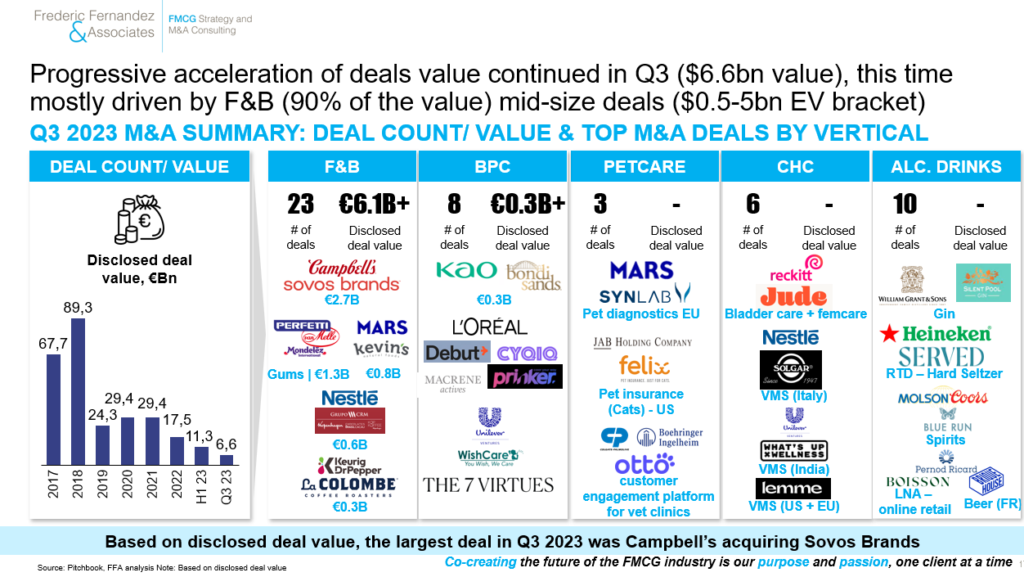

4) Market cap wise, we see an increasing divergence across (BPC/ Impulse F&B vs. Rest) & within (L’Oreal/ Coty vs. Estee Lauder/ Shiseido) FMCG verticals

5) L’Oreal continues to outperform while Danone/ Beiersdorf growth acceleration results start being acknowledged by investors. Estee Lauder has now lost 70% of its market cap in 24 months. Diageo/ GenMills/ Kenvue are penalized for missing consensus. The slight stock price evolutions/ adjustments at some of the world largest FMCG companies (KO, Nestle, Pepsico) are not driven by structural changes in intrinsic performance

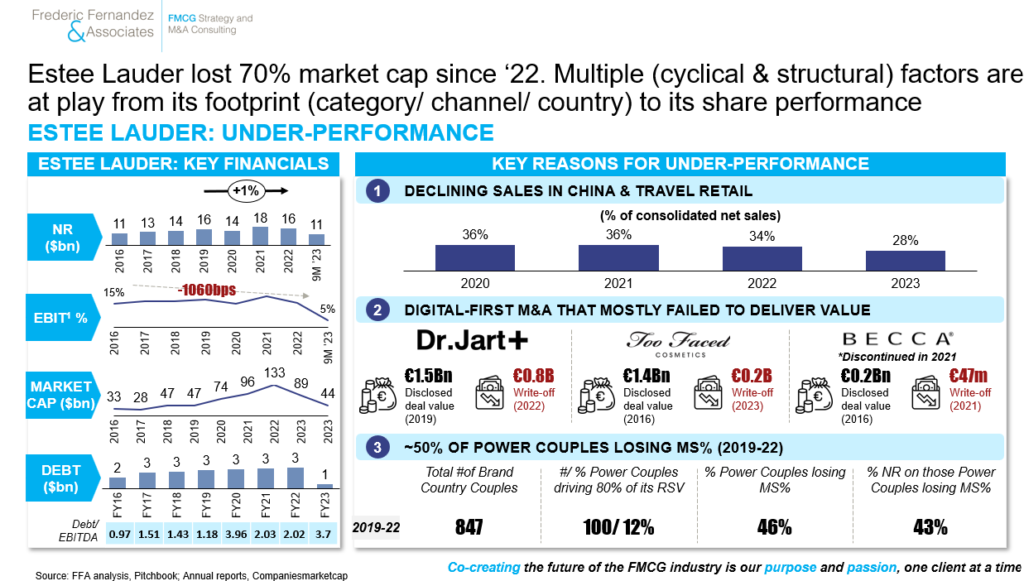

6) EL under-performance is driven by three main factors:

i) In the current environment, a more vulnerable category/ channel/ country footprint than its competitors (over-exposed to the most cyclical Beauty segment: Prestige; to China, Travel Retail and Department Stores in the US)

ii) A genuine growth underperformance on its current footprint (losing market share in almost half of its key country/ brand couples since 2019)

iii) A M&A strategy that, mostly (except DECIEM), failed to deliver an acceptable ROCE

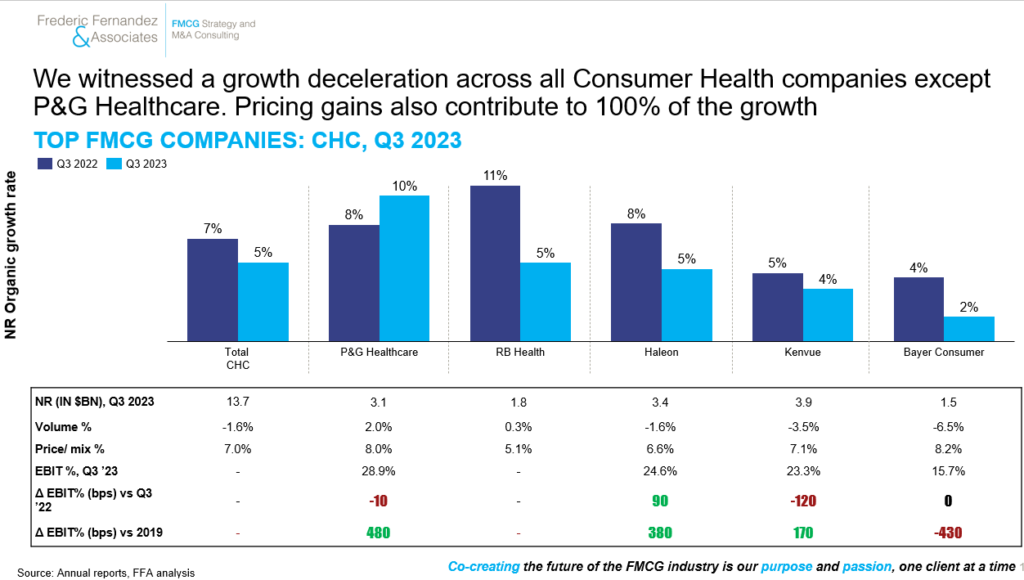

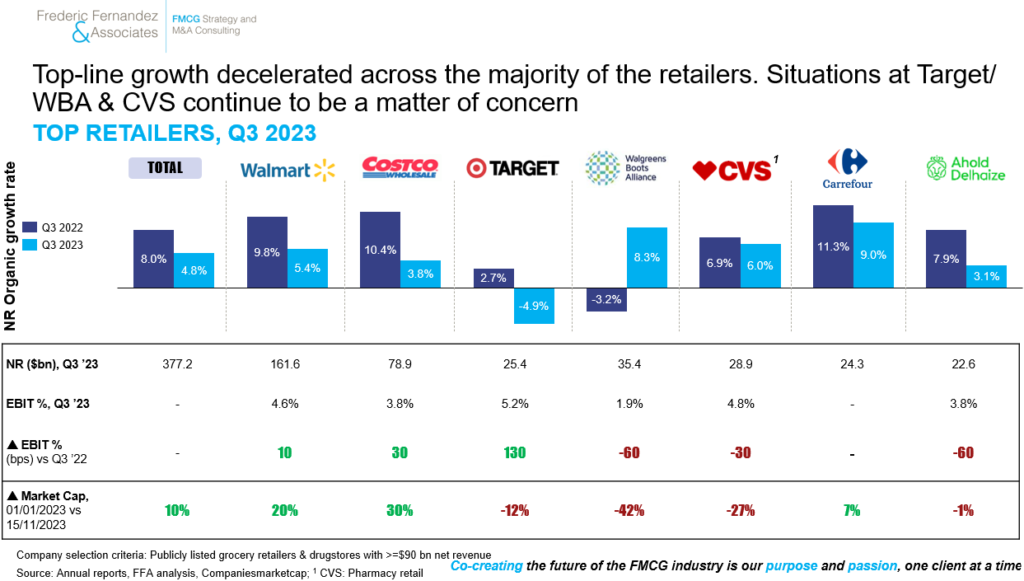

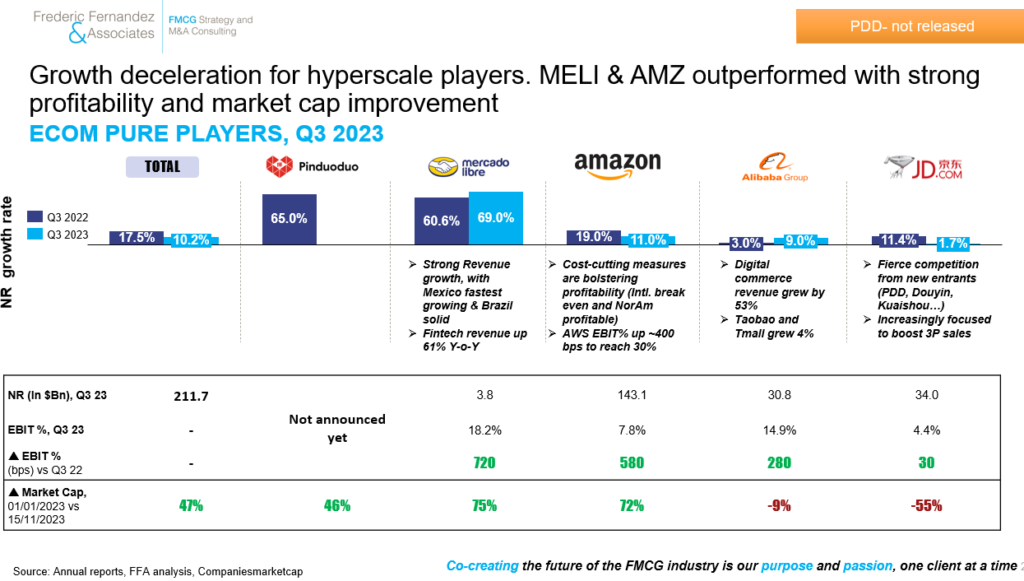

7) Pricing continues to drive >100% of the reported growth in Q3 across all verticals. Only BPC does not record a volume decline

8) On F&B: if the top-line growth is slowing down for all, the gap between well internationalized Impulse F&B and US-centric non-impulse Food players continues to widen

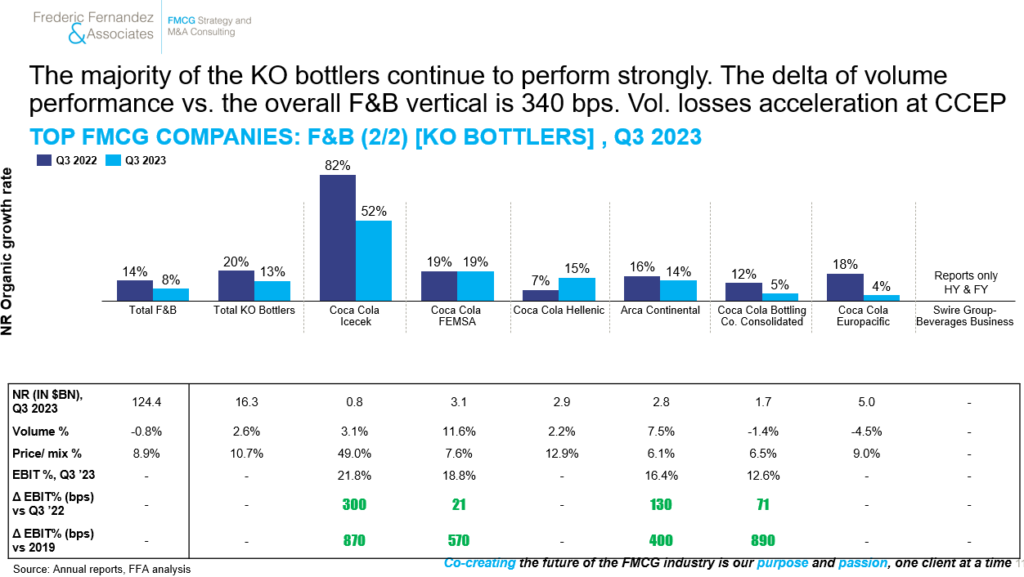

9) What is true for KO is also true for all its bottlers although the CCEP volume decline acceleration needs to be monitored in the next quarters to finely understand the role of price elasticity & weather

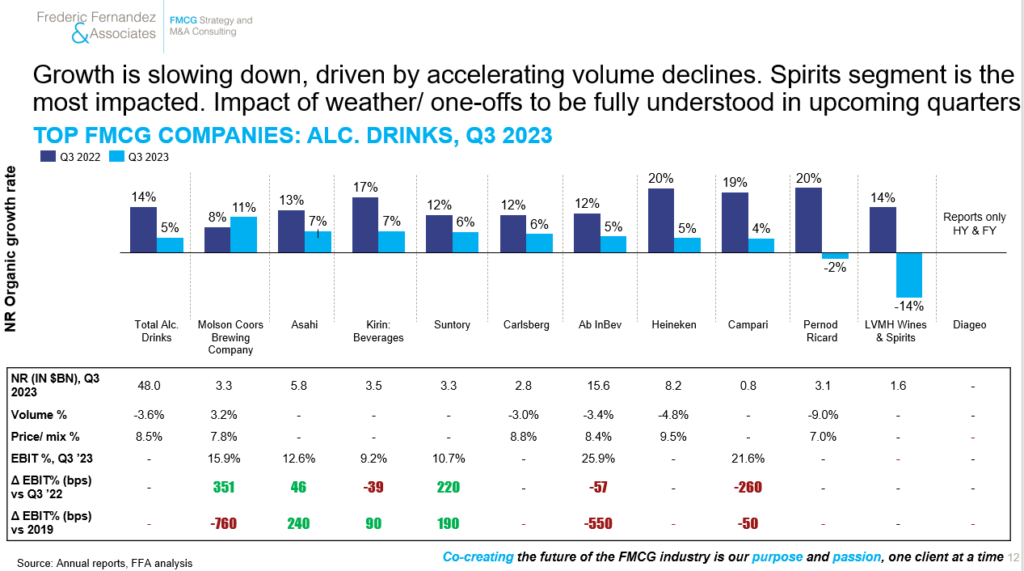

10) Volume performances disappointed most on Alcoholic Drinks. Again next quarters will be critical to finely assess role of price elasticity vs. weather. Molson Coors continues to benefit from the Bud Light consumers boycott

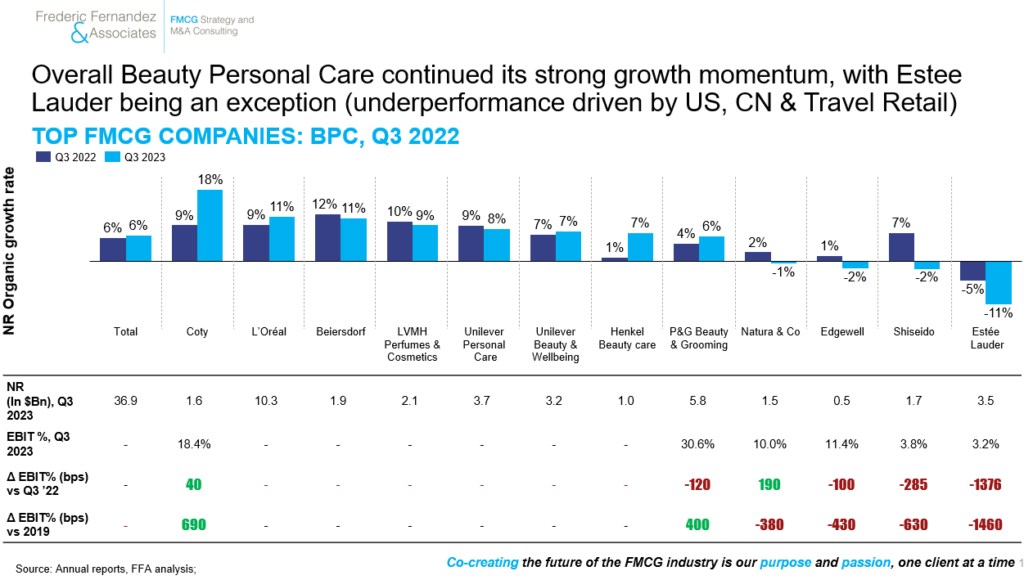

11) BPC continues to demonstrate resilience, even in a context of unprecedented price increases. Estee Lauder, Natura, Shiseido, Edgewell continue to underperform. Coty confirms its turnaround and its profitability is for the first time approaching the 20% bar. L’Oreal continues its well-balanced outperformance fuelled by all its Divisions

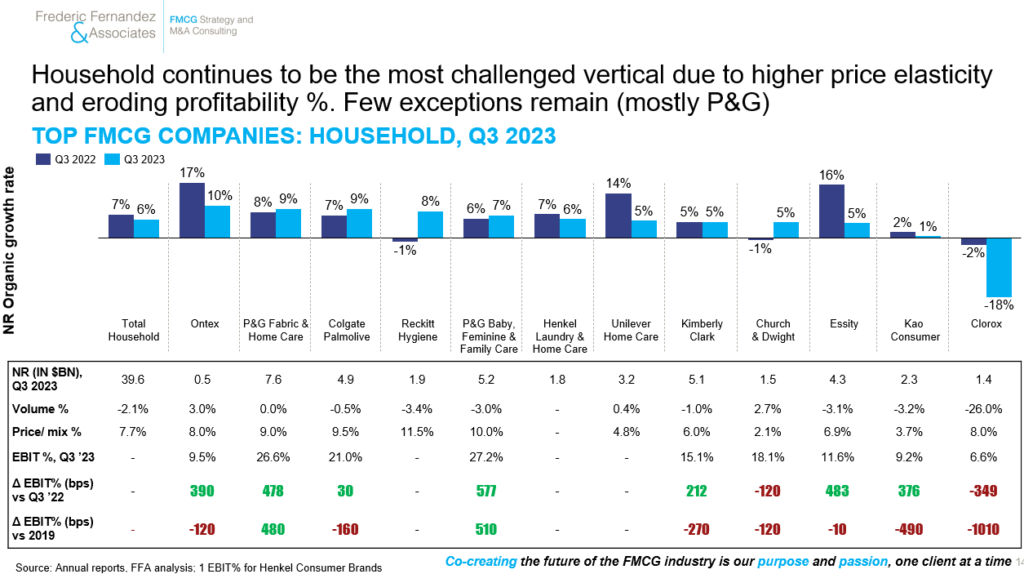

12) Household remains the most challenged vertical due to higher price elasticity. P&G performance (both in terms of top-line but also profitability) is astounding. F&HC and Baby/ Family have now a high 20s% EBIT(!!!)

13) Volume losses are also accelerating on Consumer Health. P&G remains here as well an exception

14) M&A transactions continue to bounce-pack very progressively, this quarter driven by F&B (90% of deals value) with transactions still very much skewed toward mid-size deals ($0.5-5bn EV bracket) as predicted at the beginning of the year. We remain very far away from the exceptional 2017-18 levels (>$70bn p.a.) but we are now progressively approaching the quieter 2019-21 period (>$25bn p.a.)

15) Growth, along with inflation, is slowing-down at the world largest retailers. Some of the world largest grocers have been bouncing back strongly (WMT +20% stock price YTD, COSTCO +30%), the situation at the world largest Drugstores (CVS/ WBA) remain worrying (stores closure, eroding profitability, large stock price decline) in what remains a friendly channel for the world largest FMCG companies (high barriers-to-entry, high penetration, high control on the shelf)

16) The gap between Winners (PDD, MELI, AMZ) and Losers (BABA, JD) widen here too. AMZ market cap (correlated with its profit expansion) is spectacular, all demonstrating the revelance of its where-to-play/ how-to-win choices (AWS, increased focus on profitability on ecommerce) to sustain EPS growth in a structurally slower growth environment

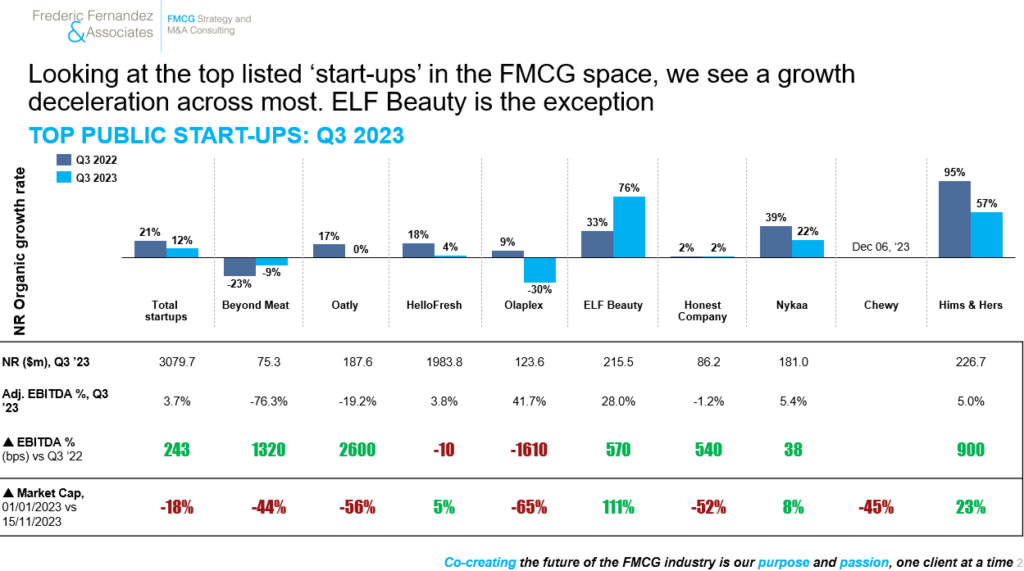

17) We continue to monitor the ‘next gen’ listed FMCG assets. The gap here too between Winners (ELF and in a lesser extent HIMS) and Losers (Plant-Based, Honest) continue to widen. ELF Beauty performance remains remarkable both in terms of top-line outperformance consistency, profitability & consequently shareholder vlaue creation

Considering the above and in an increasingly challenging environment, we see a number of themes strongly emerging for 2024 calling each for a better approach:

1) Sharpen focus on organic (volume) growth enabled by sharper portfolio choices & a consumer-back approach in a context of pricing gains annualization & accelerating volume decline. We expect the ‘high-inflation-through-now-desinflation-to-likely-deflation’ sequence to be unprecedently challenging for the world largest FMCG companies calling for a better approach to Organic Growth (from where-to-play definition through how-to-win to key enablers) . Traditional tactics (Revenue Growth Management, marginal 4Ps improvement with a ‘market-back’ approach…), if useful, are unlikely alone to be sufficient. We should remember that the only sustainable driver of shareholder value in our industry has been and remains organic growth outperformance

More in our latest article on why/ how to accelerate organic volume growth:

2) Accelerate growth in Emerging Markets (EMs) with bespoke strategies. They are expected to account for 2/3 share of growth of the global FMCG market over the coming decade. There will be no growth (out-)performance without strong results in EMs. Those markets are structurally different (retail & media fragmentation, different consumers’ drivers, highly heterogeneous consumers…) and call for a fundamentally different strategic approach

More in our latest article on why/ how to outperform in Emerging Markets:

3) Sustain the ecommerce effort even in a slower growth context as share of growth is expected to remain stable across verticals. This is particularly important for the verticals that will remain ecommerce driven (Pet Care & BPC with ~50% share of growth on ecommerce but also Tissue/ Consumer Health with >30%). In a context of slower growth, with unsustainable mid-term ecommerce targets, increasing competition, greater risk of sell-in price deflation, there is a case to adapt our ecommerce strategies from ‘reaching fair share’ to deliver large incremental omnichannel value. This requires a new approach

More in our latest article on how to drive ecommerce out-performance

4) Leverage M&A to complement organic growth acceleration as appropriate to address growth priorities (demand spaces, categories, countries…). Favour already successful (not turnaround cases), mid-sized ($0.5-5bn EV bracket) assets on well understood segments, with replicable success models that have actionable value creation cases (still often through distribution scale-up). Those are the main characteristics of the most successful transactions over the last decade. Some exceptions may remain (e.g. DTC businesses with large adoption potential & profitable/ scalable brand growth model). Beware large acquisitions (>20% of your EV) as they often do not deliver (risk of being a distraction, often mature assets with a performance that is hard to turnaround and with profit improvement potential not commensurate to the EV/ overall risk taken). Beware too small acquisitions (<$100m) as those have often not only an unproven penetration potential but also hard-to-scale brand growth models

More in our latest article on how to leverage M&A to drive shareholder value:

FMCG CEOs: 2012-22 M&A Winners & Losers Or Breaking The Code Of Successful M&A In The FMCG Industry

5) Complement the above with selective future-back strategic initiatives based on a granular value-at-stake/ right-to-win assessment

a. For FMCG companies with a large value at stake in fragmented channels, especially Impulse F&B companies, we favor EB2B(2C) that we predict will be a key enabler to protect & expand share of profit capture in the highly strategic fragmented channels (most of on-trade & emerging markets). Those channels can account for more than 60% share of growth (& profit) for some FMCG companies

More in our latest article on how to leverage EB2B to drive outperformance in fragmented channels:

FMCG CEOs: Could This Be The Largest Strategic Opportunity In The FMCG History?

b. On Pet Care, Beauty, Consumer Health & Premium Coffee, we still see large unrealized value behind DTC: from eliminating low right-to-win organic initiatives through turning around or divesting DTC M&A to start differentiated DTC value propositions on the largest & most DTC friendly brands that have the potential to deliver large incremental omnichannel value

More in our latest article on DTC:

We need to learn from the last decade. We need to anticipate this ‘Shrinking-To-Glory’ cycle. The excess of ZBB (Zero-Based-Budget) coupled with dicey M&A transactions doomed for many the 2014-2020 period. Our hope is that a holistic focus on Growth (mostly organic complemented by selective M&A) will be the key enabler of growth & EPS outperformance over this coming decade

As Jack Welch will put it: ‘Change before you have to’

Exciting & decisive times

Get in touch:

To follow Frederic, please click Here, To start a conversation, email at: frederic@fredericfernandezassociates.com

To get the full deck of this publication, please write us at contact@fredericfernandezassociates.com

To subscribe to our newsletter and receive all our CEOs Insights, sign-up at the following link: FMCG CEOs: Managing For Growth

Upcoming event:

With the last one taking place pre-COVID in January 2020, our next exceptional FMCG CEOs conference will take place on Friday, January 12th 2024 in our Zurich office (10 Bahnhofstrasse, 8001 Zurich) from 10 am to 3 pm (breakfast & lunch will be served):

FMCG CEOs: Which Strategies Per Vertical To Outperform Over 2024-30? Per vertical (F&B, Alcohol Drinks, Beauty & Personal Care, Household, PetCare, Consumer Health, Non-tobacco Nicotine), we will cover:

- Performance drivers (organic growth, M&A…) & key learnings over the 2012-22 period

- Our perspective on outperformance for the 2024-30 period (Organic Growth, Emerging Markets, M&A, Sustainability, Ecommerce, DTC, EB2B & many more)

The attendance is strictly limited to 12-persons and the event is by-invitation only (for more information, email at: lea@fredericfernandezassociates.com). Personal invitation will be sent by mid-November

About the Firm:

Frederic Fernandez & Associates (FFA) is a global bespoke Strategy Consulting Firm exclusively focused on Growth (Zero-Based-Growth® approach), Digital GTM (Ecommerce 2.0®, DTC, & EB2B) and M&A serving the world largest FMCG companies. Its purpose is to help its clients win today while renewing their competitive advantages to win tomorrow. 14 out of the top world 20 largest FMCG companies are repeat Clients.

Our passion is to co-create the future of the FMCG industry, one client at a time. The Firm’s team intervenes all across the globe. To know more about the Firm, please visit our website: www.fredericfernandezassociates.com

No FFA employees own any stocks or financial instruments of any FMCG companies or companies mentioned in the above article. All the above information are public information